If uranium prices boom, these ASX explorers are ready to ride the wave

Pic: via Getty Images

Earlier this month New York fund managers Leigh Goehring and Adam Rozencwajg flagged that, as quickly mobilised spot volumes become scarce, speculators could use the Sprott Physical Uranium Trust (SPUT) to push yellowcake prices sharply higher.

SPUT currently has over 61.7 million pounds of U3O8 under lock and key – and is considered by Goehring and Rozencwajg as a barometer of uranium investor sentiment.

“When investors are bullish on uranium, the Sprott Uranium Trust often trades at a significant premium to the value of its uranium holdings,” they said.

“Speculators will eventually realise they can bull the Sprott Physical Uranium Trust, force a premium, have the Trust issue shares, and permanently sequester physical material.

“Although this strategy would not work in a well-supplied market, it could create sharp price increases when physical material is scarce as utilities are forced to compete with speculators for volumes.

“Uranium is bullish on its own; however, this unique dynamic could cause prices to surge.”

Higher prices are needed to incentivise new production

Spot, which is just an indication of term contract pricing (where most uranium production goes), is currently edging higher towards US$60/lb, and according to Canaccord Genuity, US$60-90/lb the new consensus price to incentivise new projects to come online.

Bank of America (BofA) analyst Michael Widmer reckons prices could hit $75/lb by the end of 2025.

BofA also forecasts a production deficit of 60 million pounds in 2035 – on par with Kazakhstan’s (15% of global reserves) annual output.

It’s no surprise then that uranium players are scrambling to restart old mines and find new resources, but the projected production from returning mines will not be sufficient to meet this deficit.

A rising tide lifts all boats, as the saying goes – which is why explorers could be sitting pretty if prices rise and they find a deposit.

While the miners mint profits — which means dividends — the more speculative junior stocks could enjoy some of the biggest % gains.

Who are some explorers who could stand to benefit?

For the sake of simplicity – because there are tonnes of uranium explorers on the ASX – we’ve picked five explorers with projects in Australia, Africa and the Americas (Canada and the USA).

Here’s a few stocks with a uranium project in Australia:

In March Norfolk completed a downhole geophysical survey at the Orroroo project in South Australia which confirmed uranium occurrences in all three target zones (wells) of which the depths are potentially suitable for proven in-situ mining.

It also flagged peak uranium at 650ppm pU3O8 within an interval of 192ppm pU3O8 over 0.5m from 112.59m via PFN in well 7P3.

Plus, uranium recorded from the survey supports the company’s proposed “oxidized tails or interface zones” of roll-front uranium style mineralisation theory.

The next step is a gravity survey to define the paleo channels in the Walloway Basin, with a maiden drill program to follow.

