Guy on Rocks: This virile young REE stock will likely ‘surprise to the upside’

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

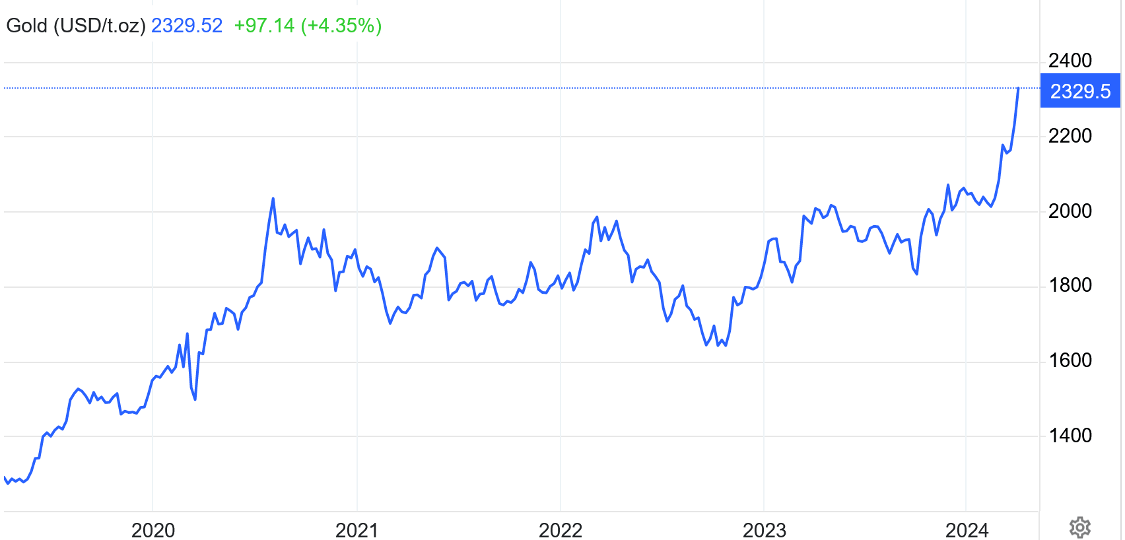

Gold (figure 1) finished the week at US$2,322/ounce up another 4.5% for the week and was trading at US$2,338/ounce early Tuesday morning.

Gold has gained over US$300 in the last few months, overbought in the view of the Mercenary Geologist Mickey Fulp in his weekly podcast, however in inflation adjusted dollars he believes gold should be trading closer to US$3,000/ounce.

Silver continues to lag gold and closed at US$27.32/ounce, up 10% on the week. Platinum and palladium didn’t follow gold’s lead with platinum up US$18 to close at US$925/ounce and palladium down US$13 to finish the week at US$984/ounce.

Gold responded positively to a strong jobs report in March which showed the addition of around 303,000 jobs, well above expectations.

Unemployment also fell to 3.8%, however a closer look at the figures shows part time jobs accounted for much of the improvement together with government and government healthcare related positions in response on the back of the government’s US$1.7 trillion healthcare spend.

The US dollar was slightly weaker off 24 basis points for the week to close 104.3, after soaring above 105 after Powell’s speech last week. US 10-year treasuries were also up 20 basis points to close at 4.40% representing a 4½ month high.

Over the last week, the Federal Open Market Committee has been non-committal regarding the prospect of interest rate cuts with the CME FedWatch Tool now predicting a 54% chance of a rate cut in June compared to 60% last week.

While this environment isn’t necessarily the ideal driver of gold prices, Ole Hansen, from Saxo Bank, suggests gold is attracting safe haven flows in response to geopolitical tensions in the Middle East.

Like Mickey Fulp, Nicholas Frappell, from ABC Refinery however also believes gold is somewhat overbought at current levels.

Although the Federal Reserve has been hesitant to signal the start of a new easing cycle, it is clear the Fed’s next move is a cut. Frappell also goes on to point out that “…the next Fed funds move is a cut, and historically, that led to 57%, 235%, and 69% gold price increases in 2000, 2006, and 2018”.

