Titan verifies 2.1moz Dynasty project’s ‘company making’ credentials ahead of Q4 resource update

Mining

Mining

Special Report: Titan Minerals has barely scratched the surface of its flagship 2.1-million-ounce Dynasty gold project in Ecuador. Thousands of metres of historic drilling are currently being assayed ahead of an aggressive six-month, +6,000m exploration program.

Titan (ASX:TTM) has just finalised the acquisition of Canadian company Core Gold, which will now be delisted from the TSX. This deal includes a large, ~2moz and growing mesothermal gold project called Dynasty.

The upside at Dynasty is substantial.

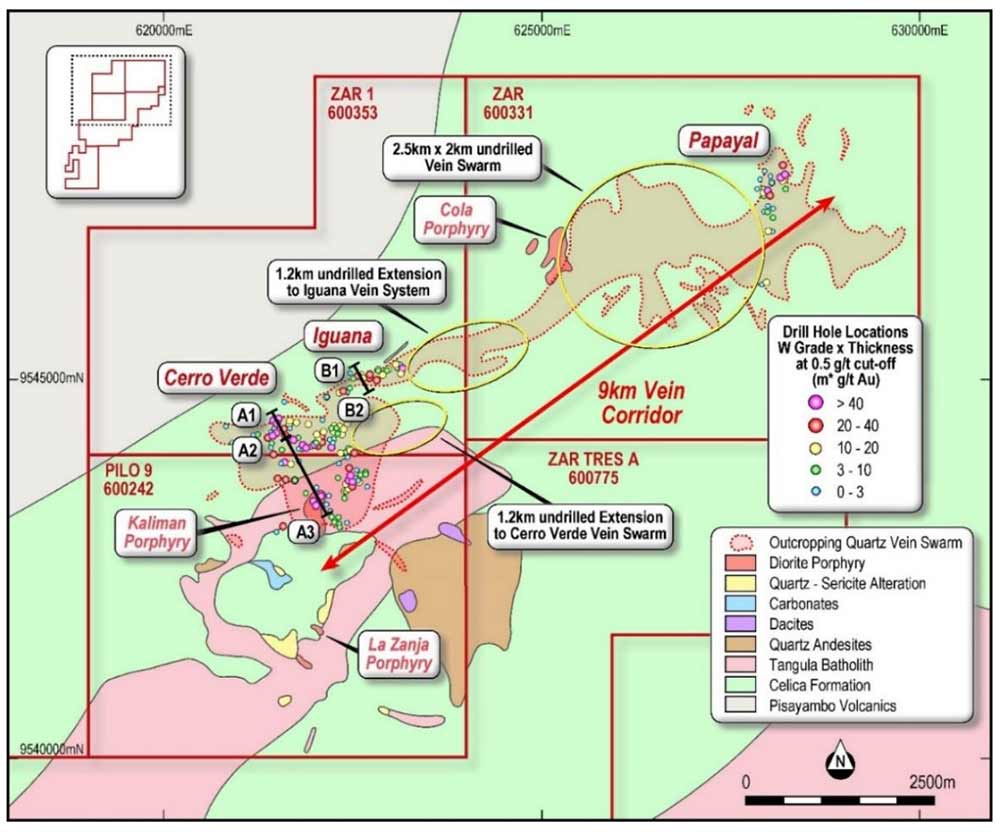

The project includes a 9km long by 1km wide mineralised corridor with outcropping vein swarm hosting high-grade gold. The shallow non-JORC resource of 2.1moz at 4.5 grams per tonne (g/t) gold covers just a small part of that 9km strike.

This resource was based on about 26,000m of drilling in 2005-07 over a small section of the 9km of mineralised strike, when gold was fetching $US650/oz ($800/oz). No systematic drilling has occurred since.

There’s a 5km ‘drill gap’ on the mineralised corridor which Titan plans to assess. Old drilling was also predominantly shallow (within 100m of surface) which means considerable potential remains at depth.

Titan’s strategy is to conduct an aggressive drilling campaign across the project and deliver a JORC resource during Q4 this year.

Right now, Titan is re-logging a considerable amount of historical drilling from previous owners. Testing of another 6,000m of new samples from archived core is planned over the next two months.

This has “strong potential” to deliver additional volume to mineral resource updates, Titan says.

Re-evaluating previous mining operations at Dynasty has also given Titan a big head start.

From 2017 to 2019, Dynasty included a small-scale mine producing on average 17,000 tonnes per month at a 3.46g/t gold grade average.

This mining focused on three identified gold veins from several small open pits within the Cerro Verde prospect at Dynasty.

But a reconciliation of the historic operations shows that small-scale mining produced gold from several other ‘blind’ veins not intersected in previous drilling at the Cerro Verde prospect area.

These blind veins were also not included in the current 2.1moz foreign resource estimation.

The additional density of high-grade veining, in combination with indications of low-grade ‘aureoles’ around veins and vein intersections, highlight the bulk tonnage open pit mining potential of the resource at Cerro Verde, Titan says.

The initial planned May drilling campaign has been delayed due to COVID-19 shutdowns. Titan now anticipates the 6,000m drilling campaign, designed to ‘upcycle’ that 2.1moz into JORC-compliant resources (a must-have for ASX-listed companies), will kick off in July.

But future resource growth for the project above 2.1moz is anticipated through several key targets, where no significant exploration has been completed after 2007.

Right now, Titan has a team of geologists at Dynasty, where local labour is permitted to work in compliance with Federal and Local travel and curfew restrictions.

Drilling campaigns in southern Ecuador anticipated to commence in May have been delayed due to the impact of the National Emergency in response to the COVID-19 pandemic.

Titan will restart its drilling and field exploration campaigns including expansion of exploration teams as soon as restrictions allow, and while minimising risk and providing a safe environment for employees, local communities, and other stakeholders.