Talon could be sitting on Perth Basin’s largest untested gas prospect

Pic: Schroptschop / E+ via Getty Images

Early indications are that Talon’s Condor prospect could deliver up to 10 times the gas resources the company is targeting at its Walyering prospect in the highly prospective Perth Basin.

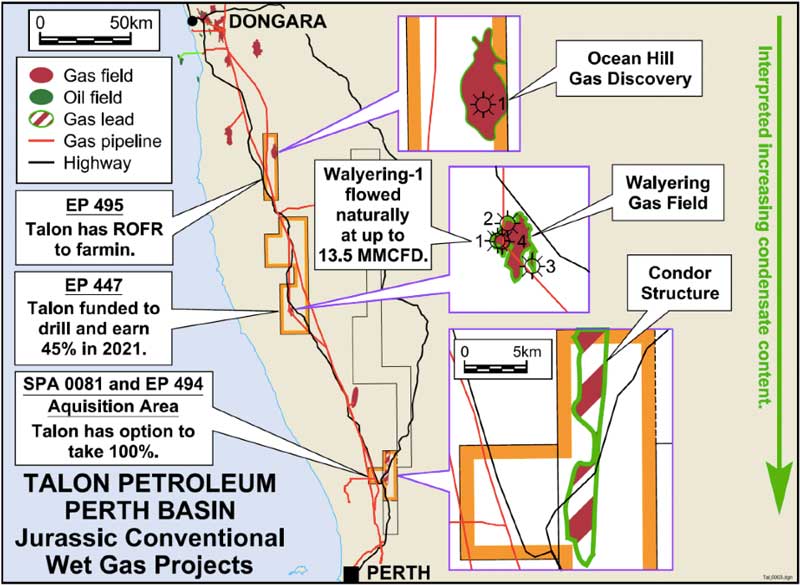

Talon Petroleum (ASX:TPD) has released initial estimates of the recoverable prospective resources at its Condor prospect, showing the potential for up to 710 billion cubic feet of conventional gas resources.

This means Condor could be the Perth Basin’s largest untested wet gas structure, which is timely given the ever-tightening gas supply situation in Western Australia.

Condor also offers significant additional upside with estimates the prospect hosts over 20,000,000 barrels of condensate (light oil), which is currently commanding over $US60 ($77) a barrel.

Another big advantage of the prospect is that less than 1 per cent CO2 content is expected, which makes it a lower cost development because of the minimal processing required.

Condor provides Talon with an important follow-on drilling opportunity in the event of success at the company’s planned maiden Perth Basin well Walyering-5, which will appraise the Walyering wet gas discovery.

“This is an exciting step forward for Talon in its Perth Basin strategy,” managing director David Casey said.

“Talon now has access to another conventional gas play that could, if matured by our planned work programs, deliver up to 10 times the resources we are targeting with appraisal drilling at Walyering.

“Plus, there is potential for the gas composition to contain an even higher, value-adding component of condensate than is projected for Walyering.

“The addition of Condor further demonstrates the Talon’s team’s ability to both identify and capture high-impact exploration and appraisal assets at modest cost, and we look forward to progressing initial exploration activities at Condor alongside ongoing work in the rest of our portfolio in the Perth Basin, Mongolia and the UK North Sea.”

The Condor prospect will be drilled with Talon’s partner and operator Strike Energy (ASX:STX) later in 2021.

Perth Basin the answer to WA’s gas shortage

Strike’s success with the drilling of its West Erregulla-2 well was what propelled the gas-fertile Perth Basin back into the spotlight as a potential solution to the tightening gas supply situation.

While WA is very well supplied in the short term, the Woodside Petroleum (ASX:WPL)-led North West Shelf will prioritise the liquefied natural gas export market post 2023/24 as fields decline.

And more recently Santos (ASX:STO) announced that production at its Reindeer field offshore WA would cease earlier than expected, which is a major concern given that it supplies about 17 per cent of the state’s domestic gas supply.

Talon locked in the deal to acquire a 100 per cent interest and operatorship in the area covering the Condor structure (formerly Muchea) with Macallum Group in January.

The structure of the transaction allows Talon to undertake low-cost initial exploration work to better define the potential at Condor while progressing towards and during drilling at Walyering.

Talon’s strategy for the Perth Basin, which has only been in play for less than 12 months, has now yielded entries into Walyering and Condor, as well as the securing of a right of first refusal over the Ocean Hill gas discovery.

All these projects have gassy, conventional targets supplemented by strong projected yields of condensate. If the high levels of condensate can be proven at Condor there is potential to generate significant value given the recent strengthening in the oil price.

This article was developed in collaboration with Talon Petroleum, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.