Vanadium use in redox flow batteries is on the rise – these are the Aussie stocks with a horse in the race

Pic: via Getty Images

Vanadium’s bread and butter has traditionally been its use in high strength steel but as the world rushes to decarbonise, its use in safe, low-cost energy storage batteries could soon take over.

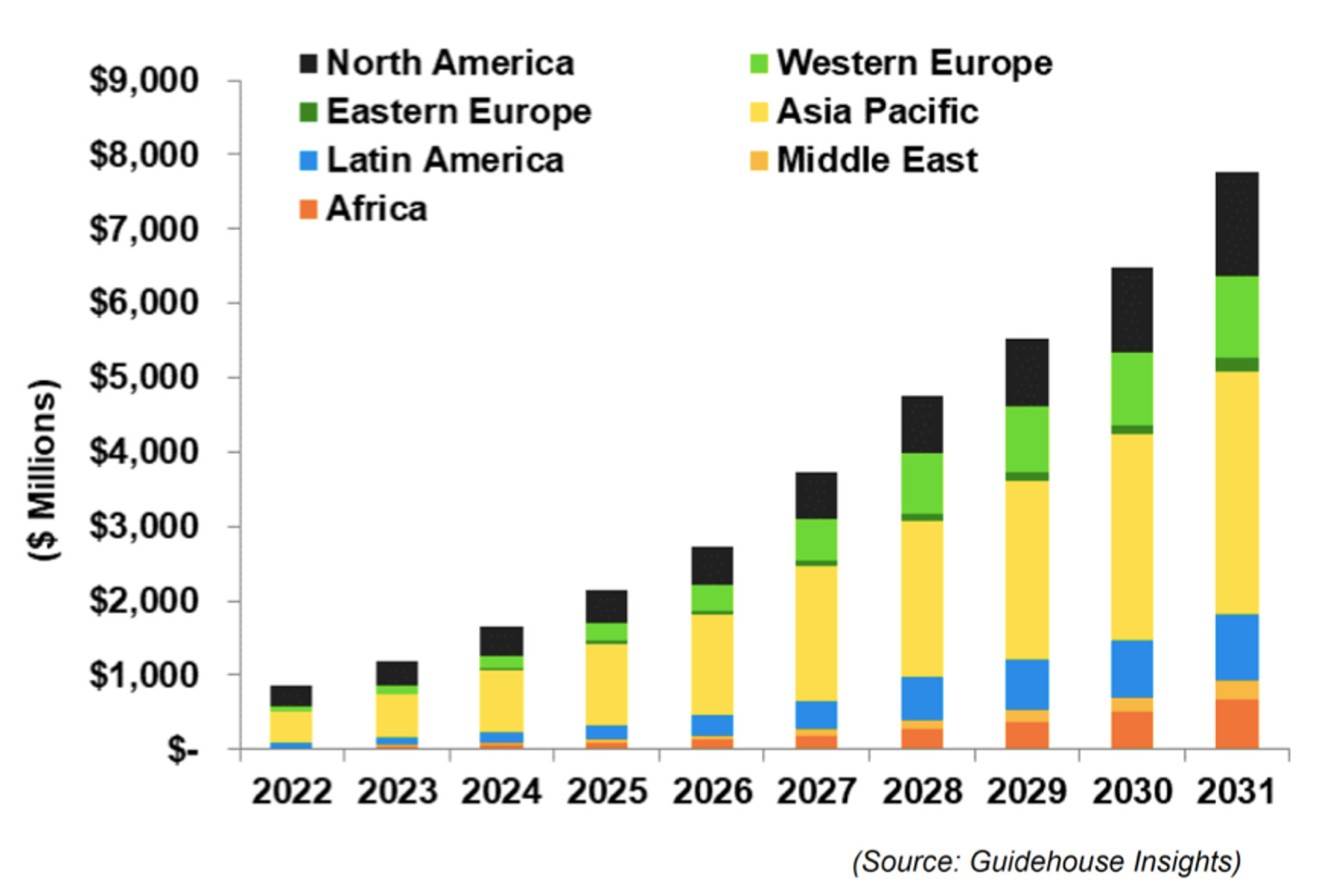

With a market of ~110,000 tonnes in 2022, Commodity analysts CRU Group expects vanadium demand to double by 2032, owing more than 90% of this growth to its use in Vanadium Redox Flow Batteries (VRFBs).

