Miramar Resources is getting stuck into gold and critical minerals projects across WA

M2R is accelerating exploration work across its WA gold projects. Pic: Getty Images.

- Miramar is working towards a maiden drilling program at Bangemall

- Eastern Goldfields gold projects have now expanded to 480km2

- Targets outlined for drill testing at the Gidji JV gold project

Special Report: Targeting nickel-copper-cobalt-PGE mineralisation, mining boffin Allan Kelly’s Miramar Resources is working towards a maiden drill program at its highly prospective Bangemall project in WA’s Gascoyne region and has expanded its Eastern Goldfields tenement portfolio while planning further drilling at its Gidji JV gold project.

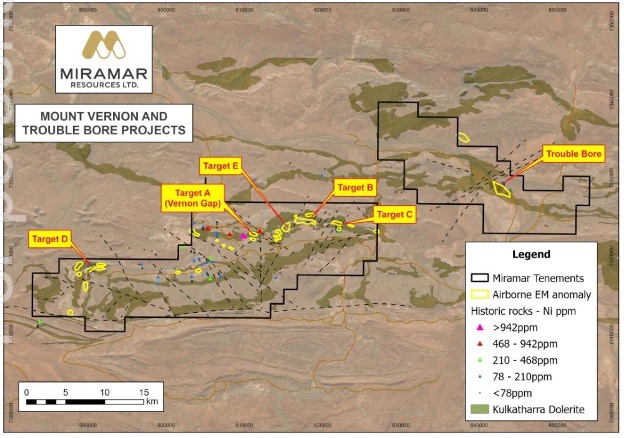

Miramar Resources’ (ASX:M2R) Bangemall project area consists of six target areas across the Mount Vernon and Trouble Bore projects in the Edmund and Collier Basins where it’s looking to show “proof of concept” of Norilsk-style sulphide mineralisation.

That’s a reference to the Russian giant, one of the world’s great nickel and PGE deposits. It’s a rich style of deposit not seen at scale in WA … yet.

The junior has also expanded its landholding in the Eastern Goldfields up to 480km2 with a new exploration license application at Lake Yindarlgooda and has made a plethora of new gold discoveries at its Gidji JV.

The upcoming exploration work across M2R’s projects and new acquisition comes on the back of a recently supported $1.7m cap raise.

What’s the lowdown on Bangemall?

Over the last 24 months, the company has progressed from regional-scale area selection to collection of project-scale datasets at Bangemall to delineating six individual targets across Mount Vernon and Trouble Bore.

The company is well on its way towards a maiden drill program targeting nickel-copper-cobalt-PGE sulphide mineralisation and has already received its program of works approval from the WA government.

Upcoming work includes the completion of a heritage survey, systematic rock chip sampling, and/or further ground geophysics to help refine the initial RC drill targets.

Pending receipt of all relevant approvals, M2R is looking to complete drilling mid-year.

Drill targets at Gidji

M2R reckons it’s on the cusp of discovering a new gold camp 15km north of Kalgoorlie across its Gidji JV, nestled in the Boorara Shear Zone.

That regional feature has been relatively underexplored and could potentially contain multiple new gold deposits close to several existing gold mining and processing operations.

At least two discoveries have been identified that are yet to be closed off along strike with significant bedrock aircore gold intersections still to be followed up with deeper RC and/or diamond drilling.

At Blackfriars assays returned an intersection of 1m at 11.8g/t gold and 6g/t silver at end of hole, with elevated pathfinders indicating it’s related to bedrock gold mineralisation.

One of the later AC holes at the northern end of the Marylebone target intersected 6m at 2.2g/t gold, including 4m at 3.0g/t and 13.4g/t Ag, indicating another bedrock gold mineralisation that M2R plans to follow up.

Miramar is planning to reprocess regional and project-scale geophysical data to help refine the structural interpretation of the project, followed by RC drilling of selected targets.

Lake Yindarlgooda

A new exploration license application has been submitted across an 11km-long gold anomaly on Lake Yindarlgooda, ~50km east of Kalgoorlie.

M2R exec chair Allan Kelly came across the area during his time at Riversgold (ASX:RGL) in 2019 and implemented a first-pass lake AC drill program that identified the anomaly, with several holes ending in gold mineralisation.

Those results show a lead to geological structures similar to the +2Moz “Invincible” gold deposit within Gold Fields’ St Ives gold camp near Kambalda.

Despite this, no further exploration was carried out and the tenements were ultimately surrendered by Riversgold in March this year for M2R to snap up.

Work is progressing towards tenement grant with follow-up AC drilling on the cards once approvals are in.

Kelly says the company’s Eastern Goldfields exploration portfolio has significant value not recognised in the current share price.

“Since listing in 2020 with a portfolio of highly prospective early-stage gold, nickel and copper projects in WA, we have systematically advanced our key projects up the exploration value chain, added to our land position through strategic tenement applications and relinquished those tenements which lacked significant discovery potential,” Kelly says.

“In a record gold price environment, the inherent value of our gold projects, including our flagship Gidji JV project, where we have made multiple new gold discoveries immediately along strike from one of the richest patches of earth on the planet, is significant.

“We’ve also advanced our Bangemall projects from the initial concept to high-priority drill targets which could define a new style of nickel mineralisation in a new mineral province.”

This article was developed in collaboration with Miramar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.