Resources Top 4: Surefire winning with greenies (possibly) on new vanadium extraction method

"All we are saaaayiiing… is give vanadium extraction from magnetite… a chaaance." (Pic via Getty Images)

- Surefire discovers vanadium extraction process that reportedly could be more environmentally friendly than current methods

- NickelSearch identifies additional high-priority lithium targets at Carlingup project, WA

- Aruma up on quarterly activities and “sound” cashflow

Here are some of the biggest resources winners in early trade, Wednesday January 24.

Surefire Resources (ASX:SRN)

WA-based Surefire is scouring for gold, magnetite and vanadium, and it’s the latter that’s giving the explorer a good start to its hump day this week.

It’s made a pretty head-turning announcement, too, noting it’s achieved a breakthrough process of extracting vanadium directly from magnetite concentrate out of its 100% owned flagship Victory Bore vanadium project in Western Australia.

Recently, Surefire signed a non-binding MOU with Saudi company Ajlan & Bros Mining and Metals to back the Victory Bore operation in a JV development arrangement.

But re this breakthrough, lab test work has reportedly revealed a new pre-treatment and leach process achieving what the company says is “a remarkable extraction of 91% of vanadium and 88% of titanium directly from Victory Bore magnetite concentrate”.

It’s big news for Surefire, and stems from the company’s strategy of teaming up with METS Engineering in May last year, specifically to look into developing a better method of extraction, specifically for vanadium – as it appears that the ”unexpected extraction” of titanium during the process is a surprise bonus for the team.

The company notes the new metallurgical application alleviates the requirement for standard pre-treatment processes that are currently used in the vanadium extraction industry.

The newly found method is expected to be more environmentally acceptable with lower emissions thus delivering a reduced carbon footprint.

The process is, as you’d expect, commercial in confidence – so, full specifics aren’t going to be made public just yet – and Surefire says it is subject to a Provisional Patent protection and remains solely the company’s IP.

Surefire says it will apply the process to the planned development of Victory Bore and will then crunch the numbers on the impact on capital cost and operating cost benefits.

SRN share price

NickelSearch (ASX:NIS)

This $10m market capped nickel sulphide and lithium explorer is focused on its flagship Carlingup nickel project in WA, where it’s finding very high prospectivity for both battery metals.

Today’s news sending NIS up and to the right in double-digit awesomeness is the identification of further priority lithium targets at the project, west of the Quarry site.

The 108km2 Carlingup project sits within the Ravensthorpe greenstone belt – a highly prospective region for nickel sulphide deposits on the southern margin of the Archean Yilgarn Craton.

Notably, the corridor also hosts IGO’s (ASX:IGO) Forrestania nickel mining complex and is adjacent to First Quantum Minerals’ laterite mine, the Ravensthorpe Nickel Operations (RNO).

Despite all the promising nickel searching from NickelSearch, though, as well as an existing 155,000t nickel resource, the company is currently focusing efforts on proving up the lithium prospectivity at the site.

NIS reveals today that infill soil sampling results over high priority areas of interest confirm significant lithium-caesium-tantalum (LCT) anomalies to the west and south of the Quarry area.

Those anomalies measure between 250m x 500m and 200m x 100m.

“Values peak at 3x average background for lithium, 4.5x for caesium, and 4.7x for tantalum,” reads the latest company report.

Infill soil sampling results over high priority areas of interest at $NIS.AX Carlingup Project confirm significant #lithium–#caesium–#tantalum anomalies to the W & S of Quarry.#Drill program planning underway to test these strong LCT anomalieshttps://t.co/pWFbRMxwOi pic.twitter.com/nS8f0SNZLI

— NickelSearch Ltd (@NickelSearch) January 23, 2024

What next? Drill program planning is underway to test the anomalies, with five targets identified as top priority. Assays for further infill soil sampling over other high priority areas are pending.

NickelSearch MD Nicole Duncan said:

“Our work so far demonstrates compelling evidence of the presence of a LCT pegmatite system, with anomalism within and to the north, west and south of the Quarry. Based on these results, it is plausible to suggest that the LCT indicators observed over this area represent one large system.”

NIS share price

Aruma Resources (ASX:AAJ)

Goldie and lithium…y Western Australian-based explorer Aruma’s share price is up about 11% so far today, on the back of its latest quarterly activities and cashflow report, ending December 31.