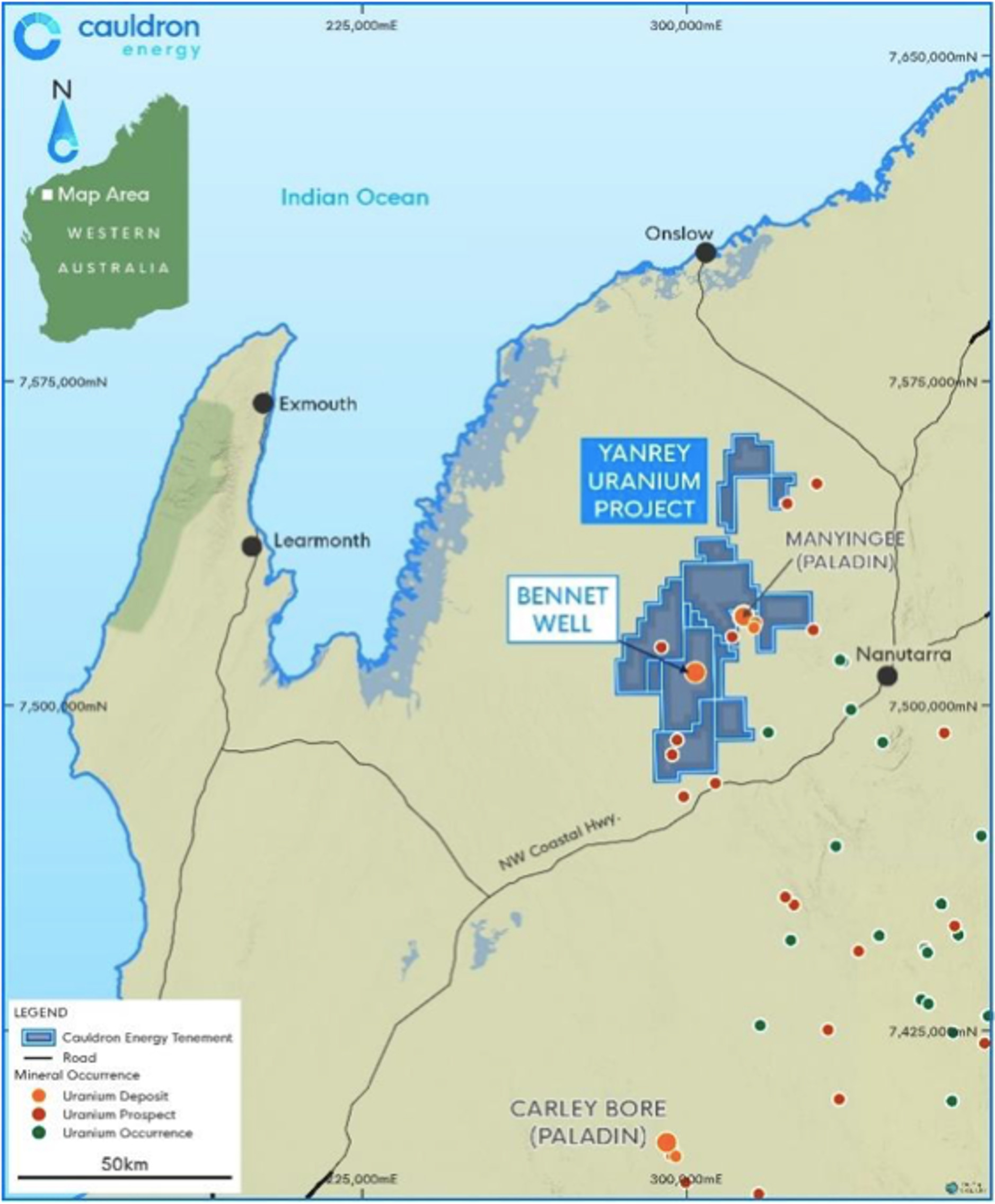

The company stopped working at its Yanrey project in 2017 when the Western Australian state government implemented a ban on most new uranium mines, however the company is committed to the project while simultaneously exploring the potential for Rare Earth Elements and last month flagging an option to acquire the Melrose nickel-copper-PGE project.

They’re also set to start drilling at Yanrey after the WA Department of Minerals, Industry Regulation and Safety (DMIRS) approved the company’s Program of Works last month to target extensions of uranium mineralisation at Bennet Well and assess the potential for vanadium.

CEO Jonathan Fisher told shareholders earlier this month that the Bennet Well Deposit at Yanrey remains “one of the world’s best undeveloped uranium deposits.”

If only the pesky stage gov would just change its policy.

In March KNG announced the mineral resource estimate for the Cleo deposit – within the Allamber uranium project in the Northern Territory – was in excess of 5 million pounds (2,260kg) of U3O8.

The company is confident the project is now well placed for future work to expand this resource.

“There is still unfinished work at Cleo with mineralisation open along strike and at depth,” MD Richard Maddocks said at the time.

“This first MRE sets a firm platform upon which to build the resource base for Cleo. We look forward to further success growing the Cleo Mineral Resource.”

The company holds the Lake Surprise’ project — ~90km from the Four Mile uranium mine in South Australia.

