Resources Top 5: Tolga’s Raiden on raising radar, GCX Metals makes bold nickel-copper grab

Pic via Getty Images

• Lithium hunter Raiden Resources pulls in another $6m worth of funding, including from a well-known mining identity

• GCX Metals storms up the ASX charts this morning courtesy of major nickel-copper project acquisition

• Apollo Minerals is also grabbing copper – making a move to acquire the Belgrade project in Serbia

Here are the biggest small cap resources winners in early trade, Tuesday August 29.

RAIDEN RESOURCES (ASX:RDN)

Some great news this morning for this fast-growing lithium hunter. It’s managed to secure firm commitments to raise another $6 million in funding via a share placement.

To professional, sophisticated, and institutional investors that is. In other words, not dirty-sneakers-wearing journalists in desperate need of a proper beard trim.

The placement of some 272.2 million shares is priced at 2.2 cents per share. That’s a discount compared with Monday’s 2.5 cents closing price, but nowhere near as steep as most juniors need to go to lure in the big fish in the current market.

Raiden says it will use the funds chiefly to progress exploration work and drilling at its portfolio of lithium projects located in the Pilbara region of Western Australia. That, and to potentially upgrade its 85% interest in lithium-gold acreage held by Arrow Minerals (ASX:AMD) to 100% interest.

And the investment is coming from? A notable source is the “ever bustling mining investor Tolga Kumova” via Kitara Investments. More than a quarter of a million has been sent down that particular funnel to RDN this time around, with Tolga/Kitara maintaining a substantial holding.

Tolga, who shot to fame as the managing director of Syrah Resources (ASX:SYR) before making a motsa as an early bird in Bellevue Gold (ASX:BGL), muted his previously vibrant public profile around a year back as he ran a (successful) defamation claim against FinTwit identity StockSwami.

Like any punter not all his bets have landed, but his quiet investments in Meteoric Resources (ASX:MEI) and Patriot Battery Metals (ASX:PMT) have been recent wins.

Raiden also notes that while strong support has come from existing shareholders, a number of new deep-pocketed institutional investors have put their names down on the funding register.

“We are very grateful for the level of support received from existing and new shareholders,” RDN managing director Dusko Ljubojevic said.

“These funds will allow us to mainly evaluate and advance the company’s lithium projects, including drill testing of our most important lithium prospects.”

Raiden’s recent surge has come off the back of its proximity to Azure Minerals’ (ASX:AZS) SQM and Mark Creasy backed Andover discovery.

@LtdRaiden (#ASX: $RDN) is pleased to announce that the current #mapping and rock #sampling program across the Andover South Project areas, has defined significant outcropping #pegmatites up to 30 metres in width.

Read the full release here: https://t.co/0hU6F2clUn pic.twitter.com/3cn0JCowWc

— Raiden Resources Ltd (@LtdRaiden) August 23, 2023

RDN share price

GCX METALS (ASX:GCX)

Stockhead has just published a special report on GCX, which goes into the explorer’s big, price-pumping (+78% at time of writing) news today in depth.

But, just quickly, the gold explorer is up today after announcing to market that it’s expanding its horizons with a move to acquire the Dante nickel-copper-PGE project.

That’s a site 15km from BHP’s $1.7bn, 390Mt Nebo-Babel development in WA’s West Musgrave region.

The West Musgrave region is a major mineral province that hosts the Giles Complex – one of the most important clusters of mafic-ultramafic intrusions globally.

This is a big move for GCX as (per our report) “the Dante project, which contains large-scale nickel-copper-PGE targets as well as extensive PGE-gold reef targets identified by previous exploration, will benefit from the infrastructure investment that the development of Nebo-Babel about 15km to the south will bring into the region.”

Those targets include ~23km of outcropping mineralised strike grading an average of 1.1g/t PGE3ii, 1.13% V2O5, and 23.2% TiO2, with grades up to 3.4g/t PGE3.

The company also notes that Dante has a clear pathway to drilling, with a signed Native Title Agreement with the Ngaanyatjarra Land Council and initial heritage surveys already completed.

Big announcement today: GCX Metals Ltd is to acquire Dante Resources and its flagship Dante Ni-Cu-PGE Project. As incoming Managing Director and CEO of GCX, I look forward to delivering growth for all GCX shareholders. #nickel #copper #ASX

Read more: https://t.co/0nCUC2QBTj pic.twitter.com/n69VEpUY6g

— thomasline8 (@thomasline8) August 29, 2023

Incoming managing director and CEO Thomas Line said: “Backed by its major shareholder, Tribeca Investment Partners, GCX is well-suited to support Dante’s projects through all phases of resource development.

