GCX secures ‘unmatched’ exposure to the West Musgrave region and its nickel-copper-PGE riches

GCX’s new Dante project already has large-scale nickel-copper-PGE targets. Pic: via Getty Images

- New project provides “unmatched opportunity” into the West Musgrave region

- Previous exploration has identified large-scale nickel-copper-PGE drill targets

- Proximity to BHP’s Nebo-Babel mine development de-risks logistics

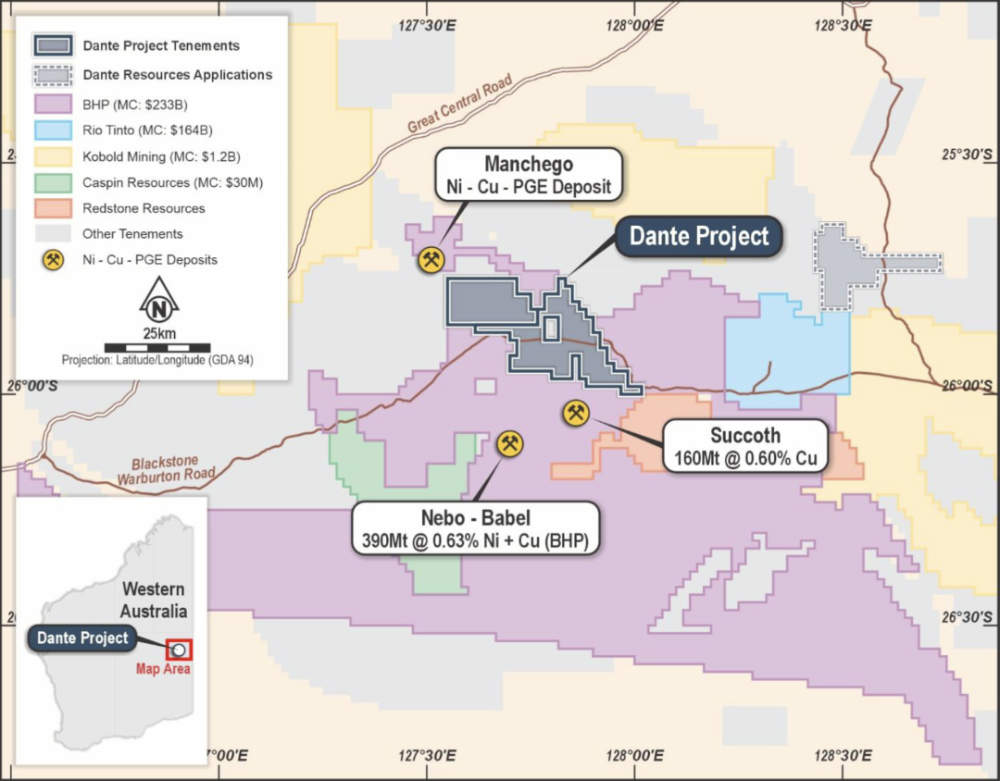

GCX Metals is expanding its horizons with a move to acquire the Dante nickel-copper-PGE project, 15km from the $1.7bn, 390Mt Nebo-Babel development in WA’s West Musgrave region.

The West Musgrave region is a major mineral province that hosts the Giles Complex – one of the most important clusters of mafic-ultramafic intrusions globally.

Giles has proven PGE reefs commonly compared to the South African Bushveld Complex that is estimated to host 2.2 billion ounces of PGEs and gold.

It is also an emerging major mining hub thanks to the $1.7bn, 390Mt Nebo-Babel nickel-copper-PGE mine, which was green lit for a development by mining giant BHP in September last year.

This is significant for GCX Metals (ASX:GCX) as the Dante project, which contains large-scale nickel-copper-PGE targets as well as extensive PGE-gold reef targets identified by previous exploration, will benefit from the infrastructure investment that the development of Nebo-Babel about 15km to the south will bring into the region.

Dante also shares the same geological complex as the mine development, which provides hints about its colossal potential given that Nebo-Babel, or West Musgrave, is expected to deliver annual production of 28,000t of nickel and 35,000t of copper over a 24-year operating life.

Previous exploration at the project has already defined some 23km of outcropping mineralised strike with rock chip sampling returning average assays of 1.1 grams per tonne (g/t) PGE (platinum, palladium and gold), 1.13% vanadium pentoxide and 23.3% titanium dioxide with a top grade of 3.4g/t PGE.

New project, new leadership

As part of the transaction, the company will appoint former Taruga Minerals chief executive officer Thomas Line as its managing director.

Line, who has is an experienced geologist, project generator and executive with over 10 years’ experience in mining, exploration and resource development, said that with the backing of its major shareholder Tribeca Investment Partners, GCX is well-suited to support the Dante project through all phases of its resource development.

“The Dante Project provides an unmatched opportunity to gain exposure to one of the worlds’ last major frontier metallogenic provinces, the West Musgrave region,” he explained.

“Investors are increasingly looking for scale, materiality, long mine life potential and exploration upside, and Dante Project delivers all of this.

“The green-light Final Investment Decision by Oz Minerals (now BHP) to commence a $1.7 billion dollar mine development at Nebo-Babel just 15km south of Dante will bring substantial new infrastructure into the West Musgrave region, de-risk logistics and place GCX in a strategic position to fast-track potential discovery and development.

“Nickel and copper price outlook remains strong, and with the acquisition of these new assets, GCX is now well positioned to take advantage of growing demand for these green technology metals.

“PGE price outlook also remains strong with major supply issues arising in two of the world’s largest producing regions of the critical metals, South Africa and Russia.”

Drill ready project

GCX is acquiring Dante Resources, which holds a portfolio of projects including Dante, for 50 million shares and 60 million performance shares that convert into ordinary GCX shares subject to the satisfaction of certain performance milestones.

Dante Project contains large-scale magmatic nickel-copper-PGE targets and is highly prospective for Nebo-Babel style and Julimar/Gonneville-style magmatic nickel-copper-PGE deposits.

Magmatic deposits often develop in tube like intrusions referred to as chonoliths and often occur in areas of structural complexity, such as craton margins.

Line told Stockhead that the Dante project is not a pure greenfields play.

Rather, the project is covered by an extensive historical dataset including full coverage airborne electromagnetic and magnetic data, over 3,000 auger drillholes, reverse circulation and diamond drill holes, ground EM and gravity data.

The combination of this exploration data – estimated to be worth between $15m and $20m – means that GCX has some advanced drilling targets that it can jump straight on with minimal delay given heritage surveys have already been completed and land access secured.

However, GCX noted that the acquisition complements its existing portfolio, adding that its existing Onslow copper-gold project in the Pilbara has compelling iron oxide copper-gold (IOCG) targets that will be drill tested in the coming months.

This article was developed in collaboration with GCX Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.