Argonaut says it keeps getting harder to build a new project – but rates these 11 developers to get it done

Yes, there are 11. Picture: Getty Images

- Argonaut has named its 11 best undeveloped mining projects held by Australian companies in 2023

- It comes as development timeframes blow out, threatening the next wave of major mines

- De Grey Mining leads cohort, with six new projects in the prestigious list

For the past decade Argonaut has tipped off punters to the best undeveloped projects (BUP) on the ASX held by companies with a market cap of under $5 billion.

That list remains extensive. There are 11 on the card in its 2023 edition, released last week. Another 10 are rated as special mentions.

And over the past 10 years on average those companies listed in the guide have grown 15% over the next 12 months, outperforming the ASX 200 by 3% and small resources index by 9%.

But there are rising threats to companies looking to bring projects into production, with Argonaut noting S&P Global now sees a gulf of 15.7 years from the time a project starts to first output.

That makes identifying companies that can actually bring developments to market even more important for investors.

“At the development phase companies themselves are often overly optimistic on how long it will take to bring their projects into production. Geology, engineering, permitting, and financing can all bring unexpected delays that blow out even the most conservative schedules,” Argonaut said.

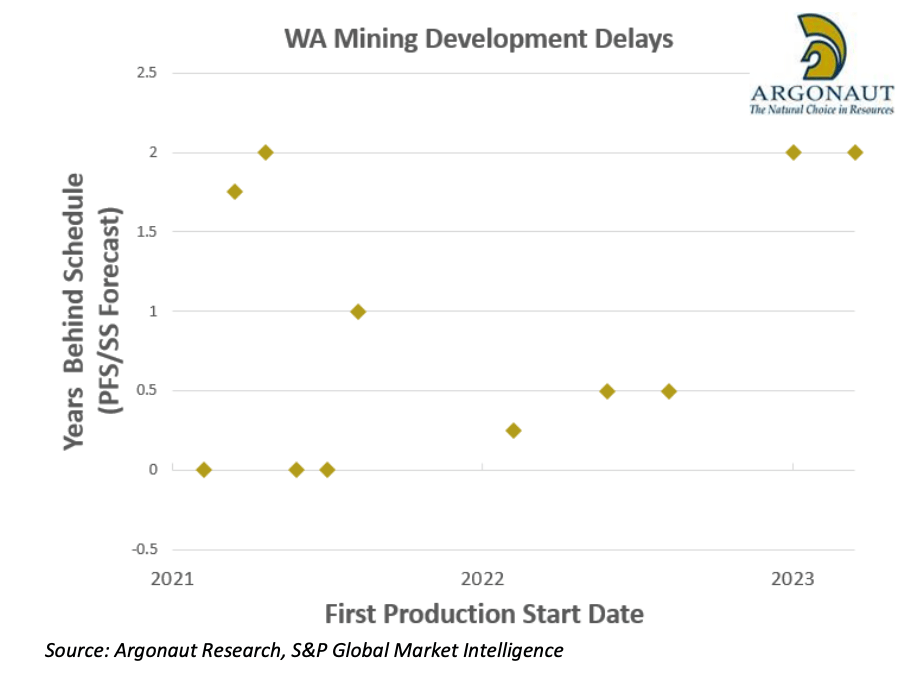

“For example, Argonaut’s analysis of WA gold and base metal projects brought online in the last 3 years suggests most projects have been delayed 0.5-2 years relative to the projected timelines in scoping and pre-feasibility studies.

“New standalone development projects are the worst offenders, particularly where first-time developers are involved.

“Investors should view scoping and PFS development timelines presented by developers with some scepticism and as a rule of thumb add 12-months for a more realistic first production date for a standalone project.”

Yikes.

What’s driving this?

This runs counter-intuitively to the need to build and mine more deposits to extract critical minerals for both the rapid urbanisation of a growing world population and a shift to metals intensive energy technologies like electric vehicles and renewable energy generators.

The biggest concerns when it comes to project delays come from the exploration, discovery and study phases, Argonaut says, with lack of funding, permitting, poor exploration results and metal prices all a factor.

In short,”unviable project economics” is normally where projects stall and hit delays. But permitting delays are also a concern, especially prominent in Canada and Brazil. The latter now has a 21-year gap between the start of a project and production, almost double that seen in Australia.

And even there, Argonaut notes, Rio Tinto has seen approvals blow out by 12-18 months in just five years.

A slow response from regulators to come up with a workable solution to the increased need to incorporate heritage assessments and traditional owner agreements into mining proposals is also hampering the sector in Australia as ESG requirements and compliance become more important.

