Who Made the Gains? Here are the top 50 ASX miners and explorers for May

Pic: Stock, Via Getty

- Incredible 28 of the top 50 stocks had lithium in their portfolios

- SEVEN companies made gains of 100% or more

- Top ASX resources stocks for April: WA1, Wildcat, Westar, Voltaic, Solis, Reach

While May could be considered subdued by some standards, seven explorers made gains of 100% or more: a 2023 record.

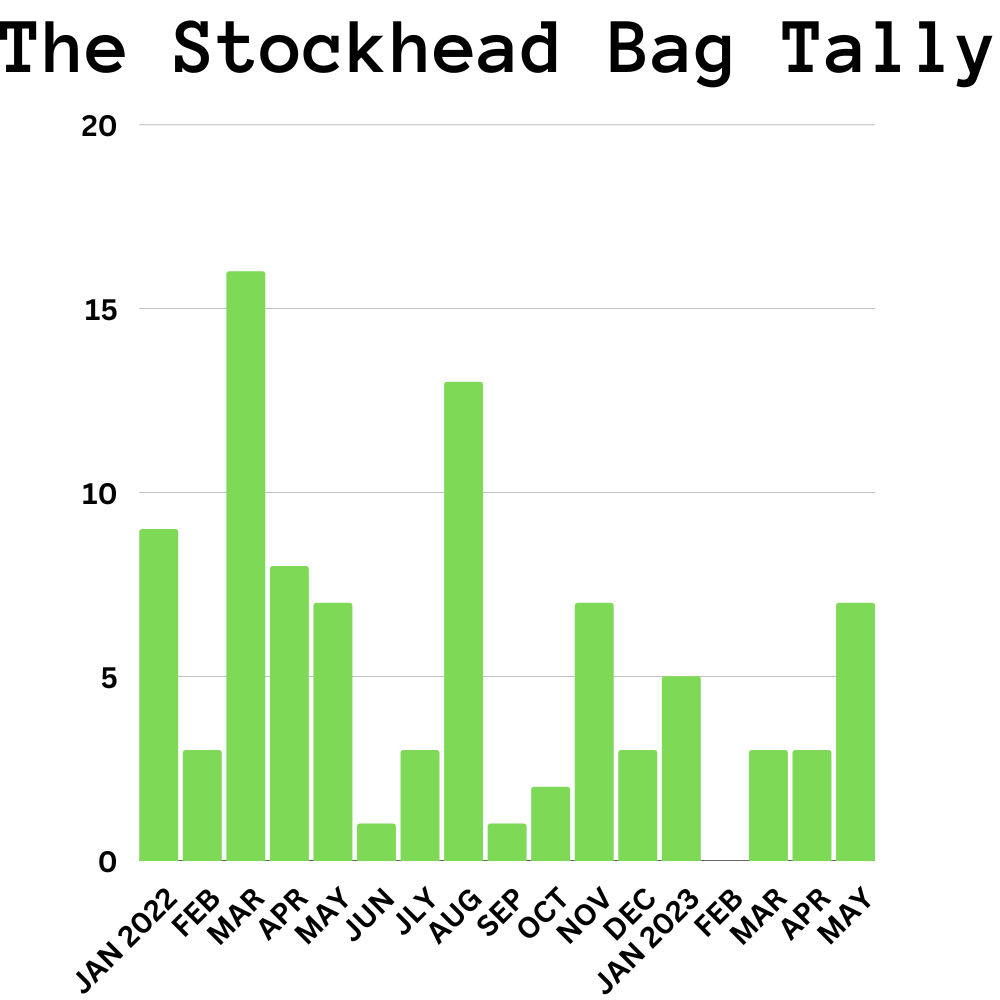

The ‘Bag Tally’ (+100% gains) is Stockhead’s unscientific measure of speccy resources sentiment in any given month.

Here’s how the Bag Tally has tracked since January 2022.

As you can see, May is a recent standout.

Why though? Far East Capital head honcho Warwick Grigor says when market sentiment is low “that is when news flow and new stories come into their own”.

The top stocks for May – WA1, Wildcat, Westar, Solis, and Voltaic — all have stories of (potential) discovery, nearology and transformational acquisition to tell. Punters love a good story.

