Top Resources 4: Rox searches for a heart of gold on bloody Valentine’s Day

Mining

Mining

Here are some of the biggest resources winners in early trade, Wednesday February 14.

This WA goldie is bucking the blood-spattered materials sector trend today with a +16% intraday gain at time of looking swiftly away from portfolio and breathing steadily in and out through a paper bag.

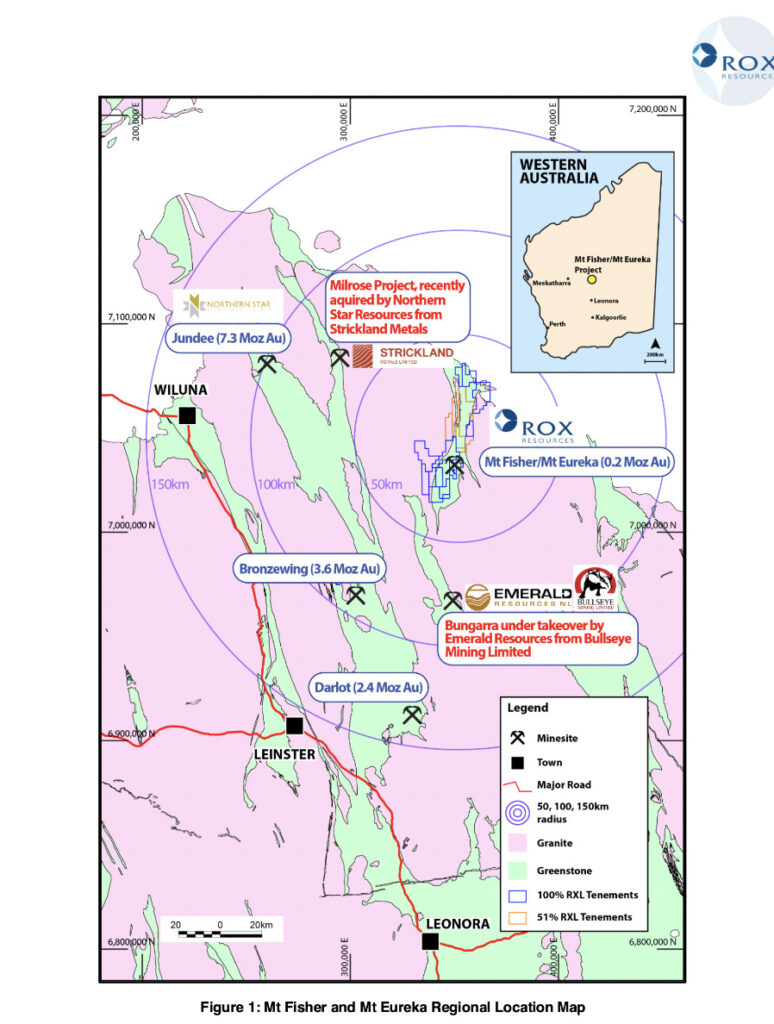

Rox, which, btw, has mesmerising drone footage of its sites on its website home page, has identified numerous new high-priority gold targets at its Mt Fisher-Mt Eureka gold and nickel project.

That’s a site that covers 1,150km2 of ground in one of the least explored greenstone belts in the gold-prolific Yilgarn Craton in WA.

And this comes after recently completed geophysical Gradient Array Induced Polarisation (GAIP) surveys.

Some things to note here:

Past drill intercepts at Mt Fisher of 9m at 34.34g/t Au demonstrate the high-grade potential of the belt, says Rox Resources. And at present, limited drilling in the Mt Fisher – Mt Eureka corridor has delineated a gold Mineral Resource of 187koz Au within 100km of Strickland Metals’ (ASX:STK) Milrose project – recently acquired by Northern Star for about $61m.

The geophysical surveys have now identified “multiple walk-up drill targets”, located along strike from known gold mineralised trends that are characterised by high-sulphide content.

