You might be interested in

Mining

Resources Top 5: Does this stonker copper hit bring back the Sandfire days for you as well?

Mining

MinRes remains bullish on lithium, and it could take a host of WA explorers along for the ride

Mining

Mining

Here are the biggest small cap resources winners in early trade, Monday March 11.

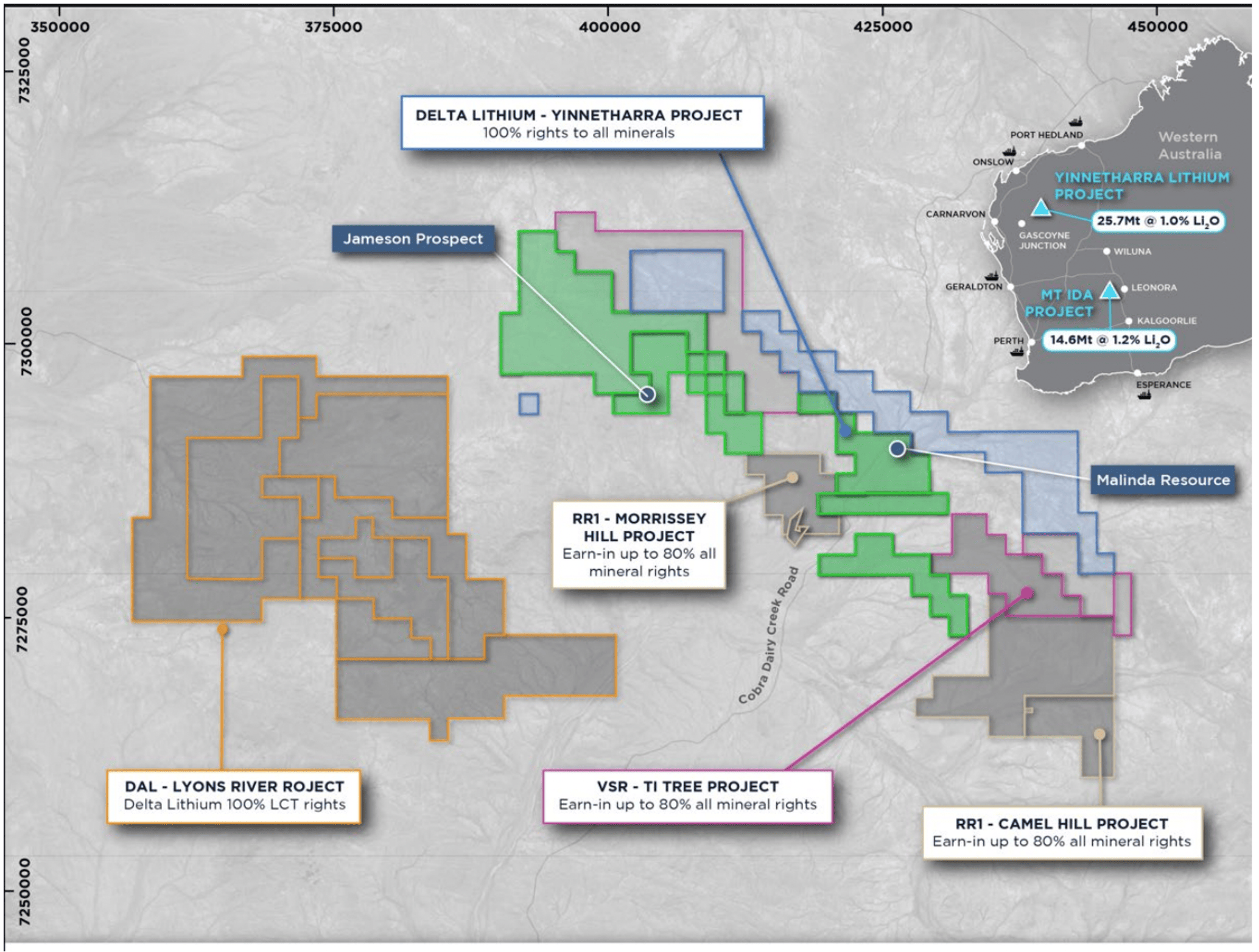

Aspiring WA lithium major and aggressive consolidator Delta (ASX:DLI) will pay up to ~$13m to earn into the Morrissey Hill and Camel Hill projects owned by small neighbour RR1.