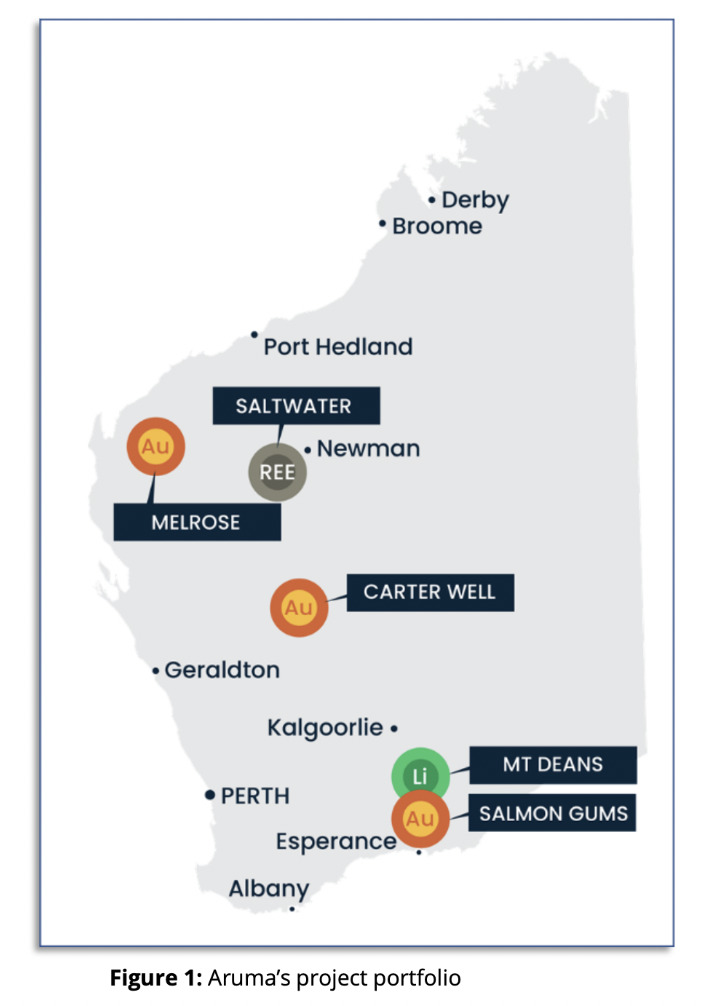

Background: Aruma has a portfolio of gold projects in active gold domains in Western Australia, as well as the prospective Mt Deans lithium project in the lithium corridor of southeast WA, and the multi-commodity Saltwater project in the Pilbara region of WA.

Some cherry-picked, non-exhaustive highlights include:

• Results from a 7-hole diamond drilling program at the Salmon Gums gold project in WA confirmed a high-grade gold-bearing structure. (Including: 5.90m at 10.5g/t Au from 38.4m, along with 2.60m at 9.85g/t Au from 38.4m and 0.85m at 40.9g/t Au from 43.4m.)

• A program of work (PoW) has been submitted for the Mt Deans lithium project in the Eastern Goldfields for the next big phase of drilling.

• A “sound” cash balance at quarter’s end of $2.154m.

AAJ share price

Red Mountain Mining (ASX:RMX)

(Up on no news)

Another lithium hunter, Red Mountain Mining is focused on its Nevada-based projects in the US, but is also well into REEs at the Monjebup project in Western Australia.

Not sure why RMX has suddenly burst up 25% today, so let’s revert to its most recent news of note for any clues.

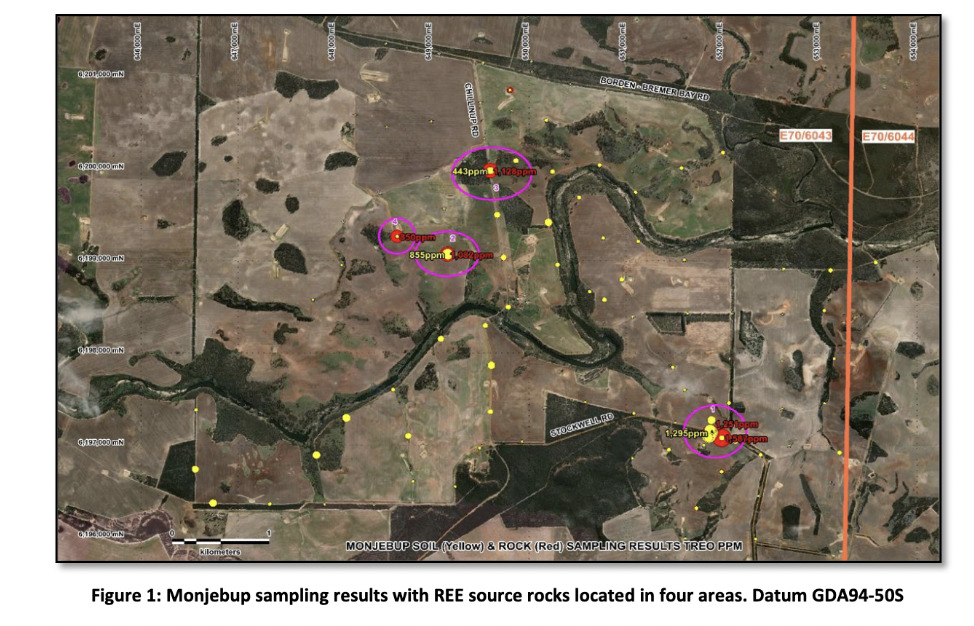

About 10 days ago, on Jan 15, the company revealed a new discovery of multiple zones of anomalous rare earths at Monjebup.

Results came in from the project’s Chillinup prospect, with rock chip sampling from five of nine samples producing TREO (+Y) greater than 1000ppm, with three specific soil samples over 1000pm.

All up, four notable zones of anomalous REE were revealed with confirmation initially provided by Liontown Resources (ASX:LTR) via repeat sampling.

At least that’s some decent news involving LTR this week, then.

Red Mountain Mining has a farm-in agreement with LBM (a wholly owned subsidiary of LTR) to earn a 80% stake in Monjebup.

RMX notes that further geological mapping at the project will be continued with drill targets to be generated.

RMX share price

At Stockhead we tell it like it is. While NickelSearch is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.