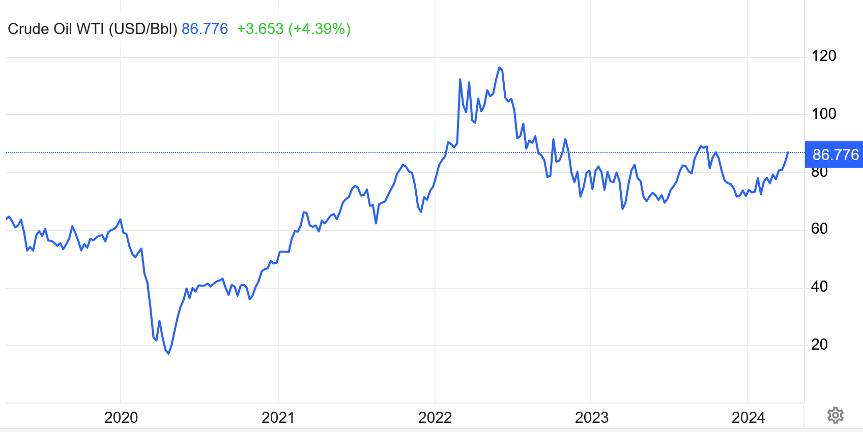

Oil (figure 2) prices also responded to escalating tensions in the Middle East and was up over 2% last week closing at to climb over US$90/bbl for the first time since October last year before settling at US$87/bbl.

At the same time the US government put a halt on further strategic oil purchasing until October this year with stockpiles less than half compared to the period of the Trump administration.

In prior years this reserve was never used to supplement daily domestic demand and was only supposed to be used in times of crisis.

