Q+A: An exclusive chat with lithium maestro Steve Promnitz about leaving Lake and his new gig at QX Resources

Pic: Supplied

In 2016, Steve Promnitz was named managing director of $9.5m market cap Lake Resources (ASX:LKE), which had just acquired the early stage Kachi lithium project in Argentina.

Fast forward to the near-present and Lake is a ~$2bn project developer, with Steve Promnitz and his team working though lithium’s dark days so they would be perfectly placed to advantage of the EV industry’s now-insatiable demand.

But Promnitz isn’t the architect of Lake’s production story anymore. In June, seemingly out of nowhere, he left. The only reference to his departure was a solitary sentence buried in the back end of this announcement.

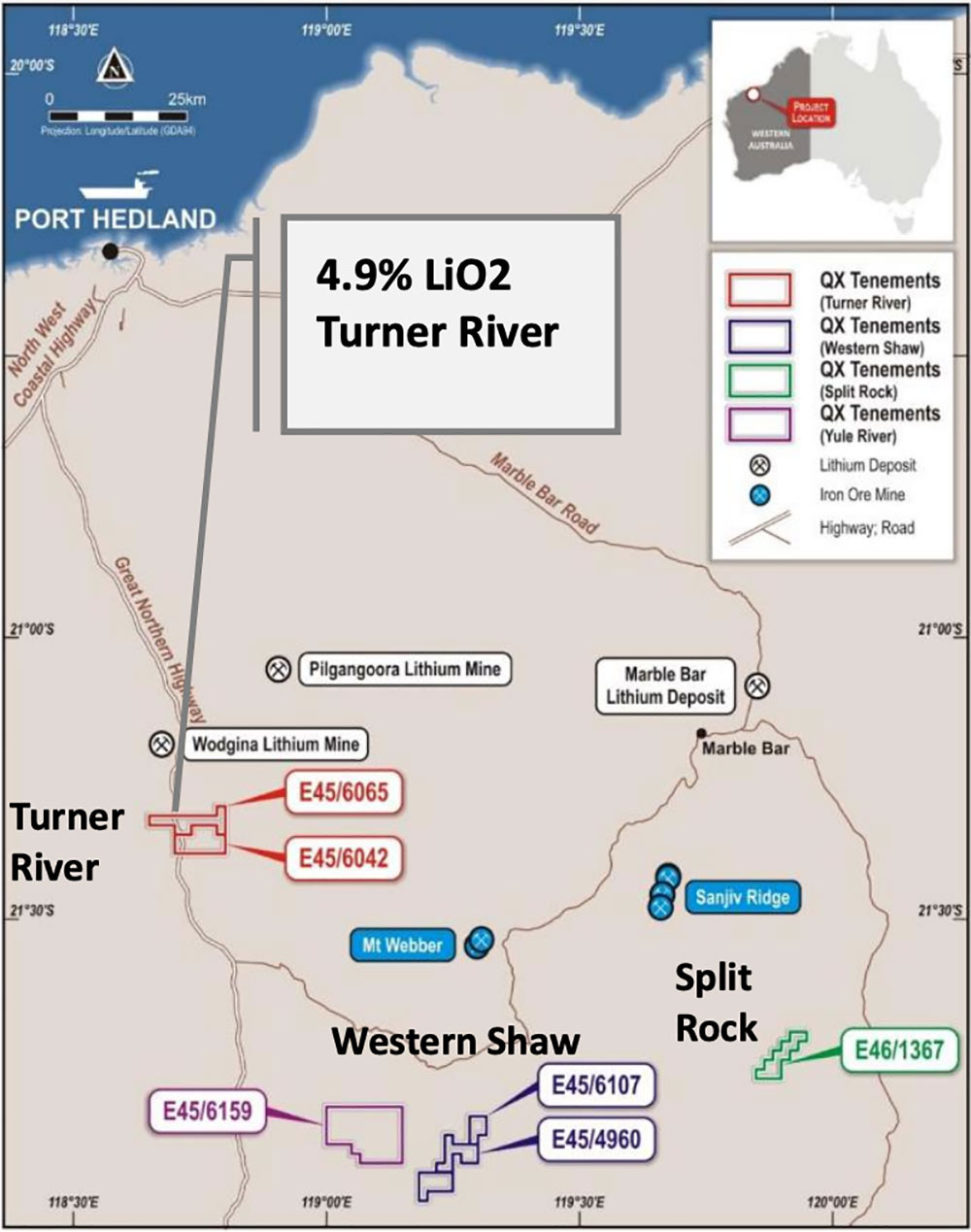

Late last month he popped up as new managing director of early stage hard rock lithium play QX Resources (ASX:QXR), which has projects in the Pilbara region of WA.

Promnitz – who has experience at all stages of the project development cycle — said he was confident “we can transform and scale up QXR into a major player in this sector”.

MD Steve Promnitz remains incredibly bullish on the macro thematic around #batteryminerals – and $QXR has a big part to play ⬇ #lithium #exploration #drilling #mining #ASX $QXR.ax pic.twitter.com/myE5NCHMuH

— QX Resources (@QXResources) October 6, 2022

Stockhead and Promnitz sat down for a frank discussion about leaving Lake, and what attracted him to start it all again at QXR.

You left Lake suddenly. Was it an abrupt decision?

“I didn’t want to leave; the board wanted a CEO transition,” Promnitz says.

“There was a broad feeling that as the company grew, Lake would need an operational CEO and a new board.

“I had expected the CEO transition would logically occur post financial close and post DFS.

“The board decided that they wanted a new CEO sooner. They advised me at the end of May that they wanted it announced by the end of June.

“I simply said that my biggest concern was the shareholders and the need for clear communication that this was a normal and seamless transition.

“I had spent six years building the company and the shareholder base and, with the team, had it almost readied for construction.

“I stated that the best way would be to announce a transition to a new leader with operational skills and provide me with a contract for ~6 months and a bonus for what we had achieved in the company, increasing the value more than 30 times in 18 months.

