Investors hope Congo cuts will support a turnaround in cobalt stocks

Mining

Cobalt investors are hoping a cut in sales by the Congo’s biggest producer could help bolster the price of the battery metal.

A sales suspension by one of the world’s biggest cobalt miners, Glencore, could stabilise recent price declines caused by a perception that the current cobalt market is oversupplied, experts say.

>> Scroll down for a list of ASX cobalt stocks and their recent performance

About 20,000 tonnes of cobalt hydroxide sales will be removed from the market until the third quarter of 2019 after Glencore announced an extended sales suspension due to radioactivity.

Glencore subsidiary Katanga Mining postponed cobalt sales from its Katomo mine in the Democratic Republic of the Congo for at least seven months after detecting high uranium levels in the product.

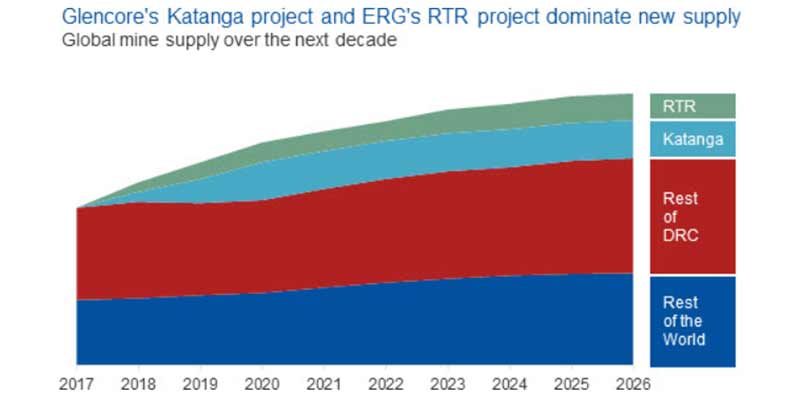

Katanga was in the midst of ramping up to 34,000 tonnes per year of cobalt hydroxide in 2019 – that’s equivalent to 21 per cent of global supply.

Analysts are divided on whether the supply side impacts will be significant or not.

But they do agree that this event could put a floor underneath the price of the battery metal and even catalyse a new period of growth – with cobalt stocks set to benefit.

Wood Mackenzie research director Gavin Montgomery says cobalt supply will now “significantly tighten” over the near term – and that’s without taking into account possible delays Glencore may have getting the uranium-removal process up and running.

“We think this will once again shift the balance of power from refiners back to miners,” Mr Montgomery says.

As spot cobalt prices have fallen over the second half of the year, so has the amount paid to miners.

This trend is likely to reverse sharply, Mr Montgomery says.

“Those [cobalt customers] caught short by Glencore’s suspension [will] rush to lock-in feedstock supply into 2019,” he says.

With concerns mounting that new cobalt supply is depressing prices, the suspension comes at a convenient time.

Seem opportunistic timing for #cobalt production issues at Katanga as Glencore is negotiating hydroxide supply deals for 2019 https://t.co/yZQsQeEjj1

— Caspar Rawles (@CDMRawles) November 6, 2018

And CRU analyst George Heppel told Stockhead there was absolutely no mention of uranium in a Katanga technical report published in March 2017.

“Glencore hasn’t had any major issues with uranium on the site before now, to my knowledge,” he says.

Roskill analyst Jack Bedder doesn’t believe the Katanga curtailment will have a big impact on overall supply – but it is likely to have a positive impact on prices over the short term.

“The curtailment won’t have a significant impact on the fundamentals, as there is sufficient hydroxide to meet demand at present, “he told Stockhead.

“But over the next three years the market will need Katanga to ramp up – and for major projects in the DRC to enter production.”

Mr Bedder says cobalt prices may have hit a floor and will now stabilise.

“We expect prices to remain around the US$35/lb mark over the short term,” he says.

“Roskill doesn’t expect prices to fall much below that owing to a tightness in the metal market.”

CRU’s George Heppel said growing global cobalt production would easily offset Katanga’s loss – and market sentiment would improve regardless.

“Around 20,000 tonnes of cobalt hydroxide has effectively been removed from supply between now and Q3 2019,” he told Stockhead.

“This may sound like a large amount, but I don’t believe that it is large enough to cause a shortage in cobalt over the next six months.

“We have seen a huge increase in cobalt production from the DRC from the likes of [producers] ERG, Shalina, Jinchuan, Huayou and many others, which should be more than enough to offset this.”

However, prices for cobalt hydroxide — which have been falling steadily due to new supply for the last few months — will undoubtedly rise as a result, Mr Heppel says.

“[And] it will definitely result in an improvement in sentiment which could renew interest in the cobalt market and subsequently boost prices,” he says.

