Resources Top 5: Uranium hunters glow; Nickel explorer Armada hauls in $1.2 million

Mining

Mining

Here are the biggest small cap resources winners in early trade, Monday September 25.

(Up on no news, except: ‘uranium’)

This uranium and potential lithium explorer had nothing fresh to report to shareholders and the ASX this morning, but it seems to be well up, along with a few other competitors, on the growing uranium narrative.

With a current market cap of nearly $24m, Aurora is focused on the exploration and development of its namesake project in Oregon, USA, which hosts a defined uranium resource of 107.3Mt at 214ppm U3O8 for 50.6Mlbs U3O8 – and is also prospective for lithium.

A scoping level metallurgical testwork program is currently underway using samples from the latest drill campaign.

As Stockhead’s Jess Cummins wrote in her ’15 uranium explorers under the $50m market cap’ article last week, there are a few bullish factors lining up for the nuclear-related fuel:

Nuclear industry forecasters are more bullish than they’ve been in years with spot uranium prices hitting a decade high of US$67/lb this week.

On the demand side, there’s a forecasted supply shortfall of approximately 1.5 billion pounds by 2040.

When you take that into consideration, the bullish reports from the World Nuclear Association (WNA) and price reporter Ux Consulting make sense when they say new operations needed to fill uranium demand from nuclear power plants will almost double by 2040.

Not to mention that countries which had been less than enthusiastic on nuclear are looking to sanction new developments amid the energy transition because they provide baseload electricity with lower emissions than fossil fuel plants.

Tim Boreham also gives 1AE a ‘glowing recommendation’ over here.

via @StockheadAU

With current US domestic uranium production at next to nothing, #1AE is in an interesting position as it seeks to develop its Aurora Energy Metals Project (#AEMP) in southern Oregon, near the Nevada border.https://t.co/aJ9iA9Fi49#Uranium #Lithium #ASX

— Aurora Energy Metals (@Aurora_1AE) September 21, 2023

1AE share price

(Up on no news, except: ‘uranium’)

This geographically diverse uranium hunter is digging for the metal in both Australia and Namibia. It didn’t make Jessica’s list (see 1AE, above) and that’s because it’s moved ahead to a $145m market cap.

That, of course, does not mean it doesn’t have a lot of room to grow. In fact, there’s no shortage of positive vibes emanating from the project just lately.

Stockhead’s ‘Garimpeiro’ columnist Barry FitzGerald recently spoke with Elevate’s MD and CEO Murray Hill to discuss why the company’s U-pgrade process could be a game changer.

This refers to its 100% owned breakthrough beneficiation process, which reduces ore mass by 95% prior to leach.

#EL8 boss Murray Hill says nuclear energy has a big future ahead, with uranium supply-side constraints set to significantly elevate the uranium price.

Article by @StockheadAU https://t.co/bEcbio5QK9#uranium #mining $EL8

— Elevate Uranium (ASX: EL8) (@Elevateuranium) August 30, 2023

EL8 share price

(Up on no news, except: ‘uranium’)

This $11.4 market capped uranium, gold and sand explorer is up 20% at the time of writing.

As Stockhead’s Emma Davies reported in June, this is another ASX stock that could be well set to ride a potential uranium price wave.

Recapping, per Em, then:

