Our energy mix needs an U-pgrade, and Elevate Uranium is ready to deliver

Elevate Uranium’s U-pgrade™ beneficiation process stands to deliver better capital and operating cost outcomes. Pic: via Getty Images.

- EL8 is looking for uranium in two tier-one exploration districts

- Work in Namibia has shored up 4 discoveries in the last 4 years

- Its proprietary beneficiation process has environmental and financial upside

Elevate Uranium boss Murray Hill says nuclear energy has a big future ahead, with uranium supply-side constraints set to significantly elevate the uranium price.

The global energy revolution is here, and the world is on the hunt for the next generation of cleaner, greener energy sources to fuel a carbon-free future.

Uranium is undoubtably at the heart of this important conversation: this concentrated energy source is the feedstock for nuclear reactors, which account for nearly one-fifth of electricity generation in the world’s most advanced economies.

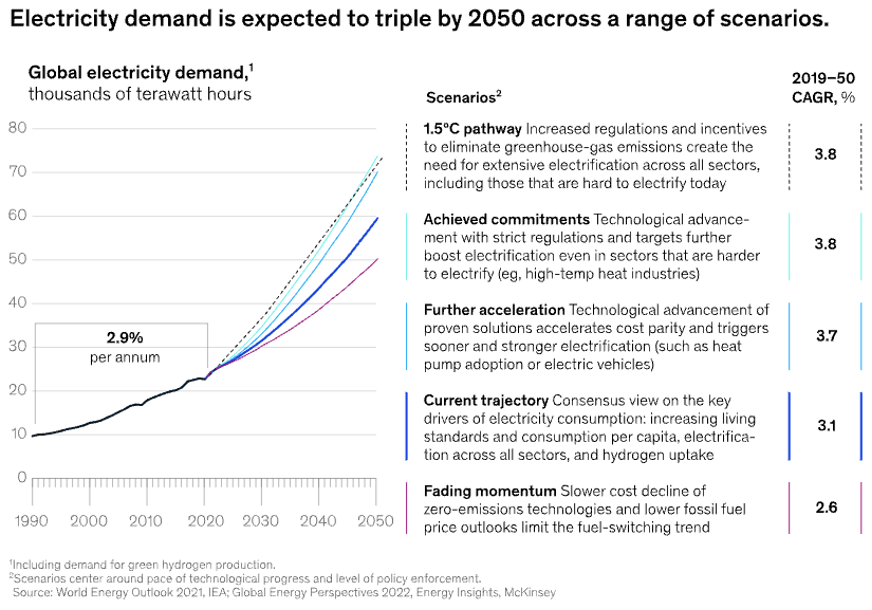

But that statistic is only set to grow. McKinsey’s 2022 Global Energy Perspective predicts that energy crises the world over, as a result of the push for electrification and zero-emissions mandates, could triple the world’s energy consumption by 2050.

And while it’s clear that uranium will play a critical role in our future energy mix, one big question remains: where will the feedstock come from?

Enter Elevate Uranium (ASX:EL8), a nuclear fuels explorer with sizeable resources in two globally recognised uranium hotspots.

From its 81 million pound uranium portfolio in Namibia’s renowned mining districts to 48 million pounds of resource across Northern and Western Australia, Elevate is crafting a diverse mix of future energy opportunities.

But this discovery-centric yellowcake player isn’t just focused on what’s in the ground: its wholly owned and patented U-pgrade beneficiation process could be a game-changer for production and project economics.

With interest in the uranium space rising as the world inches closer to 2050, Elevate is poised to lead the pack in two of the world’s exploration engine rooms.

Let’s set the scene

According to the World Nuclear Association, 75% of the world’s uranium comes from four countries: Kazakhstan, Canada, Australia and Namibia.

Elevate has skin in the game in two of the four hotspots, combined with 16 years of uranium-focused exploration and a proven management team.

Managing director and CEO Murray Hill says uranium is firmly in the spotlight as the race for zero carbon energy heats up.

“Uranium is used for nuclear energy, and the demand for nuclear is increasing because it’s a carbon free energy source,” he explained.

“A lot of countries are developing nuclear facilities. Small modular reactors (SMRs) are becoming prevalent and are likely to replace coal fired power stations, so, there’s a big future for nuclear.”

