These aerials show FMG has drilled out a Pilbara lithium deposit. This explorer is right next door

Picture: Getty Images

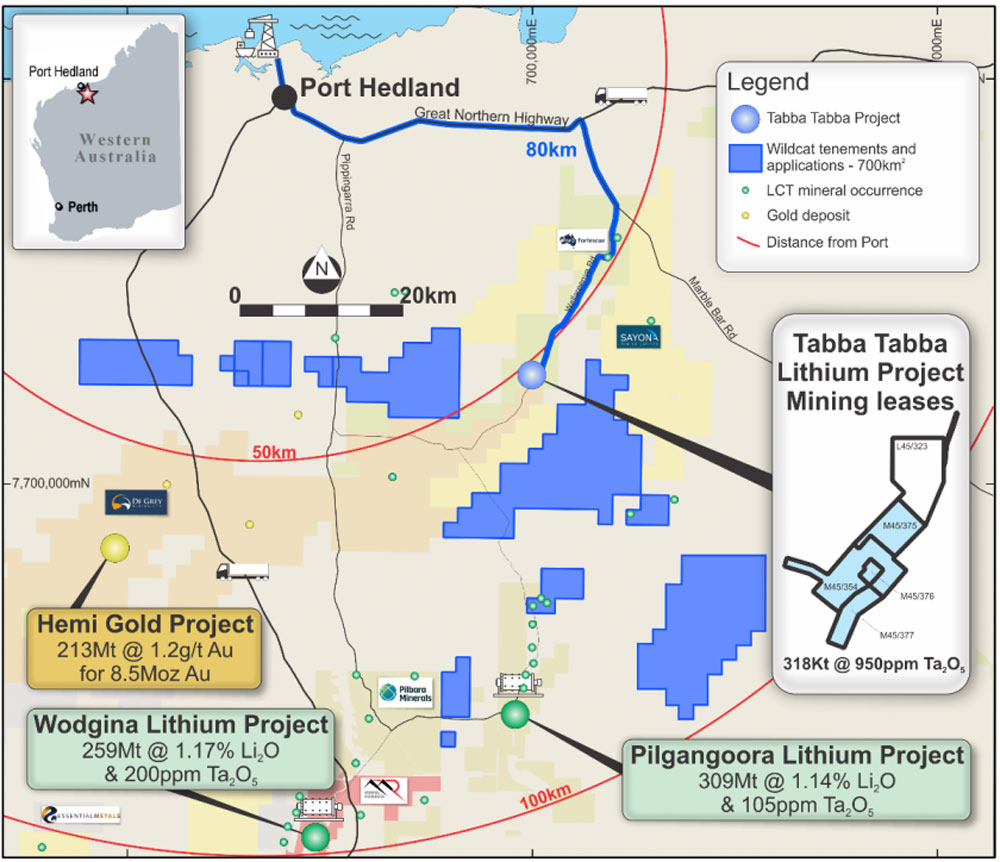

Last week, explorer Wildcat Resources (ASX:WC8) acquired the historical Tabba Tabba tantalum mine and lithium-tantalum project in the Pilbara.

It includes a bunch of mining leases – important if you want to get into production quickly — large areas of outcropping pegmatites, and a high-grade 318,000t at 950ppm Ta2O5 tantalum deposit.

The project, briefly explored and mined by Pilbara Minerals (ASX:PLS) in 2015, was historically a tanty asset so assays for lithium are limited.

However, there are some nice hits like 8m at 1.42% Li2O from 4m for WC8 to follow up.

The deal will cost WC8 up to 250m shares worth $17.25m at current prices, which makes vendor and tantalum producer Global Advanced Metals (GAM) a major shareholder in WC8.

All very interesting in itself, but what sent our curiosity into overdrive was this slide, tucked away in the backside of the announcement.

Anyone know what $FMG has found next to $WC8.ax?

“resource drilling targeting #lithium” pic.twitter.com/uff6WqZvI4

— smallcaps_asx (@SmallCaps_asx) May 22, 2023

What is FMG doing drilling out a lithium orebody?

$60bn capped FMG is an iron ore company, first and foremost, but it has expended considerable time, money and resources looking for copper, lithium, and nickel deposits.

It is yet to report a major discovery, but it remains hopeful. Boss Twiggy Forrest recently mentioned FMG was still aiming to supply the “future facing” metals, like lithium, required by its clean energy division, FFI.

