New gold producer Kaiser Reef readies to ramp up its A1 Mine

Mining

Mining

Special Report: Victorian high-grade gold producer Kaiser Reef has a production target of 150,000 tonnes per year of gold ore for its A1 Mine acquired by the company in January.

The operator of the A1 Mine for gold in Victoria, Kaiser Reef (ASX:KAU) recently published some high-grade drilling results for the mine that included 3.7m at 68.62 grams per tonne (g/t) gold.

Since acquiring the A1 Mine, its adjacent Maldon processing mill and Maldon gold project in January, Kaiser Reef has drawn up a detailed investment strategy for the assets.

The assets emerged debt-free from administration and into a high gold price environment.

The company inherited a 75-strong skilled workforce, processing equipment and mining gear with the acquisition which has placed the A1 Mine asset in a good position to flourish.

Added to this, Kaiser Reef has $10m of cash on its balance sheet to fund its assets’ development after relisting on the ASX.

“Now, there is opportunity there for us with a stronger financial position and no debt to ramp up gold production,” executive director, Jonathan Downes, said.

Kaiser Reef’s next target for drilling is the mine’s Queens lode gold deposit which sits about 20m below the A1 Mine’s current workings.

This lode deposit has significantly wider lodes veins than that contained in the mine’s current workings.

Drilling has commenced at the Queens lode with drilling results expected shortly.

“The wider lodes allows us to mechanise mining and to increase production,” Downes said of developing the Queens lode deposit.

The company believes that very little exploration drilling has been undertaken beneath the mine’s existing mined lodes in recent times, leaving high potential for economic discoveries.

The A1 Mine went into administration because of a combination of relatively low gold prices, around $US1,600 per ounce at the time, a poorly financed mine development at a new site and its heavy debt burden.

“In a perfect world we would like to fill the ore processing mill, which has a capacity of 150,000 tonnes per year (tpy), but has managed 180,000 tpy,” he said.

The company can explore tolling arrangements with neighbouring gold producers to bridge any potential production shortfall from its own operation.

Higher gold production has the added benefit of decreasing its production costs on a per-unit basis, and this will increase its net margins in the current high gold price environment.

“Today’s is a very healthy gold price and with ongoing quantitative easing the future looks phenomenal for gold,” said Downes.

The company believes it will take around six months to commence its planned increased production at the A1 Mine and Maldo which have historical production of 2 million ounces of gold.

“We will have to upgrade the power and air supply to the mine and extend the decline down to the Queens Lode to get into that larger production rate,” he said.

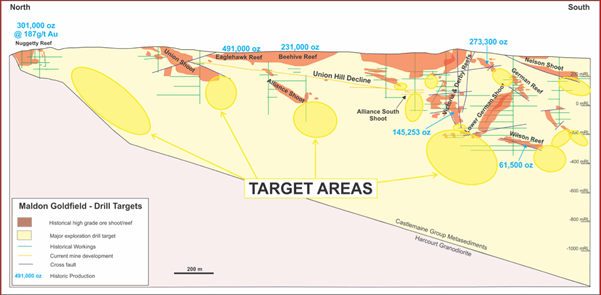

The Maldon gold project includes the Nuggety Reef mine that produced 300,000 ounces of gold at 187 g/t gold, and its Union Hill mine/Eagle Field Reef system is currently idled.

“When we have finished drilling at the A1 Mine, we plan to take the drilling rig to the Maldon goldfield project which has a spectacular head grade of 1.7 million ounces at 28 grams per tonne, which is as twice as large as the Bellevue gold mine in WA,” said Downes.

The Bellevue mine was one of Australia’s highest-grade gold mines, producing around 800,000 ounces at 15 g/t gold between 1986 to 1997.

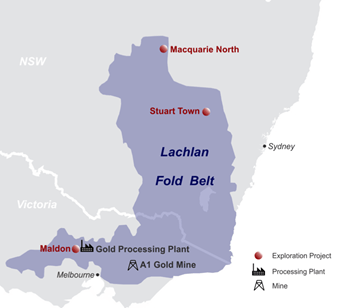

In addition to its Victorian gold assets, Kaiser Reef has two exploration assets – Stuart Town and North Macquarie — in the highly prospective Lachlan Fold Belt for gold in NSW.

Stuart Town is directly south of Alkane Resources’ (ASX:ALK) Boda gold prosect in the LFB, for which a large scale soil anomalism and magnetic target has been detected.

Stuart Town is also more advanced in terms of exploration activity than North Macquarie.

Coarse gold was identified in several recent drill holes to test the project’s mineralisation. Test work on the drill samples is ongoing,

Macquarie North is at the northern end of the Macquarie Arc in the Lachlan Fold Belt which is host to some of Australia’s largest gold mines.

With its host of gold projects, progress to date, and plans for increased production, Downes expects there to be plenty of news flow on Kaiser Reef in the coming months.

This article was developed in collaboration with Kaiser Reef, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.