Chris Ellison backed DLI – which has a 25.7Mt @ 1% resource at its Yinnetharra project – has also inked an deal over Voltaic Strategic Resources’ (ASX:VSR) nearby 243sqkm Ti Tree project.

RR1 will receive $3.2m upfront, with hard-drilling DLI to then spend $3m on exploration to earn 51%, followed by another $6m to earn up to 80%.

In the event DLI delineates a resource of at least 7.5Mt at 0.8% Li2O (at a 0.5% cut off grade) on the projects at any time within eight years, DLI will pay RR1 $10m in either in cash, shares, or a combination of both.

It’s a solid deal, especially in today’s terrible lithium market, RR1 CEO Jeremy Bower says.

“To receive $3.2m cash up front, and a further $10m cash/script if a successful JORC mineral resource delineation of equal to or greater than 7.5Mt at 0.8% Li2O (at a 0.5% cut off grade) is achieved, is a great result during these difficult market conditions,” Bower says.

“Combined with our recently announced rights issue to raise up to ~$2M, and further subject to shareholder approval being obtained to consolidate the capital of the company, Reach will re-emerge with a tight capital structure and over $6M cash.”

RR1’s early-stage projects haven’t exactly lit the world on fire. Latest drilling from Morrissey Hill announced early February returned subpar hits like 16m @ 0.15% Li2O from surface, with Bower commenting that “Reach is still at an early stage in progressing its understanding of the … project”.

Meanwhile, DLI will pay VSR an initial $1.25m cash, before spending up to ~$10m to earn 80% over the next four years. VSR will get another $1.5m from DLI upon completion of certain milestones.

VSR, like RR1, is still figuring out its project with late 2023 drilling failing to hit paydirt.

“Entering a mutually advantageous strategic partnership with Delta Lithium is an excellent outcome for both companies and will see Voltaic receive an immediate payment of $1.25 million that further bolsters our already robust proforma cash reserves to >$7.0 million,” VSR CEO Michael Walsh says.

“This transformative deal positions Voltaic for substantial near-term project development catalysts, and leveraging Delta’s robust balance sheet, offers a significantly de-risked route to production and cashflow.”

During periods of low sentiment cash is king for exploration stocks, as raising money is hard and usually done at a steep discount to the share price.

RR1 and VSR were up 75% and 10% respectively in morning trade. $240m capped DLI gained ~4%.

(Up on no news)

The $30m capped copper porphyry hunter is bouncing back from recent lows in early trade Monday.

Porphyry mines produce to the bulk of the world’s copper, with their massive volumes and easy mineability more than making up for low insitu grades below 1%.

SPQ’s main game is Greenvale in QLD, where first drilling at the Cockie Creek prospect in over 30 years hit a “very impressive” 117m @ 0.52% Cu, 0.11g/t Au and 109ppm Mo from 20m.

These copper grades are high for a porphyry deposit, says the company, which also hit a bonus gold zone (3m @ 9g/t from 80m) during the late 2023 program.

“The results of the maiden program at Cockie have been outstanding and highly notable, especially considering that only a few years ago a preserved porphyry belt was not known to exist in this part of Australia,” managing director Pete Hwang said late January.

“Even though the grades to date have been relatively high for peripheral wall rock mineralisation, we are expecting the core or cores of the system to be truly impressive.

“We are very much excited and looking forward to the next exploration programs on both Cockie Creek and Bottletree, each of which, have the potential to result in significant discoveries.

“We will also be planning a maiden program on a possible third porphyry, Wyandotte. In the meantime, we aim to provide further information on Cockie Creek from our interpretation of results and also Bottletree as assays are received from the lab.”

SPQ had $2m in the bank at the end of December.

A Monday morning webinar by G50 boss Mark Wallace appears to be ticking boxes for investors, who tuned in for updates on the Golconda gallium project in Arizona.

Used in semiconductors and other tech, gallium hit headlines after world’s largest producer China announced export controls last year.