During the March quarter, an aircore program of 56 holes for 742m was completed at the project, confirming uranium mineralisation as being contained within a complex braided stream environment.

Follow-up geophysics will be used to target uranium within the mineralised braided channels at Canegrass, Jubilee and Mookwarinna prospects.

This company has eight mothballed exploration projects in the Northern Territory and WA, but notably their largest shareholder is a subsidiary of the state-owned China Nuclear Power Group (CGN), one of the largest nuclear power providers in the world.

As of 31 December 2022, the installed capacity of CGN’s operating nuclear generating plants was 29,380MWe from 26 nuclear power units with seven other power units of 8,380MWe capacity under construction in various locations across China.

“This unique relationship with CGN gives Energy Metals direct market exposure as well as access to significant capital and places the company in a very strong position going forward,” the company said in its March quarterly.

Recent exploration work has focussed on the re-optimisation of the Bigrlyi Project 2011 Prefeasibility Study (PFS) with the aim of being ready to restart quickly once the uranium market shows sustained recovery.

NFL, CXU, KNG, ADD and EME share prices today:

Who’s got a uranium play in Africa?

The company listed on the ASX last year with a bunch of uranium and gold projects in West Africa, but considers its Saraya uranium project in Senegal to be both an advanced-stage exploration project and large greenfield exploration project.

In May, Haranga secured All Senegalese authorities’ approvals to airfreight 834 drill core samples from its recently completed 22-hole diamond drilling program to the ALS Laboratory in Canada, and expects the assay results shortly.

The next step is to then finalise the maiden mineral resource over the Saraya uranium project within 6-8 weeks from the receipt of the assay results.

