For Titan, Dynasty is a gold project worth fighting for

Pic: Schroptschop / E+ via Getty Images

Special Report: Titan Minerals fought tooth and nail to acquire Ecuador-focused Core Gold early this year — and for good reason. The flagship Dynasty gold asset is already shaping up as a company-maker.

South America-focused explorer Titan Minerals (ASX:TTM) came across TSX-listed Core Gold at the annual Prospectors & Developers Association of Canada (PDAC) convention three years ago.

The main attraction in Core’s Ecuadorian portfolio was Dynasty, a 2.1-million-ounce project Titan soon recognised as a company maker.

An initial plan of arrangement (friendly takeover) between Core and Titan was overturned via court hearing.

Titan was then forced into a ‘David and Goliath’ battle with Zhaojin Mining; a $30bn, +650,000ozpa Chinese gold producer.

“Zhaojin were actively pursuing Core’s directors and major shareholders to do a deal on the flagship Dynasty asset,” Titan Executive Director Matthew Carr told Stockhead.

“There was a lot of noise around the transaction. One group of dissident shareholders were actually a proxy for Zhaojin, who was working activity behind the scenes to get those assets.

“Zhaojin clearly understood the opportunity, they knew what they were looking at and have a strong presence in Ecuador– an already big project with opportunities for massive scale.

“No issue with them and it was a tough contest.”

In January — after 18 gruelling months — Titan closed the $80m takeover deal after receiving the support of Core’s major shareholders.

Dynasty: A tier 1 asset with massive upside

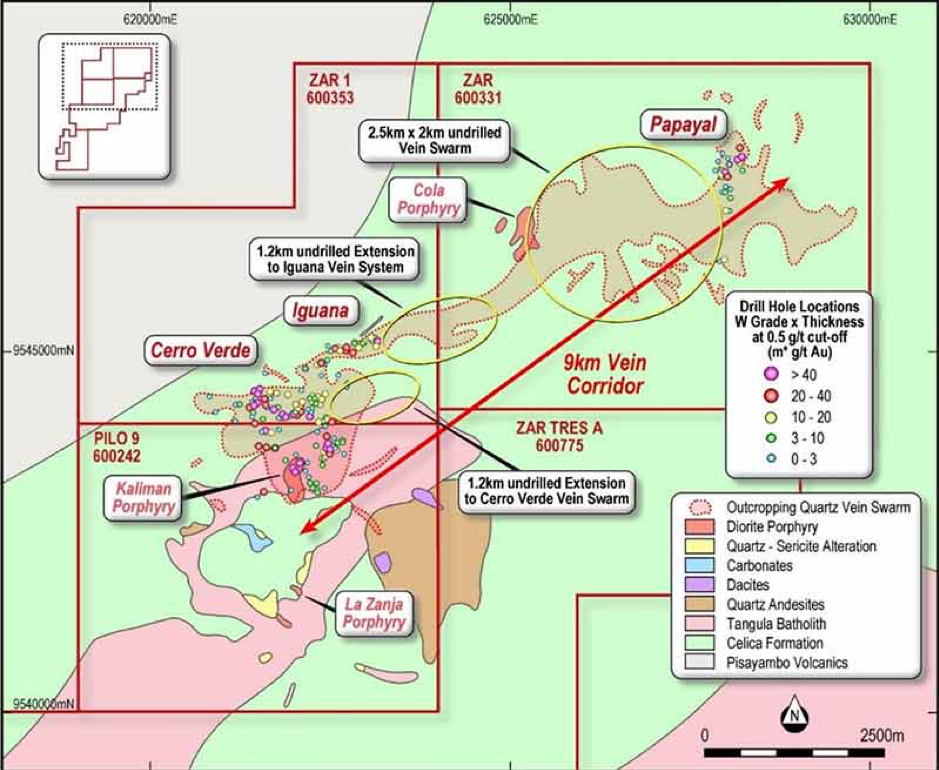

The 139sqkm fully permitted Dynasty project has a non-JORC resource of 2.1 million ounces of gold, which is already impressive.

But Dynasty has never come close to reaching its full potential.

This resource was based on about 26,000m of drilling in 2005-07 over a small section of the 9km of mineralised strike, when gold was fetching $US650/oz (A$800/oz). No systematic drilling has occurred since.

Core subsequently decided to start mining a small high-grade pit based on historic drilling. ~20,000oz per annum of gold is currently being processed through the company’s Portovelo plant, about 100km away.

For Titan, this minor open pit operation suggests that Dynasty ore is easy to process. It also demonstrates just how prospective the project really is.

“Core opened up on three veins and immediately found that the mineralisation was a lot more pervasive than they expected,” Carr says.

“There were another eight additional veins including orthogonal veins and tension veins. Because the previous management opened the first pit, it gave us really good insight into the geology and the metallurgy and a much better understanding than we could have ever hoped from reading geological reports. When we went on site, we could see the mineralisation. It is a stunning asset.

“The gold-bearing veins making up most of the resource are between 2m and 16m wide; they are actually more like mineralised structures than what we consider veins here in Australia.

“One of them is about 1km long that looks to be longer at widths of up to 6m.”

Titan also has a thesis that a mineralised gold ‘halo’ surrounds the veins and mineralised structures and there looks to be low grade in between these veins. Dynasty could end up bulking out into a large open pit.

The explorer will kick off a 12,000m drilling campaign soon, designed to ‘upcycle’ that 2.1moz into JORC-compliant resources (a must-have for ASX-listed companies).

Titan has initiated its exploration program by assaying another ~7,000m of the existing 26,000m of drill core, where only 4,600m of the original 26,000m of drilling was sampled.

The original program focused only on high grade vein intercepts, and in an $US600 gold price environment, ignored the surrounding mineralisation adjacent to veining in some locations.

The company will also be re-analysing 4,000m of drilling completed by Core Gold’s owner-operator diamond drill over the past 15 months.

“It’s been tested in their own lab, but we will send it off to a professional international lab to validate the numbers,” Carr says.

“We are looking to update the geologic model following up on additional information delivered in small scale mining of the resource, and deliver a JORC compliant update of the resource after the first 12,000m, which will show the market that there’s a clear runway towards a significant size increase.”

There is only 3kms at either end of the strike that has been drilled, with a whopping 6kms of mineralised strike open in all directions to be drilled.

Titan have timed this acquisition well, given who its neighbours are in Ecuador, Carr says.

“We think Dynasty is a tier 1 project in a great jurisdiction,” he says.

“All the majors are now picking up large swathes of ground in Ecuador – companies like BHP, Newcrest, Lundin, and Fortescue.

“You certainly wouldn’t get an opportunity like this anywhere in Australia.”

This story was developed in collaboration with Titan Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.