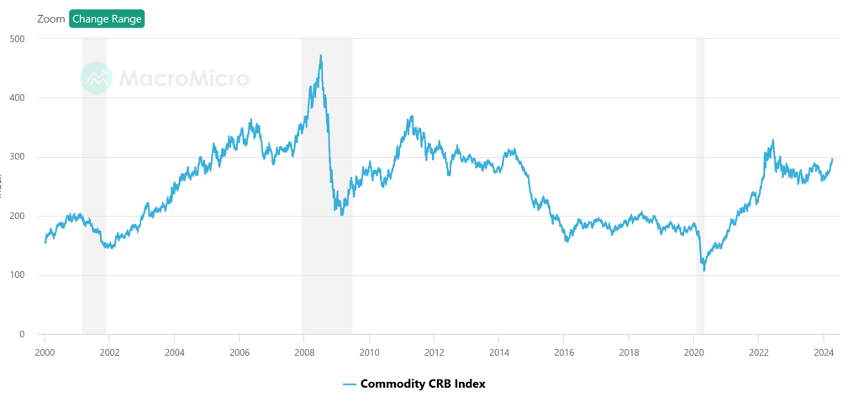

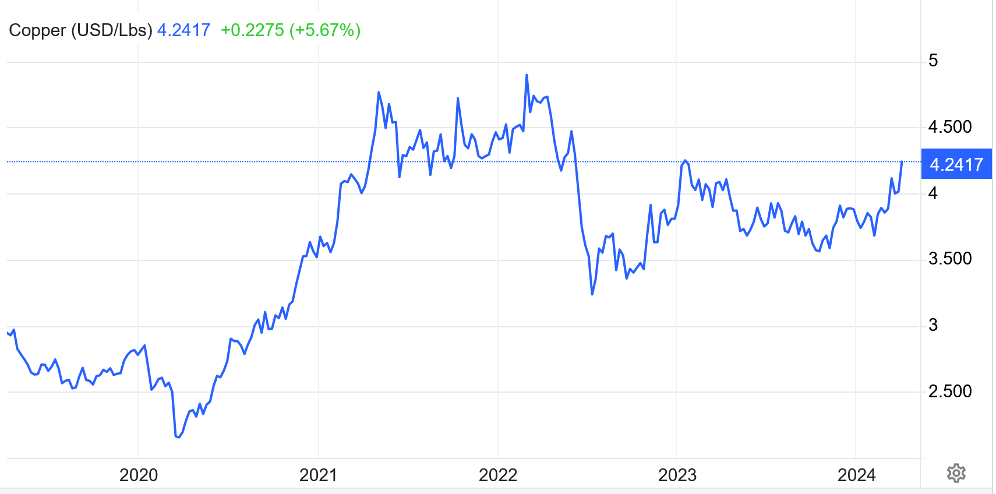

Commodities as measured by the CRB index (figure 3) are up over 13% year to date with copper (figure 4) gaining 20 cents to close at US$4.24/lb for a 14-month high.

Commodities generally appear to be catching up with the prevailing high-inflationary environment. Notably three-month copper futures are at a very large 10 per cent contango driven by Chinese smelter cuts and production shortfalls from the DRC.

It appears supply side pressures are having more influence in the short term than falling copper demand from China.

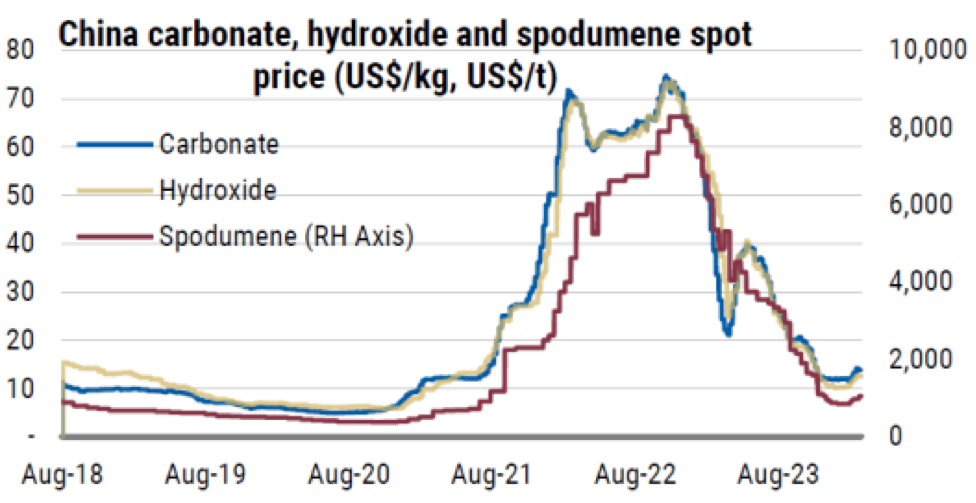

China lithium carbonate prices (ex-VAT) price have rallied 18% this year (figure 5), driven by environmental inspections in China, which, according to Morgan Stanley (March 2024), has seen roughly one-third of lepidolite production halted.

The prevailing low prices have seen significant supply cuts with approximately 78kt or 6% of global supply wiped from Morgan Stanley’s production estimates since December 2023.

This includes slower growth from SQM and reduced output from Greenbushes and Mt Cattlin, among others.

The projected 2024 surplus has been therefore reduced to approximately 107kt, but the bank still believes that supply will outpace demand by +27% YoY, so further production cuts are likely.