“Requests by exploration and mining companies for heritage clearance surveys in WA were further stretched this year as the introduction of the new Aboriginal Cultural Heritage Act (2021) came into force on 1 July 2023,” Argonaut noted.

“The rush of survey requests overwhelmed available resources, and although the Act ultimately was repealed by the WA government after an overwhelming public pushback, the sector remains inhibited by long turnaround times.”

Bigger miners are now growing more from M&A than their own organic developments, with producers able to shortcut the system by buying fully permitted projects that are ready to be built.

But Argonaut warns a market where financiers are wary of funding smaller companies would dry this source of growth.

“Whilst this tactic has been successful to date, it still relies on a market where explorers and developers are being funded to advance projects,” Argonaut says.

“Unless conditions improve, we see a scarcity of quality development projects in WA and elsewhere that may force producers to up their exploration spend to ensure an ongoing supply of development assets.

“Capital constraints, a tangle of red and green tape, and geopolitical risks make it harder to move a project forward in a timely manner, encouraging growth by acquisition rather than development.

“The latter does nothing to grow supply in aggregate, in our view exacerbating what we increasingly see as a looming commodity supply crunch, particularly in the decarbonisation exposed space.”

However, many projects do have the muscle to power ahead.

How is the 2022 cohort going?

A check-in of last year’s 13-strong best undeveloped project list shows Argonaut has picked out some winners and some laggards.

Bellevue Gold (ASX:BGL) has now delivered first gold at the mine of the same name, while Liontown Resources’ (ASX:LTR) Kathleen Valley lithium mine is — M&A shenanigans and cost blowouts notwithstanding — more than 50% complete.

OreCorp’s (ASX:ORR) Nyanzaga has not been built, but is closer to production with the Nick Giorgetta and Tim Goyder backed Tanzanian explorer’s imminent takeover by Canadian listed, Chinese-focused SilverCorp Metals.

Others make another appearance on this year’s list — evidence they obviously remain undeveloped — and a handful have stalled or come a cropper on regulatory issues.

Perseus Mining’s (ASX:PRU) Meyas Sand/Block 14 project in Sudan for instance has had to be halted while the company arranges security to protect workers in the midst of a civil war.

Leo Lithium (ASX:LLL) is still building its Goulamina JV with Ganfeng in Mali, but reporting on the project has stalled while it works with the West African country’s military government on ownership arrangements for the mine.

Across its list of best undeveloped projects, those companies gained 6% over the period but were heavily impacted by market volatility, with the class up a collective 82% at one point during the year.

The 12 strong list of special mentions, which included Chalice Mining’s (ASX:CHN) Gonneville project and a host of other companies that lost favour as battery metals came off the boil, were down 22% YoY.

Who returned for the 2023 list?

And now to the 11 projects in the 2023 list.

Argonaut has five projects from last year still on the card.

One is De Grey Mining’s (ASX:DEG) undeniably world class Hemi project.

A potential M&A target for some of the world’s biggest gold miners, it confirmed its potential as one of the largest undeveloped gold projects in the world with a DFS in September that put a $1.3 billion price tag on the development of a project that will deliver 530,000ozpa over its first decade of life.

Production is now anticipated in 2026 for the project, where drilling is ongoing to expand Hemi’s 9.5Moz resource and studies are going to be undertaken on building a second processing plant to expand by mining regional pits away from the Hemi deposit.

With a similar capex, NexGen Energy (ASX:NXG) is planning to bring the Rook I uranium discovery in Canada’s Athabasca Basin to production by 2027.

It carries a $4.8b NPV and 60% IRR (25% is the base limit for BUP inclusion, with minor exceptions), something likely to rise if uranium prices continue their upward trajectory — up over 50% YTD.

Also on the 2022 list and making a return leg were Centaurus Metals’ (ASX:CTM) Jaguar nickel project in Brazil, Peak Resources’ (ASX:PEK) Ngualla rare earths project in Tanzania and Sovereign Metals’ (ASX:SVM) Kasiya in Malawi.

Jaguar carries an NPV of a little over $1 billion and IRR of 45%, with a planned start date of 2027 at a capex of $450m. However, Centaurus has pushed back its DFS timetable to Q1, 2024, meaning it will be around a year until we get an FID, with CTM looking for a strategic partner to advance the large nickel sulphide mine.

Peak is targeting an FID on Ngualla by the end of May 2024, having executed a binding offtake agreement and a non-binding strategic EPC and funding MOU with China’s Shenghe Resources.

