You might be interested in

Mining

Metal Hawk returns serve at Yarmany with RC rigs now drilling the 1km-long F-camp pegmatite

Mining

High Voltage: Exxon lithium pivot to push lithium narrative into overdrive; EV sales surge in Europe

Mining

Mining

Special Report: Experienced resource investors have demonstrated their support for Metal Hawk by strongly backing its placement of 19.4 million shares priced at 18c each to raise $3.5m.

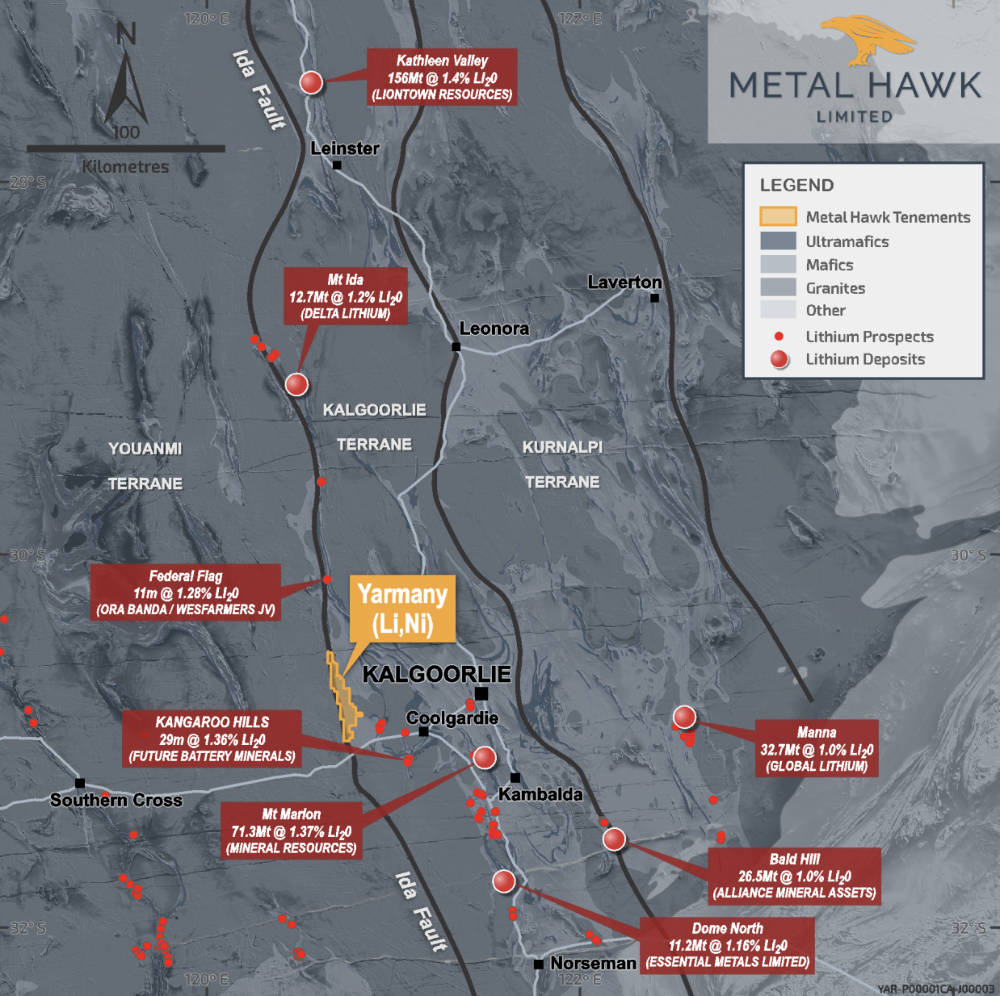

Metal Hawk (ASX:MHK) is currently focused on advancing its Yarmany lithium and nickel project within the lithium-rich Ida Fault in the WA Goldfields region.

This region is an emerging world-class lithium precinct, hosting the likes of Liontown Resources’ (ASX:LTR) 156Mt @ 1.4% Li2O Kathleen Valley and Delta Lithium’s (ASX:DLI) 12.7Mt @ 1.2% Li2O Mt Ida projects.

Historical work has confirmed a favourable geological setting with potential for pegmatite-hosted lithium and komatiite-hosted nickel sulphide mineralisation while recent mapping by the company had outlined a 1km long and 140m wide pegmatite from rock chip sampling that returned up to 1,268 parts per million (ppm) Li2O at the F-Camp prospect.

This led the company to kick off a drill program earlier this month to determine if Yarmany will be the next big Goldfields lithium deposit within the Ida Fault.

This includes aircore drilling that will include several traverses and carefully placed angled holes to determine the orientation and depth of weathering of the F-camp pegmatite target.

Resource investors – including many existing shareholders – have now made firm commitments to subscribe for just under 19.2 million shares priced at 18c each – a 21.1% discount to the five-day volume weighted average price prior to the placement – to expand lithium exploration and drilling at Yarmany.

Subject to shareholder approval, directors in the company have also demonstrated their confidence by subscribing for a further 255,556 shares.

Proceeds will be used to prioritise drilling and continued generation of new targets at Yarmany through a range of activities such as aircore and RC drilling, geophysics, auger/geochemistry and native title/heritage surveys.

“We are very pleased with the strong level of support from new and existing shareholders,” managing director Will Belbin said.

“We are leading into a very exciting period of exploration activity at Yarmany and the Metal Hawk team is keen to advance drilling at F Camp and other prospects.”

“It’s great that we are now well funded to aggressively explore this highly prospective project,” Will Belbin told Stockhead

Besides ongoing aircore drilling, MHK is also planning to test a number of other geochemical lithium anomalies and targets around the F-camp prospect area using reverse circulation drilling, which will commence in early December.

This article was developed in collaboration with Metal Hawk, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.