You might be interested in

Mining

Resources Top 5: Is this well-located explorer ready to catch up to its potential?

Mining

Monsters of Rock: Stanmore buys Chinese steel giant out of Aussie coal, another miner goes bankrupt

Mining

Mining

Here are the biggest small cap resources winners in early trade, Monday November 8.

The big boys are exiting coal, which is creating huge opportunity for the small to mid-cap cohort.

A couple of months ago Bowen Coking Coal (ASX:BCB) boss Nick Jorss said coal small caps were considering bigger assets “that would make sense for us and are too well priced to ignore”.

“That is a tremendous opportunity for companies, like BCB, to look at assets of increasing size and quality and continue to try and grow the business,” he says.

“It is a once in a generation opportunity.”

$330m market cap Stanmore (of which Jorss was founding managing director) is the latest to acquire assets “of increasing size and quality”, inking a $1.2bn deal to buy BHP’s 80% interest in the BMC (BHP Mitsui Coal Pty Ltd) joint venture.

Stanmore intends to fund the acquisition with a combination of debt and equity and has in place committed debt term sheets for US$625m and equity commitments for a further US$600m.

This transaction will see the company become one of the world’s top metallurgical coal producers, chief exec Marcelo Matos says.

“This is an exciting and transformative acquisition for Stanmore, and we are fortunate to be able to rely on the full support received from our controlling shareholders, GEAR as well as the Sinar Mas Group, to successfully execute this deal,” he says.

“This transaction will see the company become one of the leading metallurgical coal producers globally and provide Stanmore with a portfolio of tier 1 assets, with a significantly increased reserves and resources base and assets with an expected mine life exceeding 25 years production, positioning the company for substantial cashflow generation and future growth opportunities.”

Stanmore has ridden coal’s resurgence to an 80% gain over the past 6 months.

Stockhead’s large cap resources expert Josh Chiat has more here.

(Up on no news)

Buying a couple of North American lithium and copper-gold projects has propelled this explorer’s share price to three-year highs.

The ‘Kibby Basin’ lithium project in Nevada is ~50km from Ioneer’s (ASX:INR) advanced Rhyolite Ridge lithium boron project, and 60km from MQR’s existing ‘Clayton Valley’ lithium project.

A drill campaign will begin in Q1 of 2022, MQR says.

The historic Lone Star copper-gold mine in Washington State comes with a non-JORC resource of ~200,000oz gold and ~15,000 tonnes copper. A 5,000m drilling campaign begins here on 15 November.

The $21m market cap stock is up 150% over the past month. It had about $2m in the bank at the end of the September quarter.

The WA copper-gold explorer has a project called ‘South Telfer’ in the world class Paterson Province, about 12km from the world class Telfer gold mine which produced 393,164 ounces of gold and 16,278 tonnes of copper in FY21.

5,000m of drilling at ‘South Telfer’ is due to kick off in the next 2 weeks, the company says.

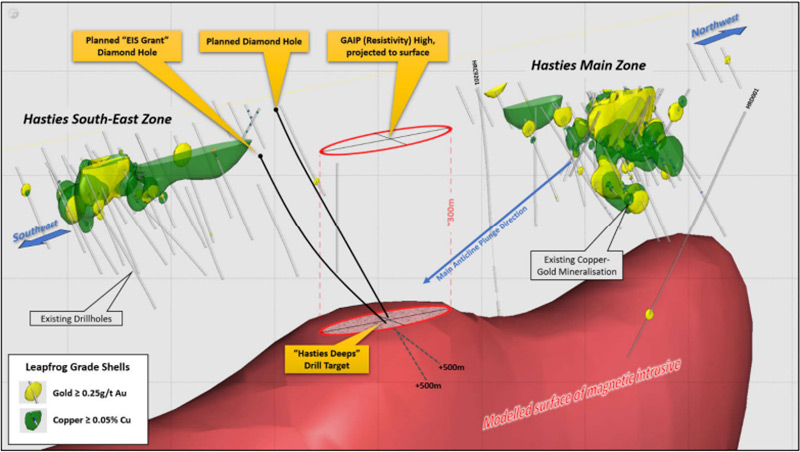

“Our maiden drilling program was very successful in defining broad zones of significant copper-gold mineralisation at both the Hasties Main and Hasties South-East zones,” Rincon managing director Gary Harvey says.

“The upcoming program will now test extensions to these zones, including the untested gap between the two zones and the high priority Hasties Deeps target.”

Hasties Deeps could be a monster:

“Given we are less than 12km from the world-class Telfer Gold Mine, we are excited by the prospectivity at Hasties,” Harvey says.

The $8m market cap explorer is currently trading at its December 2020 IPO price of 20c per share. It had $3.3m in the bank at the end of the September quarter.

(Up on no news)

The WA gold-base metals explorer is prepping for some early-stage exploration work at its ‘Binti Binti’ (gold), ‘Fraser Range’ (nickel, copper, PGE) and ‘Errabiddy’ (gold, nickel, copper) projects in the current quarter.

A follow-up program of shallow auger drilling targeting prospective trends is being planned at our Binti Binti Project for this Quarter and is aimed at identifying target zones for deeper drill testing.#ASX $ERW #gold #exploration #BintiBinti pic.twitter.com/iPxWSgzLBy

— Errawarra Resources Ltd (@AuNiCuWA) November 4, 2021

The company also “continues to seek out and examine further exploration opportunities in favourable jurisdictions which could complement its existing focus on gold and the green technology metals nickel and copper”.

ERW is now up 42% per cent since its ASX debut late last year. It had ~$3m in the bank at the end of September.

(Up on no news)

The Aussie project developer was one of Octobers biggest small cap winners after China, which produces around 85-90% of the world’s magnesium, began slashing production due to the ongoing power crisis.

Magnesium metal prices rose from ~$3,200 per tonne in September to $11,000 per tonne in October 2021.

Last week, LMG said it would expand its yet-to-be-built demonstration plant from 3,000tpa to 10,000tpa to meet world demand.

The plant will cost $123m to build will result in estimated EBITDA of $42m.

Funding for this expansion of ~$75M will be financed through 100% magnesium offtake agreements, LMG says.

8,000tpa is already allocated in its current offtake agreements and enquiries have been received for an additional 2,000tpa.

LMG’s eventual objective to scale up to a 40,000tpa plant.