Resources Top 5: Pure Resources embarks on lithium quest in Crystal Mountain

Mining

Mining

Here are the biggest resources winners in early trade, Tuesday October 10.

Lithium explorer Pure Resources is in amongst it as the white-gold-hunting frenzy in North America continues apace.

PR1’s share price is well up today on news that the company has announced it’s staked 13.5km2 of exploration claims in the Crystal Mountain Pegmatite District, Colorado, USA.

The claims cover three “historical, artisanal mines” including the Kings Canyon, Debbie Doll and Buckhorn.

Why is this potentially a big deal? PR1 notes that the claims contain artisanal beryl mines with “noted spodumene occurrences within a past-producing lithium pegmatite district”.

$PR1 STAKES HISTORICAL SPODUMENE OCCURRENCES – CRYSTAL MOUNTAIN, COLORADO

The Crystal Mountain pegmatites are the same age (1.78 Ga old) and mineralogically resemble the pegmatites in the southern Black Hills of South

Dakota, currently being explored by Iris Metals Ltd $IR1 pic.twitter.com/ntvxngKzBA— Pure Resources (ASX: PR1) (@ASXPR1) October 9, 2023

Crystal Mountain provides something of a tantalising precedent for Pure Resources, then, with past reports having identified quartz-albite-spodumene-amblygonite mineral assemblages.

“The Crystal Mountain pegmatites are the same age (1.78 Ga old) and mineralogically resemble the pegmatites in the southern Black Hills of South Dakota, currently being explored by Iris Metals (ASX:IR1) notes the company.

Also, the fact there has been no modern exploration in the area whatsoever is another reason for Pure’s deep interest here, which it says represents a “genuine greenfield opportunity” to discover a spodumene-rich lithium deposit.

Reconnaissance mapping and sampling is currently underway.

PR1 share price

Iron-ore and manganese hunter CZR is on the rise today after announcing it’s set to generate “outstanding financial returns” on its Robe Mesa iron ore project in the Pilbara, WA.

This comes from its completed Definitive Feasibility Study on the project, which highlights low costs and strong free cash flow.

Bullets, per the company’s ASX announcement:

• Low C1 cash cost of A$49/wmt FOB

• Life of mine EBITDA of $824 million

• Base case life of mine free cash flow of $419 million, NPV8% of $256 million

• Financial returns rising to $1.3 billion free cash flow at current iron ore prices

• Base case IRR of 62%, rising to 159% at current iron ore prices

CZR Managing Director Stefan Murphy said: “The DFS shows that Robe Mesa is an outstanding project which is set to generate exceptional financial returns.

“The project is underpinned by low costs, an extremely robust orebody and the benefits of shared infrastructure.

“Robe Mesa is a shining example of how collaboration with industry experts and regional peers can drive down cost and be highly competitive in a market dominated by major producers, with a strong emphasis on financial returns rather than size for the sake of size.”

OK, but why bother with another iron ore tiddler? There are a couple of curiosities to CZR.

Exhibit A) is it’s biggest shareholder — billionaire prospector Mark the man Creasy, who’s ability to hoover up WA’s decent exploration ground have made him a must-watch trend-setter in the ASX resources game. Last month’s annual report places his stake at 55%, giving the tenement catcher of Bronzewing, Andover and Nova fame a controlling position.

Then there’s the neighbours. Robe Mesa is over the fence from the undeveloped Mesa F deposit at Rio’s five decades and still kicking Robe River JV. What happens when it needs to replace tonnes, hopeful CZR holders have been asking the tantalising question for years.

CZR share price

WA junior goldie GML this morning announced that diamond drilling is underway at its 526,000oz Montague gold project in the Murchison Gold District of Western Australia.

It’s in the process of testing two deep targets identified as highly prospective structural zones located directly down-dip from existing mineral resources.

Specifically, it’s drilling ~350m below the 163,000oz Montague-Boulder mineral resource, and ~180m below the deepest hole drilled into the Montague-Boulder structure.

Drilling is being co-funded by the WA Government’s Exploration Incentive Scheme.

Gateway Mining is pleased to advise that diamond drilling has commenced to test two deep targets at its 526,000oz Montague #gold project in WA. $GML #gold #exploration #ASX #drilling #discoveryhttps://t.co/Zi5rWbY8jj pic.twitter.com/ZsLUe4Cdas

— Gateway Mining Ltd (@gateway_mining) October 9, 2023

Gateway’s Managing Director Mark Cossom, said: “Our step-change exploration campaign at Montague has reached a pivotal moment with the commencement of this exciting deep diamond drilling campaign.

“These deep holes will target interpreted structural zones down-dip of existing resources at Montague-Boulder and Achilles identified through the recent 2D seismic survey. This will give us the first definitive picture of the geological structures and mineralising processes at work at Montague which have led to the deposition of the known shallow deposits.”

GML share price

Big news for this African-focused lithium player – it’s just been give the go-ahead from Ghana’s Environmental Protection Agency (EPA) to begin the diversion of the transmission lines crossing the company’s Mankessim licence.

What does this mean? It means Atlantic Lithium has just made a big leap closer to “shovel readiness” at its Ewoyaa lithium project in Ghana, which extends over the Mankessim licence areas.