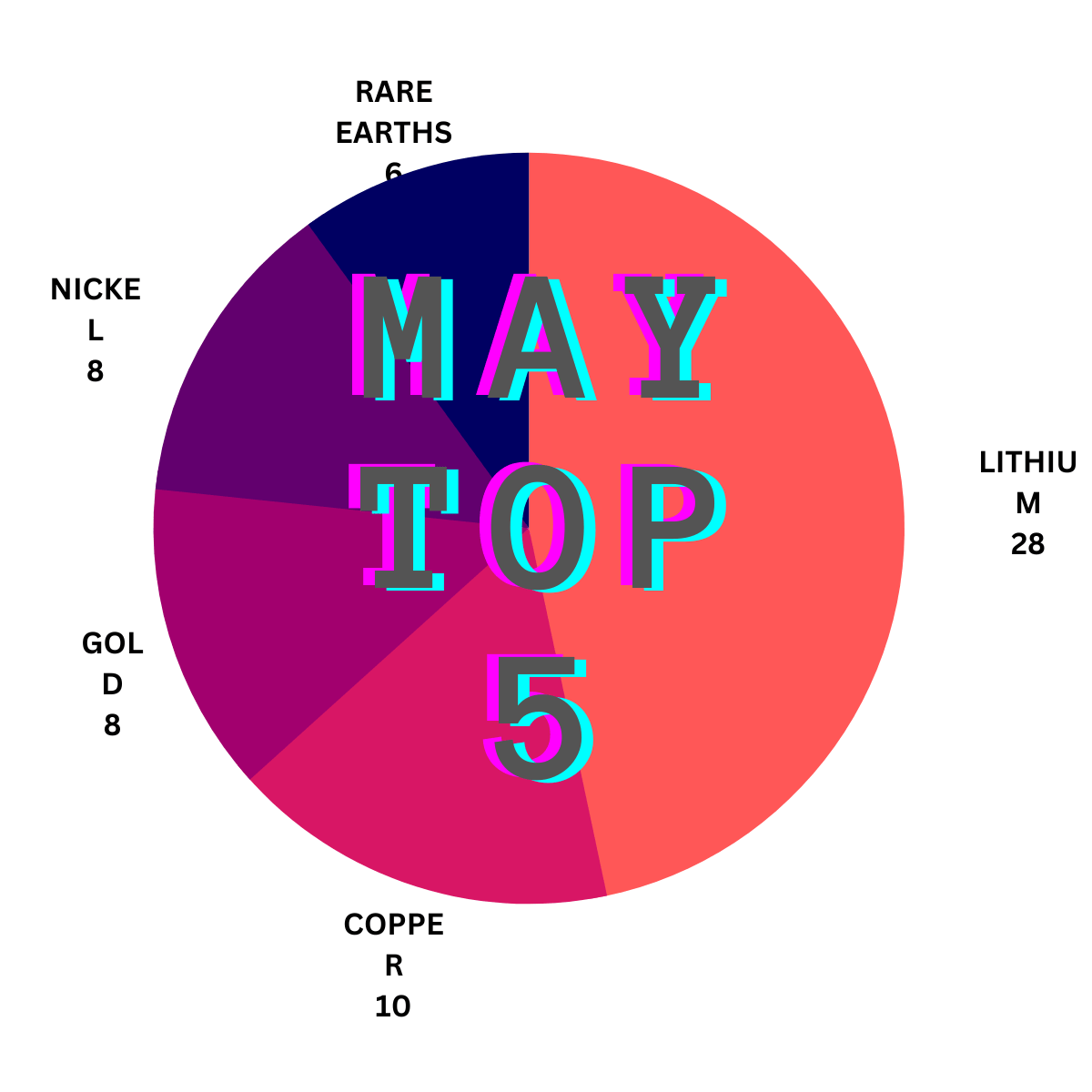

Add to that a lithium and rare earth price resurgence and you have a top 50 chock full critical mineral players. A massive 56% of stocks in the top 50 have lithium exposure, which must be some sort of record.

Here’s a breakdown of the five most popular commodities for April:

Here are the top 50 ASX resources stocks for the month of April >>>

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | MAY 2023 RETURN % | PRICE | MARKET CAP | COMMODITY |

|---|---|---|---|---|---|

| WC8 | Wildcat Resources | 267% | 0.11 | $72,822,500 | LITHIUM |

| WA1 | Wa1Resourcesltd | 189% | 5.19 | $219,266,073 | NIOBIUM, REE |

| WSR | Westar Resources | 166% | 0.083 | $14,000,000 | LITHIUM |

| VSR | Voltaic Strategic Resources | 163% | 0.071 | $26,231,500 | LITHIUM |

| ZEU | Zeus Resources | 142% | 0.029 | $12,710,000 | LITHIUM |

| RR1 | Reach Resources | 117% | 0.0065 | $17,907,829 | LITHIUM, COPPER, REE, NIOBIUM |

