Resources Top 5: Western Mines catches another rocket, punters eye cheap near-term gold miners as price hits $3000/oz

Mining

Mining

Here are the biggest small cap resources winners in early trade, Thursday April 6.

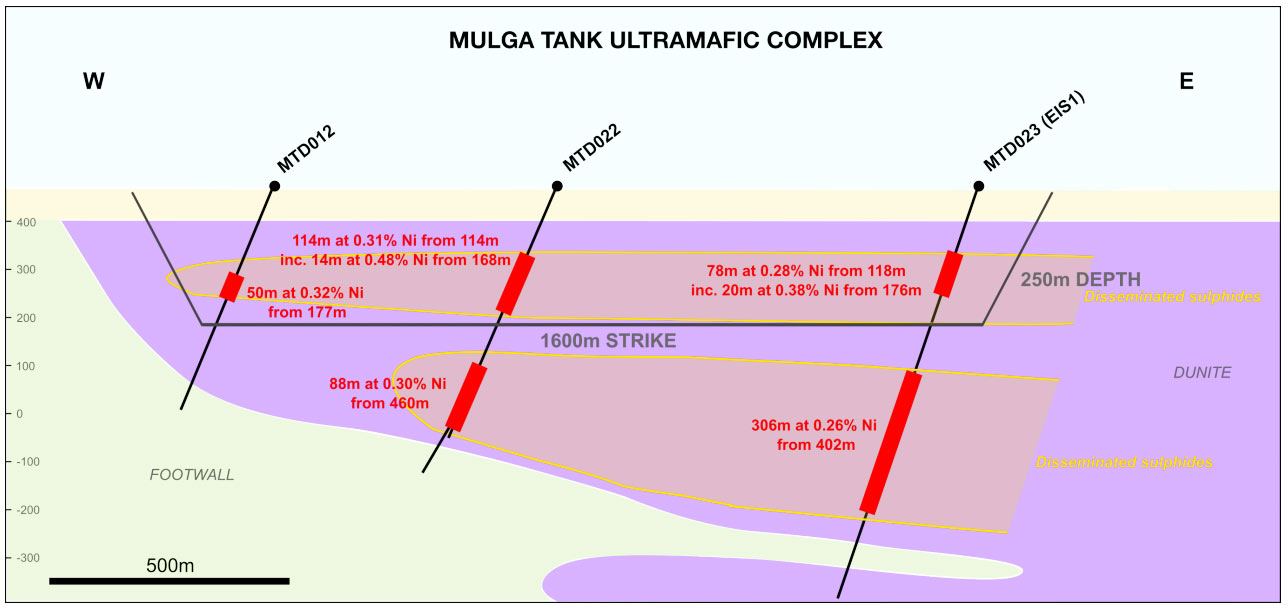

Yesterday, WMG announced cumulative 693.5m at 0.28% nickel, 128ppm cobalt, 61ppm copper, plus palladium and platinum in one drill hole at its “extensive” Mulga Tank mineralised system in WA.

Today, it says initial test work on selected drilling at Mulga Tank suggests a high percentage of nickel in sulphide form versus silicate nickel.

Nickel from sulphide minerals is easily extracted, whereas nickel locked in silicate minerals is not.

“This basic comparison test work attempts to further confirm the disseminated nickel mineralisation at Mulga Tank and prove that it is hosted in potentially recoverable sulphide form – these very positive results clearly demonstrate it is,” WMG managing director Dr Caedmon Marriott says.

“We’re conscious of exploring by economics and deliberately selected shallow intervals found in the top few hundred vertical metres that could be amenable to large scale open pit scenario.

“As a follow up to this comparison work the team is making plans for metallurgical beneficiation testwork using bulk samples from the remaining drill core.

“This will aim to demonstrate a payable high-grade nickel concentrate could be recovered from the mineralised intervals. This would unlock the project and build confidence in a resource drill out.”

There are two main types of nickel deposits: sulphide and laterite.

Sulphides are the holy grail for explorers because they are easier and cheaper to process.

This is also what makes nickel sulphides the preferred choice of electric vehicle battery makers.

But these deposits are also harder to find at scale, which makes Mulga Tank one to watch.

This tightly held small cap explorer (only 49m shares on issue) is up +300% in the last two days. It had $2.6m in the bank at the end of December.