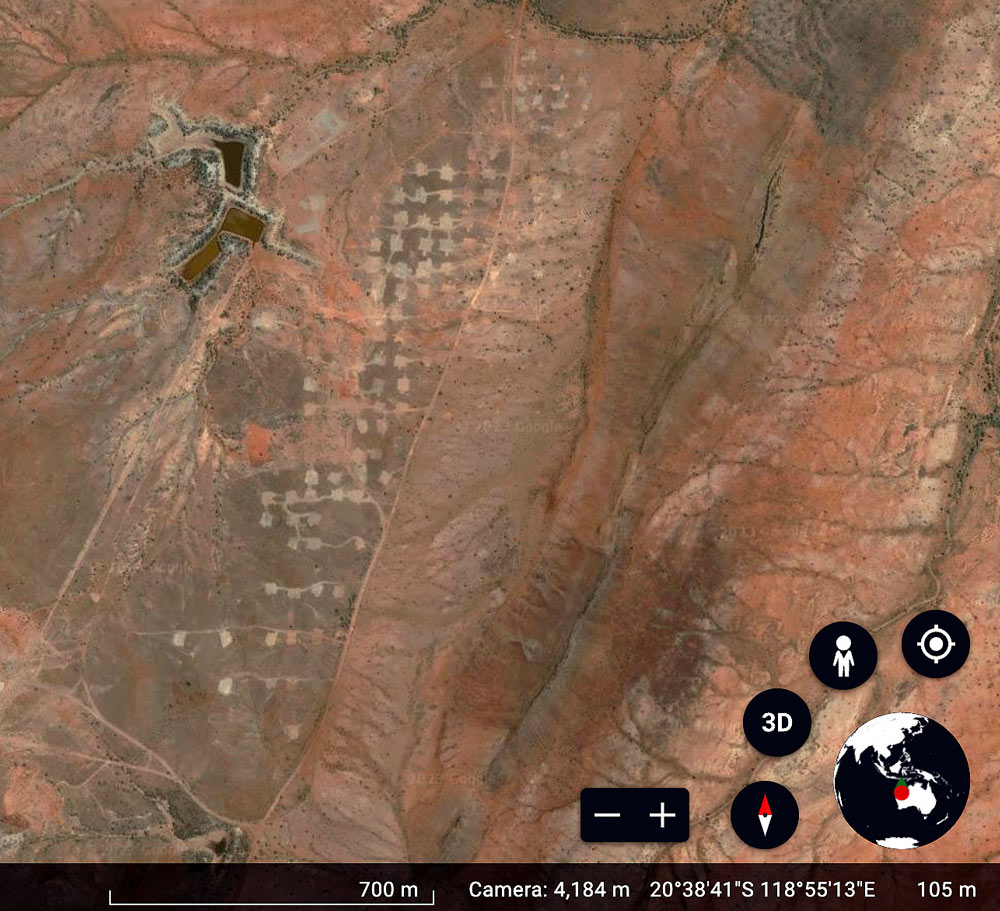

Let’s take a closer look at those drill pads:

That’s 50x50m drill hole spacing along a ~1km stretch of ground.

Looks like resource drilling to us.

