You might be interested in

Mining

Monsters of Rock: MinRes has 'seen the bottom' in lithium prices, Lynas tightens the screws on rare earths supply

Mining

Colossus metallurgy outperforms every known ionic rare earth project in the world

Mining

Mining

As far as significant goes, this milestone is right up there. In Brazil, Serra Verde has just become the world’s only ionic clay-hosted (IAC) rare earths mine in production outside China, kicking off 5,000tpa of commercial-grade REEs from its flagship Pela Ema deposit.

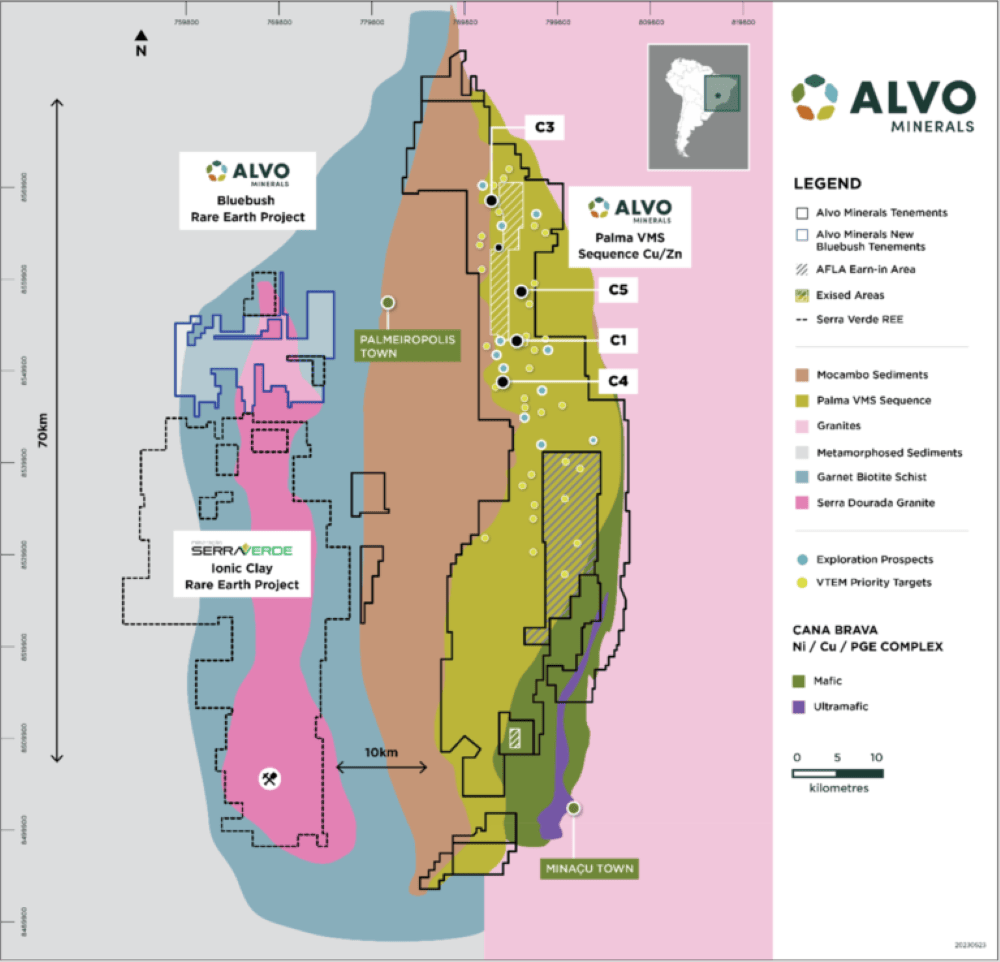

And right next door, hosted on the same type of ground, Alvo Minerals (ASX:ALV) would need a whole piano to note down the reasons why it really is a big deal – not just for Serra Verde and its namesake project – but for its own confirmed IAC project, Bluebush, as well as other ASX-listed REE explorers operating in Brazil.

Serra Verde is the first cab off the rank for developing IAC deposits, which are renowned for being geological treasure troves of earth that can meet exponential demand for the more valuable magnetic rare earths (MREO) such as neodymium, praseodymium, dysprosium and terbium – among others.

These elements are skyrocketing in value, as they’re used in everyday tech items such as smartphones and EVs, to highly complex industrial applications such as rockets, wind turbines, semiconductors and innovative research.

An advantage of IAC deposits they typically have much higher percentages of MREOs, are easier to explore due to mineralisation being near surface, and therefore cheaper to mine and process.

These factors offset the much lower grades that come in at ~0.1%, compared with hard rock mines, which can vary anywhere between about 2-10% – meaning you’ll need to discover a fairly large deposit.

Yet governments and industry alike have been, for years, reliant on Chinese exports of critical minerals, including REEs, because it was massively cheaper. Over time, domestic production has dried up and reliance on China has increased dramatically.

