Tri-Star shows confidence in Omega by upping stake through oversubscribed placement at a premium

Mining

Mining

It is not every day that a company gets to raise capital at a premium but that’s exactly what Omega Oil & Gas is enjoying with one of its largest shareholders moving to increase its stake.

Privately-owned explorer and investor Tri-Star Group, which is owned by the same Butler family that drilled the first commercial coal seam gas well in Queensland, increased its stake in the company up from 15% to 19.9% to become its second largest shareholder after the Flannery family’s Ilwella Pty Ltd.

Tri-Star Australia country manager Andrew Hackwood had previously told Stockhead that the company was “focused on realising long term value and – we think – plays where there’s an appropriate balance of risk and reward, which is what attracted us to Omega, the 3 TCF of potential resource”.

Choosing to increase its stake through Omega Oil & Gas’ (ASX:OMA) institutional placement priced at 18c – a 5.9% premium to the last traded price of 17c – is a clear sign that Tri-Star is still very much of the view that the company is an attractive buy.

And it is not the only company that thinks so.

The oversubscribed capital raising secured more than $21m in commitments – far higher than the target amount of between $18m and $20m – with Ilwella choosing to subscribe for enough shares to maintain its holding of about 29% and a new resources-focussed fund entering its register.

“The response to our capital raise has been extremely encouraging notwithstanding the challenges of the current market,” managing director Lauren Bennett said.

“It is obvious from the response we received that there is a clear understanding among parties of the looming gas shortages in Eastern Australia and the requirements for a significant discovery of a multi-TCF resource to supply domestic requirements.

“The funds from this capital raise will support Omega’s plans to accelerate the commercialisation pathway for its deep gas assets putting Omega in a strong position to support the energy needs of the domestic and international gas markets over coming decades.”

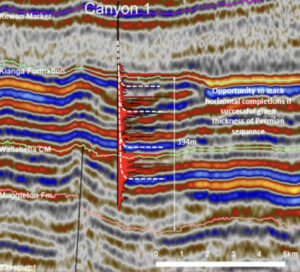

Omega’s Canyon-1 and Canyon-2, which were drilled to the Permian tight gas pay in the Southern Taroom Trough within Queensland’s Bowen Basin, had both intersected better than expected gas columns of 424m and 293m respectively.

Wireline logging at Canyon-2 also returned interpreted porosities averaging more than 9%, which is better than what most tight gas plays would normally see.

Since then, the company has completed analysis of its Canyon drilling program and assessed forward strategy options to deliver commercial flow rates from the tight gas play.

As such proceeds from the capital raising will be used to re-enter Canyon-1, where the lowermost section was left uncased just for this purpose, and a horizontal section drilled into a prospective sand interval in the primary target Kianga Formation.

This will then be subject to multi-stage fracture stimulation, which involves pumping fluids and proppants into the well to induce fractures that essentially broaden the productive area, and completion with the goal of demonstrating the reservoir’s ability to flow gas and liquids to surface at commercial rates.

Omega noted that the decision to drill a horizontal section and fracture stimulate it rather than its original plan to do the same to the vertical section intersecting the Kianga stemmed from the collective expertise of its staff, leading industry technical experts and Tri-Star staff indicating that flows from vertical wells do not often provide a reliable indication of a tight reservoir’s ultimate flow potential from horizontal wells.

“If Omega is successful in demonstrating commercial gas flow rates, we will be significantly closer to unlocking the potential of the Taroom Trough as one of the few remaining sources of untapped gas in Eastern Australia capable of meeting demand at scale,” Bennett added.

There is also potential for the company to stack horizontal completions due to the thickness of the Permian sequence intersected.

Potential well paths for illustration purposes only. Pic: Supplied (OMA).

Discovering and developing new sources of gas on Australia’s east coast is becoming increasingly critical with production for the domestic market forecast to decline rapidly over the next decade with annual supply shortages from as early as 2026, according to the Australian Energy Market Operator in its 2023 Gas Statement of Opportunities.

Whilst a fair bit of attention has been drawn by the Beetaloo Basin in the Northern Territory, the Taroom Trough targeted by Omega might actually prove the more realistic option.

There are several reasons for this.

Not only does the Taroom Trough have proven, large-scale (multi-trillion cubic feet) gas potential with associated liquids, it also possesses a significant cost advantage due to its proximity to existing pipeline access points, infrastructure and easy access to services, materials and a skilled workforce.

It is no surprise then that the Taroom, which has multiple intervals of interest within a large, mixed-lithology, basin-centred, tight gas pay, has since active interest from several operators – including majors.

Omega itself holds ATP 2037 and ATP 2038, which cover an area of more than 250,000 acres approximately 50km from critical gas transmission infrastructure.

While previous exploration by previous operator BG – now part of Shell – had indicated that gas is present in the formation, its testing failed to isolate the best gas-bearing sand in the formation.

Since then, Omega’s Canyon wells have proven the deep Permian play within its licence area with multiple, thick packages of gas-saturated rock observed throughout the Permian sediments.

This is enough for Fluid Energy Consultants to estimate Prospective Resources within its acreage at about 3,000 petajoules (about 2.8Tcf) of gas with 233 million barrels of associated liquids (condensates, petroleum liquids and light oil).

Should the coming work establish commercial gas flows, the company will then move to re-classify its gas resources into reserves, which will then set the stage for full field development planning and engaging with potential farm-in partners.

“Together with our team of experts and supportive shareholders, I am excited that we are on the cusp of testing the commercial viability of one of the very few, large-scale prospective gas assets in Eastern Australia,” Bennett concluded.

This article was developed in collaboration with Omega Oil & Gas, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.