| SLM | Solis Minerals | 100% | 0.28 | $6,760,000 | LITHIUM |

| C1X | Cosmos Exploration | 90% | 0.485 | $21,570,375 | LITHIUM, GOLD |

| BLZ | Blaze Minerals | 78% | 0.016 | $5,880,132 | LITHIUM |

| ENR | Encounter Resources | 76% | 0.29 | $114,702,476 | REE, COPPER, GOLD |

| LLL | Leolithiumlimited | 69% | 0.885 | $917,590,928 | LITHIUM |

| KNG | Kingsland Minerals | 67% | 0.325 | $10,217,949 | GRAPHITE, URANIUM |

| RDN | Raiden Resources | 67% | 0.005 | $9,272,000 | NICKEL, COPPER, COBALT, PGE |

| CLA | Celsius Resource Ltd | 63% | 0.0245 | $55,276,292 | COPPER, GOLD |

| PRS | Prospech | 63% | 0.039 | $8,512,000 | LITHIUM, REE |

| GSM | Golden State Mining | 61% | 0.053 | $7,646,000 | LITHIUM, GOLD |

| REC | Recharge Metals | 54% | 0.2 | $19,000,000 | LITHIUM |

| TZN | Terramin Australia | 53% | 0.029 | $61,380,319 | GOLD, ZINC |

| LEL | Lithenergy | 53% | 0.885 | $88,359,300 | LITHIUM, GRAPHITE |

| CHZ | Chesser Resources | 52% | 0.1125 | $66,217,652 | GOLD |

| GW1 | Greenwing Resources | 42% | 0.2625 | $39,726,090 | LITHIUM, GRAPHITE |

| DLI | Delta Lithium | 41% | 0.64 | $287,858,723 | LITHIUM, GOLD |

| AZS | Azure Minerals | 40% | 0.54 | $183,410,954 | NICKEL, COPPER, COBALT, LITHIUM |

| CAY | Canyon Resources Ltd | 35% | 0.062 | $60,945,990 | BAUXITE |

| TIG | Tigers Realm Coal | 33% | 0.008 | $91,466,917 | COAL |

| XTC | Xantippe Res Ltd | 33% | 0.004 | $51,660,449 | LITHIUM |

| BKY | Berkeley Energia Ltd | 30% | 0.46 | $211,753,440 | URANIUM |

| LRS | Latin Resources Ltd | 28% | 0.1725 | $470,051,993 | LITHIUM |

| LKE | Lake Resources | 26% | 0.5275 | $746,783,471 | LITHIUM |

| PMT | Patriotbatterymetals | 21% | 1.755 | $547,990,708 | LITHIUM |

| ORN | Orion Minerals Ltd | 19% | 0.019 | $112,940,971 | COPPER, ZINC, NICKEL |

| MEI | Meteoric Resources | 19% | 0.2075 | $394,966,499 | REE |

| POS | Poseidon Nick Ltd | 18% | 0.045 | $156,585,421 | NICKEL |

| AGY | Argosy Minerals Ltd | 16% | 0.47 | $653,049,487 | LITHIUM |

| LPD | Lepidico Ltd | 15% | 0.0115 | $95,472,278 | LITHIUM |

| WR1 | Winsome Resources | 14% | 1.625 | $272,511,989 | LITHIUM |

| DVP | Develop Global Ltd | 14% | 3.46 | $619,240,221 | COPPER, ZINC |

| XAM | Xanadu Mines Ltd | 14% | 0.05 | $81,891,210 | COPPER, NICKEL, LITHIUM |

| MI6 | Minerals260Limited | 12% | 0.465 | $111,150,000 | LITHIUM, NICKEL, COPPER, PGE |

| VR8 | Vanadium Resources | 12% | 0.084 | $47,897,679 | VANADIUM |

| GCY | Gascoyne Res Ltd | 12% | 0.1425 | $131,551,966 | GOLD |

| MMI | Metro Mining Ltd | 12% | 0.019 | $87,276,593 | BAUXITE |

| WMG | Western Mines | 11% | 0.76 | $42,381,971 | NICKEL |

| INR | Ioneer Ltd | 11% | 0.3375 | $723,926,702 | LITHIUM |

| BOC | Bougainville Copper | 10% | 0.37 | $148,393,125 | COPPER |

| VRX | VRX Silica Ltd | 10% | 0.11 | $64,446,348 | SILICA SAND |

| FYI | FYI Resources Ltd | 10% | 0.115 | $40,294,935 | HPA, REE |

| PAM | Pan Asia Metals | 9% | 0.29 | $41,921,902 | LITHIUM |

| EUR | European Lithium Ltd | 9% | 0.1 | $148,923,918 | LITHIUM |

| NC1 | Nicoresourceslimited | 9% | 0.51 | $45,281,376 | NICKEL, COBALT |

April ASX Top 5

WILDCAT RESOURCES (ASX:WC8)

WC8 has been on roll since acquiring the historical Tabba Tabba tantalum mine and lithium-tantalum project in the Pilbara.