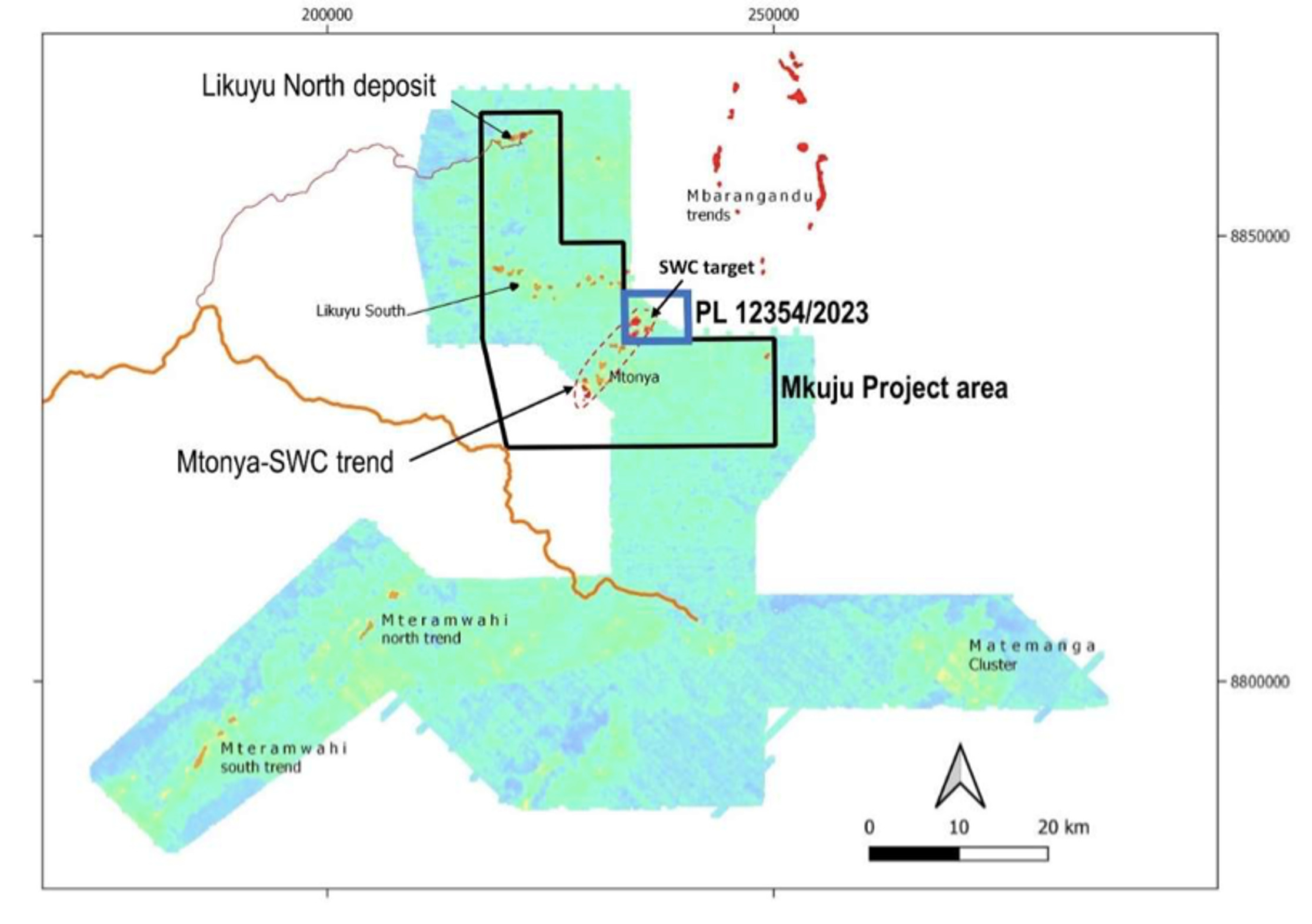

The company has two key uranium projects in Tanzania, Minjingu and Mkuju and picked up another tenement this month in the South West Corner (SWC) licence, which contains high grade uranium at shallow depth.

Historic results include 5m at 700ppm U3O8 from 7m, including 2m at 1,300ppm and 7m at 440ppm U3O8 from surface, including 2m at 675ppm.

SWC was previously owned by Mantra Resources which was subject to a successful takeover in 2011 by Uranium One for ~$1 billion and sits just 50km from Mantra/Uranium One’s Nyota deposit which hosts a Measured and Indicated MRE of 187Mt at 30ppm U3O8 containing 124.6 Mlb U3O8 in a similar geological setting.

Notably, the company also signed an Memorandum of Understanding (MOU) with Mantra during the March quarter and established a data room for the benefit of Mantra to access detailed information on the company’s uranium projects in Tanzania.

The companies are working towards negotiating commercial terms to potentially enter into a binding agreement.

Last year the company was included in the Index Composition for the Global X Uranium ETF (NYSE:URA), joining one of the world’s best known and largest uranium Exchange Traded Funds (ETFs).

It was a vote of confidence for the company’s Letlhakane Uranium Project in Botswana which hosts one of the world’s largest undeveloped uranium resources – 365.7 million pounds of contained U3O8 (100ppm U3O8 cut-off).

ACB recently completed a PQ diamond drill core program at the project which generated >2,500kg of mineralised material grading 277ppm U3O8 (with ~1,200kg grading 470ppm U3O8).

Beneficiation, mineralogy, and hyperspectral mineral classifier studies are continuing.

The company has an existing 61Mlb U3O8 resource at its ‘Marenica’ project, but exploration is currently focused at the Koppies project where drilling is underway.

So far EL8 has intersected mineralisation in holes between Koppies 1 and 2 – indicating the potential for Koppies 1 and 2 to connect, the company says.

Notable intersections from this drilling campaign include 5.5m at 1,121ppm eU3O8 from 9.5m and 2m at 390ppm eU3O8 from 13m.

The drilling is designed to add to the current inferred JORC resource of 20.3 million pounds eU3O8 at Koppies 1 and 2.

The company plans to kick off drilling at regional exploration targets during the June quarter.

Aura is more of a near-term player, with plans to fast track production at its Tiris Project in Mauritania.

