Jaguar resource rises 30%, confirms sweet spot as major near-surface nickel sulphide project

Mining

Mining

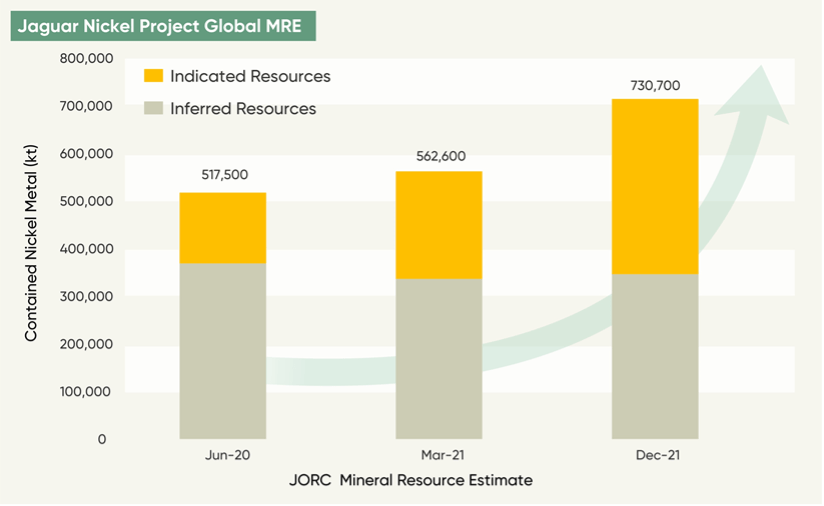

Centaurus Metals has updated the mineral resource to 80.6Mt at 0.91% nickel for 730,700 tonnes of contained nickel for its Jaguar project in Brazil. That’s a massive 30% above the scoping study resource estimate in March.

The company says the inventory jump confirms Jaguar as the world’s premier near-surface nickel sulphide development project – and paves the way for a potential increase in the scoped nickel sulphate production rate.

Importantly, the indicated component of the global MRE has increased to 43.4Mt at 0.92% nickel for 397,000t of contained nickel.

The company expects the Indicated component of the MRE, which will be available for conversion to ore reserves as part of the definitive feasibility study (DFS) due for completion next year, will continue to grow as further in-fill drilling is undertaken over the next six months.

Centaurus Metals (ASX:CTM) managing director Darren Gordon said the 30% increase in the contained nickel was an exceptional result which confirmed Jaguar as one of the most significant new nickel sulphide projects to emerge globally over the past decade.