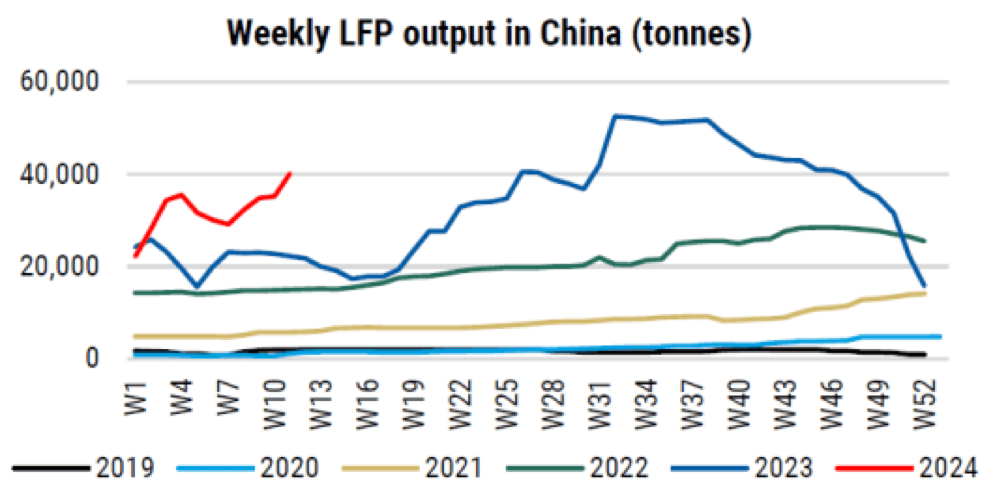

With weekly LFP cathode output up ~40% since the beggining of February this year (figure 6), this explains the pick-up in China’s lithium carbonate inventory.

Overall, according to Morgan Stanley, the near-term outlook for lithium looks well supported due to supply cuts, environmental disruptions and higher than expected China cathode output.

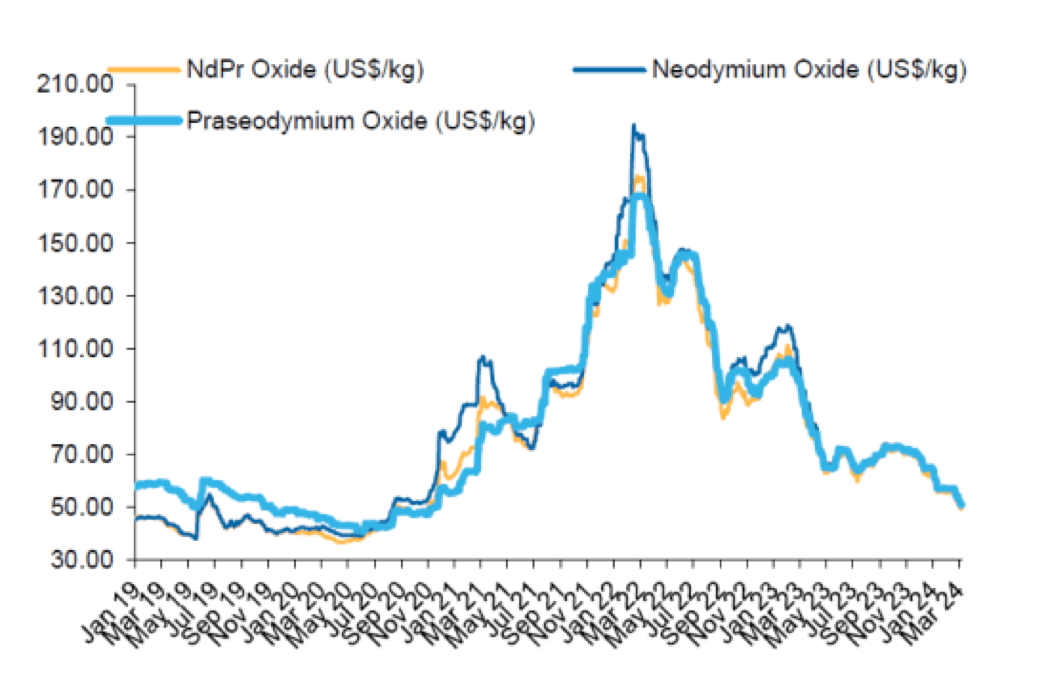

Rare earths have been a tough gig for the last 18 months or so with declining basket prices with Nd/Pr, the more valuable of the rare earths basket, under serious pressure (figure 8).

One thing the market has learnt the hard way is that there are very few genuine ionic rare earths projects out there with the majority being promoted in Australia being saprolite hosted requiring more aggressive sulphuric or in some cases hydrochloric acid at very low PHs to achieve acceptable extractions.