An Enhanced Definitive Feasibility Study (EFS) released earlier this year confirmed robust financial returns based on a 150% increase in annual production from 0.8Mlb U3O8 to 2.0 Mlb pa U3O8.

The EFS was based on a 52% increase in Measured and Indicated Resources of contained U3O8 to 29.6Mlb U3O8, 62.1Mt at 216ppm U3O8 at a 100ppm grade cut-off.

Plus, with the signing of the Mining Conventions with the Mauritanian Government, which provides 30 years of financial stability for tax, royalties, and customs associated with the development of the project, the company says it remains on track for a potential final investment decision in Q4 2023.

Front-end engineering design for Tiris is continuing using the revised metrics outlined in the EFS.

HAR, GLA, ACB, EL8 and AEE share prices today:

Here are some explorers in the Americas:

The company recently defined multiple high-priority drilling targets at its Newnham Lake and Perch uranium projects in Canada’s prolific Athabasca Basin, thanks to a geophysical survey.

Drilling to test these high-priority targets is expected to start in Q3 2023.

“In light of these positive results, Okapi Resources is well-positioned to accelerate its exploration activities and capitalise on the re-emerging uranium sector,” MD Andrew Ferrier said.

Last month, the company increased its ownership in uranium enrichment company Ubaryon from 19.9% to 21.9%.

The company also holds a resource 49.8Mlb at 540ppm U3O8 in the Tallahassee Project in the US and is confident its exposure to Ubaryon’s uranium enrichment places it uniquely in both the mining and enrichment of the nuclear fuel cycle.

