Monsters of Rock: Second big bank upgrades gold forecasts. Can miners catch up?

Pic: RichVintage/E+ via Getty Images

- Gold prices fell on Thursday night as US economic data surprised to the upside

- But ANZ has joined Commonwealth Bank in ratcheting up forecasts, projecting prices to hit US$2300/oz by the year’s end

- Miners fall hard on iron ore, lithium woes

Gold wobbled for the second time in a week as American economic data again looked brighter than expected, this time a strong producer price index result.

But the outlook for rate cuts remains strong, if not as strong as it did seven days ago, when it felt nothing could stop bullion.

It feels like a price correction could be on the way.

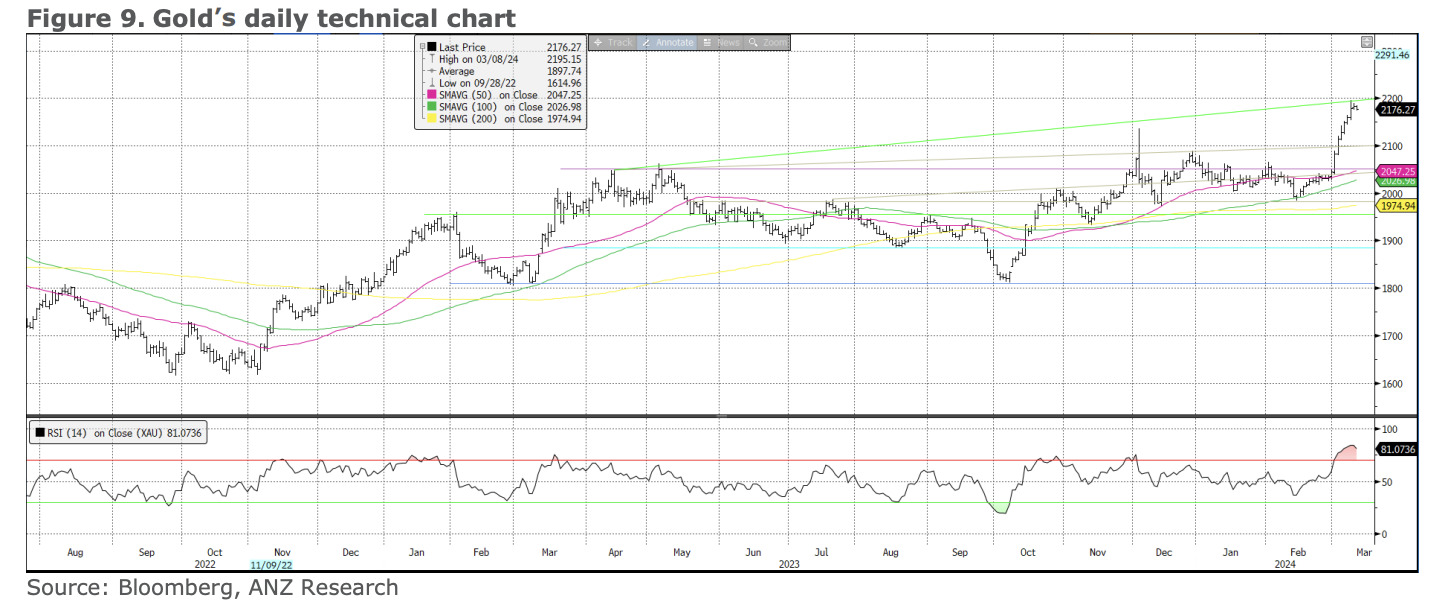

ANZ’s commodity team of Daniel Hynes and Soni Kumari noted technical charts were not supporting current prices of ~US$2162/oz, predicting a flip back to below US$2100/oz.

They’ve noted that positions taken by speculative investors have not matched price rallies, with ETF outflows from gold funds still ongoing.

Rate cut hopes for 2024 have also trailed from an optimistic 150bps to 70-80bps since the start of the year.

But Hynes and Kumari say long term their price target has been ratcheted up from US$2200 to US$2300/oz, matching the bullish projections this week from their Commonwealth Bank counterpart Vivek Dhar.

They view weak investment demand as latency rather than a contradiction to the recent price run.

“A lean level of investment in gold should be seen as a potential driver. This not only limits scope for a heavy liquidation, but also leaves ample room for fresh buying. Investment demand will be crucial this year to mitigate any physical demand losses due to higher prices,” they wrote.

“Central banks purchased 39t of gold in January, setting a strong base for demand. Heightened political and geopolitical risks will keep the backdrop conducive for official purchases in the 750–800t range.

“While physical gold demand has been holding up well since 2021, a sharp price rally is likely to temper discretionary gold buying in 2024. For jewellery demand, fewer auspicious wedding days could be a headwind.

“The recent price rally lifted well above our forecast, so a retracement is likely in the short term. Having said that, we reiterate our long-term positive view and adjust our year-end price target to USD2,300/oz from USD2,200/oz.”

