Gold Digger: Gold pulls back but gets to grips with sticky inflation situation

Pic via Getty Images

- Gold has pulled back from very recent highs after the latest ‘sticky’ US inflation figures

- But… the price action in general looks pretty solid from where we’re sitting, and so does the TA

- Leading ASX goldies this week include: BMR, BMO, GSM

What’s happening in the world near and far pertaining to gold on Friday March 8? Let’s take a quick squizz.

The latest inflation report has come in a bit… “ewww”… warm and sticky.

The latest US Producer Price Index (PPI) has shown that wholesale inflation in the US jumped 0.6% in February – quite a bit more than expected, unfortunately. This also followed a stronger-than-anticipated CPI (Consumer Price Index) report earlier in the week.

The PPI report is the final bit of information of note for inflation watchers before the US Fed’s upcoming policy meet next week.

It’s put a pin in the hopes of an early rate cut, which means resignation that Jerome Powell and pals probably won’t be slicing and dicing until June at the absolute earliest, and maybe even later than that.

Hence a potential dip of note being touted from analysts for gold, equities and crypto, while traders’ bottom lips wobble as they come to terms with having to ride out sideways/choppy action a while longer yet.

That said, where does this actually leave gold for now? Okay, granted lower than several hours ago, when it was flying high at US$2,175 an ounce (and earlier this week up around $2,195), but it’s still about on par, or even a touch higher than this time last week.

Not too bad at all, then, although gold traders will probably be keeping one eye on what currently looks like a bit of a recovery for the US dollar over the past 24 hours.

At last check, spot gold pricing was trading around US$2,165, while the precious yellow commodity was changing hands for a handy $3,301 Aussie bucks.

In the meantime, while gold remains far less volatile in comparison, as you’d expect, the store-of-value contender Bitcoin (BTC) has retraced significantly today – falling from its ATH up above US$73k a few days ago to its more meme-friendly figure of roughly $69k… actually about another $1,000 below that now.

Professional gold bug and Bitcoin booter Peter Schiff will be delighted.

Bitcoin related publications are falsely claiming that I've changed my position on #Bitcoin because I admitted I wished I had bought some back in 2010. I think everyone wished they bough Bitcoin in 2010. Even those who did wish they bought more. If I had bought then I'd sell now.