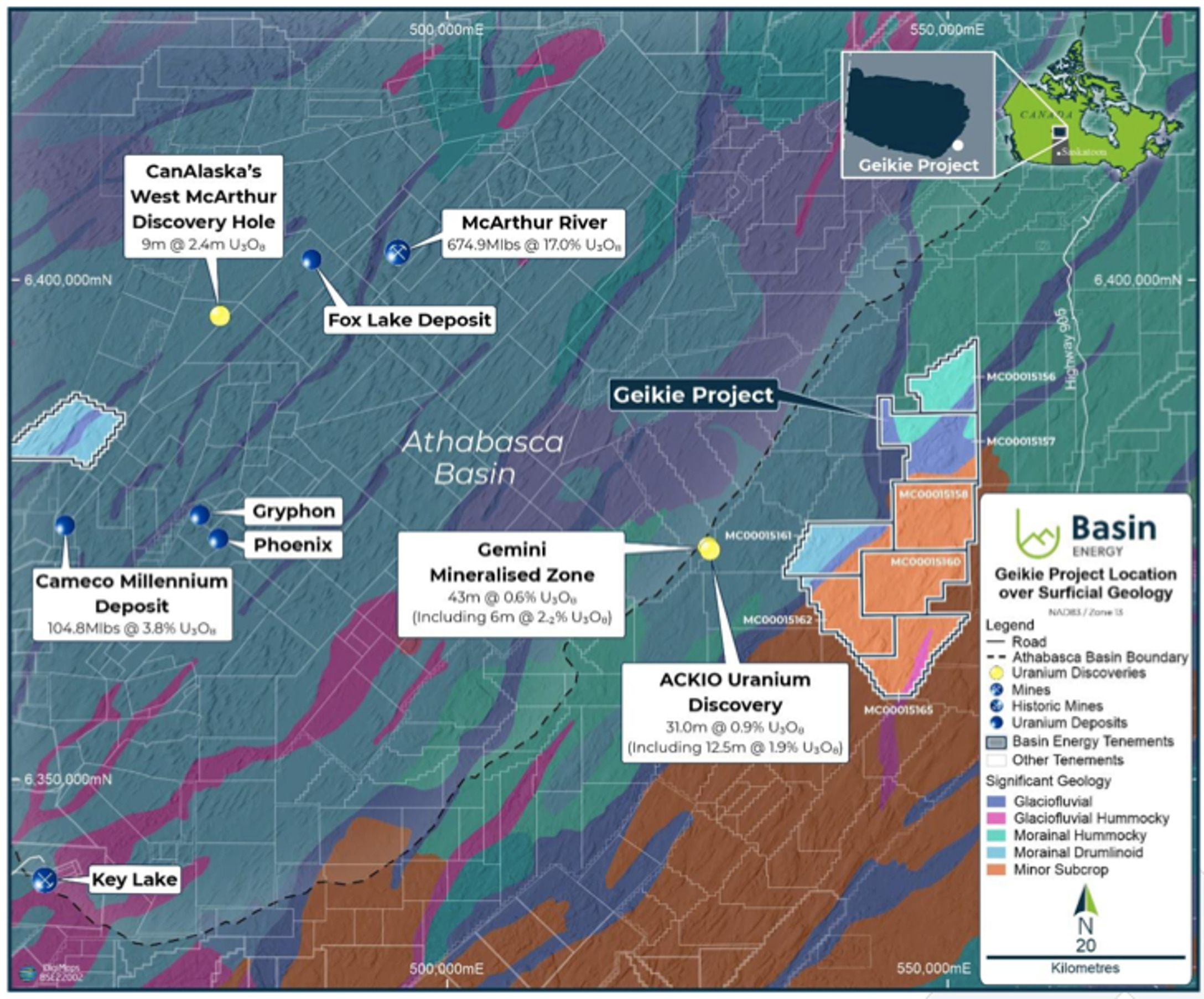

The company has an interest in three projects in Canada’s Athabasca basin, including North Millennium which is 7km north of Cameco’s Millennium Deposit which contains 104.8Mlb U308 at 3.76%, Geikie close to 92Energy (more on them later) and Baselode Energy, and Marshall which is 10km from the Millennium Deposit.

Basin is currently mobilising for maiden drilling at Geikie, which has been largely overlooked for uranium exploration since the initial phase of work which concluded in the early 1980s.

An initial 2,000m of diamond drilling for eight holes is planned to target shallow prospects, deemed favourable for high grade uranium.

Moab is progressing its drill permit application for the REX uranium-vanadium project in Colorado, and is currently in the process of lodging a security deposit as requested by the Bureau of Land Management (BLM) and Colorado Department of Reclamation (DRMS).

The company has also commenced a program of environmental baseline monitoring in line with permitting requirements.

Tender documents have been submitted to a number of drill companies that have experience in drilling for uranium and vanadium in Colorado with site visits to follow once a short list of prospective drilling companies has been selected.

The total drill program as permitted, when completed, is expected to consist of 21 drill holes for a total of 3,150m.

The company has four key Canada-based uranium projects in its portfolio and plans to kick off 2023 field programs at Hidden Bay, Surprise Creek and Cluff Lake this month.

At Hidden Bay, the company has identified priority targets with potential for both basement hosted and Athabasca hosted uranium deposits.

The company has also expanded its land package at Surprise Creek and combed through the historical drilling data with six surface samples returning above 1% uranium with associated copper.

At Cluff Lake, four priority targets have been identified following a comprehensive review of all available exploration data with two targets at the Moose prospect the main focus for upcoming drill testing.

92E is focused on its Gemini project in the Athabasca Basin, where it flagged high-grade uranium up to 9.7% U3O8 last month.

For context, 1.00% U3O8 is over 10 times the average grade of mined uranium deposits elsewhere in the world.

Follow up drilling is planned.

Plus, over at the Clover project, 92E has flagged three electromagnetic (EM) targets on meeting point the interpreted Cigar Lake-Close Lake trend and the McArthur River associated structures.

Planning is now underway to drill-test the EM conductors.

OKR, BSN, MOM, VAL and 92E share prices today:

At Stockhead we tell it like it is. While Basin Energy, Aura Energy, Norfolk Metals, Kingsland Minerals, Adavale Resources, Valor Resources and Moab Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.