VRFBs are used in large scale, battery storage systems that store excess power from the grid for use during peak demand periods.

Whether in combination with solar PV, biogas generators, wind power, the bulk storage capacity of these batteries allows consumption to be shifted completely to off-peak hours with cheaper electricity.

VRFBs use vanadium-ions in the electrolyte solutions and are considered safer, more scalable, and longer lasting than their lithium counterparts with a lifespan of more than 20 years.

A unlike other battery types like lithium-ion or leach-acid which are subject to a charging cycle, VRFBs come with vanadium electrolyte storage tanks, which can be replenished even when the system is supplying power.

According to global not-for-profit vanadium industry organisation Vanitec, energy storage actually became the second-largest consumer of vanadium in 2022 for the first time.

#energystorage became the second-largest consumer of vanadium in 2022 for the first time, surpassing chemicals & catalysts, and titanium alloys, while steel continues to be the largest consumer of vanadium. Read more here: https://t.co/KvO3ayhnOx pic.twitter.com/PNyLEhpJ4X

— Vanitec (@VanitecVanadium) June 6, 2023

While steel continues to be the largest consumer of vanadium, this shift in the use of vanadium in energy storage highlights that the transition to a more sustainable and resilient energy future is well on its way.

Establishing an Aussie supply chain

Vanadium is classed as a critical mineral – with priority for development and investment – by the Australian Government due to its use in VRFBs.

Just last week, the Federal Government launched its new Critical Minerals Strategy eyeing over 250,000 jobs if we can head downstream.

While little new funding has been committed, Association of Mining and Exploration Companies CEO Warren Pearce said the strategy provides an enduring framework for the sector, with as many as 81 projects worth $40 billion in the pipeline.

He says the government should look closely at ways to support minerals outside the list like nickel and copper.

“The world needs Australia to develop its critical minerals so that we can decarbonise,” Pearce said.

“As such, AMEC would like to see the government look more closely at copper and nickel, and other areas such as lithium and vanadium redox batteries, which are Australia’s opportunity to establish the full battery supply chain, from pit to battery and into our grid.”

And with 31% of the world’s undeveloped vanadium resources but no domestic production as yet, Australia has the opportunity – like it does with many other mineral commodities – to be a significant player in this space.

So, which ASX stocks have a vanadium play?

The company’s 249.6km2 Julia Creek project in Queensland’s North West Minerals Province has a resource of 2,850Mt grading 0.31% vanadium pentoxide, with 360Mt in the higher confidence Indicated category as well as a best estimate (2C) Contingent Resource of 79 million barrels of oil contained within its shales.

Testing has achieved greater than 98% vanadium oxide extraction using acid leaching and a still impressive plus 92% extraction with alkali leaching.

QEM has secured a vanadium-rich waste stream that when combined with the Queensland Resources Common User Facility (QR-CUF), will allow it to demonstrate its ability to upcycle Queensland industrial waste to battery grade vanadium pentoxide.

And the company recently raised $2.7m via a placement at $0.17 per share to progress pilot plant work, along with beneficiation and mineral characterisation work with the University of Queensland to further optimise the processing plan while funds have been allocated to update the mining scoping study and JORC report.

AVL is nearing development at its flagship Australian vanadium project in WA which has the potential to produce 11.2kt per annum of vanadium pentoxide over a 25+ year mine life.

In May, the company and the Commonwealth executed a grant agreement under the Modern Manufacturing Initiative – Manufacturing Collaboration Stream for up to $49 million to help the company (and industry partners) create an Aussie vanadium battery industry.

The Grant funds eligible activities to construct and commission a concentrator and high-purity vanadium processing facility capable of using green hydrogen as part of the extraction process for the project – a critical mineral extraction process which is a key precursor for vanadium electrolyte manufacturing.

AVL is also working on the VRFB angle through its subsidiary VSUN Energy which is installing a battery system at the IGO (ASX:IGO) Nova nickel operation.

It has also been working to develop a 5kW/15kWh residential version of the VRFB for people who are looking for an alternative to lithium-ion batteries.

TMT is developing the Murchison Technology Metals Project (MTMP) in Western Australia’s Midwest region, which will produce 6% of the world’s vanadium when it comes online.

As it stands, Australia has the world’s second largest vanadium reserves and no downstream production capabilities, but TMT is hoping to change that.

The company recently produced high-grade vanadium electrolyte feedstock from the MTMP with its Japanese technology partner, LE System Co.