Westpac reduced its December quarter outlook for gold from US$2100/oz to US$2080/oz on Wednesday, but upped its long-term, five-year-out forecast from US$2220/oz to US$2280/oz.

Let’s WAFfle on

News from gold equities has been mixed and which ones will really get the full benefit of record prices remains up in the air.

Bellevue Gold (ASX:BGL) put its best foot forward this week, opening its namesake mine and running ahead of schedule on its ramp up to a 200,000ozpa nameplate capacity as it reported a largely inconsequential $2.2m profit early doors for the half year.

Gold Road (ASX:GOR) and Capricorn Metals (ASX:CMM) meanwhile were struck by wet weather at their respective WA gold mines.

Others are working hard to capture the opportunity. Calidus Resources (ASX:CAI) has had a pretty torrid time ramping up its Warrawoona gold mine.

It’s currently in a trading halt trying to restructure its debt and hedge book to get on a more solid footing.

CAI wants to ramp up production to 119,000oz by FY27, from 66,000oz next year. It sold 12,174oz in the December quarter at an average price of just $2377/oz and still had over 80,000oz of hedges in its book as of December 31.

Looking more positive are some miners hitting exploration success, notably West African Resources (ASX:WAF), which reported intercepts of 9.5m at 81.9g/t and 8.5m at 41.4g/t in a northern extension of the M1 South deposit at its Sanbrado mine in Burkina Faso.

It says the high-grade underground mining area could be fast-tracked into the 2024 mine plan at the ~200,000ozpa gold mine.

WAF reported a $164.8m after tax profit after producing 226,823oz at an all in sustaining cost of US$1136/oz in 2023 from Sanbrado. Its operations will grow to a capacity of over 400,000ozpa once the nearby Kiaka mine is switched on in Q3 2025.

Meanwhile, Alkane Resources (ASX:ALK) was up today after reporting the highest grade interval to date from its Kaiser deposit, a porphyry near its large Boda discovery which contains 2.1Moz of gold and 500,000t copper in inferred resources.

Drill hole KAL159 hit a pyrtie breccia containing a string of gold hits including 8.6m at 14.8g/t gold equivalent (14.5g/t gold and o.24% copper) from 316.4m. A 1m stretch graded as high as 62.2g/t AuEq.

An indicated resource for Kaiser will be due in April, backing a scoping study on it and the 10.9Moz Boda deposit.

“The final results from the infill drilling at Kaiser contain even more high-grade sections, including the highest grade intercept we’ve ever seen at Kaiser at 62g/t gold equivalent in a metre section,” Alkane MD Nic Earner said.

“There’s also a very interesting ‘Boda’ style breccia that has two section totalling over 70 metres with great(er) than 3 g/t gold equivalent.”

Will gold miners catch up?

One notable aspect of the latest gold boom is that while physical gold bars have been taken along for the ride, those industrious miners who pay people to make them haven’t enjoyed the same success.

It’s a phenomenon that MineLife senior analyst Gavin Wendt says is not unique to Australian producers.

“I think investors to some degree are still nervous about resource equities, including gold. The gold sector has disappointed over a period of a couple of decades in terms of investor returns and investors have a long memory,” he said.

“There are also other ways to get gold exposure these days, including ETFs and physical gold, without investors being exposed to equity risk.

“If we analyse the data, over the past 12 months gold in both US$ and A$ terms has risen 17% and 16% respectively, both reaching all-time highs.

“Gold equities though continue to lag, with the GDX +9% and the S&P/ASX Gold Index +15% over the same period.”

That underperformance, especially noteworthy in the international names, should present an opportunity, Wendt believes.

“The GDX and S&P/ASX Gold Index are currently ~17% and ~13% below their 52-week highs. This should represent an opportunity for investors. All of the positive factors driving gold aren’t going away,” he said on Thursday.

Gold miners followed the price down today, with profits also taken off copper stocks that surged yesterday as prices hit 11 month highs of US$8927/t.

The broader materials sector tanked ~2.4% in morning trade with iron ore’s descent to levels only marginally above US$100/t sending the majors lower – Fortescue (ASX:FMG) down more than 3% – while lithium producers were hammered.

Pilbara Minerals was down almost 5% as investors digested the return of its Battery Material Exchange for what appears to be a one-off auction, accepting a pre-auction bid for 5000t of 5.5% Li2O spodumene concentrate of US$1106/dmt.

The implied US$1200/dmt 6% Li2O spodumene price of the sale came in well above Fastmarkets recently quoted US$975/t benchmark. But with delivery only due in December thanks to PLS’ stuffed order book and Pilbara saying they were unlikely to pursue regular spot sales, the result may have underwhelmed investors hoping for clearer signs of a rebound.

Liontown Resources (ASX:LTR) and Arcadium Lithium (ASX:LTM) both sunk more than 7% this morning, with a massive dive in Guangzhou lithium carbonate futures yesterday in China also likely spooking the market.

Monstars share prices today

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.