Meeting with Hon. Samuel A. Jinapor and representatives of the @gstockexchange, @MineralsFundGH and @mincommgh on the finalisation of the Mining Lease for the Ewoyaa Lithium Project in Ghana.#ALL #A11 $A11 $ALLIF #Lithium #Ghana #Mining pic.twitter.com/cWctK751Vc

— Atlantic Lithium (@AtlanticLithium) October 9, 2023

In early September, as reported by Stockhead‘s Josh Chiat, Ghana’s Minerals Income Investment Fund booted US$32.9 million ($51.4m) Atlantic’s way.

A11 is partnered with Piedmont Lithium (ASX:PLL) in development of the Ewoyaa project, which will be Ghana’s first lithium mine, with an aim to produce spodumene concentrate via a “simple gravity-only process flowsheet”.

The EPA’s approval will remain valid up to March 24, 2025.

Atlantic Lithium CEO Keith Muller said: “The diversion of the transmission lines that traverse the proposed project site forms an important part of the mine plan and the company’s preparations towards shovel readiness at Ewoyaa.

“At Ewoyaa, we consider ourselves exceptionally fortunate to be able to leverage Ghana’s impressive existing infrastructure and the considerable expertise from over a century of mining activity in the country.

“We believe these elements play a major role in positioning the project as one of the leading hard rock spodumene assets globally.”

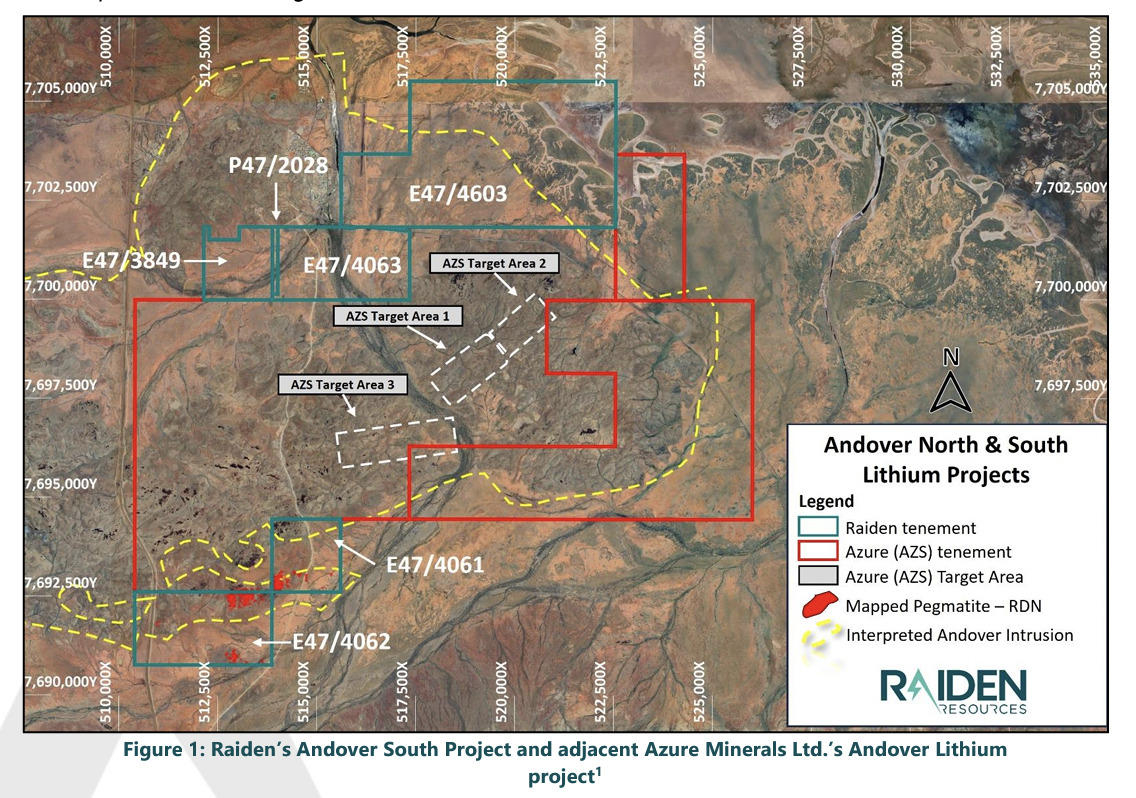

Another battery metals explorer, Raiden is on the hunt locally, over in the Pilbara, WA. It’s up today specifically on news from its Andover South project, where it has announced its highest-grade lithium and rubidium results to date.

Raiden’s Andover South, and North, prospects are right next to Azure Minerals’ (ASX:AZS) attention-stealing Andover project, which is an emerging Tier-1 lithium discovery.

One of the lithium rock-chip samples at Raiden’s ground has come in at a 2.73% Li2O grade, the highest from the project so far. As for its admittedly slightly less exciting (sorry rubidium fans) rubidium find, it’s pulled in a sample at 0.55% from a different hunk of rock.

More assay results are apparently on their way.

Raiden’s MD, Dusko Ljubojevic, said: “The recent results have defined further mineralised pegmatites and have extended the high-grade trend significantly to the west of the previously 50 metre wide pegmatites.

“High-grade pegmatites are now defined over a significant strike extent through the pegmatite field and are extending the strike for planned drill testing.”

Note, Raiden’s other big game is nickel. Its nearby Mt Sholl project boasts a maiden resource released in April of 23.4Mt at 0.60% nickel equivalent or 1.54% copper equivalent depending on which side you look from.

RDN share price

At Stockhead we tell it like it is. While Raiden Resources is a Stockhead advertiser at the time of writing, it did not sponsor this article.