— Peter Schiff (@PeterSchiff) March 14, 2024

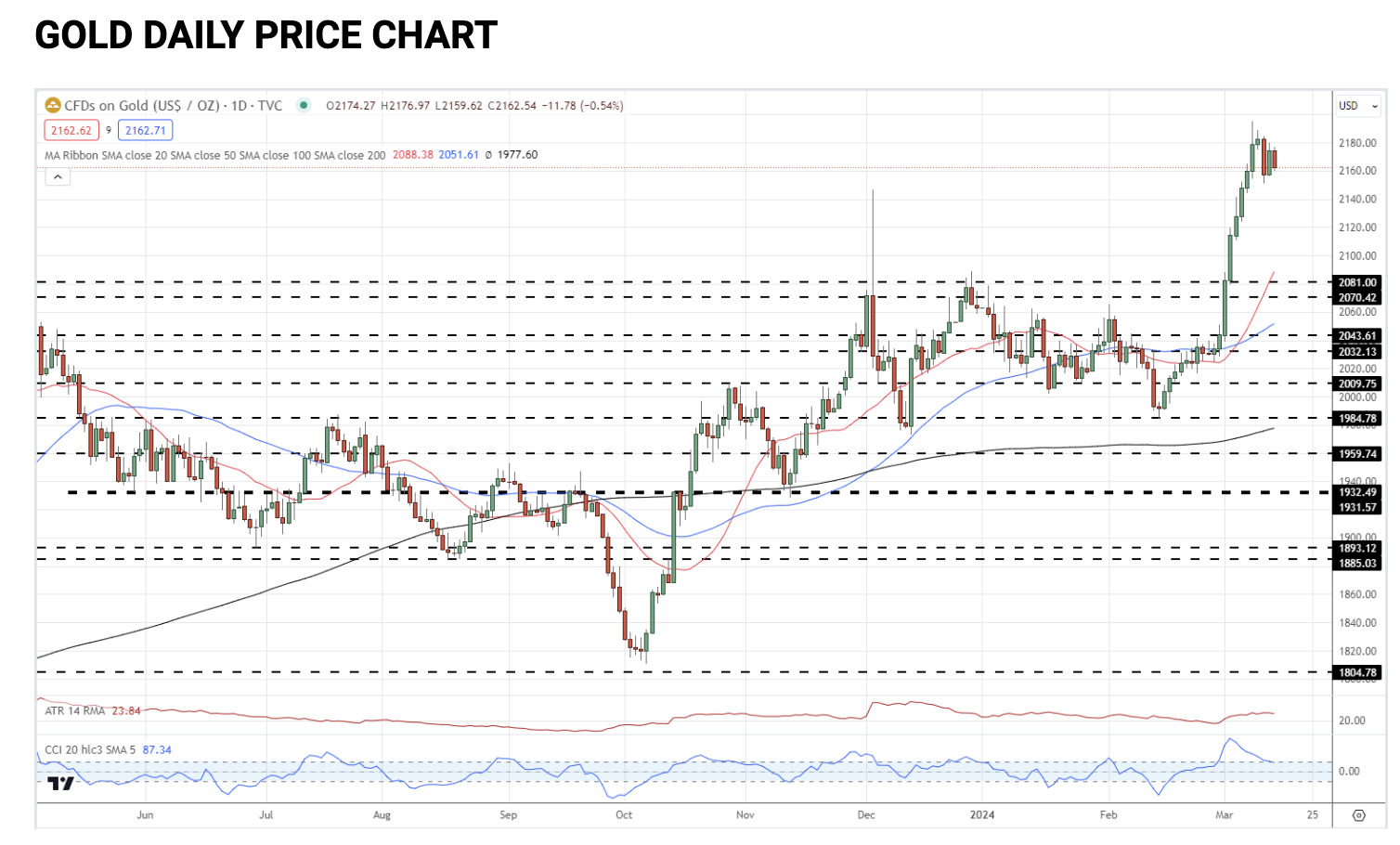

A gold pennant, suggests technical analysts

Some second-hand technical analysis for you from the US TA gurus over at DailyFX.com.

They say that the period of consolidation gold appears to be forming, “is starting to look like a new bullish pennant formation, although it will need another couple of candles to see if this plays out.

“If this pattern is formed, gold is likely to push further ahead and make a fresh record high. Support is seen at $2,148/oz, ahead of $2,128/oz.”

Here’s their chart, courtesy of Trading View, with said pennant pattern top right.

A pennant in technical analysis, by the way, can suggest a continuation pattern, and is formed after a large movement upwards, forming the flagpole. You can see that on the chart above, and just how impressive gold’s March has been to this little period of consolidation.

Quite often, a pennant like the one above, is followed by another breakout move in the same direction as the one preceding. We’ll see.

Big banks are leaning positive, too

Supporting that positive TA, we’ve also seen very recently two big Aussie banks projecting a strong outlook for the yellow metal.

As Josh notes in his Monsters of Rock column, ANZ has this week joined Commonwealth Bank in “ratcheting up forecasts [from US$2,200] projecting prices to hit US$2,300/oz by the year’s end”.

Interestingly, ANZ’s TA for gold short term isn’t reading as strongly as DailyFX’s, above, but certainly the long-term view is positive.

“Central banks purchased 39t of gold in January, setting a strong base for demand. Heightened political and geopolitical risks will keep the backdrop conducive for official purchases in the 750–800t range,” said the bank’s commodity analysts.

We won’t steal that thunder any more than is necessary, so read the full article > here for more, in which Bellevue Gold (ASX:BGL); Gold Road (ASX:GOR); Capricorn Metals (ASX:CMM); Calidus Resources (ASX:CAI); West African Resources (ASX:WAF) and Alkane Resources (ASX:ALK) all receive a mention for various news items.

ASX Winners & Losers

Here’s how ASX-listed precious metals stocks are performing, circa 3pm March 8:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Please email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.0135 | -4% | 13% | -50% | $14,645,711 |

| NPM | Newpeak Metals | 0.01 | -9% | -23% | -90% | $1,099,469 |

| ASO | Aston Minerals Ltd | 0.0145 | -9% | -28% | -86% | $19,425,964 |

| MTC | Metalstech Ltd | 0.17 | 0% | 3% | -59% | $33,067,053 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.046 | 15% | 15% | -43% | $5,314,028 |

