‘I don’t think people expected +500,000oz’: BMG’s Bruce McCracken talks upside at Abercromby

Mining

Mining

How many sub $10m capped explorers have a +0.5Moz free milling gold resource, surrounded by mining majors, in an established WA goldfield?

Not many, we reckon.

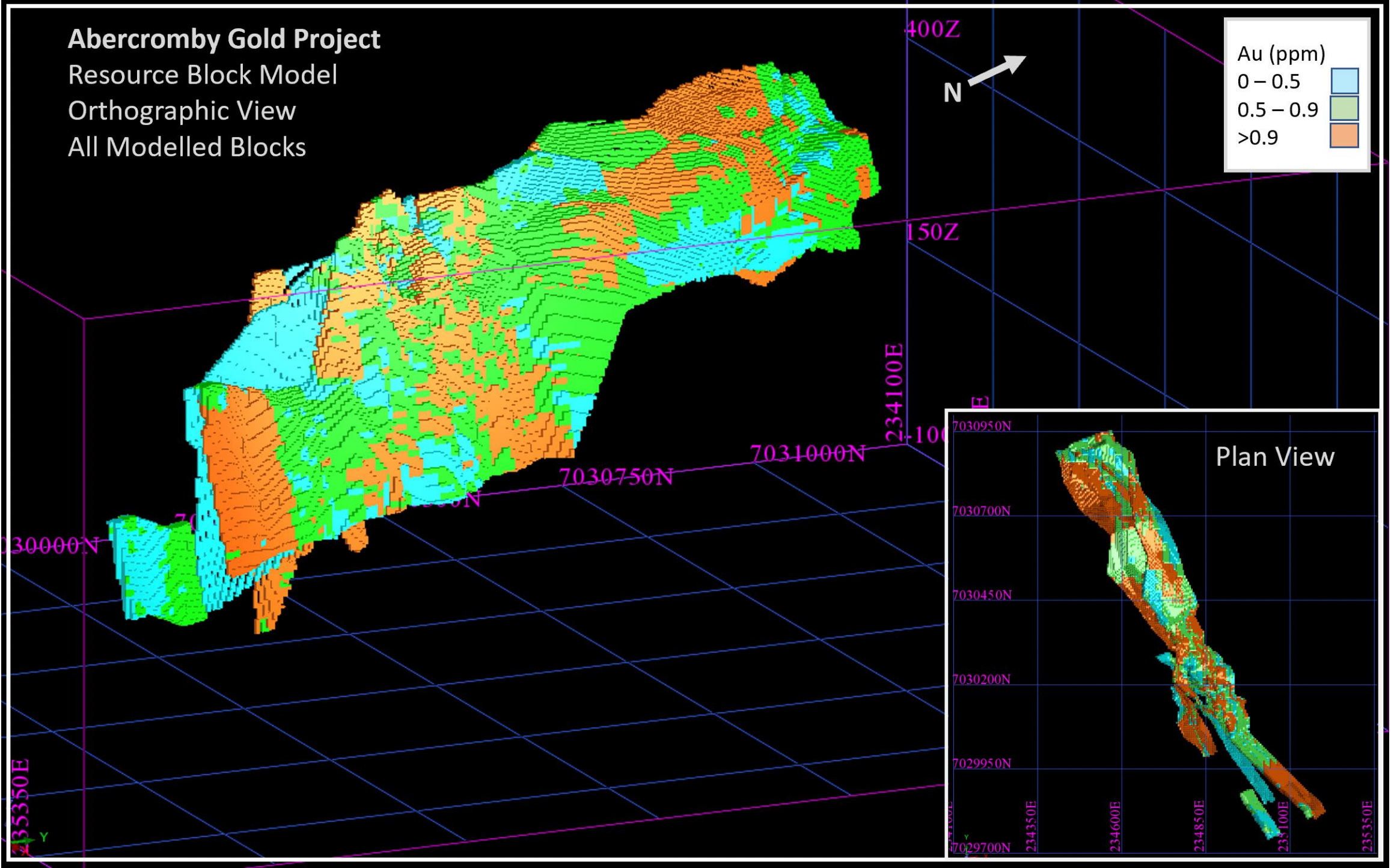

In April, BMG RESOURCES (ASX:BMG) unveiled a maiden 518,000oz resource for the Abercromby project, delivered at a discovery cost of just $8.35 per ounce.