The advantage with ionic clays is they can be leached with ammonium sulphate at PHs of 4 so, not only is it cheap, but the equipment specifications and capex/sustaining capital is significantly lower.

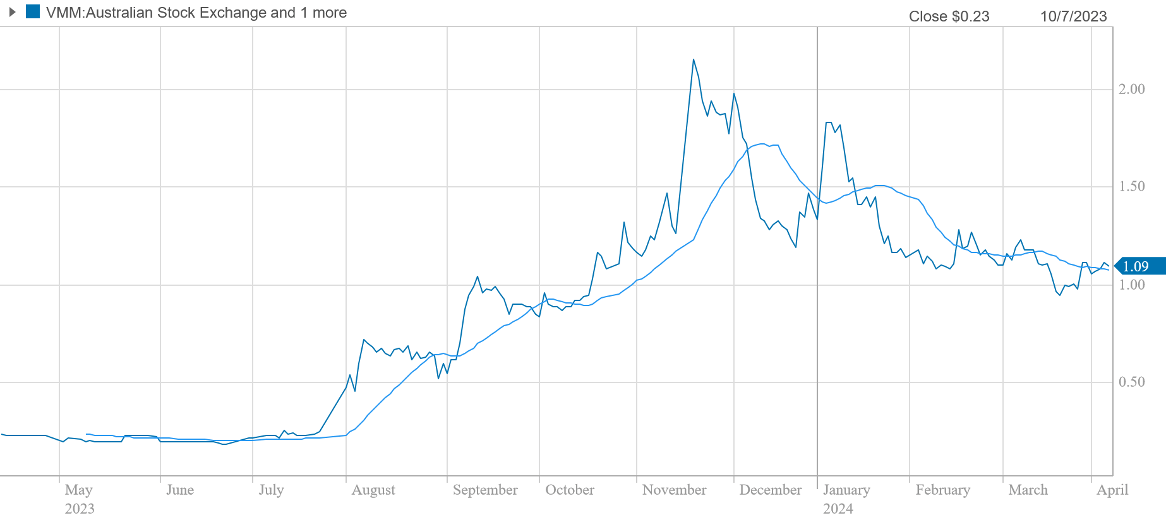

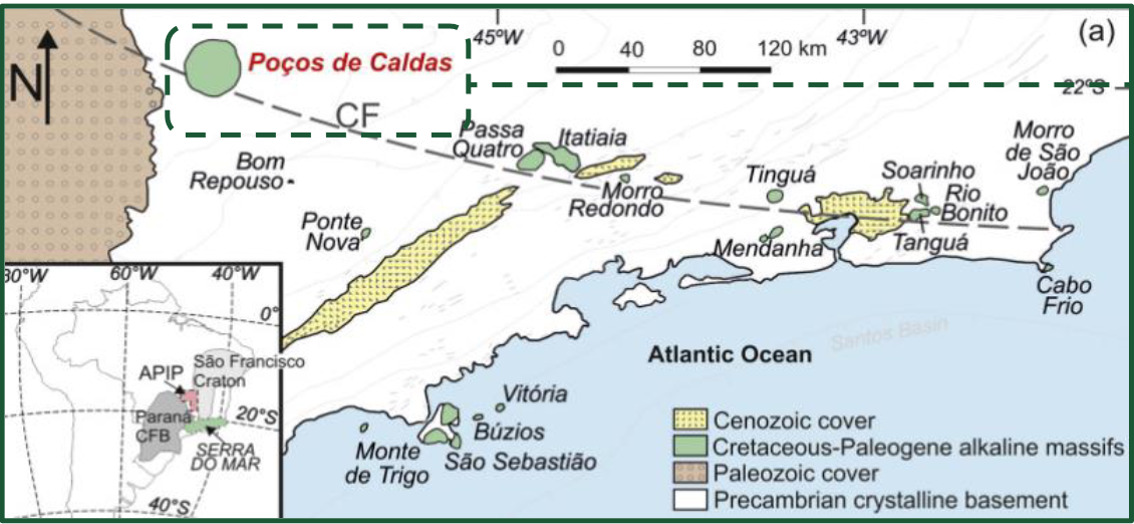