| G88 | Golden Mile Res Ltd | 0.012 | 9% | -8% | -25% | $4,934,674 |

| DCX | Discovex Res Ltd | 0.002 | 0% | 0% | -33% | $6,605,136 |

| NMR | Native Mineral Res | 0.021 | -16% | 0% | -68% | $4,404,761 |

| AQX | Alice Queen Ltd | 0.005 | 0% | -17% | -81% | $3,454,921 |

| SLZ | Sultan Resources Ltd | 0.014 | -46% | 0% | -74% | $2,319,888 |

| MKG | Mako Gold | 0.014 | -7% | -22% | -65% | $11,712,098 |

| KSN | Kingston Resources | 0.08 | -2% | 4% | -2% | $40,832,870 |

| AMI | Aurelia Metals Ltd | 0.14 | 0% | 27% | 53% | $245,016,274 |

| PNX | PNX Metals Limited | 0.006 | 0% | 20% | 140% | $29,593,436 |

| GIB | Gibb River Diamonds | 0.027 | -4% | -10% | -51% | $5,710,755 |

| KCN | Kingsgate Consolid. | 1.33 | -4% | 13% | -16% | $350,542,301 |

| TMX | Terrain Minerals | 0.004 | 0% | -20% | -20% | $5,726,683 |

| BNR | Bulletin Res Ltd | 0.077 | 8% | -5% | -15% | $22,608,226 |

| NXM | Nexus Minerals Ltd | 0.044 | 7% | 26% | -74% | $17,896,766 |

| SKY | SKY Metals Ltd | 0.033 | -18% | -13% | -28% | $15,687,535 |

| LM8 | Lunnonmetalslimited | 0.27 | 6% | 8% | -72% | $64,261,690 |

| CST | Castile Resources | 0.079 | 10% | 0% | -14% | $19,110,292 |

| YRL | Yandal Resources | 0.1 | -17% | -9% | 8% | $25,441,723 |

| FAU | First Au Ltd | 0.002 | -33% | -33% | -33% | $3,323,987 |

| ARL | Ardea Resources Ltd | 0.665 | 22% | 64% | 40% | $130,031,164 |

| GWR | GWR Group Ltd | 0.105 | 11% | 21% | 24% | $33,727,749 |

| IVR | Investigator Res Ltd | 0.042 | 5% | 20% | 2% | $66,522,942 |

| GTR | Gti Energy Ltd | 0.008 | 0% | -20% | -19% | $16,399,577 |

| IPT | Impact Minerals | 0.015 | 0% | 50% | 67% | $40,105,854 |

| BNZ | Benzmining | 0.15 | 3% | 11% | -61% | $14,466,137 |

| MOH | Moho Resources | 0.006 | 0% | 0% | -68% | $3,235,069 |

| BCM | Brazilian Critical | 0.021 | -16% | -16% | -82% | $15,539,093 |

| PUA | Peak Minerals Ltd | 0.002 | -20% | -33% | -56% | $2,082,753 |

| MRZ | Mont Royal Resources | 0.07 | 9% | -26% | -63% | $5,782,026 |

| SMS | Starmineralslimited | 0.035 | -8% | -8% | -48% | $2,657,298 |

| MVL | Marvel Gold Limited | 0.01 | -9% | 0% | -44% | $7,774,116 |

| PRX | Prodigy Gold NL | 0.004 | 0% | -33% | -60% | $7,004,431 |

| AAU | Antilles Gold Ltd | 0.021 | 0% | 5% | -48% | $18,866,074 |

| CWX | Carawine Resources | 0.105 | 5% | 9% | 8% | $24,793,172 |

| RND | Rand Mining Ltd | 1.37 | 10% | 7% | 5% | $77,920,067 |

| CAZ | Cazaly Resources | 0.02 | 5% | -9% | -26% | $8,638,090 |

| BMR | Ballymore Resources | 0.125 | 28% | 14% | -11% | $22,922,976 |

| DRE | Dreadnought Resources Ltd | 0.018 | -5% | -14% | -73% | $62,668,313 |

| ZNC | Zenith Minerals Ltd | 0.1 | 11% | -17% | -51% | $35,238,088 |

| REZ | Resourc & En Grp Ltd | 0.01 | 0% | -9% | -33% | $4,998,058 |

| LEX | Lefroy Exploration | 0.11 | -4% | -24% | -49% | $23,052,725 |

| ERM | Emmerson Resources | 0.052 | 2% | 4% | -28% | $28,324,909 |

| AM7 | Arcadia Minerals | 0.07 | 0% | 6% | -67% | $7,633,507 |