And in April, TMT executed an MoU with fast-growing Indian VRFB maker, Delectrik Systems for the potential sale of vanadium raw material from the MTMP as well as supply of vanadium electrolyte by vLYTE to Delectrik within Australia.

An $11.5 million placement at $0.28 per share last month is expected to progress the development of the MTMP including early works to enable the smooth transition into construction once all permits and approvals have been received and the progression of financing and customer engagement discussions.

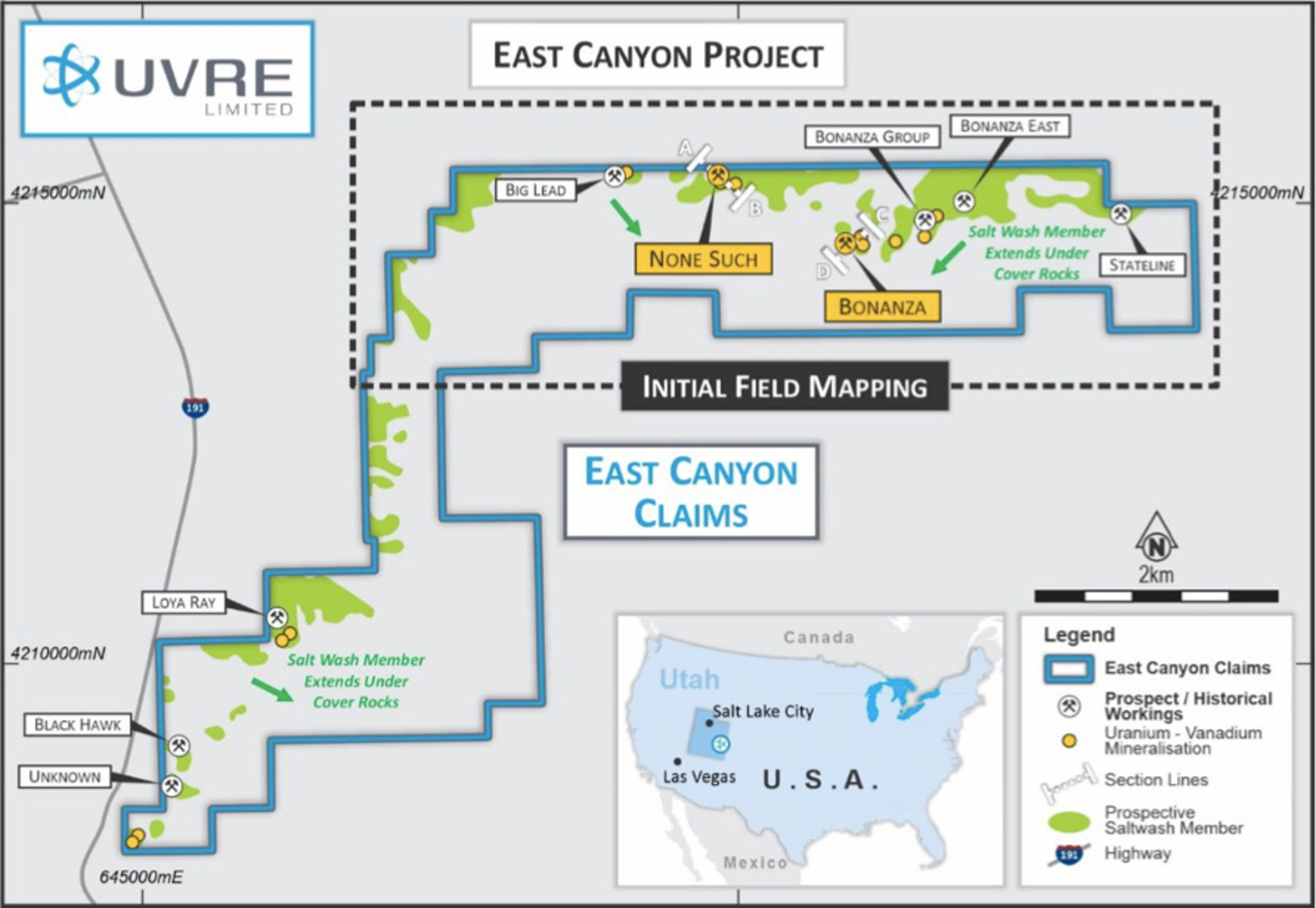

Uvre owns the East Canyon project in Utah, USA within the extended Uravan belt – a well-known uranium and vanadium district.