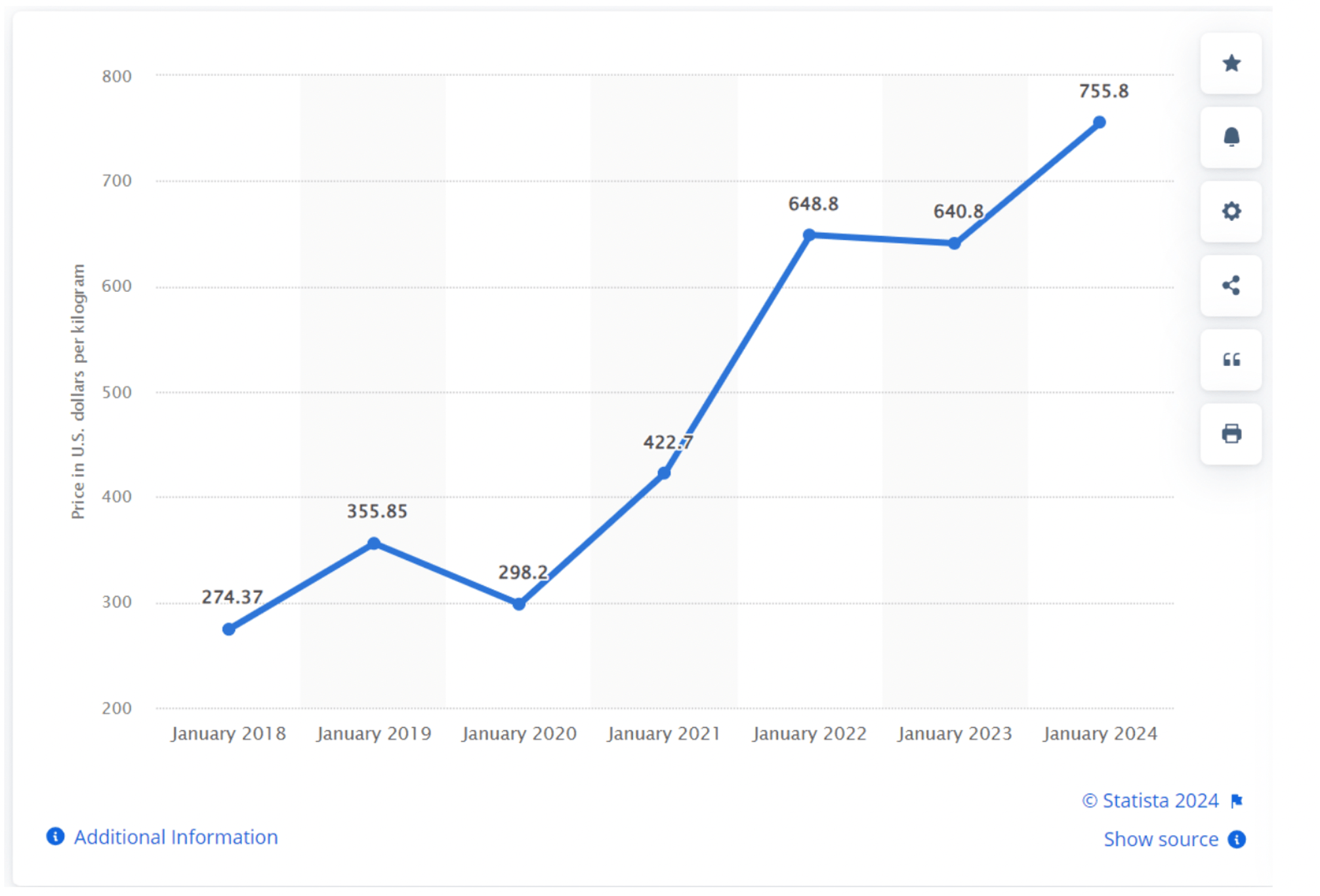

This has boosted prices for the obscure metal, which was paying US$755.80/kg in January 2024, up from US$640.80/kg in January 2023.

Golconda — historically mined for lead and zinc — “matured from brownfield exploration to new discovery” after mid-2023 drilling pulled up a highlight 109m at 40.5g/t gallium from 129m.

The project is also right next door to a major porphyry copper deposit.

Planning for phase 2 drilling is now underway.