“The Dante Project provides an unmatched opportunity to gain exposure to one of the world’s last major frontier metallogenic provinces, the West Musgrave region. Investors are increasingly looking for scale, materiality, long mine life potential and exploration upside, and Dante Project delivers all of this.”

GCX share price

APOLLO MINERALS (ASX:AON)

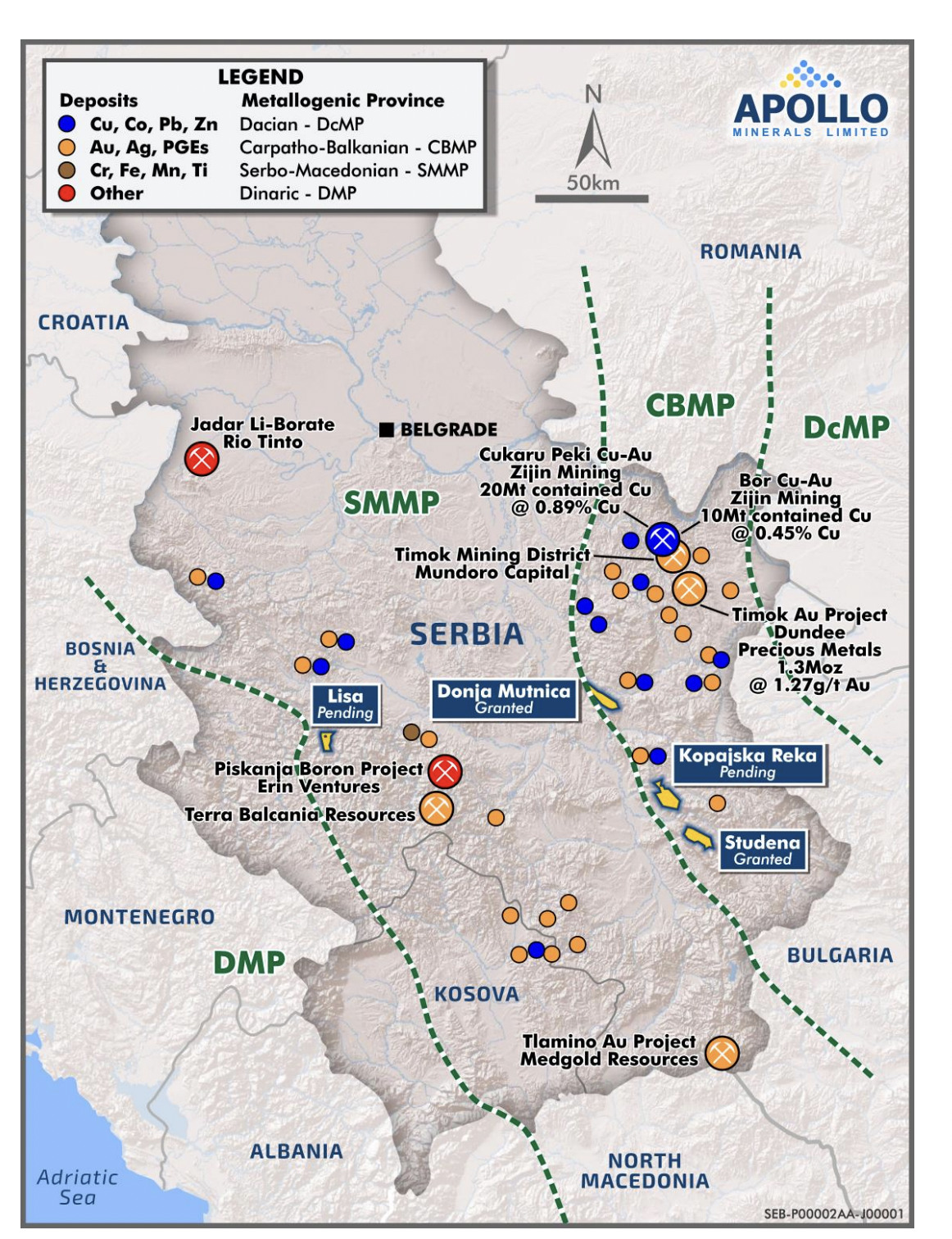

Exploration company (zinc, lead and copper) Apollo Minerals burst out of the ASX gates this morning on the news it’s entered into a conditional agreement to acquire 100% of shares in Edelweiss Mineral Exploration, which holds the Belgrade copper project in Serbia.