“I provided suggestions on a release to the market.

“That didn’t happen … but I wish them well, as I put my heart and soul 24/7 into that company.”

It was very anti-climactic. The announcement said the CEO transition was underway and you had left. That was it.

“It was clear that I was not part of the transition,” Promnitz says.

“Also, I did not have a platform to explain what happened. That was unfortunate given the major effort I made putting together a robust property package, coming up with a new development method, and with the team, successfully worked with different levels of governments and local communities to ensure support.

“Under my leadership, a project that had never been drilled before was turned it into a top 10 global brine project, with a new, more efficient processing method with direct lithium extraction (DLE).

“My team secured indicative terms from low-cost, long-term debt providers and offtake partners.

“I’m also bemused that the major lithium brine producers scoffed and belittled the new DLE approach, yet recently they are all pursuing similar methods.”

At least a couple of bonuses came out of it. One: you’ll never be short a job offer. Two: you got a nice payout from selling those LKE shares.

“People were complaining online about me selling, but the entire block was sold in a single line so that it wouldn’t mess up the market,” Promnitz says.

“That’s the sort of thing a responsible CEO does.”

Why QXR? Why would you pick a small, early-stage Pilbara hard rock explorer over another advanced project developer?

“A lot of people came to me with Lake lookalikes and things similar which were quite sizable, and with pay packets quite a lot larger than what I was on at Lake,” Promnitz says.

“The problem with taking on a mid-cap company is that they already have their shareholder base, so you just become another grunt CEO. Where’s the fun in that?

“I imagined I could get shareholder support [at QXR] because there were quite a few people following me when I left Lake.

“Lake had about 31,000 followers on Twitter and thousands by email, so I wasn’t unknown.

“It’s been flattering to see their support for this new venture.

“QXR has a good hard rock lithium portfolio in a prime location with a strong board, and I can continue to add opportunities.