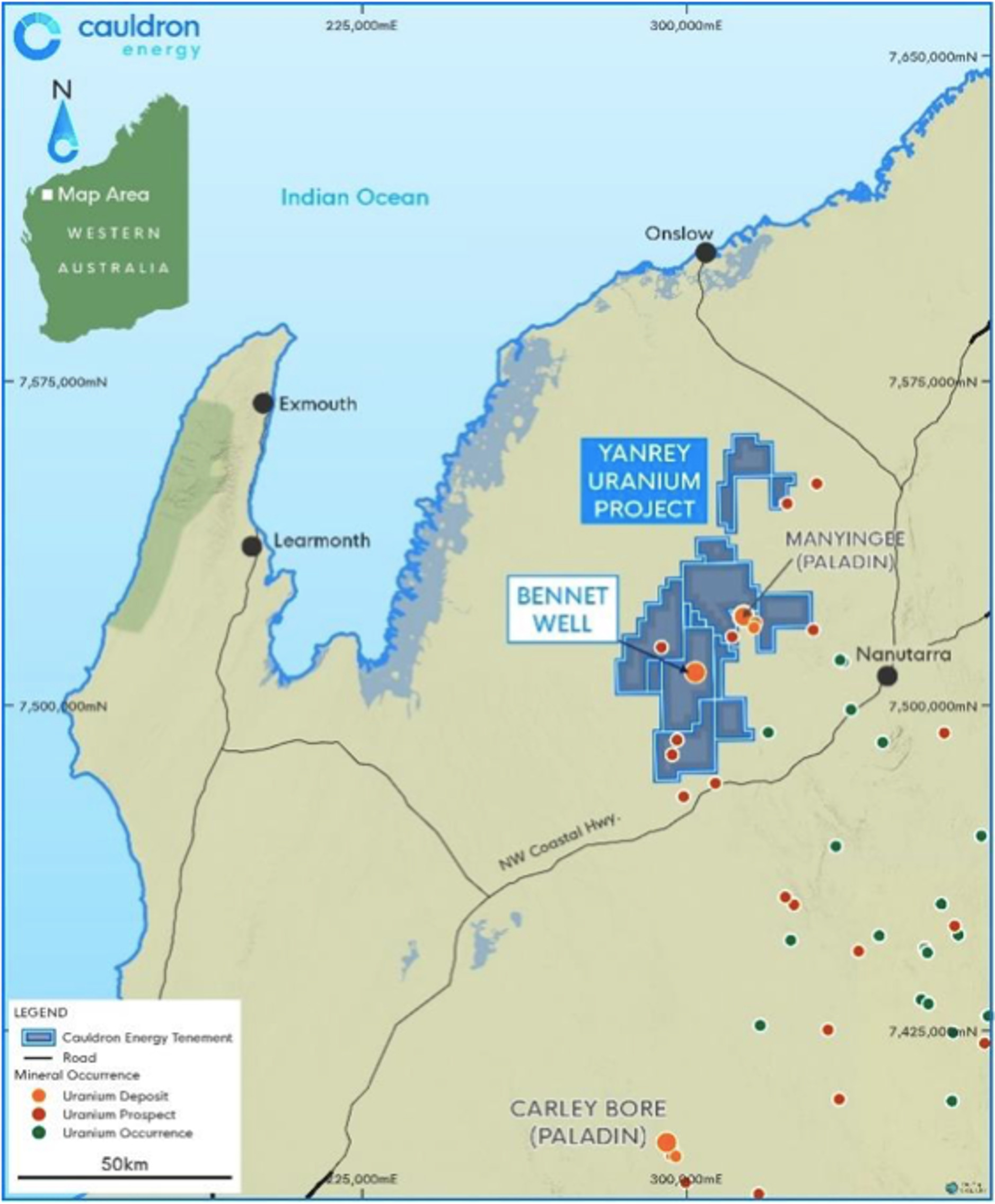

The company stopped working at its Yanrey project in 2017 when the Western Australian state government implemented a ban on most new uranium mines, however, the company is committed to the project while simultaneously exploring the potential for Rare Earth Elements and last month flagging an option to acquire the Melrose nickel-copper-PGE project.

They’re also set to start drilling at Yanrey after the WA Department of Minerals, Industry Regulation and Safety (DMIRS) approved the company’s Program of Works last month to target extensions of uranium mineralisation at Bennet Well and assess the potential for vanadium.

CEO Jonathan Fisher told shareholders earlier this month [in June] that the Bennet Well Deposit at Yanrey remains “one of the world’s best undeveloped uranium deposits.”

CXU share price

AMM was in a trading halt late last week amid some significant institutional capital raising for the company, which has now completed.

Armada this morning announced it’s raised $1.2 million before costs at $0.02 per share. AMM is trading at $0.026 at the time of writing.

$AMM is thrilled to announce the successful completion of the #institutional component of our accelerated 1 for 1 non-renounceable entitlement #offer, raising A$1.2M before costs at A$0.02 per New #Share.📈 pic.twitter.com/8QYvPgXYa4

— Armada Metals Limited (@ArmadaMetals) September 25, 2023

As Stockhead reported in late July, AMM recently inked a deal to acquire 80% of a historic Zimbabwean nickel sulphide deposit, untouched since the ’90s.

The Bend nickel deposit was initially discovered by Anglo-American Prospecting Ventures in 1971, and subsequently drilled in the 1990s, “with notable nickel intercepts reported from these programs”, AMM noted.

The company can earn 50% of the project by funding a 2500m drill program. That stake will increase to 80% after it spends another $3 million on exploration over three years.

Drilling at Bend is expected to kick off in the coming weeks, AMM says. Meanwhile, it’s found three new drill targets at the nickel project – see below.

$AMM has announced a recent #NSAMT #survey has successfully defined three new #drill targets at the #BendNickel #Project, #Zimbabwe.

An 8-hole (2,500m) diamond #drilling #program is set to commence in the coming weeks.https://t.co/mZcXvmupv6 pic.twitter.com/r3M3JBcLYy

— Armada Metals Limited (@ArmadaMetals) September 19, 2023

AMM share price

Just when you thought we’d get through this column without much of a battery minerals mention, QX Resources comes to the rescue.

Per a Stockhead special report late last week:

QX Resources-backed Bayrock Resources has expanded the mineral lease area around its promising Vuostok nickel-copper project in Northern Sweden.

In July, the Steve Promnitz-led lithium explorer QX Resources (ASX:QXR) acquired 39% of the unlisted Aussie company Bayrock Resources, which has a portfolio of nickel-copper-cobalt projects in Sweden.

Bayrock’s Vuostok project is located roughly 60km northwest of Lainejaur, offering a potential joint development opportunity as a ‘district play’.

The newly added Nr 102 lease expands the total mineral lease by 33% at Vuostok, which QXR says could be within potential trucking distance to Lainejaur given the well-established all-weather road network and supporting infrastructure in the district.

ICYMI: Bayrock Expands Vuostok Nickel Project Lease to ~130km2 following Encouraging #Nickel–#Copper, Near-Surface Drill Results

Read more: https://t.co/AAMvI27qYV #Bayrock $QXR $QXR.ax #ASX pic.twitter.com/UPYzVefh6B

— QX Resources (@QXResources) September 21, 2023

“This would benefit any future stand-alone nickel-copper-cobalt operations or provide additional ore feed for a possible Lainejaur development,” the company says.

“Trucking of ore material for processing is a regular feature of operations in this part of northern Sweden.”

QXR share price

At Stockhead we tell it like it is. While Elevate Uranium and QX Resources are Stockhead advertisers at the time of writing, they did not sponsor this article.