Promising stuff, and it provides extra confidence for Rox to now advance and further monetise Mt Fisher-Mt Eureka alongside its primary focus, which is the development of the flagship, high-grade Youanmi gold project.

We (okay, I) mentioned yesterday in this column that HMX was rising on no news. How wrong we (okay, I) turned out to be. To be fair, though, we (I) were/was right at the time.

Hammer Metals has now delivered a significant update on its Mt Isa East (MIE) JV project.

Hammer’s joint venture partner Sumitomo Metal Mining Oceania has reached a $6m, (60% interest) earn-in milestone and has elected to continue to fund the JV, with drilling of the Shadow South IOCG (iron oxide copper-gold) target scheduled to kick off in early March.

The company notes the following:

• It’s elected to dilute its position in accordance with the JV agreement. It can still elect to contribute to the JV in the future to maintain an interest at that point in time.

• The 2024 JV programs will begin with RC drilling at the Shadow South IOCG prospect, which is a “coincident magnetic and IP anomaly with a peak chargeability response in excess of 40mv/V”.

• Hammer will combine this program with drilling on the 100%-owned Hardway prospect.

Hammer’s MD, Daniel Thomas, said:

“This is another important and positive milestone for our Mount Isa exploration efforts… Importantly, this will ensure that we have ongoing funding for exploration activity within the JV, with the first cab off the rank being the start of drilling in early March at the high-priority Shadow South IOCG target.”

Bastion, an early-stage exploration minnow focused on copper, gold, and green metals, is up and to the right today on the back of beaut REE news.

It’s an update on its rare earths exploration on the strategic Gyttorp land holding in Southern Sweden.

That’s a project located on the southern end of a belt of iron and REE-enriched skarns, more than 100km long, known locally as the “REE-line”, with Bastnäs type REE mineralisation.

The company reports that 53 samples from old mine workings confirm the property is highly prospective for high-grade REE, with laboratory results to 6.8% (68,078 ppm) Total REE + Y (TREO including Cerium) and elevated results throughout the property.

Other high-grade total REE+Y samples exceeding 1.0% (10,000 ppm) include: 3.09%, 2.85%, 2.46%, 2.09%, 1.52%, 1.49%, 1.45%, 1.29% and 1.1%.

“The project also contains high-grade copper occurrences, with locally extensive chalcopyrite in the magnetite skarn, with concentrations in four samples over 2.5% copper that will be re-assayed to determine the higher values,” wrote BMO in an ASX announcement this morning.

Fifty three Samples from old mine workings confirm the $BMO Gyttorp land holding in Southern Sweden is highly prospective for high-grade #REE, with laboratory results to 6.8% (68,078 ppm) Total REE + Y &elevated results throughout the property.https://t.co/xOQU3KwFVh pic.twitter.com/6OySmzRFoZ

— Bastion Minerals Limited (@BastionLimited) February 14, 2024

BMO exec chair Ross Landles outlined what happens next:

“With this initial work completed, Bastion has established the area of highest REE and will continue the sampling program, to define the full lateral distribution of REE mineralisation associated with zones of magnetite skarn. Historical aeromagnetic data available from the SGU will also be optimised for the purpose of defining the magnetite skarns in the properties.

“Additional acquisition of magnetic data will be collected, if required, to better assist definition of potential tonnages of mineralisation and to target a drilling program.”

This critical minerals-hunting, clean-energy-future-focused company has some news – perk up lithium lovers, it’s not all bad news across this effing bloody Valentine’s Day.

