Red Mountain set to break into the lucrative heavy rare earths market

Mining

Mining

Special Report: Red Mountain Mining has negotiated itself a pretty lucrative deal to buy a heavy rare earths mine not too far from an already producing operation that presents it with attractive processing options.

The company (ASX:RMX) has entered a three-stage earn-in and joint venture agreement with Unearthed Resources, which owns the Mt Mansbridge project in Western Australia.

Mt Mansbridge is located in the highly rare earths-prospective Tanami region of northern Western Australia just 40km from Australia’s newest heavy rare earths producer, Northern Minerals (ASX:NTU).

And soil sampling at the Mt Mansbridge project is already showing similarities to Northern Minerals’ Browns Range project.

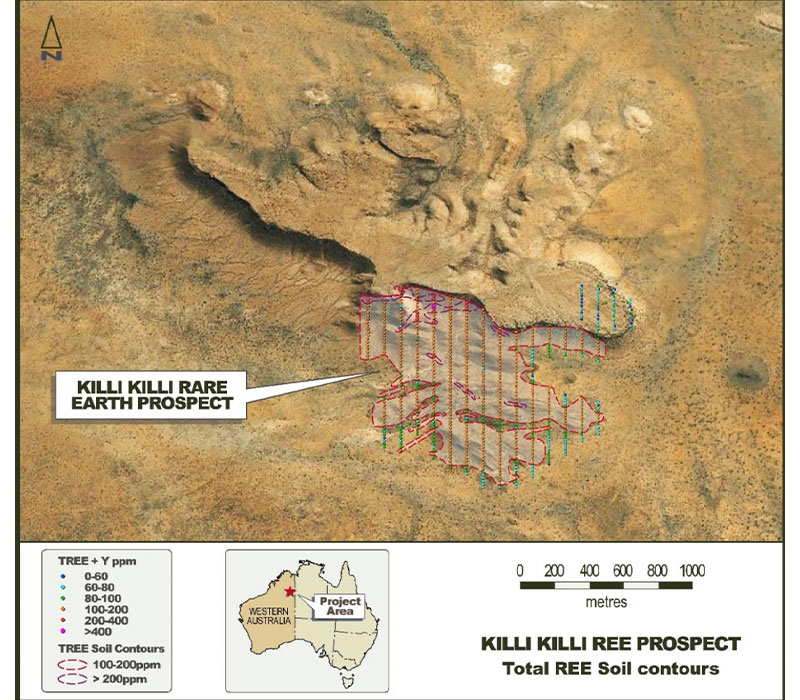

Early exploration at the Killi Killi prospect has uncovered a 1km-long rare earth element (REE) anomaly.

Red Mountain said the anomaly is coincident with historically reported heavy rare earth element (HREE) xenotime mineralisation in rock chip samples, suggesting a similar mineralisation model to Northern Minerals’ Dazzler REE discovery.

Northern Minerals’ Browns Range processing facility is located 40km to the north-east of the Mt Mansbridge project and provides a potential low-cost pathway to toll treating economic quantities of rare earths discovered at the project.

“The Mt Mansbridge rare earths project is an exciting opportunity for the company to obtain leverage to the rare earths market,” director Jeremy King said.

“Subject to finalising due diligence, we intend to move forward aggressively on a focused exploration program at Mt Mansbridge for which we are comfortably fully funded.”

Red Mountain has around $2m in the kitty to support the acquisition and maintain its existing portfolio and activities.

The two biggest moves in rare earths this year have been Australian heavyweight Wesfarmers (ASX:WES) lobbing a $1.5bn bid for major producer Lynas (ASX:LYC), and China threatening to “weaponise” its rare earths by cutting off supply to the US.

Both of these have put rare earths in the spotlight and seen investor interest in the space pick up, as well as prices head north.

At the same time, China is no longer allowed to source rare earths from neighbouring Myanmar.

And Chinese authorities have been cracking down on the mining of ionic clay deposits in Southern China for environmental reasons.

These moves, coupled with a lack of substitutes and very few significant sources of heavy rare earths outside of China, have resulted in a favourable outlook for heavy rare earths.

Rare earths are a group of 17 metal oxides that are actually more common than gold or silver. Heavy rare earths have a higher atomic weight than light rare earths.

Late last year, dysprosium was labelled the “dark horse in the rare earth stakes” by New York investment bank Hallgarten and Company as the rapid growth in the electric vehicle market spurs higher projections for demand.

Not only is the Mt Mansbridge project prospective for heavy rare earths, which are critical in the development of high-tech applications and high-performance magnets used in electric vehicles and wind turbines, it is also prospective for high-grade cobalt.

And now is the perfect time to be on the hunt for cobalt, with heavyweight Glencore’s recent news it is mothballing its DRC-based Mutanda mine — the world’s largest cobalt mine.

Previous drilling at the Déjà vu prospect at Mt Mansbridge has returned high-grade cobalt of up to 0.34 per cent associated with disseminated copper and nickel sulphides.

The strong global demand for cobalt due to the rapid growth in lithium-ion batteries for electric vehicles has prompted Red Mountain to fast track exploration and development of the Mt Mansbridge project.

The acquisition is structured as a three-stage earn-in to provide Red Mountain with flexibility and control over expenditure.

Red Mountain will pay an initial $50,000 to secure an exclusive 28-day option to strike an earn-in deal.

If the company goes ahead, it can earn a 49 per cent stake by spending $500,000 on exploration within 18 months, paying $150,000 cash and issuing $350,000 worth of Red Mountain shares.

It can then take its interest to 70 per cent by spending a further $1m within 18 months, paying $500,000 cash and issuing $500,000 worth of shares.

At the final stage Red Mountain can take its ownership to 100 per cent by spending a remaining $1.5m within 18 months, paying $500,000 cash and issuing $1m worth of shares.