If you’re looking for a lithium player who could outride the volatility, this could be your hedge

Mining

Mining

Special Report: While the long-term demand picture for lithium looks very rosy indeed, for an emerging producer it’s a great strategy to have a second equally valuable co-product.

While in the short-term there will be some supply-demand imbalances and lithium price volatility, all indicators point to a market that will increase five-fold over the next decade.

Many market watchers expect the overwhelming demand side to eventually get both lithium and cobalt out of their current predicaments.

In short, we’re in the first phase of a broader lithium story — and while the market sorts itself out, expect to see more volatility.

It’s in this context that lithium miners offering more than the white metal (particularly juniors) will be able to ride out the storm, while still being in a great position when the lithium price picks back up.

In the small cap space, that’s not all that common — enter ioneer (ASX:INR).

The main game for ioneer is its Rhyolite Ridge project in Nevada.

What makes Rhyolite Ridge different than other lithium projects is that boron is a genuine co-product, as both lithium carbonate and boric acid are to be produced at the mine site.

ioneer is planning to process only the lithium-boron ore and stockpile the lithium-only mineralisation.

According to the latest numbers on the project, the lithium-boron resource for the project is 154 million tonnes, which contains 1.3Mt of lithium carbonate and 12.4Mt of boric acid.

The maiden measured lithium-boron resource for the project is 41Mt at 1,700 parts per million lithium and 14,400 parts per million boron.

In either case, the project offers up roughly 8 parts boron to every one part lithium. In a neat bit of maths, one tonne of lithium carbonate sells for at least 10 times more than one tonne of boric acid.

The boron revenue will pay for ioneer’s operating costs, meaning the company is uniquely well placed to thrive even at lithium carbonate prices less than the current $US10,000 per tonne.

You can take a look at the nuts and bolts of its proposed project below.

At this stage, the company is making progress towards a definitive feasibility study, which should be wrapped up in late September this year. Production has been pencilled in for late 2021 (although it would have signed offtake agreements before this point).

The lithium portion of the project is welcome in a country which has put a new-found focus on ‘critical minerals’.

Amid the trade dispute with China, the US Department of Commerce set up an action plan aimed at shoring up supply of 35 minerals deemed important to national security — lithium being one of them.

It’s due to present its final report to President Donald Trump in the middle of this month.

At this point in time, ioneer is shaping as the first major domestic producer of lithium in the US, where industrial users such as Tesla are sure to want to ensure supplies of this essential component of their electric vehicles from a safe, ethical source.

But it’s not necessarily the lithium portion of its project which is driving excitement for ioneer (especially in times of headlines about depressed prices); it’s the fact it’s also plans to produce boron which takes ioneer from the realm of ‘just another lithium junior’ into the realms of something very interesting indeed.

Boron, as it turns out, is anything but boring. It’s shaping up not only as a key mineral for increasing urbanisation in Asia, but also to making sure farms are able to get the best out of their crops.

If you’re interested in the nuts and bolts of boron, you can take a quick look at this primer we’ve written up.

>>BORON: Everything you ever wanted to know about boron… including how it may save the world

But the really interesting part, from a producer’s point of view, is about how stable the supply side is.

There are estimates that just two – that’s right, two – producers control 80 per cent of the refined boron market. That’s helped prices remain somewhat stable.

It’s certainly not been subject to the ‘boom and bust’ cycle we’re seeing play out in lithium circles at the moment.

The demand side is also fairly robust, with some estimates forecasting out a compound annual growth rate of 4.5 per cent.

While it doesn’t compare to lithium’s growth prospects (some estimating a CAGR of around 18 per cent), it does give ioneer access to a stable market which has good growth prospects in its own right.

But what makes ioneer really interesting, certainly from an investor viewpoint, is the way it’s set to use boron to almost wipe out the entire cost base at Rhyolite Ridge.

Here’s how:

How boron credits will help it see through the worst of the lithium slump

A quick look through ioneer’s (then named Global Geoscience) pre-feasibility study released towards the back-end of last year illustrate how boron is becoming vital to placing ioneer at the bottom of the lithium cost curve worldwide.

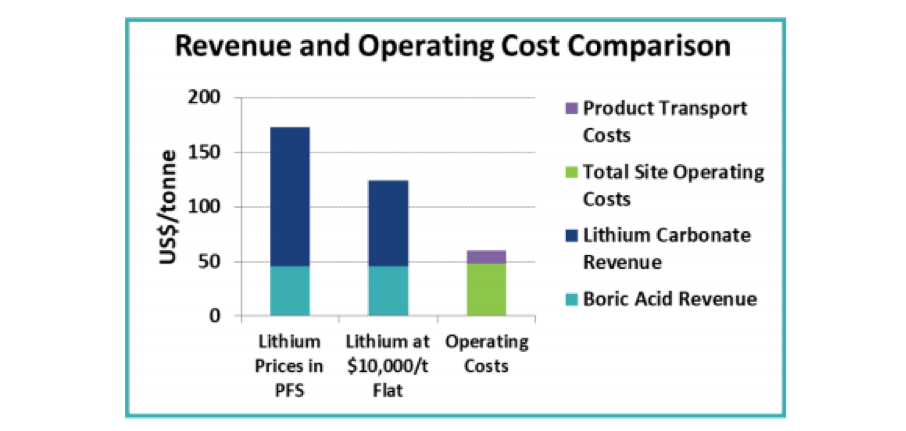

As you can see from this chart alone, the revenue from the sale of boric acid from the project almost entirely wipes out the total site operating costs.

So, there are a few uncertainties in the picture for lithium in the years to come, but the robust demand side isn’t in question, just how much supply will make its way to the market in time to meet very rapidly growing demand..

But thanks to its boron credits, ioneer is in a great position.

It’s managed to get its cost of production down to $1796 per tonne, thanks largely to the boron credit.

So whether the lithium demand growth goes the way pessimistic Morgan Stanley thinks it will, or whether it goes the way more optimistic Roskill and Benchmark Mineral Intelligence thinks it will, ioneer will have the certainty of boron sales taking care of costs.

And that’s certainly an envious position to start from for any miner, let alone a junior.

>> Now watch: 90 Seconds with… Bernard Rowe, ioneer Ltd