You might be interested in

Mining

Miramar Resources could be on the cusp of a new gold camp as first RC hole at Blackfriars wraps up

Mining

Miramar Resources is getting stuck into gold and critical minerals projects across WA

Mining

Mining

Miramar Resources executive chairman Allan Kelly knows a thing or two about building a gold mining business from nothing.

The respected geologist is best known for taking Doray Minerals from a $4.6 million IPO that barely crossed the line in 2010 to a gold producer within three years, with a market cap worth hundreds of millions of bucks on the back of its Andy Well discovery near Meekatharra in WA.

Kelly views newly listed Miramar (ASX:M2R), which comfortably raised $8 million to list on the ASX last year, as a better bet than Doray was when it first floated.

That belief is backed by the high-quality and relatively advanced Gidji and Glandore projects Miramar counts as its flagship assets.

“I reckon these projects are better than Doray’s,” Kelly told Stockhead.

“Andy Well’s a special case. I had worked on Andy Well, back in the 90s with Western Mining.

“Western Mining was going through a funny period, where the target size increased and increased and increased, that it was just unrealistic.

“I went back there with a bit of a different idea, followed that up, and we turned it into a discovery.

“But everything else pretty much in that Doray IPO was really early stage. So we certainly didn’t have anything like Gidji or Glandore in the Doray float.”

While Andy Well exceeded expectations for Doray to deliver over 1Moz at 15g/t, Kelly says Miramar has not one but two projects with the potential to host 1-2Moz or more.

Both the Gidji and Glandore gold projects were picked up last year in a one-two punch when Kelly only thought one would come to fruition.

Like a football coach with superstars to stock the bench, it is undoubtedly a good problem to have.

In acquiring an 80 per cent stake in Gidji from former Doray geologist Toby Wellman, Miramar managed to lock up premium real estate just 14km north of Kalgoorlie-Boulder adjacent to Kalgoorlie Consolidated Gold Mines’ Gidji Roaster.

Now home to one of the world’s largest ultra-fine grinding mills, KCGM also hosts the little known 314,000oz Runway resource abutting the tenement boundary, while Zijin’s 10Moz Paddington gold camp is visible on the horizon.

Even more exciting to Kelly and Miramar is the presence of the Boorara Shear Zone running through the ground.

“To use a real estate analogy, it’s like the cheapest house on the best street sort of thing,” Kelly said.

“It’s under-explored, but it’s got the same geology, it’s on the structure, you can see the Gidji Roaster here, and you can see Paddington just up the road.

“So we’re just going to get to work and it’s great for a company like us.”

Aircore and RC drilling are some of the most effective tools of the patient gold explorer, and Miramar has conducted three rounds of drilling at Gidji since listing last year.

One of the big success stories has been the identification of the Marylebone target, which has grown to 2km in length, remains open along strike and untested at depth.

“The first round of drilling, we basically did pretty wide space drilling up and down a north south structure, which pretty much ran from Runway up to the Boorara Shear Zone,” Kelly said.

“When it hit the Boorara Shear Zone we got two meters at seven grams, including 1m at 13g/t. So almost half an ounce in a first drilling program, that’s pretty exciting.

“Then we followed that up with a second round of aircore and that grew that target, and we’re getting another 2, 3, 4 or 5g hits.

“And then we just did a third program in May- June, we put those results out two weeks ago.

“Now that Marylebone footprint is at least two kilometres at sort-of +1g/t in aircore, which is pretty good. But it’s still open to the northwest and the southeast.

“And it hasn’t been tested at depth yet. All our drilling has been 50-60m deep aircore.”

Those results revealed visible gold in quartz veining, pointing to significant structural similarities between Marylebone and the Paddington deposit just a few klicks up the Goldfields Highway.

“At Paddington you have the Boorara Shear Zone, it does a little bit of a flexure, a jog and it’s got some north-south structures running through it,” Kelly explained. “And the base of the mineralisation is either side of the north-south structure.

“We see exactly the same thing at Marylebone, we’ve got this dilational jog in the Boorara Shear crosscut by north-south structures.

“The Paddington 1 and 2 pit, which produced about 4 million ounces, is about 1.5km long. We’ve got about 2km of supergene gold footprint now. So it’s very similar, but without any deep drilling.

“We’re excited about the potential to find something that could be a 1 or, 2 million ounce deposit like a Paddington.”

There are a number of other high priority targets across the Gidji JV including the Piccadilly and Railway prospects, while Kelly notes half the tenure there – including some of its most prospective geology – has not even been granted yet.

Glandore is located on a salt lake 40km east of Kalgoorlie, and was the domain of South African giant AngloGold Ashanti until it was vested into the Miramar float.

Because of its tough terrain and complicated ownership history the project remains underexplored, despite a diamond drill hit of 8m at 22.5g/t from one time Jubilee gold mine operator Harmony Gold.

Like Gidji, it is located in prime real estate, nestled between Silver Lake Resources’ Mt Monger gold project, Gold Fields’ St Ives gold mine and Horizon Minerals’ Boorara project, and not far from Bulong where Black Cat Syndicate is planning to build a new processing plant.