Apollo has an existing Gabon base metals focus in the province-scale Kroussou zinc-lead project in Central Africa, but believes this new venture would add greatly to its expanding portfolio.

And it seems a pretty big deal for the company, considering Serbia’s renowned Carpatho-Balkanian Metallogenic Province, where the project is situated, is renowned as a fertile copper-hunting ground.

The Belgrade copper project consists of four licences covering 202km2, which formed part of the Serbian copper exploration project portfolio held by Reservoir Minerals.

Reservoir was acquired by Nevsun Resources (TSX:NSU) in 2016 in a deal worth US$365 million, which was subsequently part of a US$1.4 billion takeover by Zijin Mining Group in 2018.

Apollo believes the potential for major discoveries of world-class sedimentary-hosted copper mineralisation in the location is high, based on its geological history and with more than 70km of untested prospective contacts.

It notes that historical surface rock chip assays exhibited exceptional values of up to 20% copper and 1,540ppm silver supported by recent fieldwork, confirming significant surface copper and silver anomalism.

Apollo Minerals’ managing director Neil Inwood said: “The Belgrade copper project has a compelling exploration thesis which the team are extremely excited to test.

“Reservoir Minerals, who put the project together, discovered the 20 million tonne Cukaru Peki copper deposits at Bor and consequently did not focus on the highly prospective ground we have acquired.

“Serbia is currently Europe’s second-largest copper producer and I am convinced there are world class sedimentary-hosted copper discoveries to be made in the region.”

AON share price

RESOURCES AND ENERGY GROUP (ASX:REZ)

REZ has delivered an update this morning on its activities at its flagship East Menzies gold field project (EMP), about 130km north of Kalgoorlie in Western Australia.

Gold ore processing is set to commence at the project, the company notes – via vat leaching with 5,000 tonnes of ore from REZ’s Maranoa prospect.

🔔 $REZ.ax $REZ Gold Ore Processing To Commence At East Menzies 🔗 https://t.co/1aGLG8X5iv

⛏️Maranoa identified as the ideal shallow, higher-grade ore to support a vat leach #gold production campaign at the East Menzies Project

⛏️On establishing economics of the process, REZ… pic.twitter.com/AdL2Cp3uet

— Resources + Energy Group Limited (ASX:REZ) (@REZ_GOLD) August 29, 2023

Once the company gets a handle on the economics of the process, it says, it will then develop a larger-scale vat-leach campaign to treat additional shallow resources identified at its Maranoa (8,000 Oz) and Goodenough (43,000 Oz) gold deposits.

“These deposits have been thoroughly drilled out to identify near term mining opportunities within the cluster of high-grade, near-surface deposits on the western side of the East Menzies project area,” reads today’s REZ release.

Part of the campaign’s aim is to provide funding for the exploration development of the company’s 100km2 tenement package “within which two major prospects – one gold and one nickel – are being resolved”.

REZ share price

BURLEY MINERALS (ASX:BUR)

Burley Minerals is back in the news with more diamond-drilling action at its Chubb lithium project in Canada, which is in the provincial heart of what’s become a magnet for lithium hunters the world over – Québec – with several ASX companies all jostling for space.

Canada itself, however, only has one operating lithium mine – North America Lithium Operation (NAL) – and the Chubb project is only a chunk of pegmatite’s throw (10km) from it.

The NAL, incidentally, is owned by Sayona Mining (ASX:SYA) (surging up 20% at time of writing, by the way) and Piedmont Lithium (ASX:PLL), with mineral resources of 58Mt at 1.23% Li2O reported.

Plus, there’s several emerging projects in the region, including the Authier Lithium Project, with resources of 17Mt at 1.01% Li2O reported.

Today’s BUR announcement notes the company has commenced its latest drilling program at the project, which is expected to comprise up to 4,000m of diamond drilling, logging, core cutting and sampling for assay.

Some 5,200m of diamond drilling has been completed at the site since April 2023 and further assay results stemming from July’s drilling are apparently being compiled and on their way some time in September. Stay tuned.

$BUR have recommenced #diamonddrilling at our 100% Chubb #Lithium Project in Quebec, Canada, with up to 4,000m planned in this new program.

Read more of the ASX Announcement here: https://t.co/4Q04yWesYp pic.twitter.com/UGxNqO49JT

— burleyminerals (@burleyminerals) August 29, 2023

BUR share price

At Stockhead we tell it like it is. While CGX Metals, Raiden Resources and Burley Minerals are Stockhead advertisers at the time of writing, none of them sponsored this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.