Drill results to date returned up to 3.36% V2O5 returned over 0.3m from 41.5m depth.

The results have confirmed the uranium and vanadium mineralisation extends beyond the historical underground workings at both None Such and Bonanza prospects at shallow depths of less than 60m.

Extensive surface mapping and ground scintillometer test work has now commenced with an initial focus around None Such and Bonanza.

The results of this survey will be evaluated along with mapping and scintillometer work to assist with planning of future work programs to test for further uranium, vanadium or rare earth mineralisation at the project, the company says.

Richmond Vanadium Technology (ASX:RVT)

The company listed late last year with IPO proceeds earmarked to complete a Bankable Feasibility Study for its namesake project in North Queensland, which has a resource of 1.8 billion tonnes grading 0.36% V2O5 for 6.7Mt of vanadium pentoxide and an Ore Reserve of 459Mt at 0.49% V2O5 for 2.25Mt of contained V2O5.

In April, the Queensland Gov finalised the terms of reference for an Environmental Impact Statement (EIS) for the proposed $242.2 million mine.

“There are huge opportunities to grow production of critical minerals in the North West Minerals Province and our investment in Copperstring 2032 and the Queensland Resources Common User Facility will support companies like Richmond Vanadium Technology,” Resources Minister Scott Stewart said at the time.

RVT is now working on the draft EIS, and reckons its mine could extract up to 4.2 million tonnes annually of vanadium ore, processed on site to produce 790,000 tonnes annually of vanadium concentrate.

A Bankable Feasibility Study (BFS) is also underway, with both the EIS and BFS to run in parallel until Q4 2024.

QEM, AVL, TMT, UVA and RVT share prices today:

Back in April, SRN announced a new exploration target of 682Mt to 1190Mt @ 0.2% to 0.43% vanadium which it said propelled its Victory Bore project in WA to “world class status.”

When added to the current 321Mt @ 0.39% resource, the exploration target boosts the project’s potential to 1003Mt-1,511Mt @ 0.2% to 0.43% V205, “making it world class and potentially one of the largest vanadium resources in the world.”

For reference, advanced vanadium stocks AVL, Vanadium Resources and Technology Metals have respective resources of 239Mt at 0.73%, 680Mt at 0.70%, and 153.7Mt at 0.8%.

An update on the Pre-Feasibility Study (PFS) – a look at the economics of building a project – is on track for completion in November.

Direct vanadium extraction work is also being conducted, with testing underway. If successful, it will be incorporated into the PFS.

VR8 owns the Steelpoortdrift Vanadium Project within the Bushveld Complex of South Africa, which has a resource of 612Mt at an in situ grade of 0.78% V2O5 including a high grade resource of 167Mt at an in situ grade 1.07% V2O5.

In May, the company inked an investment and offtake deal with Chinese co Matrix Resources, a subsidiary of ~$3bn Hong Kong listed nickel stock Lygend Resources.

Matrix will acquire a 9.99% stake in VR8 for ~$6m, which represents a big 40% premium to the 30-day volume weighted average price (VWAP).

The cash will be used towards progressing plant design, completing additional technical work, and growing the operations team as the company moves towards an all-important Final Investment Decision (FID) in late 2023.

Meanwhile, Matrix also has exclusive rights to negotiate an offtake of 40% of vanadium products produced from the Phase 1 operations at Steelpoortdrift over a 10-year term.

Mining projects often lock in offtake deals to attract project financing.

A DFS on Steelpoortdrift released October last year envisaged post tax NPV 7.5% of US$1.05bn and IRR of 42% over a 25-year life.

It would take 27 months to pay back pre-production capex of US$211m, says VR8, which now has an increased project stake of 86.49%.

Critical Minerals Group (ASX:CMG)

The company listed last year with the Lindfield vanadium project in Queensland, with Japanese petroleum heavyweight Idemitsu on the register (32% stake).

The project has a resource of 210Mt at 0.39% V2O5 (vanadium pentoxide) and this month the company increased the grade (+10%) and tonnages (+73%) to 363mt @ 0.43% V2O5 and 4.8% Al2O3.

In May, CMG announced it had upgraded the resource by 10% in grade and by 73% in tonnage to 363mt (254mt indicated) at 0.43% V2O5 and with a further identified enriched zone within the shallow oxidised area containing 128mt at 0.48% V2O5.