| ADT | Adriatic Metals | 3.72 | 7% | 13% | 5% | $940,154,804 |

| AS1 | Asara Resources Ltd | 0.009 | 0% | -18% | -69% | $8,720,040 |

| CYL | Catalyst Metals | 0.63 | 4% | 19% | -44% | $150,807,918 |

| CHN | Chalice Mining Ltd | 1.1425 | -14% | 6% | -81% | $466,755,965 |

| KAL | Kalgoorliegoldmining | 0.025 | 9% | 19% | -58% | $3,170,014 |

| MLS | Metals Australia | 0.023 | -12% | -21% | -44% | $16,976,869 |

| ADN | Andromeda Metals Ltd | 0.026 | -13% | 13% | -41% | $83,977,315 |

| MEI | Meteoric Resources | 0.225 | 2% | 25% | 105% | $467,678,164 |

| SRN | Surefire Rescs NL | 0.011 | 0% | -8% | -39% | $19,863,078 |

| SIH | Sihayo Gold Limited | 0.0015 | 50% | 0% | -25% | $18,306,384 |

| WA8 | Warriedarresourltd | 0.045 | 10% | 41% | -70% | $26,646,115 |

| HMX | Hammer Metals Ltd | 0.037 | 0% | -27% | -33% | $31,910,665 |

| WCN | White Cliff Min Ltd | 0.015 | 0% | 7% | 50% | $24,365,811 |

| AVM | Advance Metals Ltd | 0.036 | 3% | 0% | -78% | $1,443,058 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -7% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.005 | 0% | -17% | -58% | $6,655,983 |

| MCT | Metalicity Limited | 0.002 | 0% | 0% | 0% | $8,970,108 |

| AME | Alto Metals Limited | 0.029 | -3% | 4% | -54% | $21,645,695 |

| CTO | Citigold Corp Ltd | 0.0045 | 13% | -25% | -10% | $12,000,000 |

| TIE | Tietto Minerals | 0.61 | -1% | -1% | 5% | $694,882,627 |

| SMI | Santana Minerals Ltd | 1.28 | -6% | -2% | 91% | $234,737,591 |

| M2R | Miramar | 0.015 | -6% | -25% | -67% | $2,233,043 |

| MHC | Manhattan Corp Ltd | 0.003 | 0% | 0% | -50% | $7,342,449 |

| GRL | Godolphin Resources | 0.036 | 9% | -10% | -34% | $6,092,713 |

| SVG | Savannah Goldfields | 0.029 | -3% | -6% | -82% | $8,462,437 |

| EMC | Everest Metals Corp | 0.08 | 4% | 3% | -6% | $13,142,649 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -2% | $11,262,521 |

| CY5 | Cygnus Metals Ltd | 0.051 | -18% | -27% | -84% | $14,869,516 |

| G50 | Gold50Limited | 0.096 | 25% | 7% | -58% | $10,491,840 |

| ADV | Ardiden Ltd | 0.15 | 3% | -9% | -50% | $8,752,451 |

| AAR | Astral Resources NL | 0.055 | -5% | -15% | -21% | $48,378,950 |

| VMC | Venus Metals Cor Ltd | 0.09 | -5% | -10% | 3% | $17,075,581 |

| NAE | New Age Exploration | 0.004 | -20% | 0% | -33% | $7,175,596 |

| VKA | Viking Mines Ltd | 0.01 | -9% | -9% | 0% | $10,252,584 |

| LCL | LCL Resources Ltd | 0.0125 | 14% | 14% | -58% | $12,417,932 |

| MTH | Mithril Resources | 0.002 | 0% | 0% | 0% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.004 | 0% | -20% | -60% | $3,521,956 |

| RMX | Red Mount Min Ltd | 0.002 | 0% | 0% | -50% | $5,347,152 |

| PRS | Prospech Limited | 0.035 | 6% | 13% | 58% | $9,455,205 |

| TTM | Titan Minerals | 0.029 | 0% | 45% | -57% | $45,787,849 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -42% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.04 | 5% | 11% | -53% | $20,986,443 |

