- Recent IPO Iltani Resources preps to drill Herberton project, home to “one of Australia’s best silver exploration targets”

- Results imminent from Western Yilgarn’s lithium, nickel augur program

- Olympio Metals goes into a trading halt pending transaction announcement

Here are the biggest small cap resources winners in early trade, Wednesday July 26.

(Up on no news)

The explorer is performing strongly since listing on the ASX late June following a $5m IPO at 20c/sh.

Its initial focus is the Herberton project in Far North QLD, home to “one of Australia’s best silver exploration targets”.

The main target is the historically mined (1886-1924) Orient prospect, an extensive precious metal-rich epithermal system 3-5km long. ILT is now making final preparations for first drilling activities at Orient in more than 35 years, it said mid-month.

“We are eager to get to work exploring Orient, which we believe is Australia’s most exciting silver exploration target,” managing director Donald Garner says.

“It has additional potential as a lead-zinc-indium-antimony project, with indium and antimony both recognised as critical minerals.

“Our Stage 1 RC drilling program [~2300m, 16 holes] represents the first drilling at Orient since 1988 and will target high-grade vein hosted mineralisation at Orient.

“We expect it will help us better understand the size and potential of the Orient mineralising system and set us on the path to delivering outstanding returns for our shareholders.”

(Up on no news)

Results are imminent from an early-stage augur program testing potential lithium pegmatites and a 2km-long nickel-copper-cobalt anomaly at the Bulga project in WA.

Augur drilling is often used when the transported cover is too thick for soil and rock sampling.

While Bulga is sparsely drilled, previous owners BHP and St George did get promising results from a couple of short programs in 2011 and 2015, including a highlight 45m @ 0.55% Ni, 229ppm Co from 24m.

Bulga is close to BHP’s tier 1 Leinster and Mt Keith operations.

Planning is already underway for a deeper RC drill program, WYX says.