This is welcome news for cobalt-facing ASX stocks, which have been battered this year.

Most have suffered significant share price declines, irrespective of how impressive (or not) their projects look on paper.

Small cap investors – concerned by the battery metals oversupply narrative – have been unimpressed by strong announcements and punished the slightest hint of bad news.

But in the last week or so we have seen green shoots – 23 share price winners in our representative list of cobalt stocks on the ASX.

Some of these are significant too.

Arguably a bellwether for small cap cobalt stocks, Australian Mines (ASX:AUZ) has looked to turn a corner this month – up 50 per cent to 6c.

That’s still a distance away from the 14c share price seen in January, but if the explorer puts together a strong bankable feasibility study (and financing) for Sconi, investors could push it a lot higher.

Other big winners over the past week included Fe (ASX:FEL), up 70 per cent to 1.7c; Pure Minerals (SX:PM1) up 50 per cent to 1.5c; Meteoric Resources (ASX:MEI), up 33 per cent to 4c; and Ardea Resources (ASX:ARL), up 27 per cent to 69c.

The cobalt market could enter a supply deficit as soon as 2023 if new mines don’t come online.

“There are around 200 cobalt projects that we are tracking,” Roskill’s Jack Bedder says.

“[But] few are at advanced stages. Few are of a large scale.

“And of course, these are mostly copper or nickel projects.”

This is because cobalt supply is closely tied to copper and nickel production – meaning a cobalt resource is only developed if the incentive price for nickel or copper supports that investment.

“Roskill’s ten-year outlook for cobalt consumption is a trebling of the market – to around 360,000 tonnes by 2028,” he says.

“There should be sufficient refined cobalt and cobalt feedstock for the next 3 years – but after that we will need to see some projects enter the market.”

Here’s a list of ASX cobalt stocks and their recent performance:

Swipe or scroll to reveal full table. Click headings to sort

| ASX code | Company | Change since Nov 2 | One-year price change | Price Nov 9 (intraday) | Market Cap |