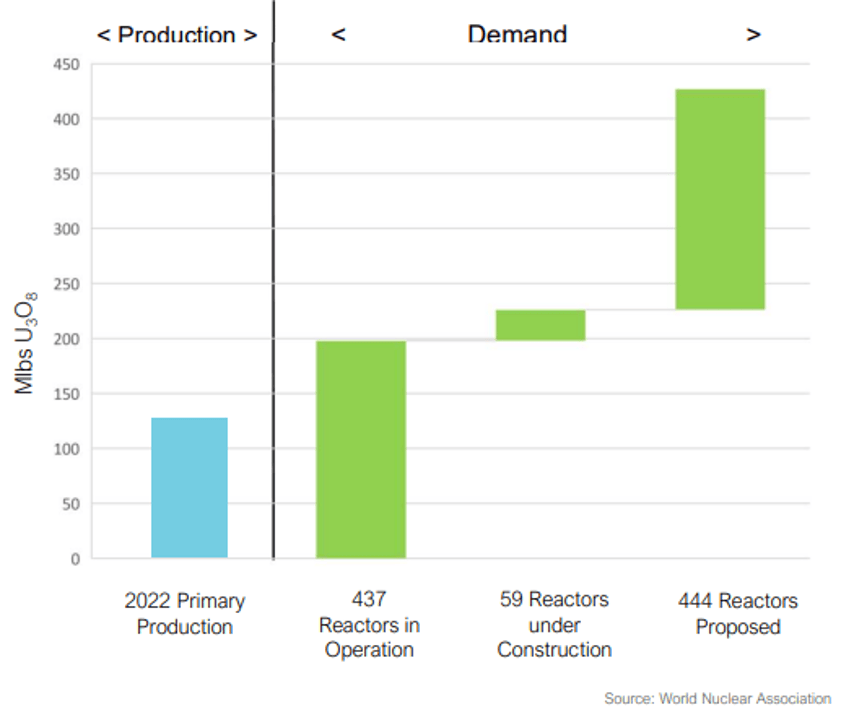

But that future could be restricted by a uranium shortage. Supply-side constraints and increasing demand are butting heads, but the current uranium price is yet to incentivise new production.

A substantial increase in the uranium price will be required to incentivise new uranium production.

Pricing aside, an imminent crunch places even more impetus on explorers to shore up the next generation of nuclear feedstock, knowing that current production is not meeting the current demand.

All eyes on Namibia

Elevate’s portfolio puts it at the heart of an established, tier-one uranium district with a 46-year history of uranium production.

Namibia is the world’s fourth-largest uranium producer and is home to the fifth-largest resource pool.

“Namibia is our primary focus simply because we’ve had four discoveries in the last four years, we’ve got the largest land package for nuclear fuels in the country, and of course, we’re actively exploring it with three drill rigs working full time,” Hill stated.

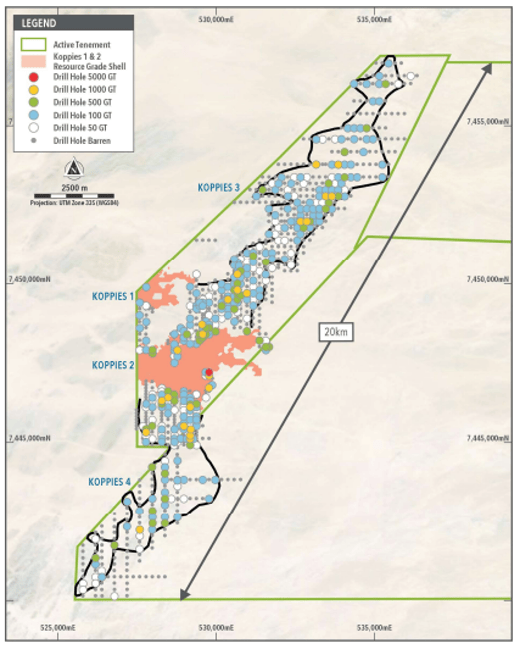

“The Koppies project was the first we explored outside of the known resources we had at Marenica, and in the first period of tenure we estimated a resource of 20 million pounds.

“It’s unprecedented for anybody to estimate a resource in the first three years of tenure.”

Since establishing the initial 20 million tonne resource, Elevate has taken the magnifying glass to four of Koppies’ key prospects and connected the dots along an aggregate 20km of strike.

A resource definition campaign — poised to add more ounces to portfolio — remains front of mind as Elevate fine-tunes its roadmap.

“There are a lot of holes to be drilled, so we’re staging our resource updates, we’re aiming for a resource update sometime in October,” Hill said.

“Then hopefully next year in Q1, as drilling progresses, we’ll release another resource update.”

Beyond the Koppies project, Elevate is sizing up uranium upside at Hirabeb, Namib IV, Capri and Marenica to name a few — the latter of which is host to 61 million pounds of uranium resource.

And in Australia, Elevate is focused on upside in WA and the NT, where 48 million pounds of high grade resource is contained in the company’s wholly owned and joint venture projects.

But the blue-sky potential is in Namibia, Hill says.

“It doesn’t mean we’re not doing any work in Australia, it just means there’s a lot of emphasis in Namibia with the biggest bang for our buck over there.”

Time for an U-pgrade

Namibia is known for its near-surface uranium ore bodies, which generally means uranium concentrations are less than 20 metres deep and hosted in sediment.