G88’s WA exploration portfolio includes ‘Quicksilver’ (nickel, cobalt) and Yarrambee (nickel, copper, gold), plus a handful of lithium and gold projects.

Much of the action is taking place at Quicksilver, where G88 has established a 26.3Mt resource grading 0.64% Ni & 0.04% Co (168,000t of nickel and 11,300t of cobalt), plus rare earths and scandium.

It has now completed a small metallurgical drilling program to de-risk the process flowsheet and provide confidence to proceed to a Scoping Study, the first proper look at the economics of building a project.

Stage 2 metallurgical testing completed last year has already developed the company’s understanding of the unique clay mineralisation at Quicksilver.

CEO Damon Dormer says what makes Quicksilver exciting – beyond the scandium and REE bonus finds – is that it could be a very simple, free dig, low cost and low complexity mining and processing operation.

And with that simplicity comes risk reduction and lower CapEx and OpEx.

“We don’t have to worry about blasting and dealing with explosives, with mechanical processing we don’t have to deal with harsh chemicals for processing,” he said.

“That simplicity comes down to the high potential for a very low cost, low capital and efficient operation which is all about getting the best product to maximise the saleable price and maximise margin.”

The $6m capped minnow is down 10% year-to-date. It had $808,000 in the bank at the end of December.

(Up on no news)

A rocketing gold price has come at the perfect time for HRZ, whose proposed high-grade 32,000oz Cannon underground mine is scheduled for development in H2 CY2023.

A recent PFS envisaged solid cash flow of ~$10.1 million over five quarters “with a proven and relatively low risk operating strategy”.

This is based on a gold price of A$2600/oz (currently far higher at A$3000/oz).

The mine is now fully permitted with final mining contract/JV negotiations underway and a milling allocation in place at FMR’s 1Mtpa Greenfields Mill.

Next up for is Penny’s Find (43,000oz at 5g/t), where a drilling program is due to kick off in the June quarter to enable updated resource modelling and reserve studies.

The $33m capped stock is down 5% year-to-date. It had $1.6m in the bank at the end of December, plus $6m in listed investments and $3m in unused financing facilities.

READ: Bargain Barrel: Here are 5 of the cheapest emerging gold and silver producers on the ASX

(Up on no news)

HOR is busy on a couple of promising gold and copper projects.

There are a bunch of targets in the crosshairs at the Glenloth goldfield project, near Barton Gold’s 1Moz Tunkillia project in the Gawler Craton of South Australia.

Meanwhile drilling results from its historical Horseshoe Lights project, ~60km from Sandfire Resources’ (ASX:SFR) DeGrussa mine have pulled up thick and shallow copper.

Highlights from the late 2022 program included 55m @ 0.88% Cu from 22m incl. 3m @ 4.33% Cu from 56m.

More drilling was expected to recommence in March.

Horseshoe Lights has already produced ~316,000oz gold and 55,000t copper metal in two phases of mining. It contains a current resource of 128,000t copper metal @ 1.0% (0.5% cut-off) and 36,000oz gold.

The $20m capped stock is up 40% year-to-date. It recently raised $2m to accelerate Horseshoe Lights development.

(Up on no news)

Northern goldfields explorer WGR listed July 2021 and has mostly flown under our radar ever since.

But, like HRZ, WGR has a bunch of established gold resources ready to mine at its 293,000oz ‘Gold Duke’ project once it locks in toll treating agreements with a nearby plant.

Existing mining approvals are in place at the Eagle, Emu and Golden Monarch deposits containing a total 142,000oz gold with approvals progressing for Gold King which contains 36,000oz, it said late March.

Previous mining schedules and pit optimisation at Gold Duke were calculated using a gold price of $2450. WGR is currently reviewing and updating pit optimisations and mine planning to reflect the significantly higher gold price in 2023.

“As part of this project review the mining approval for the Gold King prosect … is to be submitted,” it says.

“The Gold King deposit is located just 500m to the south of the Golden Monarch deposit and its incorporation into the mining schedule is likely to increase mining efficiencies between the two deposits.”

In total, the mining plan is to include eight shallow (<60m) pits comprising above-water-table oxide ore (>above 60m).

WGR are continuing discussions with nearby plants within an economic radius of the project and have started heap-leach test work, it says.

The $5m capped minnow is down 30% year-to-date. It recently raised $550,000 “to accelerate gold production assessment & project generation”.