Kaiser Reef picks up projects in hot Victorian goldfields

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Kaiser Reef enters highly sought-after Victorian gold district with material acquisition of high-grade gold projects and processing plant.

Embracing the vision of becoming a profitable gold producer, Kaiser Reef Limited (ASX: KAU) has taken full advantage of an opportunity that gives it immediate gold production and future prospects that the board believes will provide growth in value for shareholders.

The company has entered into an agreement with Golden River Resources that will see Kaiser add a number of material assets, once it receives regulatory and shareholder approval.

In what has been dubbed ‘The Project’, two high-grade Victorian gold projects and a processing plant are set to come under the control of Kaiser Reef:

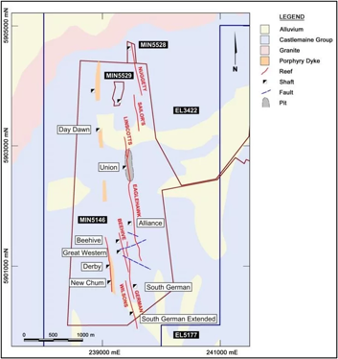

- Four mining leases with proven gold endowment — three of which are in the Maldon Goldfield located in the Bendigo Block, with the fourth at Woods Point.

The Maldon Goldfield has produced 1.74 million oz of gold at an average grade of 28 grams per tonne (g/t) and includes the Nuggetty mine — one of the highest-grade gold mines in Victoria. Maldon is located between Bendigo and Ballarat.

- The Porcupine Flat gold processing plant, also in Maldon, which is fully permitted and operating; and

- The A1 gold mine which is similarly fully permitted and operating.

Kaiser will reap immediate gold production from the A1 gold mine which historically produced 620,000oz of gold since 1861. Preliminary review work on the mine suggests strong potential, with Kaiser set to benefit from expanded production.

Despite an exceptional production history, the region remains poorly tested by modern exploration. The Victorian goldfields are now supporting high-grade gold, with the Nuggetty mine being one of the highest-grade gold mines, having already produced 301,000oz at the extraordinary average grade of 184g/t gold.

Indicating just how high-grade this is, anything over 5g/t is generally considered high grade.

The A1 mine has been identified as having potential to be significantly expanded with further drilling and geological modelling.

Acquisition of the fully permitted and operating gold treatment processing plant will allow for ongoing production and support the rapid and low-cost production of future discoveries made in the region.

With this ownership, Kaiser will have the ability to utilise crush, grind and carbon-in-leach processing for gold production on site.

All scrip, no cash outlay

The Project is held by Centennial Mining Limited (CTL), which was unable to capitalise on the holding due to insufficient working capital, coupled with struggling equity markets. The Project is now subject to a Deed of Company Arrangement.

Golden River Resources (GRR) is an Australian special purpose vehicle that recently raised $13.5m in cash and acquired a senior debt position and stepped into a Deed of Company Arrangement (DOCA) to ultimately acquire The Project from the Administrators of Centennial.

The agreement will then see Kaiser buy GRR, subsequent to a shareholder vote, via the issue of around 53.3 million Kaiser shares, worth around $16m.

The corporate advisor to this transaction will also be granted an additional 1.9 million shares in Kaiser and 1.3 million options with a 50c/share exercise price within three years of issue.

On completion, The Project will be debt free.

To ensure Kaiser has adequate funds, it plans to offer 25 million shares at 30c each to raise $7.5m to conduct further exploration at the Maldon and A1 mine sites. Existing shareholders and strategic cornerstone investors will be invited to participate.

It is anticipated that the completion of this transaction with GRR will occur by late December, following lodgement of the prospectus and shareholder participation.

Highly prospective Lachlan Fold landholding

The latest acquisition supports Kaiser Reef’s goal of becoming a profitable gold producer, adding a cash flow generating asset to its portfolio — which also includes a patch of highly prospective ground in the hot Lachlan Fold Belt of New South Wales.

In early September, Kaiser started maiden drilling at its Stuart Town gold project, which is located between Newcrest Mining’s (ASX:NCM) big low-cost producing Cadia mine and Alkane’s Resources (ASX:ALK) recent Boda gold discovery that sparked an exploration frenzy in the underexplored Lachlan Fold. Drilling is ongoing.

Kaiser also owns the Macquarie North project, contained within the Macquarie Arc, giving the company a growing presence in the Lachlan Fold Belt.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.