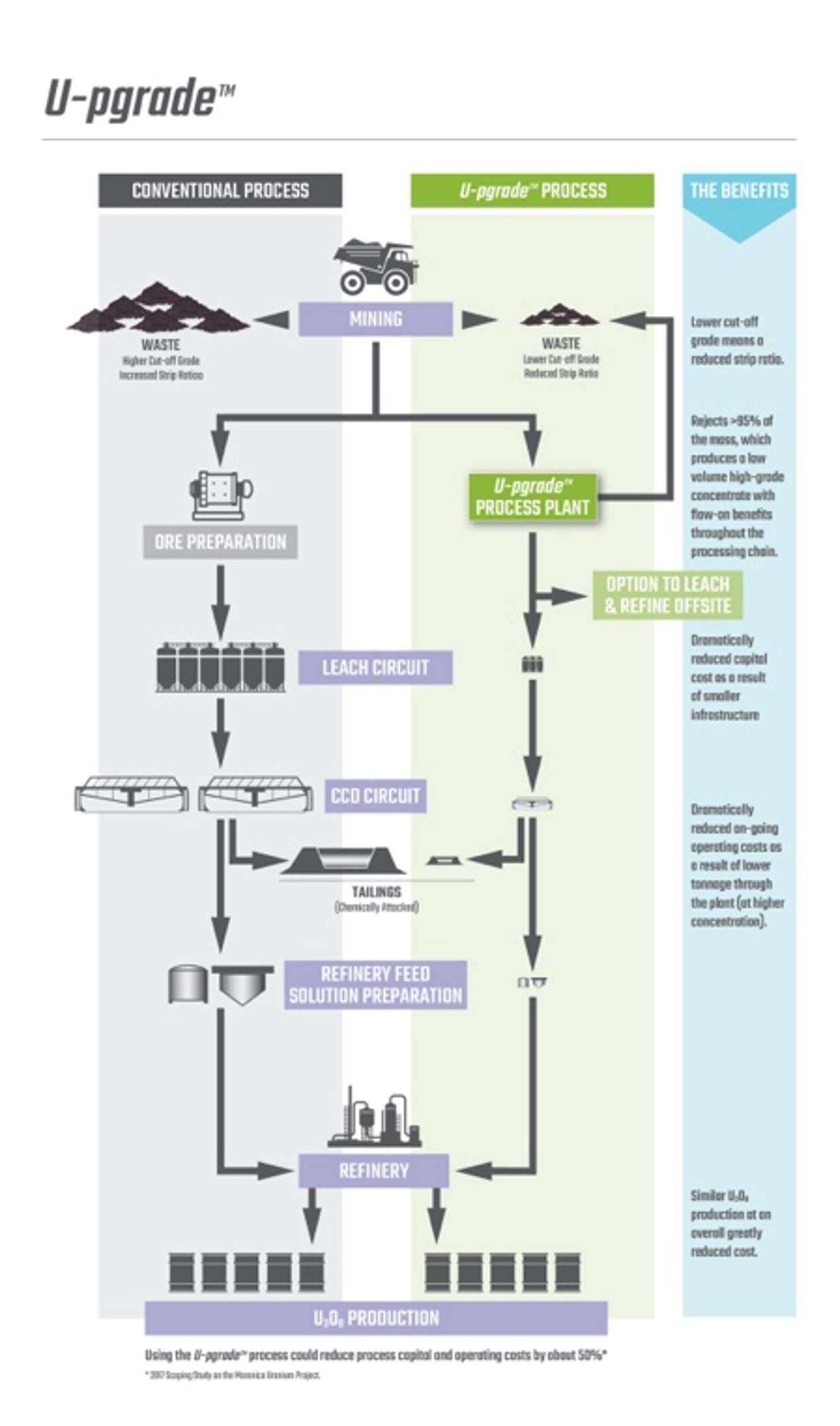

That’s good news for Elevate: surficial uranium ore is ideal for its proprietary beneficiation process, which can sift out more than 95% of the mined ore mass before the leaching stage, producing a low-mass, high-grade uranium concentrate.

“Leaching is the highest unit cost operation of any uranium processing facility, so lowering the mass to be leached has a huge impact on the cost structure,” Hill said.

“Using this U-pgrade process, the cost, both capital and operating, is estimated about 50% lower than conventional.”

According to Hill, that point of difference opens the doors to myriad development pathways.

“It gives us optionality — we could potentially take that concentrate from the U-pgradeTM circuit, leach it and refine it to U308 ourselves, or we could take it to somebody like Rossing and they leach it and refine it, which lowers the capital costs further.”

There are also environmental benefits. With a smaller ore mass to contend with, Elevate can opt for a downsized tailings facility. The beneficiation process also produces an inert and environmentally friendly tailings.

With a beneficiation process that’s the icing on the proverbial yellowcake, as well as an exploration portfolio covering two of the world’s premier uranium districts, Elevate is committed to one day supplying a key commodity in the green energy puzzle.

This article was developed in collaboration with Elevate Uranium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.