| KZR | Kalamazoo Resources | 0.093 | 9% | -15% | -36% | $16,081,925 |

| BCN | Beacon Minerals | 0.025 | 4% | 14% | -11% | $93,919,204 |

| MAU | Magnetic Resources | 0.9675 | -12% | 1% | 34% | $247,113,933 |

| BC8 | Black Cat Syndicate | 0.215 | -10% | 5% | -42% | $72,257,018 |

| EM2 | Eagle Mountain | 0.071 | 6% | 16% | -60% | $22,567,548 |

| EMR | Emerald Res NL | 2.94 | -6% | -6% | 98% | $1,990,309,505 |

| BYH | Bryah Resources Ltd | 0.008 | 0% | -20% | -55% | $3,483,628 |

| HCH | Hot Chili Ltd | 1.02 | 2% | -3% | 15% | $121,834,110 |

| WAF | West African Res Ltd | 1.0225 | -1% | 23% | 7% | $1,031,707,065 |

| MEU | Marmota Limited | 0.049 | 7% | 4% | 36% | $53,998,829 |

| NVA | Nova Minerals Ltd | 0.27 | -5% | 2% | -39% | $60,103,668 |

| SVL | Silver Mines Limited | 0.155 | 3% | 15% | 0% | $248,825,982 |

| PGD | Peregrine Gold | 0.225 | 5% | -10% | -45% | $15,543,037 |

| ICL | Iceni Gold | 0.025 | -19% | -26% | -72% | $6,164,026 |

| FG1 | Flynngold | 0.043 | 0% | -17% | -47% | $7,058,059 |

| WWI | West Wits Mining Ltd | 0.015 | -12% | 36% | 15% | $36,455,875 |

| RML | Resolution Minerals | 0.003 | 0% | 0% | -40% | $3,779,990 |

| AAJ | Aruma Resources Ltd | 0.018 | 6% | 6% | -68% | $3,347,156 |

| AL8 | Alderan Resource Ltd | 0.004 | -33% | 33% | -43% | $4,980,876 |

| GMN | Gold Mountain Ltd | 0.004 | 0% | 0% | 0% | $9,111,514 |

| MEG | Megado Minerals Ltd | 0.012 | 9% | -20% | -71% | $2,799,011 |

| HMG | Hamelingoldlimited | 0.074 | 3% | -3% | -14% | $11,655,000 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.13 | -10% | -7% | -64% | $12,387,643 |

| TBR | Tribune Res Ltd | 3.47 | 8% | 18% | 1% | $179,440,823 |

| FML | Focus Minerals Ltd | 0.17 | -3% | 6% | -3% | $48,714,970 |

| GSR | Greenstone Resources | 0.007 | 0% | 0% | -65% | $9,576,794 |

| VRC | Volt Resources Ltd | 0.006 | 0% | 20% | -45% | $22,715,587 |

| ARV | Artemis Resources | 0.018 | 0% | 13% | 38% | $30,441,531 |

| HRN | Horizon Gold Ltd | 0.29 | 18% | 5% | -3% | $42,003,578 |

| CLA | Celsius Resource Ltd | 0.013 | 0% | 18% | -19% | $29,198,672 |

| QML | Qmines Limited | 0.072 | 18% | -3% | -56% | $14,088,296 |

| RDN | Raiden Resources Ltd | 0.024 | -4% | -8% | 532% | $63,758,043 |

| TCG | Turaco Gold Limited | 0.16 | 10% | 33% | 158% | $97,034,667 |

| KCC | Kincora Copper | 0.035 | 13% | 13% | -51% | $6,927,182 |

| GBZ | GBM Rsources Ltd | 0.009 | -10% | 13% | -72% | $8,019,703 |

| DTM | Dart Mining NL | 0.015 | 0% | 15% | -65% | $3,413,694 |

| MKR | Manuka Resources. | 0.077 | 4% | 9% | 18% | $57,916,531 |

| AUC | Ausgold Limited | 0.03 | 3% | 15% | -40% | $71,180,377 |

| ANX | Anax Metals Ltd | 0.02 | 0% | 0% | -71% | $11,933,855 |

| EMU | EMU NL | 0.001 | 0% | 0% | -50% | $2,024,771 |

| SFM | Santa Fe Minerals | 0.045 | 0% | 0% | -34% | $3,276,846 |

| SSR | SSR Mining Inc. | 6.05 | -7% | -14% | -71% | $31,478,700 |

| PNR | Pantoro Limited | 0.055 | 10% | 34% | 2% | $286,221,678 |

| CMM | Capricorn Metals | 4.84 | -7% | 14% | 8% | $1,830,525,950 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | 0% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.004 | 0% | 0% | -33% | $7,975,438 |