A scoping study is underway and expected to be completed and delivered in Q3.

“I am very pleased to inform our shareholders that we are well advanced on our development timeline at Lindfield vanadium Project and this scoping study has commenced almost a year earlier than we’d anticipated at the time of IPO and outlined in our prospectus,” MD Scott Drelincourt said.

The company has the Watsons Well vanadium-titanium-iron project in WA, where maiden RC drilling in the March quarter located thick zones with robust grades of vanadium-titanium mineralisation associated with strong magnetite (iron) content over 400m strike within the central part of the 7km long magnetic anomaly.

One hole was drilled 400m further east than the rest of the drilling and intersected two zones of mineralisation, 6m at 0.62% V2O5, 5.35% TiO2, 26.73% Fe and 3m at 0.49 V2O5, 4.15% TiO2, 25.02% Fe – which the company says indicates the mineralised magnetite rich gabbro may be up to 600m wide whereas the current drilling has tested only 300m width.

Previously reported high-grade outcrops of massive magnetite over about 5km strike suggests similar style vanadium titanium iron mineralisation is likely to be discovered over the entire length of the 7km long magnetic anomaly.

This is a large target and SFM is now considering a range of exploration and drilling strategies to advance towards defining a resource.

In the March quarter, Manuka an initial 3.2 billion tonnes at 0.05% vanadium pentoxide (V2O5) resource for its recently acquired Taranaki vanadiferous titanomagnetite (VTM) iron sand project in New Zealand.

The titanomagnetite iron ore concentrate grading 55% to 57% iron contains 0.5% V2O5and 8.4% titanium dioxide (TiO2).

With 1.6 million tonnes of contained V2O5 the project ranks as one of the larger drilled vanadium deposits globally. Over 65% of the resource is in the higher confidence indicated category.

At an assumed production rate of 5 million tonnes per annum, the VTM concentrate produced each year from the Taranaki project would contain 25,000 tonnes per annum of V2O5.

A bankable feasibility study is already underway with the company undertaking additional metallurgical test work to optimise the flowsheet for processing of the VTM concentrate to confirm economic recovery of vanadium as a separate product stream.

SRN, VR8, CMG, SFM and MKR share prices today:

The company has the Abenab vanadium-zinc-lead resource in Namibia where a scoping study and PFS are underway.

Back in January, GED announced the results of gravity testwork on a bulk sample with an exceptionally high-grade vanadium-zinc-lead (descloizite – PbZn(VO4)(OH)) concentrate produced, grading 15.6% V2O5, 11.2% Zn, 38.2% Pb and 0.8% Cu5.

These new metallurgical results will be incorporated into the Abenab resource model to allow finalisation of the Mineral Resource upgrade for the deposit.

Similar gravity concentrate metallurgical testwork is in progress on bulk-samples of high-grade copper-vanadium-lead mineralisation grading 1.8% V2O5, 4% Cu and 7% Pb from the neighbouring Nosib discovery, where a maiden mineral resource is planned to be released.

The plan is to develop a flowsheet from the gravity concentrate and Phase 2 hydrometallurgical testwork which will be applied to the new resource models to produce an integrated mining and two-stage processing development and production plan for the Abenab and Nosib deposits.

The company owns the Barrambie titanium and vanadium project in WA, where it recently executed an offtake term-sheet with Jiuxing for both ‘direct shipping ore’ (DSO) and titanium-rich mixed gravity concentrate (MGC) products.

A PFS update is underway for a DSO/MGC only operation.

NMT also has a collaboration agreement with unlisted Scandinavian mineral development company Critical Metals to jointly evaluate the feasibility of constructing a recycling facility to recover and process high-grade vanadium products from vanadium-bearing steel by-product in Finland.

An investment decision is expected Q2 2023.

The company also has an MOU with H2Green Steel for up to 4Mt of slag, which underpins a potential second operation in Boden, Sweden.

And while there’s not much happening in the exploration sense, a quick mention goes to Venus Metal Corporation (ASX:VMC) which has the Youanmi vanadium project in WA and Sabre Resources (ASX:SBR) with the Ngalia uranium-vanadium project in the NT. There’s also Tivan (ASX:TVN) which picked up the Speewah project in WA in the March quarter.

GED, NMT, VMC, SBR and TVN share prices today:

At Stockhead we tell it like it is. While QEM and UVRE are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.