“Furthermore, they have $4m in the bank so it’s not like we need to go out and raise money straight away.

“Hard rock lithium projects can be discovered, explored, developed, and brought into production in a short time period, less than three years.

“Even though brine projects can be larger and longer term, they just take a bit longer to come to market.

“The other beauty of hard rock is that you don’t have to spend a fortune to get these things up and running, comparatively speaking, with less processing risk.

“The whole battery minerals macro is solid for years and years, but there is a real ‘here and now’ demand in the battery minerals space.

“Some investors and forecasters still don’t seem to understand that.

“Benchmark Minerals just stated last week that the sector needs another 18 deposits the size of Pilbara Minerals (ASX:PLS) Pilgangoora project in the coming years – the recent auction prices achieved by Pilbara Minerals are astoundingly high for spodumene concentrate.

“For me, QXR is a way to create shareholder value in a short amount of time, finding and developing a new project and ‘feeding the beast’.”

QXR share price chart

Are there things about QXR’s projects that excite you?

“I don’t want to talk about it too much now as I expect some news coming out soon, but the tenements at Turner River are only 15km from Wodgina, one of the largest hard rock lithium projects in the world,” Promnitz says.

“I’m not a nearology guy, but QXR have some pegmatites at surface which look good.

“Results from sampling, followed by geophysics and drilling will show whether we can develop this quickly.

“QXR are reasonably well funded, and relationships with end users can accelerate the timeline for development. One is a shareholder. That may also assist in consolidation if appropriate.”

So, acquisitions are on the table?

“QXR has a very solid portfolio so it would need to be the right project, in the right jurisdiction,” Promnitz says.

“Some of those come up opportunistically especially while progressing current projects.

“Outside lithium I am looking at the broader battery minerals, including rare earths projects.

“I’m aiming for QXR to go well for shareholders. I can’t promise the x30 uplift like in Lake, but I suspect that even in a tough junior equities market it is going to go well.”

What main things did you learn at Lake which will help at QXR?

“My core skills are in finding good projects, assessing the projects and then coming up with a development model to make them happen, often with new technologies or models,” Promnitz says.

“I’ll give you an example, before Lake.

“Back in the late 1990s I went to Mongolia to look at a project BHP was selling, called Oyu Tolgoi.

[This Rio Tinto (ASX:RIO) owned mine is now expected to be the 4th biggest copper mine in the world once underground development is completed]

“It was very early days. There had only been three drill holes into it at that stage, but I said to my then employer Western Mining (WMC) ‘you should buy this thing as it looks like a big copper gold deposit’.

“There were draft terms deal to buy 51% for $1m, but WMC was downsizing and I was criticised for trying to go into a new country.

“Another thing I can really bring to QXR is the end users. I have worked with offtakers, battery makers and global financiers. The thing a lot of juniors miss is asking end users ‘exactly what product do you want, and how can we deliver it to you?’

“If you can get offtakers involved early enough, you can concertina your timeline to production.”

Any milestones coming up with QXR?

“I am particularly focused on having a timeline to deliver some meaningful results out of the hard rock lithium projects in WA,” Promnitz says.

“I’m trying to sort that out now – trying to find availability of drill rigs and assay labs for the summer. I am hoping to do drilling before year end but wet weather and rig availability may delay it.

“As soon as I get some half decent results there, I want to do some bulk sampling and get discussions underway with end users.

“You will note that a 9% shareholder on QXR’s register is a company called Suzhou in China. The key person in that company was a seed capital investor in a start up battery company called CATL when they were worth $200m.

“They are now the largest battery maker in the world worth around $1 trillion.

“There’s an investor who can spot a good story.

“Separately, the company has gold projects in Queensland. I quite like that area of Queensland for gold, as I worked there in the ‘80s and always felt that area was underdone.

“Gold will pick up again sometime soon but is not popular at the moment.

“However, with a small investment, these low sulphidation epithermal gold projects can form companies.

“There will be a lot of news over the next 18 months. Should be fun.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.