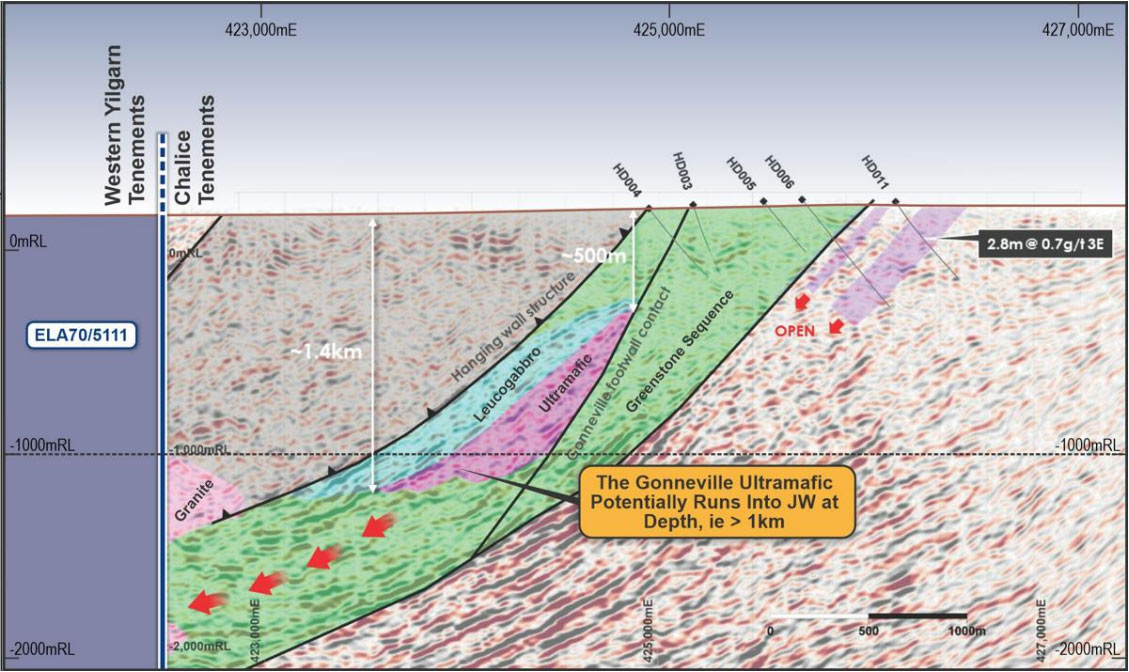

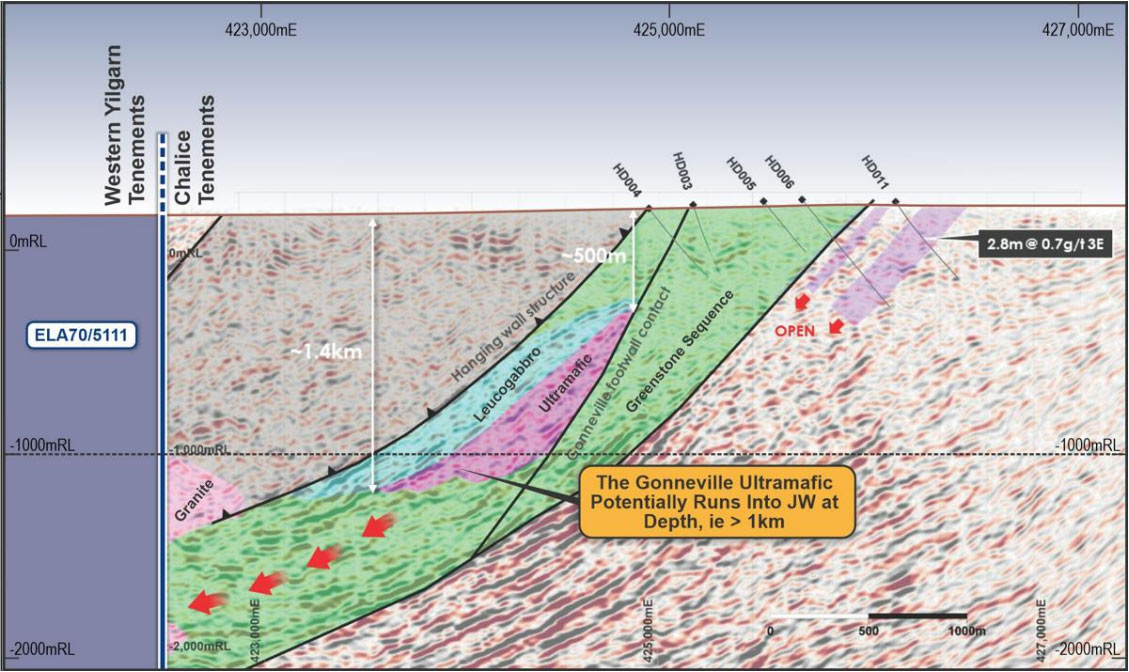

Meanwhile, the stock has uncovered a bunch of targets at its Julimar West project, right next door to Chalice Mining’s (ASX:CHN) 3Mt NiEq Julimar project in WA.

There’s potential for CHN’s Gonneville intrusion – which hosts the monster resource – to continue at depth into WYX’s ground, the company says:

The exploration stock formerly known as Pacific Bauxite was reinstated to the ASX in May 2022 following a $4.5m, 20c per share recapitalisation process.

It had ~$2.1m in the bank at the end of June.

(Up on no news)

WSR’s recent form is an example of punters buying the hype and selling the news.

In May, the lithium explorer bounced higher on big volume after hitting “multiple thick pegmatites” (rock that can contain lithium) at the Olga Rocks project in WA.

Traditionally a gold project, historical drilling at Olga was never assayed for lithium, despite its proximity to the Covalent’s emerging 380,000tpa Mt Holland project.

But those gains plummeted into the sea and drowned, like the proverbial Icarus, after the assays failed to live up to expectations.

WSR aren’t giving up though, with “fast-tracked” follow up drilling already planned.

The $4.5m capped minnow is down 40% year-to-date. It had $1.2m in the bank at the end of March.

OLY – which has been hit with a couple of price/volume queries from the ASX in recent months — went into a trading halt shortly after open, but not before gaining ~25%.

The gold, lithium, and rare earths focused company is now formulating a response to another ASX price query and an announcement regarding a potential transaction. We have our money on a lithium project in James Bay or Brazil.

In May, Liontown (ASX:LTR) inked a deal to farm into OLY’s early stage Mulline and Mulwarrie lithium projects in the eastern goldfields of WA.

It’s fairly low cost for LTR as far as earn-in deals go, with the $6.4bn stock able to earn a 51% interest in the projects by spending just $400,000.

OLY can then elect to form a JV and share exploration costs, but if it doesn’t LTR can accrue another 39% by spending $1m within three years.

OLY is currently drilling a couple of targets at the Halls Creek gold project.

The current share price of 25c is an all-time high for the company, which listed on the ASX in 2022 via a backdooring of failed hemp stock Croplogic.

You might be interested in