|---|---|---|---|---|---|

| FEL | FE | 0.7 | -0.190476190476 | 0.017 | 4.8M |

| WCN | WHITE CLIFF MINE | 0.5 | -0.939759036145 | 0.015 | 1.3M |

| PM1 | PURE MINERALS | 0.5 | -0.347826086957 | 0.015 | 4.7M |

| MEI | METEORIC RESOURC | 0.5 | -0.791666666667 | 0.015 | 8.6M |

| MLM | METALLICA MINRAL | 0.333333333333 | -0.166666666667 | 0.04 | 10.0M |

| SGQ | ST GEORGE MINING | 0.285714285714 | 0.565217391304 | 0.18 | 55.2M |

| ARL | ARDEA RESOURCES | 0.277777777778 | -0.56050955414 | 0.69 | 72.4M |

| FCC | FIRST COBALT-CDI | 0.261904761905 | na | 0.265 | 89.9M |

| CLQ | CLEAN TEQ HOLDIN | 0.251219512195 | -0.683333333333 | 0.513 | 383.9M |

| CFE | CAPE LAMBERT RES | 0.25 | 0.0416666666667 | 0.025 | 22.3M |

| LRS | LATIN RESOURCES | 0.25 | -0.166666666667 | 0.005 | 11.4M |

| AZI | ALTA ZINC | 0.2 | -0.538461538462 | 0.006 | 8.2M |

| MRR | MINREX RESOURCES | 0.2 | -0.714285714286 | 0.024 | 2.3M |

| AUZ | AUSTRALIAN MINES | 0.2 | -0.555555555556 | 0.06 | 168.4M |

| N27 | NORTHERN COBALT | 0.166666666667 | -0.776595744681 | 0.105 | 5.3M |

| EUC | EUROPEAN COBALT | 0.15 | -0.795555555556 | 0.046 | 34.3M |

| CNJ | CONICO | 0.15 | -0.46511627907 | 0.023 | 8.1M |

| ARV | ARTEMIS RESOURCE | 0.107142857143 | -0.617283950617 | 0.155 | 98.2M |

| HIG | HIGHLANDS PAC | 0.1 | 0 | 0.11 | 125.7M |

| TKM | TREK METALS | 0.1 | -0.676470588235 | 0.011 | 3.7M |

| GAL | GALILEO MINING L | 0.0882352941176 | na | 0.185 | 22.3M |

| TAR | TARUGA MINERALS | 0.0833333333333 | -0.22619047619 | 0.065 | 9.0M |

| CLL | COLLERINA COBALT | 0.0769230769231 | 0.609195402299 | 0.14 | 82.2M |

| AXE | ARCHER EXPLORATI | 0.0714285714286 | -0.0506329113924 | 0.075 | 14.3M |

| CZI | CASSINI RESOURCE | 0.0625 | -0.123711340206 | 0.085 | 28.3M |

| COB | COBALT BLUE HOLD | 0.0434782608696 | -0.213114754098 | 0.24 | 28.5M |

| PGM | PLATINA RESOURCE | 0.0333333333333 | -0.704761904762 | 0.062 | 17.2M |

| HAV | HAVILAH RESOURCE | 0.0263157894737 | -0.0714285714286 | 0.195 | 42.6M |

| GPP | GREENPOWER ENERG | 0 | -0.809523809524 | 0.004 | 6.3M |

| CGM | COUGAR METALS NL | 0 | -0.8125 | 0.003 | 2.9M |

| AYR | ALLOY RESOURCES | 0 | -0.555555555556 | 0.004 | 6.3M |

| RIE | RIEDEL RESOURCES | 0 | -0.516129032258 | 0.03 | 12.5M |

| PAN | PANORAMIC RESOUR | 0 | 0.087962962963 | 0.47 | 232.4M |

| CCZ | CASTILLO COPPER | 0 | -0.433962264151 | 0.03 | 16.8M |

| BSX | BLACKSTONE MINER | 0 | -0.702127659574 | 0.14 | 13.5M |

| AX8 | ACCELERATE RESOU | 0 | na | 0.1 | 4.8M |

| ZNC | ZENITH MINERALS | -0.0125 | -0.313043478261 | 0.079 | 16.6M |

| NZC | NZURI COPPER | -0.02 | 0.19512195122 | 0.245 | 74.0M |

| GED | GOLDEN DEEPS | -0.02 | 0.139534883721 | 0.049 | 8.4M |

| HMX | HAMMER METALS | -0.0333333333333 | -0.292682926829 | 0.029 | 7.8M |

| OKR | OKAPI RESOURCES | -0.05 | -0.577777777778 | 0.19 | 6.5M |

| BAR | BARRA RESOURCES | -0.05 | -0.296296296296 | 0.038 | 20.2M |

| BMT | BERKUT MINERALS | -0.0625 | -0.772727272727 | 0.075 | 4.1M |

| HGM | HIGH GRADE METAL | -0.0666666666667 | -0.125 | 0.028 | 12.7M |

| AML | AEON METALS | -0.0689655172414 | 0.227272727273 | 0.27 | 164.5M |

| PIO | PIONEER RESOURCE | -0.1 | -0.454545454545 | 0.018 | 27.1M |

| ANW | AUS TIN MINING L | -0.1 | 1 | 0.018 | 37.6M |

| GME | GME RESOURCES | -0.111111111111 | -0.57671957672 | 0.08 | 38.6M |

| MQR | MARQUEE RESOURCE | -0.122222222222 | -0.62380952381 | 0.079 | 3.4M |

| NWC | NEW WORLD COBALT | -0.125 | -0.766666666667 | 0.035 | 18.6M |

| JRV | JERVOIS MINING | -0.15 | -0.595238095238 | 0.17 | 40.2M |

| MTC | METALSTECH | -0.166666666667 | -0.84126984127 | 0.05 | 6.5M |

| KOR | KORAB RESOURCES | -0.166666666667 | -0.166666666667 | 0.025 | 8.3M |

| THX | THUNDELARRA | -0.2 | -0.272727272727 | 0.016 | 10.8M |

| CAV | CARNAVALE RESOUR | -0.2 | -0.529411764706 | 0.008 | 5.3M |

| BPL | BROKEN HILL PROS | -0.22 | -0.264150943396 | 0.039 | 5.8M |

| CAZ | CAZALY RESOURCES | -0.233333333333 | -0.425 | 0.023 | 5.3M |

| VML | VITAL METALS | -0.3 | 0 | 0.007 | 13.9M |

| RMX | RED MOUNTAIN MIN | -0.3 | -0.666666666667 | 0.007 | 4.1M |

| MTH | MITHRIL RESOURCE | -0.3 | -0.766666666667 | 0.007 | 1.4M |

| CZN | CORAZON MINING L | -0.3 | -0.708333333333 | 0.007 | 8.9M |

| CTM | CENTAURUS METALS | -0.3 | 0.4 | 0.007 | 13.8M |

| CLY | CLANCY EXPLORATI | -0.333333333333 | -0.714285714286 | 0.002 | 7.0M |

| CLA | CELSIUS RESOURCE | -0.35 | -0.322916666667 | 0.065 | 49.1M |

| HCO | HYLEA METALS | -0.5 | -0.909090909091 | 0.001 | 5.6M |

| BDI | BLINA MINERALS N | -0.5 | -0.5 | 0.001 | 4.3M |