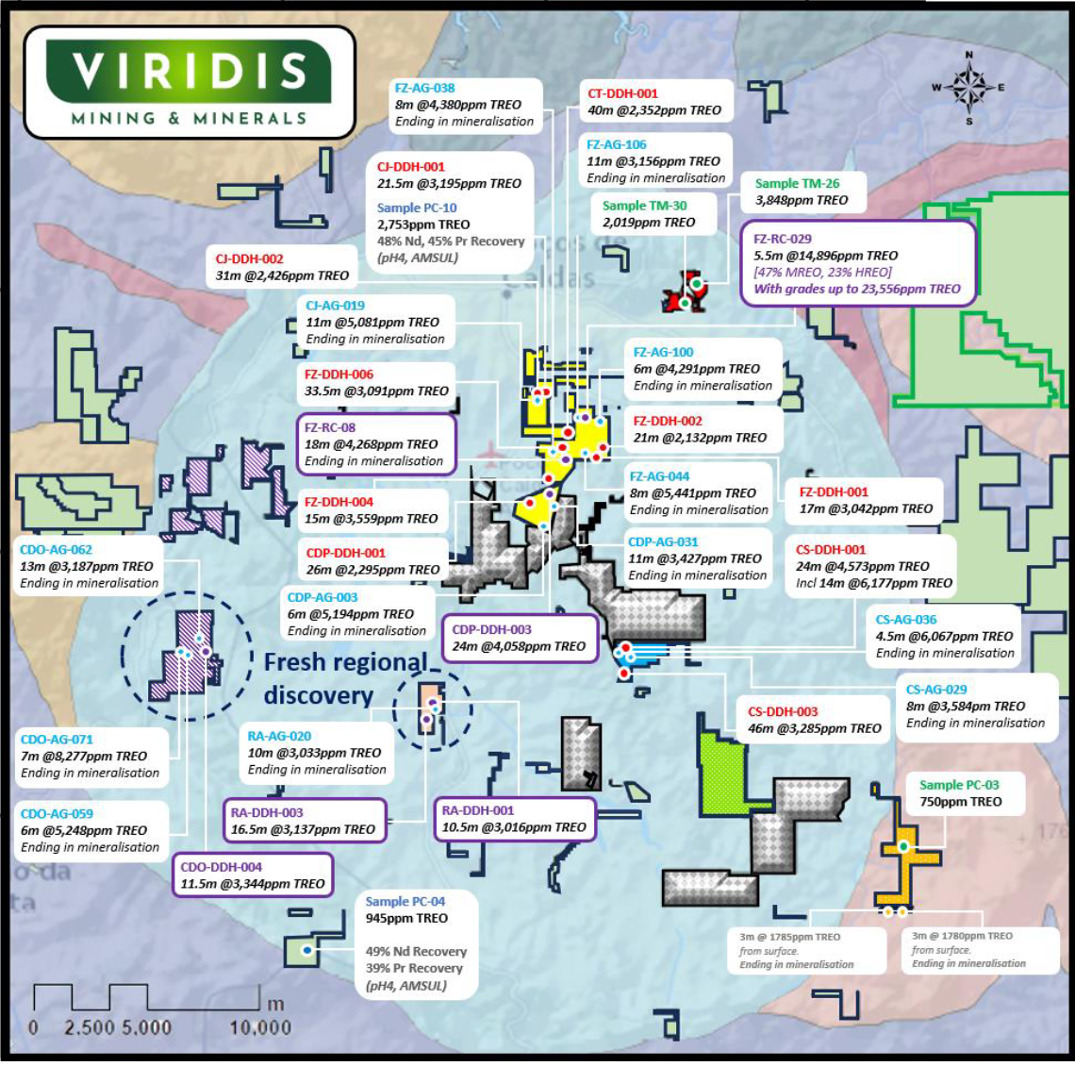

Viridis Mining and Minerals (ASX:VMM) holds ground adjacent to Meteoric Resources’ (ASX:MEI) Caldeira project (409Mt @ 2,626ppm TREO) and appears to have the same favourable metallurgy (figure, 9 and 10) as well as significant resource potential.