Now it has ‘boots on the ground’ and maiden lithium drilling is pencilled in for July, it says.

The historical Tabba Tabba tantalum mine and lithium-tantalum project in the Pilbara includes a bunch of mining leases – important if you want to get into production quickly — large areas of outcropping pegmatites, and a high-grade 318,000t at 950ppm Ta2O5 tantalum deposit.

The project, briefly explored and mined by Pilbara Minerals (ASX:PLS) in 2015, was historically a tanty asset so assays for lithium are limited.

However, there are some nice hits like 8m at 1.42% Li2O from 4m for WC8 to follow up.

More importantly, FMG has drilled out a lithium orebody right next door.

Iron ore miner FMG has secretly drilled out a 1km-long #lithium orebody in the Pilbara.

Drilling goes right up to a boundary shared with explorer Wilcat Resources’ recently acquired Tabba Tabba lithium-tantalum project. By @reubenadams6 #ASX $FMG $WC8

— Stockhead (@StockheadAU) May 24, 2023

WA1 RESOURCES (ASX:WA1)

WA1 shareholders have enjoyed a breathless rise from 13.5c tiddler to $5.59 market darling in a touch over seven months.

That’s a ~4040% gain, sparked by ongoing exploration success at the super high-grade West Arunta niobium project on the WA/NT border.

Is this the next Chalice Mining (ASX:CHN)? Here’s some insightful commentary from an actual geologist, who is also an investor.

#WA1 is having a big run up into the assays, especially when taking into an account the market cap.

A lot of people on the sideline waiting for the next set of assays. I personally wanted to top up more after the assays – it keeps running away.

Carbonatites tend to have quite… pic.twitter.com/efW1pkXOqj

— Equivest ⚒️ (@equivestinvest) May 30, 2023

WESTAR RESOURCES (ASX:WSR)

WSR has been bouncing around on big volume since hitting “multiple thick pegmatites” ~44m thick at the Olga Rocks project in WA.

Traditionally a gold project, historical drilling at Olga was never assayed for lithium, despite its proximity to the Covalent Lithium’s emerging 380,000tpa Mt Holland project.

This 14-hole, 1400m program was design to test whether the multiple pegmatite/felsic intersections logged by previous explorers contained lithium.

The maiden drilling program successfully intersected pegmatites in 8 of the 14 drill holes, the thickest continuous pegmatite being 44m from just 17m depth.

One hole was drilled to validate old gold hits, including 8m @ 4.54g/t Au, 8m @ 4.69g/t Au, and 3m @ 10.6g/t Au.

Assays are expected in 3-4 weeks.

VOLTAIC STRATEGIC RESOURCES (ASX:VSR)

(Up on no news)

In May, 2022 relistee VSR exploded out of the blocks on some promising lithium drilling results at Andrada, part of the Ti Tree project in the Gascoyne region of WA.

The 15-hole for 900m first pass program returned continuous pegmatite up to 58m thick, from surface across six targets.

All holes hit pegmatite – rock that contains lithium — which remains open at depth. Assays are due in about three weeks, VSR says.

Ti Tree sits around Delta Lithium’s (ASX:DLI) potentially monstrous Yinnetharra project, where the company recently hit 56m at 1.12% lithium as part of an extensive multi rig drill program. DLI boss David Flanagan says Yinnetharra “is looking more like a province than a project”.

Meanwhile, drilling at Neo, part of the Paddy’s Well project has uncovered a large clay REE system, the company says.

Grades go as high at 10,072ppm TREO and widths up to 78m from surface, with that hit — 78m @ 1,001 ppm TREO — one of widest reported in Australia. Met testing is now underway.

ZEUS RESOURCES (ASX:ZEU)

Tiddler ZEU has also has an early-stage lithium project near Delta Lithium’s (ASX:DLI) Yinnetharra called Mortimer Hills.

During March, ZEU carried out a field trip to confirm earlier mapping of pegmatites and plan access for a planned 1700m RC drilling program.

A Program of Works (POW) application has been submitted for this drilling, it says.

The company recently applied for a couple of adjoining tenements, which are now subject to ballot.

A ballot — in which a winner’s name is chosen at random — happens when a bunch of companies want to peg the same piece of ground.

The tenements are very popular.

“About 14 companies have applied for E09/2791 and 13 companies have applied for E09/2798,” ZEU says.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.