As China very smartly positioned itself as the global producer, supplier and exporter of rare earth elements over the past few decades and has now made moves to tighten supplies of critical minerals, forcing Western governments and industries to exfiltrate the commodities from elsewhere at a hastening pace.

Now, with more than 200 identified policies and regulatory frameworks across the globe, recent initiatives include the EU’s Critical Raw Materials Act, the US Inflation Reduction Act, Australia’s Critical Minerals Strategy and Canada’s Critical Minerals Strategy – the list goes on.

REE veteran Amanda Lacaze recently put her own stamp of approval on ionic clay-hosted (IOC) projects when Stockhead’s very own mining boffin Reuben Adams caught up with her at last year’s Diggers & Dealers conference in Kalgoorlie.

Lacaze heads up Lynas (ASX:LYC), the world’s largest rare earths missionary outside China with projects in WA and Malaysia (yet predominantly produce light rare earths) and says “finding a complementary clay deposit for the light-dominant Mt Weld is certainly what we are looking at”.

“The success of developing an outside-China industry is important for all of us. Sometimes I think that the desire is to set up outside China operators as if they’re sort of competing with each other when in fact, the main game is China, right? That is our competition,” Lacaze said.

READ MORE: Are we ready to challenge China in rare earths supremacy?

Contained in the Serra Verde IAC project, its flagship Pela Ema REE deposit is expected to produce a minimum of 5,000tpa of rare earth oxides – primarily high-value magnetic rare earths such as neodymium (Nd), praseodymium (Pr), terbium (Tb) and dysprosium (Dy), which are key to our energy transition.

Overall, the deposit is one of the largest out there, with a resource estimate of 911Mt @ 1,200ppm TREO and an ore reserve of 350Mt @ 1,500ppm TREO.

Samples from Serra Verde have already been accepted by major customers and offtakes for a large proportion of planned production are in place.

The privately-owned miner has already begun work to increase Phase I capacity at Pela Ema through plant optimisation and is assessing the potential for a Phase II expansion – which could see production double to 10,000tpa before 2030.

“As we ramp up to achieve nameplate capacity, Serra Verde is also working to build downstream partnerships to support the development of long-term, sustainable supply chains,” Serra Verde CEO Thras Moraitis says.

Speaking with Stockhead, ALV MD Rob Smakman says Serra Verde entering commercial production is proof of the economical development of IAC deposits and further raises the credentials of his company’s neighbouring Bluebush IAC project in Goias State in Central Brazil.

“Brazil is fast emerging as the most important REE jurisdiction globally, and from our perspective, being adjacent to Serra Verde is important for us because we are hosted on the same granite,” Smakman says.

“Encouragingly, the results we’ve released over the past few months for Bluebush are similar to what Serra Verde have shown.”

ALV completed six diamond holes at the Boa Vista prospect in December last year, with all intersecting saprolite clay zones with widths of up to 28m and averaging 18m.

Assays from the first hole have returned so far, showing 2,961ppm TREO containing 28% MREO. Smakman says once the rest of the assays come back the explorer will immediately commence metallurgical testwork, accelerate exploration and identify new drill targets across the project area.

Up in the northeast of the country, Viridis Mining and Minerals (ASX:VMM) is pushing forward with its recently acquired Colossus IAC project, adjacent to Meteoric Resources’ (ASX:MEI) Caldeira project.

VMM, backed with a cornerstone investment in August last year by fellow ASX REE explorer Ionic Rare Earths (ASX:IXR), is laser-focused on the Alkaline Complex within the project area, where drilling from 109 augur holes has produced assays of up to 9,447ppm TREO at the prospects’ western quarter.

Greenfields drilling and metallurgical work is continuing, with the mobilisation of an RC and diamond rig to other prospective targets at the tenure.

Next door, MEI’s 409Mt Caldeira project is a monster. Still in the development stage, metallurgical testing is showing excellent percentages for leach extraction techniques of MREOs.

Then there’s recently listed Gina Rinehart-backed Brazilian Rare Earths (ASX:BRE) with ground in northeast Brazil which has a maiden JORC resource of 169Mt @ 1,526ppm TREO.

Brazil has also piqued interest from Canadian explorers such as Aclara Resources with its Carina module resource in Goias State, which has shown an inferred grading of 1,510ppm TREO from 201 augur samples across >1.6km.

Meanwhile, fellow Canadian Appia has doubled the number of mining claims of its PCH project, also in Goias, to >40,000ha where initial exploration has shown high-grade TREO’s near surface.

Heading across to South Australia, Australian Rare Earths’ (ASX:AR3) Koppamurra IAC project’s exploration target ranges from 340 million to 3.1 billion tonnes, at average grades of 510-780ppm TREO.

At Stockhead we tell it like it is. While Viridis Mining and Minerals, Ionic Rare Earths and Alvo Minerals are Stockhead advertisers, they did not sponsor this article.