I know there are many Latin scholars out there among the Stockhead faithful and you would be well aware that the Latin viridis means “green, young, fresh, lively, youthful” and more than likely where the English word “virile” comes from.

I did have the good sense to order a blood test from CEO Rafael Moreno when he dropped into our office the other day to check his testosterone levels and I am happy to report, the laboratory report showed he was in the normal to high range. With a name like Rafael, I would expect nothing less.

Well, anyone looking for testosterone boost (or progesterone as the case may be) could do worse than have a closer look at VMM.

In the second half of last year exploration by VMM has been successful in delineating vast areas of >5,000ppm TREO within its Mining Licenses and now has more than seven drill rigs on site with a view to completing a maiden resource this half. All the concessions so far (figure 10) appear to be returning excellent grades in ionic clay material.

If you want a deep dive go to the Company’s recent releases and February 2024 Presentation.

As it happens, in news just out yesterday, VMM Maiden RC and diamond drilling at Centro Sul and Tamoyo has also made two discoveries North and South of the alkaline complex with a number of impressive intersections including TM-DDH-005: 15m @ 6,153ppm TREOA from surface, including 8m @ 9,765ppm TREO (38% MREOB). This included a peak grade of 1m at 27,087ppm TREO and 423ppm Dy-Tb Oxide.

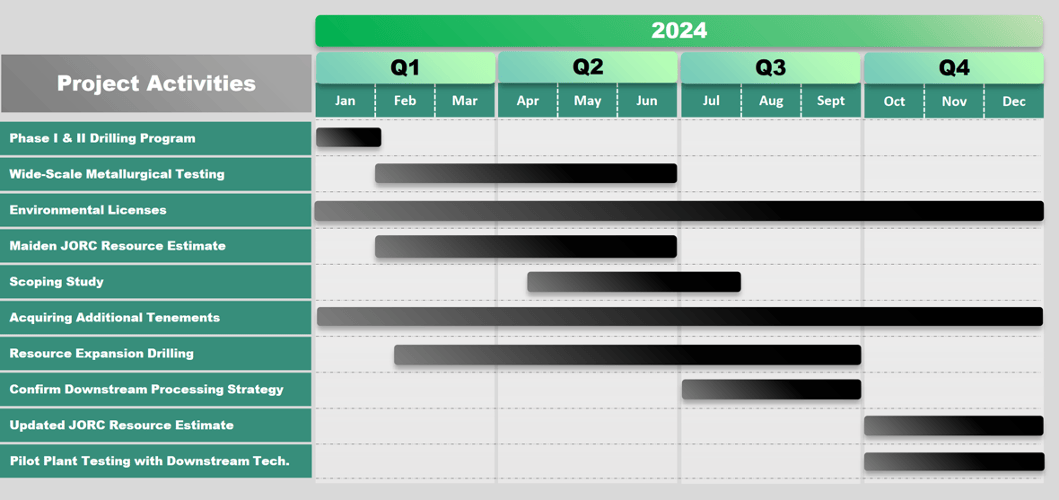

Plenty of results to flow this year (figure 11) including a maiden Mineral Resource Estimate which is likely to surprise on the upside.

With a market capitalisation of $58 million for VMM versus $457 million for MEI, I can’t help thinking there is a pricing mismatch going on here!

In case you were concerned about my testosterone levels, they also came back in the high to normal range. Apparently, a product of clean living. I am sure the Cigar Social Climate Change Sceptic Committee will be proud of me.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.