| HAW | Hawthorn Resources | 0.071 | -8% | -14% | -19% | $24,791,155 |

| BGD | Bartongoldholdings | 0.265 | 2% | 8% | 25% | $55,042,953 |

| SVY | Stavely Minerals Ltd | 0.031 | -11% | 3% | -84% | $12,985,963 |

| AGC | AGC Ltd | 0.072 | -9% | -4% | 41% | $15,555,556 |

| RGL | Riversgold | 0.008 | -11% | -11% | -47% | $7,741,292 |

| TSO | Tesoro Gold Ltd | 0.032 | 10% | 39% | 10% | $43,035,325 |

| GUE | Global Uranium | 0.1 | 0% | -23% | -31% | $27,668,899 |

| CPM | Coopermetalslimited | 0.13 | -59% | -57% | -40% | $10,969,791 |

| MM8 | Medallion Metals. | 0.057 | 4% | 2% | -44% | $17,536,144 |

| FFM | Firefly Metals Ltd | 0.58 | 5% | 16% | -12% | $215,803,073 |

| CBY | Canterbury Resources | 0.03 | 11% | 11% | -25% | $5,152,227 |

| LYN | Lycaonresources | 0.17 | 0% | 6% | -19% | $6,388,156 |

| SFR | Sandfire Resources | 8.34 | 4% | 20% | 50% | $3,870,725,662 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | 0% | $4,881,018 |

| TAM | Tanami Gold NL | 0.032 | 0% | 7% | -11% | $38,778,203 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.028 | -13% | 0% | -18% | $10,421,716 |

