Magnetite shifts into high gear after oversubscribed rights issue raises $5.95m

Mining

Mining

Special Report: Magnetite Mines has received a resounding vote of confidence from its shareholders after its $5.65m rights issue closed significantly oversubscribed.

A further $300,000 was placed to lead manager Mahe Capital in lieu of cash fees payable under the underwriting agreement, taking the total raised to $5.95m.

Magnetite Mines (ASX:MGT) executive chairman Peter Schubert says the result is a strong endorsement by both existing shareholders and new investors of the company and its 4 billion tonne Razorback iron ore mine in South Australia.

“In the last three months, despite an uncertain global situation, we have seen a substantial re-rating of the company’s market capitalisation and, with this successful rights issue, the next part of the company’s exciting study program is fully funded,” he said.

Schubert added that the fundraising was a critical step on the company’s journey of becoming an iron ore producer by developing high-grade products out of South Australia and unlocking the potential of the Braemar – the birthplace of Australia’s iron ore industry.

Under the rights issue, eligible shareholders were offered one new MGT share priced at 1c, or a 27 per cent discount to the 10-day volume weighted average price at that time, for every four shares held.

This was partially underwritten by Mahe to $4m, though just $1.9m of this capacity was used.

Proceeds from the rights issue will allow Magnetite Mines to accelerate the work on the pre-feasibility study (PFS) to develop the optimum business case for Razorback.

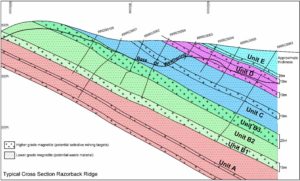

Initial studies have confirmed the lateral continuity of high-grade iron ore horizons within the existing resource are potentially amenable to selective mining.

This method, which has been used successfully by major iron ore miners like Fortescue Metals Group (ASX:FMG), can be combined with complementary ore sorting to deliver higher grade ore to the processing plant.

Test work has already demonstrated that it can produce grades of nearly 70 per cent iron.

The Razorback project has all the right ingredients to make it a lower cost development project than other mines.

Not only is the resource is at surface with low stripping ratios, it also features rocks that are much softer than other iron ore projects and thus require less energy to grind.

This substantially reduces the cost of processing the Razorback magnetite ore into high-grade products.

With the depletion of direct shipping hematite ore – material that can be just dug up and shipped – steelmakers in China are increasingly demanding more processed ores like magnetite.

This article was developed in collaboration with Magnetite Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.