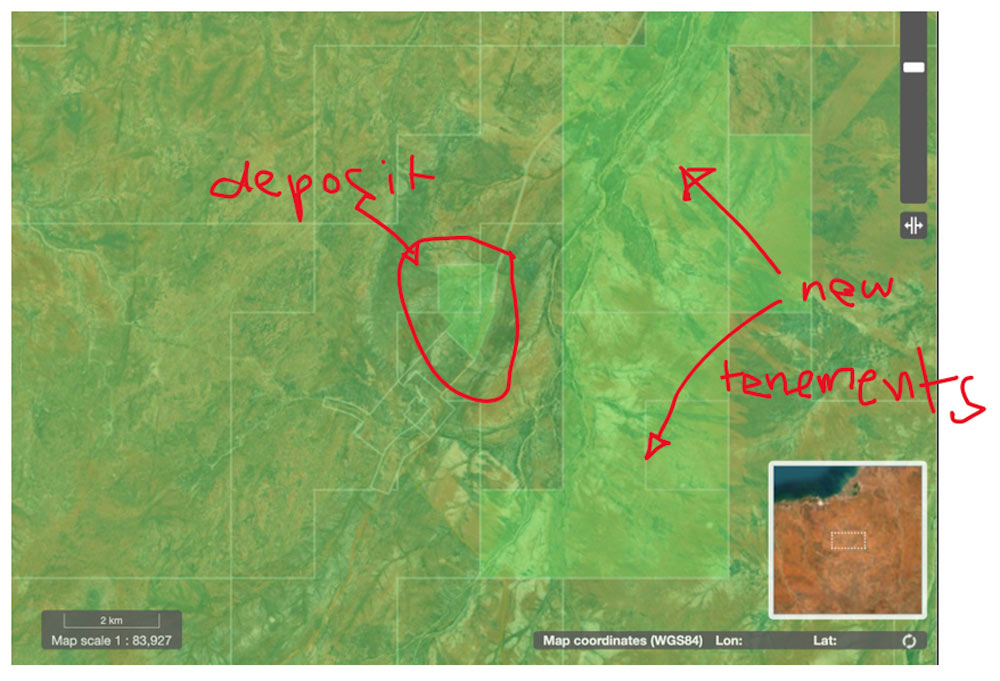

According to the AGSON Geoscience Portal, FMG also applied for more exploration ground just east of Tabba Tabba on 11 May this year.

“Is it true you have a 20Mt resource at Tabba Tabba?” we asked FMG via email, pulling a number out of thin air.

“Are there any other similar projects on the go? Is this part of supplying lithium into FFI?”

An FMG spokesperson replied.

“Fortescue has completed exploration and drilling at the 100% FMG Tabba Tabba project, located southeast of Port Hedland, for the exploration of lithium,” they said.

“Fortescue started as an exploration company, and we still firmly believe that early-stage exploration is the key to unlocking significant value.

“Leveraging our world leading track record of innovation and infrastructure development, Fortescue is transitioning to a global green energy, metals and technology company.

“With our exploration knowledge and expertise, Fortescue continues to explore for critical minerals in Australia and globally through our tenure footprint with a focus on copper, lithium, nickel and rare earth elements.”

So how did Wildcat score such a sweet project? We called Wildcat exec director Matthew Banks and managing director Sam Ekins for a chat.

Tell us what you know about the FMG project.

“It looks like the orebody is about a kilometre long,” they said.

“And the surface expression is about 200 by 200m, which is on a map you’ll see on our announcement.”

So that surface expression is the blue part.

“That’s right, outcropping pegmatite.”

Right. That’s less than a kilometre away?

“Yes, about a kilometre away, but the drilling goes right up to the boundary,” they said.

“They’ve put in for a mining lease, to be converted into a mining lease.

“If you look at Google Maps, it looks it’s a lot more significant than on this figure, because you can see the tracks between the drill pads. It’s just absolutely peppered.”

How is it that you guys were able to snag such a such an important piece of ground?

“We know that there were majors trying to buy the asset,” they said.

“But what we did was [send our] technical team to present to GAM.

“The reason why they’ve divested it to us is because they share in the upside.

“They become significant shareholders in Wildcat. They own ~15% to start with, and then there’ll be another 5% chunk of stock if we define ~10Mt at 1%.

“That the back-of-the-envelope resource that we’ll have to get to.”

What do you know about the lithium prospectivity at your project?

“There was four holes drilled in 2014,” they said.

“They were putting in a waste dump and drilled four, 40m holes just to see if there’s an orebody underneath [sterilisation drilling].

“Three of the holes hit the mapped pegmatite.

“They hit 16 metres at 0.9% lithium oxide from 10m; they hit 1m at 2% at the end of the hole; and then 8m at 1.42% from 4m.

“That’s the stuff we want, and we’ve got a 3km strike with 38 outcropping pegmatites already mapped.

“Then there’s an area to the west and the east of [our project] that is just under a little bit of cover. We’ll be going in there and doing aircore drilling.”

Who owns the ground around you?

“FMG owns all the ground to the west. Then there’s De Grey (ASX:DEG) and Sayona (ASX:SYA); they are the big groups that basically encircle us,” they said.

“It’s kind of got that Mt Ida feel. We’re a lithium project on a mining lease, like Mt Ida, where Delta Lithium (ASX:DLI) is trying to get into production as quick as possible.

“This is a key driver for value for us: if we find something, we get that material to market as quick as we can in this hot environment.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.