| ALK | Alkane Resources Ltd | 0.61 | 4% | 17% | -8% | $353,010,830 |

| BMO | Bastion Minerals | 0.011 | 22% | 0% | -61% | $3,114,441 |

| IDA | Indiana Resources | 0.079 | -4% | -4% | 58% | $50,621,639 |

| GSM | Golden State Mining | 0.012 | 20% | 0% | -68% | $3,352,448 |

| NSM | Northstaw | 0.038 | 9% | -21% | -71% | $4,755,777 |

| GSN | Great Southern | 0.023 | -4% | 21% | 15% | $17,356,609 |

| RED | Red 5 Limited | 0.37 | 3% | 21% | 185% | $1,264,287,200 |

| DEG | De Grey Mining | 1.25 | -6% | 6% | -13% | $2,378,876,200 |

| THR | Thor Energy PLC | 0.025 | 0% | -4% | -38% | $4,604,303 |

| CDR | Codrus Minerals Ltd | 0.04 | -9% | -18% | -58% | $3,880,275 |

| MDI | Middle Island Res | 0.015 | -12% | -6% | -65% | $3,264,810 |

| WTM | Waratah Minerals Ltd | 0.062 | -2% | -31% | -48% | $9,708,692 |

| POL | Polymetals Resources | 0.23 | -13% | -8% | -12% | $40,192,541 |

| RDS | Redstone Resources | 0.0045 | -10% | -10% | -55% | $4,164,203 |

| NAG | Nagambie Resources | 0.015 | -40% | -38% | -72% | $11,949,535 |

| BGL | Bellevue Gold Ltd | 1.695 | 8% | 22% | 42% | $1,954,387,473 |

| GBR | Greatbould Resources | 0.062 | -3% | 3% | -38% | $37,717,294 |

| KAI | Kairos Minerals Ltd | 0.014 | 0% | 8% | -4% | $36,692,771 |

| KAU | Kaiser Reef | 0.13 | -13% | -4% | -24% | $23,090,926 |

| HRZ | Horizon | 0.035 | 0% | 0% | -29% | $24,534,429 |

| CAI | Calidus Resources | 0.165 | 10% | 14% | -31% | $101,086,600 |

| CDT | Castle Minerals | 0.007 | 17% | 0% | -67% | $8,571,451 |

| RSG | Resolute Mining | 0.3675 | -7% | 7% | 25% | $787,748,505 |

| MXR | Maximus Resources | 0.035 | 6% | 6% | 9% | $11,233,102 |

| EVN | Evolution Mining Ltd | 3.27 | -1% | 9% | 16% | $6,712,266,822 |

| CXU | Cauldron Energy Ltd | 0.041 | 11% | -20% | 593% | $48,488,787 |

| DLI | Delta Lithium | 0.3275 | 2% | 19% | -8% | $234,900,482 |

| ALY | Alchemy Resource Ltd | 0.007 | -13% | -13% | -53% | $8,246,534 |

| HXG | Hexagon Energy | 0.017 | 31% | 21% | 31% | $8,206,654 |

| OBM | Ora Banda Mining Ltd | 0.2575 | -6% | 10% | 98% | $470,188,282 |

| SLR | Silver Lake Resource | 1.18 | -3% | 13% | 7% | $1,126,366,921 |

| AVW | Avira Resources Ltd | 0.001 | 0% | -50% | -67% | $2,133,790 |

| LCY | Legacy Iron Ore | 0.015 | -6% | -6% | -17% | $115,703,224 |

| PDI | Predictive Disc Ltd | 0.2375 | 6% | 16% | 36% | $498,298,581 |

| MAT | Matsa Resources | 0.028 | -3% | 4% | -28% | $13,885,897 |

| ZAG | Zuleika Gold Ltd | 0.017 | 0% | -19% | 31% | $12,513,454 |

| GML | Gateway Mining | 0.027 | -10% | 13% | -45% | $9,327,404 |

| SBM | St Barbara Limited | 0.1675 | -7% | 5% | -34% | $134,965,113 |

| SBR | Sabre Resources | 0.019 | 12% | -10% | -34% | $7,110,977 |

| STK | Strickland Metals | 0.087 | -3% | 5% | 142% | $147,810,134 |

| ION | Iondrive Limited | 0.009 | 0% | -10% | -54% | $4,376,568 |

| CEL | Challenger Gold Ltd | 0.078 | 1% | -3% | -29% | $100,893,470 |

| LRL | Labyrinth Resources | 0.005 | -17% | -17% | -60% | $5,937,719 |

| NST | Northern Star | 13.595 | -6% | 6% | 21% | $16,100,587,835 |

| OZM | Ozaurum Resources | 0.081 | 21% | 9% | 80% | $13,176,250 |

| TG1 | Techgen Metals Ltd | 0.029 | -28% | -24% | -58% | $4,068,242 |

| XAM | Xanadu Mines Ltd | 0.051 | 21% | 11% | 59% | $73,788,258 |

| AQI | Alicanto Min Ltd | 0.03 | 0% | 30% | -38% | $19,690,778 |

| KTA | Krakatoa Resources | 0.01 | -9% | -41% | -68% | $4,721,072 |

| ARN | Aldoro Resources | 0.082 | -1% | -18% | -64% | $10,769,899 |

| WGX | Westgold Resources. | 2.29 | -7% | 23% | 110% | $1,184,056,825 |

| MBK | Metal Bank Ltd | 0.022 | -8% | 0% | -23% | $8,590,104 |

| A8G | Australasian Metals | 0.071 | 1% | -32% | -47% | $3,752,676 |

| TAR | Taruga Minerals | 0.007 | 0% | -22% | -56% | $4,942,187 |

| DTR | Dateline Resources | 0.014 | 17% | 0% | -26% | $18,886,206 |

| GOR | Gold Road Res Ltd | 1.5425 | -7% | 10% | 1% | $1,725,983,448 |

| S2R | S2 Resources | 0.135 | -16% | -7% | 4% | $63,400,119 |

| NES | Nelson Resources. | 0.003 | -25% | -40% | -40% | $1,840,783 |

| TLM | Talisman Mining | 0.215 | 13% | 23% | 54% | $33,897,663 |