The project is expected to deliver 37,200t of mixed rare earth concentrate annually for over 20 years, based on reserves of 18.5Mt at 4.8% REO for 887,000t rare earth oxide.

Sovereign meanwhile discovered the world’s largest natural rutile and one of its largest graphite deposits at Kasiya, which currently carries an $852m capex requirement and 25% IRR. But since last year it has brought Rio Tinto on board as a 15% shareholder (potentially rising to almost 20%), with the mining giant dead keen on investigating its graphite potential in the wake of China’s announced restrictions on exports of some battery-grade graphite products.

Who’s making their first appearance?

Critical minerals dominate the new entrants onto the list, with two promoted from last year’s special mentions.

They were Chilalo, a graphite project owned by $31m capped Evolution Energy Minerals (ASX:EV1) in Tanzania.

Since 2022, the company has signed a major new offtake with a major Chinese battery player.

“Key activities included completion of the Chilalo Graphite DFS/FEED, approval of key agreements with the Tanzanian Government, renewal of mineral licences and a new offtake and strategic agreement with graphite anode manufacturer BTR,” Argonaut analyst George Ross said.

“Chilalo’s long term profitability is predominantly driven by margins generated from sales of high-value, semi-refined expandable graphite for niche technology applications.”

Also promoted up the list was Global Lithium Resources’ (ASX:GL1) Manna project, 100km east of Kalgoorlie, where it has identified 36Mt of spodumene bearing ore at a grade of 1.13% Li2O.

“GL1’s Manna Project represents one of a handful emerging new Western Australian lithium projects of meaningful scale,” Ross said.

“Ongoing drilling and supporting technical studies continue to enhance the projects technical fundamentals. Results of the Manna DFS is scheduled for completion in Q1 of CY2024 with a Final Investment Decision anticipated to follow shortly thereafter.”

Completely new to the list were New World Resources’ (ASX:NWC) Antler copper project in the United States, London-listed by Australian led SolGold’s Cascabel copper project in Ecuador, Northern Minerals’ (ASX:NTU) Browns Range rare earths development and Atlantic Lithium’s (ASX:A11) Ewoyaa lithium project in Ghana.

Ewoyaa is targeting the earliest start date for mining of any of the stocks, with its eye on a 2025 christening for the 365,000tpa spodumene mine, the first in the West African nation.

Also backed by Piedmont Lithium (which will take a 50% stake in the project) and the Minerals Income Investment Fund of Ghana, the mine has emerged as an M&A target.

South Africa’s Assore, owner of around a quarter of Atlantic’s stock, was knocked back in a 33 pence (63c) per share bid for the rest of the Ewoyaa developer by the target’s board yesterday.

SolGold falls outside the 25% IRR limit and Aussie domiciled criteria set out by Argonaut, but makes the list given BHP and Newcrest (now Newmont) sit on its register as significant shareholders, and the project is of sufficient scale to justify inclusion despite its 19% IRR and near $4bn price tag.

It is looking at a phased approach to developing the 10.2Mt copper, 23.6Moz gold and 102.8Moz silver Alpala deposit with a staged transition from sub-level caving to block caving that could reduce the funding hurdle for the 132,000tpa copper and 358,000ozpa gold mine.

That was the same model used to develop OZ Minerals’ Carrapateena mine in South Australia.

With Browns Range, Argonaut says Northern Minerals has a lower risk development pathway forward, having inked a partnership for Iluka Resources to process its xenotime ore at a new rare earths refinery at Eneabba in WA.

That will avoid development costs and risks associated with a previous stategy to deliver an integrated mine and refinery for the project which boasts a resource enriched with high value heavy rare earth elements terbium and dysprosium.

Lastly, New World’s Antler, which carries an IRR of 40% and NPV of almost $1.2b, is among the best located projects on the list.

The high grade underground copper prospect — expected to deliver average life of mine production of 15,400t Cu, 37,400t Zn, 4600t Pb, 519,000oz Ag and 3100oz Au — is located in Arizona, just 200km southwest of Las Vegas across the border with Nevada.

“The Antler deposit represents one of a handful of undeveloped high-grade copper deposits within a top tier mining jurisdiction,” Ross said.

“Exploration programs completed since 2020 by New World Resources (NWC) have delineated extensive polymetallic mineralisation beneath historical workings.”

Argonaut best undeveloped projects share prices today

At Stockhead we tell it like it is. While De Grey Mining, New World Resources and Sovereign Metals were Stockhead advertisers at the time of writing, they did not sponsor this article

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.