Matador’s Cape Ray is charging towards the golden prize

Mining

Mining

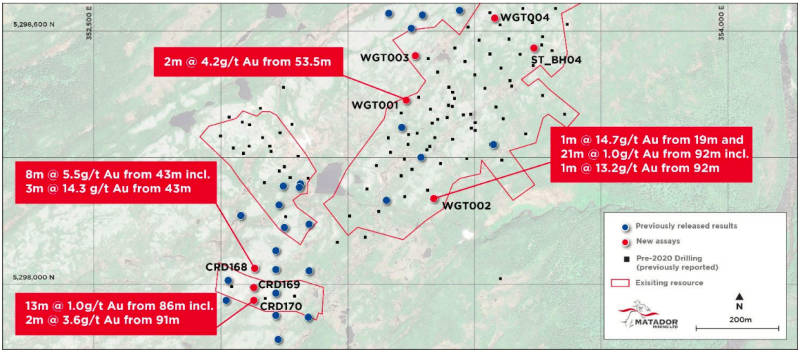

Matador’s drilling continues to extend the known gold mineralised area at the Window Glass Hill deposit within its Cape Ray project in Newfoundland, Canada.

The latest results, which intersected multiple, near-surface high-grade gold lodes, include an 8m intersection grading 5.5g/t gold from 43m that is located 70m outside the existing resource area and 21m at 1g/t gold from 92m.

These results followed assay released last month at the Isle Aux Morts deposit, which included 18m intersection grading 11g/t gold from 7m and 19m intersection grading 4.6g/t gold from 5m.

Matador Mining (ASX:MZZ) Executive Chairman Ian Murray said the latest assay results at Window Glass Hill continue to highlight its resource growth potential.

“The standout from the most recent results was hole CRD168 (8m at 5.5g/t gold from 43m) due to its grade, width, and shallow depth.

“This high-grade intercept is 70 metres from the existing Window Glass Hill mineral resource wireframes and remains open to the north-west in a previously untested area,” Murray said.

“Coupled with the new discovery at depth, the company has multiple high-confidence drill targets at Window Glass Hill to test when exploration recommences next quarter.”

All results from the 2020 exploration have now been received and the company is expecting to release its exploration strategy in the coming weeks before starting work on the ground again during April.

The Cape Ray project comprises 120km of continuous strike in the proven, yet underexplored Cape Ray Shear gold corridor, making Matador the largest continuous land holder in the region.

It is located 25km northeast of Port aux Basques and about 50km along strike from Marathon Gold’s (Market Cap – C$525m) 4 Moz Valentine Lake gold project.

Cape Ray currently hosts a resource of 840,000oz of gold at an average grade of 2g/t, most of which is located less than 200m from surface therefore open pittable.

The project is supported by excellent existing infrastructure including roads, grid power, water and proximity to a skilled workforce.

A scoping study has estimated that the project could deliver post-tax net present value (NPV) and internal rate of return (IRR) of $277m and 78 per cent respectively.

Both NPV and IRR are measures of a project’s profitability.

It is expected to produce 88,000oz of gold per annum over its seven-year mine life.

This article was developed in collaboration with Matador Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.