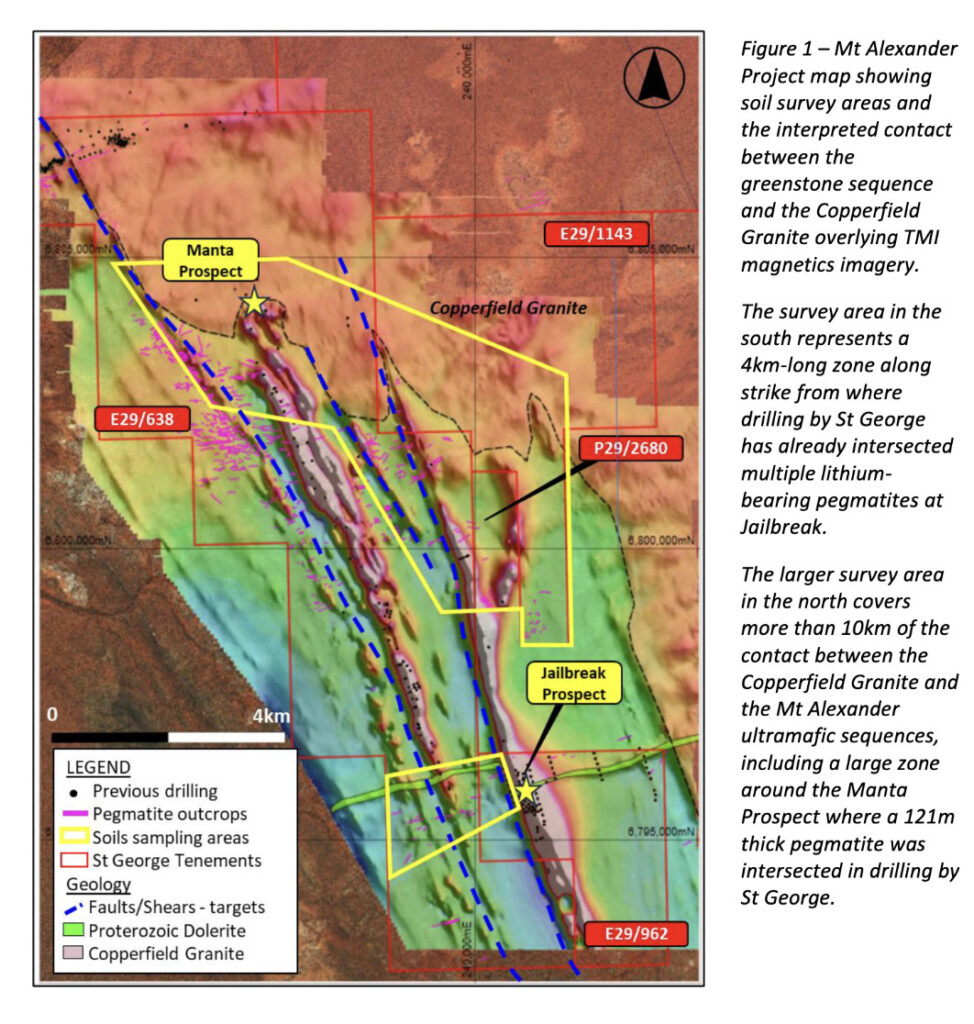

St George is headlining multiple, large-scale lithium soil anomalies it’s found at its Mt Alexander project in WA, which has been undergoing a soil sampling program.

It’s a find with a largest strike of more than 2.7km and with lithium values that have corresponding anomalous values of caesium (Cs) and tantalum (Ta). These, note SGQ are key pathfinder elements for potential lithium mineralisation.

Of particular note, one of the new soil anomalies – measuring 1.7km x 1.3km – is along strike from the Manta prospect, where drilling by St George has intersected a 121m thick fractionated pegmatite.

And another high-priority soil anomaly has been identified along the contact of the Copperfield Granite with the Mt Alexander greenstone belt – also a favourable setting for potential lithium mineralisation, and, says St George: “a direct analogue to the major lithium discovery by Delta Lithium (ASX:DLI) at its nearby Mt Ida project (14.6Mt @ 1.2% Li2O).

What’s next for these fresh targets? Drilling, which has now been locked in for March.

Exec chairman John Prineas had some comments to make about it all, including these ones:

“The consistency and cohesiveness of the lithium values within these large-scale anomalies is impressive. The coincident pathfinder elements like tantalum and caesium as well as the extensive pegmatite outcrop make these areas compelling drill targets.”