| BEZ | Besragoldinc | 0.1375 | -5% | -8% | 244% | $58,534,127 |

| PRU | Perseus Mining Ltd | 2.02 | -2% | 23% | -5% | $2,884,484,308 |

| SPQ | Superior Resources | 0.012 | 20% | 20% | -78% | $24,014,645 |

| PUR | Pursuit Minerals | 0.005 | 0% | 0% | -75% | $14,719,857 |

| RMS | Ramelius Resources | 1.5925 | 3% | 7% | 46% | $1,820,599,094 |

| PKO | Peako Limited | 0.006 | 50% | 100% | -40% | $3,162,508 |

| ICG | Inca Minerals Ltd | 0.006 | 0% | 0% | -71% | $3,526,958 |

| A1G | African Gold Ltd. | 0.035 | -5% | 0% | -53% | $5,925,892 |

| OAU | Ora Gold Limited | 0.006 | 0% | 9% | 140% | $34,440,005 |

| GNM | Great Northern | 0.017 | 0% | 0% | -62% | $2,628,694 |

| KRM | Kingsrose Mining Ltd | 0.032 | -11% | -6% | -48% | $24,080,849 |

| BTR | Brightstar Resources | 0.0165 | 3% | 18% | 3% | $40,296,440 |

| RRL | Regis Resources | 1.89 | -6% | -4% | 6% | $1,465,357,288 |

| M24 | Mamba Exploration | 0.025 | -11% | -19% | -78% | $4,602,057 |

| TRM | Truscott Mining Corp | 0.047 | -6% | -6% | 12% | $8,148,252 |

| TNC | True North Copper | 0.076 | -12% | -3% | 43% | $34,252,183 |

| MOM | Moab Minerals Ltd | 0.005 | -29% | -29% | -29% | $4,983,744 |

| KNB | Koonenberrygold | 0.031 | 19% | -18% | -42% | $4,544,478 |

| AWJ | Auric Mining | 0.165 | -6% | 38% | 259% | $19,628,939 |

| AZS | Azure Minerals | 3.62 | 1% | 0% | 1193% | $1,660,420,062 |

| ENR | Encounter Resources | 0.275 | 0% | 6% | 120% | $106,596,457 |

| SNG | Siren Gold | 0.059 | 7% | 2% | -41% | $11,261,960 |

| STN | Saturn Metals | 0.17 | 6% | 3% | 21% | $36,923,284 |

| USL | Unico Silver Limited | 0.115 | 10% | 25% | -18% | $34,045,933 |

| PNM | Pacific Nickel Mines | 0.04 | -7% | -5% | -47% | $16,730,124 |

| AYM | Australia United Min | 0.003 | 0% | 0% | 0% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.155 | 11% | 0% | -52% | $50,662,274 |

| SPR | Spartan Resources | 0.635 | 5% | 32% | 505% | $617,800,413 |

| PNT | Panthermetalsltd | 0.038 | 12% | -22% | -63% | $3,312,314 |

| MEK | Meeka Metals Limited | 0.035 | -3% | -3% | -19% | $44,449,522 |

| GMD | Genesis Minerals | 1.94 | 1% | 28% | 93% | $2,126,063,672 |

| PGO | Pacgold | 0.15 | -6% | 11% | -57% | $12,621,816 |

| FEG | Far East Gold | 0.13 | -16% | -4% | -60% | $23,478,807 |

| MI6 | Minerals260Limited | 0.15 | -9% | -3% | -52% | $35,100,000 |

| IGO | IGO Limited | 7.43 | -4% | 7% | -40% | $5,899,116,263 |

| GAL | Galileo Mining Ltd | 0.24 | -6% | 0% | -61% | $48,418,107 |

| RXL | Rox Resources | 0.16 | 0% | -14% | -41% | $59,096,682 |

| KIN | KIN Min NL | 0.068 | -1% | -8% | 48% | $81,292,388 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -50% | $12,890,085 |

| TGM | Theta Gold Mines Ltd | 0.135 | 4% | -4% | 108% | $88,942,480 |

| FAL | Falconmetalsltd | 0.12 | -14% | 0% | -64% | $21,240,000 |

| SXG | Southern Cross Gold | 1.925 | 13% | 67% | 210% | $174,707,909 |

| SPD | Southernpalladium | 0.34 | 0% | -13% | -35% | $14,000,456 |

| ORN | Orion Minerals Ltd | 0.013 | 0% | 0% | -21% | $81,847,986 |

| TMB | Tambourahmetals | 0.087 | 5% | 4% | 2% | $7,962,274 |

| TMS | Tennant Minerals Ltd | 0.028 | 4% | -7% | 4% | $21,406,371 |

| AZY | Antipa Minerals Ltd | 0.013 | -7% | 4% | -32% | $53,752,503 |

| PXX | Polarx Limited | 0.013 | 18% | -4% | 12% | $22,134,826 |

| TRE | Toubani Res Ltd | 0.125 | 14% | 9% | -26% | $17,402,537 |

| AUN | Aurumin | 0.035 | -13% | -3% | 6% | $12,895,508 |

| GPR | Geopacific Resources | 0.018 | 13% | 13% | -27% | $13,969,195 |

| FXG | Felix Gold Limited | 0.03 | -14% | -19% | -73% | $6,216,453 |

| ILT | Iltani Resources Lim | 0.155 | 11% | -18% | 0% | $5,101,576 |

| ARD | Argent Minerals | 0.01 | -9% | 11% | -29% | $12,917,590 |

Making weekly gains

Ballymore Resources (ASX:BMR) +28%

Bastion Minerals (ASX:BMO) +22%

Golden State Mining (ASX:GSM) +20%

With the Fed considering rate cuts amidst inflation risks, precious metals like silver are becoming increasingly attractive. pic.twitter.com/yCvSfJxzyA

— GoldSilver HQ (@GoldSilverHQ) March 15, 2024

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.