Kelly said the project bears geological comparison also to Gold Fields’ Granny Smith gold mine, home of the 12Moz Wallaby deposit.

“I guess the structural setting is very similar to something like Granny Smith, where the greenstone comes and wraps around the granite and you get a bit of a dilation zone, or a pressure shadow next to the granite,” Kelly said.

“And that’s what Glandore looks like.

“So a couple of companies have done aircore drilling, and they got some really nice results, you know 3-4g hits.

“Harmony drilled a couple of diamond holes back in 2005 and they got results up to eight metres at 22g.

“So fantastic result in a diamond hole, very shallow, only about 90m down the hole. So 80m vertically, and then after that pretty much nothing happened.”

With the advent of lake drilling technology, exploring projects like Glandore has become easier for juniors.

There are two anomalies at Glandore: the East Target with 2.5km of near surface gold mineralisation and a host of drill hits of over 1g/t that remains open for 800m to the south, and the West Target which holds 2km of untested potential strike.

“We’ve just finished our first little aircore program on the land just to the south of the lake,” Kelly said.

“And we’re scheduled to be out there next month with a lake rig, the special lake rig drilling on the surface.

“On the western side of the granite you’ve got a mirror image, but basically no drilling.

“So we want to get that Western Target up to a similar level of detail as the Eastern Target before we go out and do diamond drilling.

“So it will be pretty busy out there this year as well. The scale of that opportunity is probably similar to Marylebone.”

Kelly said with the grades seen in historic drilling at Glandore, it too has the characteristics for million-ounce potential.

“Gidji is in a better location, but Glandore’s got better results. We’re excited about both of them.”

Miramar has not rested on its laurels by stopping at its flagship projects, with a host of other early stage assets waiting in the wings.

One is the Randalls project further east of Glandore, which sits adjacent to Silver Lake Resources’ 70,000ozpa Mt Belches Mining Centre.

Another is the Lang Well project, an underexplored greenstone belt between the Deflector, which Kelly purchased and built with Doray, Golden Grove and Rothsay mines, where aircore drilling is planned for the second half of the year.

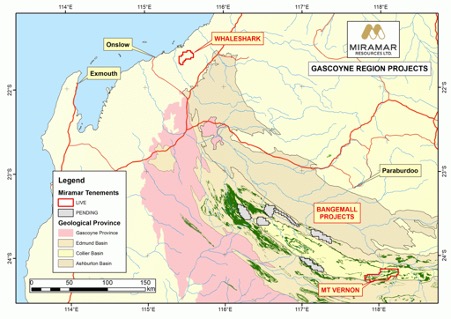

Miramar has also completed geochem sampling on Whaleshark, a large folded banded ironstone formation target hidden under 100m of Carnarvon Basin sediments near Onslow in the Pilbara.

“When I worked out there with Western Mining Corporation, we drilled a couple of diamond holes into it and got some gold and that’s never been followed up,” Kelly said.

“So that’s got potential for gold mineralisation, it’s got potential for IOCG. It’s also a similar setting to something like Havieron.”

Another interesting conceptual project is the Bangemall project in the Gascoyne region of WA.

It was identified for its prospectivity for nickel-copper-PGE mineralisation in the same Geoscience Australia map that contained early inspiration for the Julimar discovery, which has turned Chalice Mining into a $2.5 billion company.

“I had a bit of an idea of that when I was working for Avoca and got Western Mining into a JV but then it never really progressed anywhere,” Kelly said.

“But when Chalice made the discovery of Julimar back in 2019, they talked about this Atlas that Geoscience Australia put together.

“And so obviously the South West is the area that’s lit up now and you’ve got Chalice and Caspin and all those companies working down there.

“But the Bangemall area lit up as well.

“We’ve got six applications in the Bangemall and one of those has been granted. And we’re preparing to do an EM survey over that later this year.”

Kelly is not the only high-flyer on the Miramar team, with technical director Marion Bush, the former CEO of TSX-V listed African gold company Cassidy Gold, also well respected in exploration, mining and analyst circles.

Business executive and former Army and naval officer Terry Gadenne is a non-executive director.

Outside the key board appointments it is a lean crew, something Kelly says is helping Miramar ensure it spends as much money on the ground as possible, with 70-75% of funds heading into exploration.

“About three quarters, 70-75% of your fundraising is what you should be spending,” Kelly said.

“If an exploration company is not getting out there drilling holes, and putting information out there in a quarterly report, then they’re not advancing the projects, and it’s just wasting time.

“So we want to spend money on the ground, not on lots of salaries and things like that.

“You’ve got to buy tickets in the lottery, you know.”

After shooting up on listing last year, Kelly said Miramar is working methodically to prove up its assets.

“We set ourselves such a high hurdle on the first day,” he said. Our share price started trading at 53c and hit 59c on the first day. To say it was a bit overwhelming would be appropriate.

“We’re out there, we’re doing the work. We’re putting out lots of news from our projects we’re really excited that every time we drill it seems to grow and get better.”

This article was developed in collaboration with Miramar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.