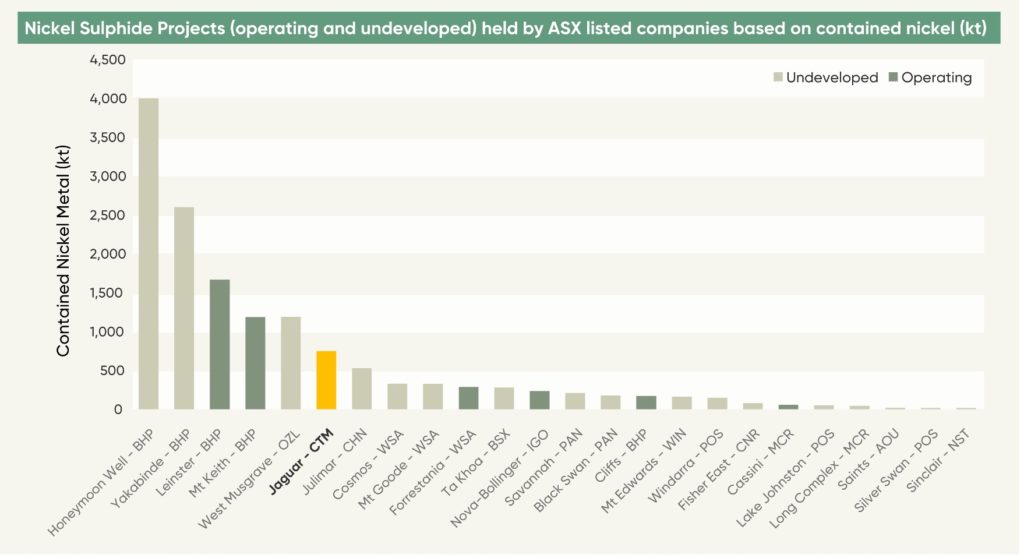

“The Jaguar Resource, which now stands at 80.6Mt at 0.91% nickel for 730,700 tonnes of contained nickel, now hosts more contained nickel than the largest nickel sulphide deposit on the ASX not held by a major mining company,” he said.

“This exceptional result confirms our view that Jaguar is well on the way to becoming a world-class nickel mine with sector leading ESG and greenhouse gas emissions credentials.

“Since our maiden JORC Resource in June of 2020 we have safely completed more than 50,000m of drilling despite the COVID-19 pandemic and have successfully added more than 210,000t of contained nickel in resources at a rate of 140kt of contained nickel per annum – which is an outstanding achievement and a credit to the entire Centaurus team.”

The company is confident that – at its current growth rate – it can realistically grow the resource to over 1 million tonnes of contained nickel by the time it starts building the project in the second half of 2023

“That would well and truly position it as a world-class project,” Gordon said.

Gordon said that part of the ongoing DFS activities include assessing the option of increasing the plant production capacity above 2.7Mtpa.

And any expansion of the processing plant capacity and/or production profile is likely to have a material positive impact on the project economics and delivery of nickel-in-sulphate, which currently stands at 20,000ktpa for 13 years.

“Any expansion of the processing plant and the resulting production rate of nickel sulphate is expected to have a material positive impact on the project economics and could move Jaguar well inside the top-10 of nickel sulphide producing mines globally,” he said.

While Jaguar’s strong economics lie at the heart of the project, the company also plans to deliver its nickel at class-leading levels of GHG emissions – both as a result of the relatively high-grade nature of the ore and the fact that 80% of the power in Brazil is generated from renewable sources (hydro and solar).

“The value-added nickel sulphate product is to be produced on site at Jaguar,” Gordon said.

“At the presently assessed level of 4.69 tonnes of CO2/tonne of nickel equivalent, the Jaguar project will be one of the lowest carbon emission projects in the nickel industry.”

Gordon reckons that Jaguar has already shown that it can keep growing, with the mineralisation open down-dip at all deposits and locally along strike.

This means there’s potential to continue strong resource growth driven by step-out and extensional drilling targeting DHEM conductor plates along with greenfields drilling.

“With focused drilling we are positioning ourselves to maximise that growth as part of the current DFS,” Gordon said.

“We have eight diamond rigs on site now and that will increase to 11 by early next year.

“This work will pave the way for a further resource upgrade, targeted for Q3 2022, that will form the foundation of the definitive feasibility study due for completion by the end of 2022.”

The key environmental licence application and the updated mining lease application have been lodged and are on schedule for approval in 2022.

And in the meantime, the company is focused on greenfields drilling, with any new discoveries expected to contribute to the next resource update that will underpin the DFS.

In a flash note issued this morning, global broker Canaccord Genuity has maintained its Speculative Buy recommendation and $1.35 price target for Centaurus, describing the resource upgrade as “large and impressive”.

“An opportunity now exists for Centaurus to review project scale and in terms of annual throughput versus mine life extensions, which will inform DFS outcomes late in 2022,” sayd Canaccord analyst Paul Howard.

“At present, Jaguar’s 13 year mine life is class-leading among the ASX nickel producer/developer peers, and its ~20ktpa of contained nickel production ranks it second behind IGO’s Nova Mine in terms of scale among the hardrock, non-NPI players on the ASX.”

This article was developed in collaboration with Centaurus Metals Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.