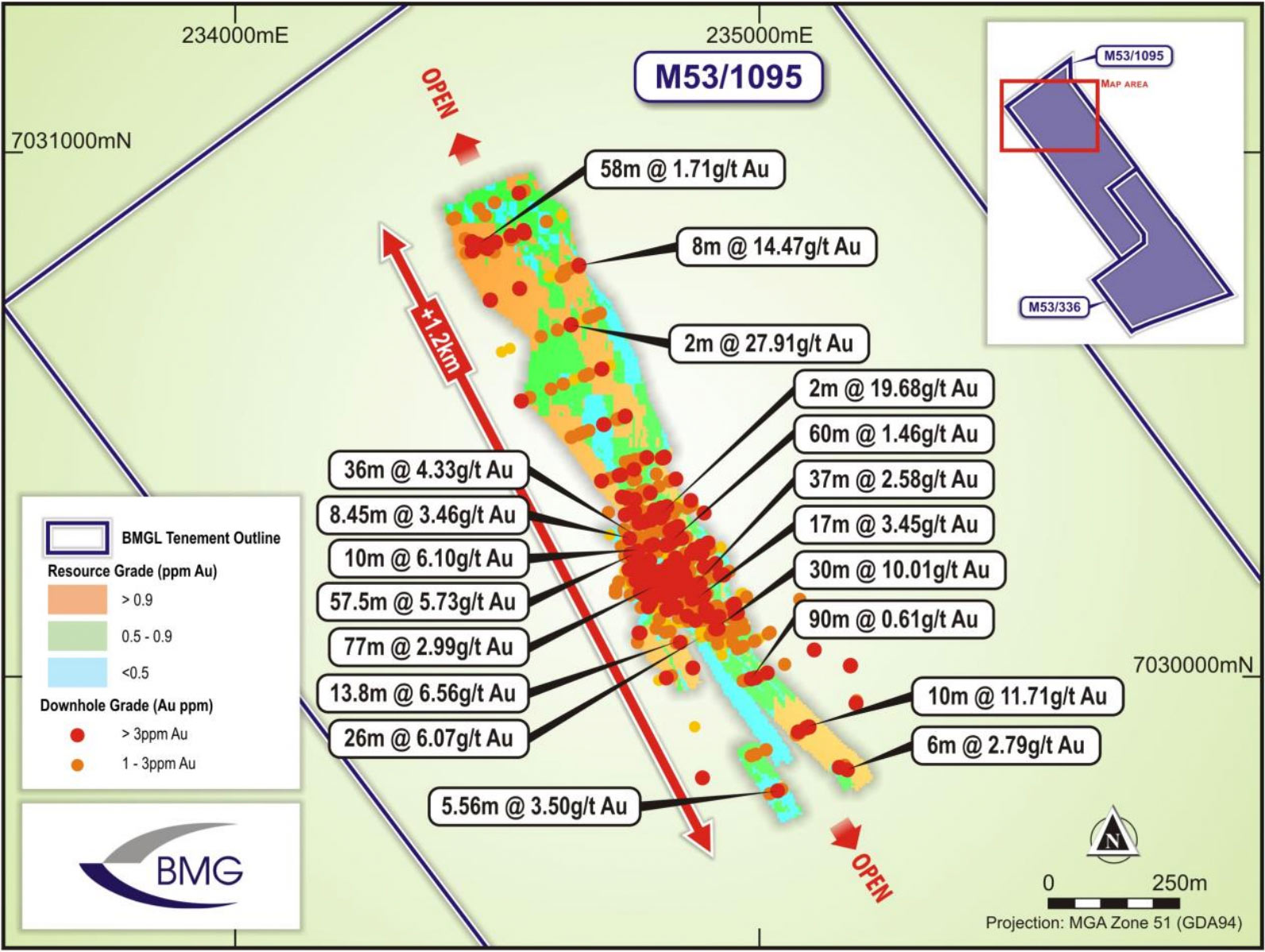

The resource comprises 354koz @ 1.17g/t Au (open pittable) and 164koz @ 3.09g/t Au (underground) at the Capital deposit, with 68% in the higher confidence indicated category.

70% of ounces are within 200m of surface, with mineralisation ‘open’ at depth and along strike.

Abercromby was acquired by BMG in 2020 after sitting idle in the portfolio of mining majors for much of the last 20 years, despite historic hits at Capital like 57.5m @ 5.73g/t Au from 80m.

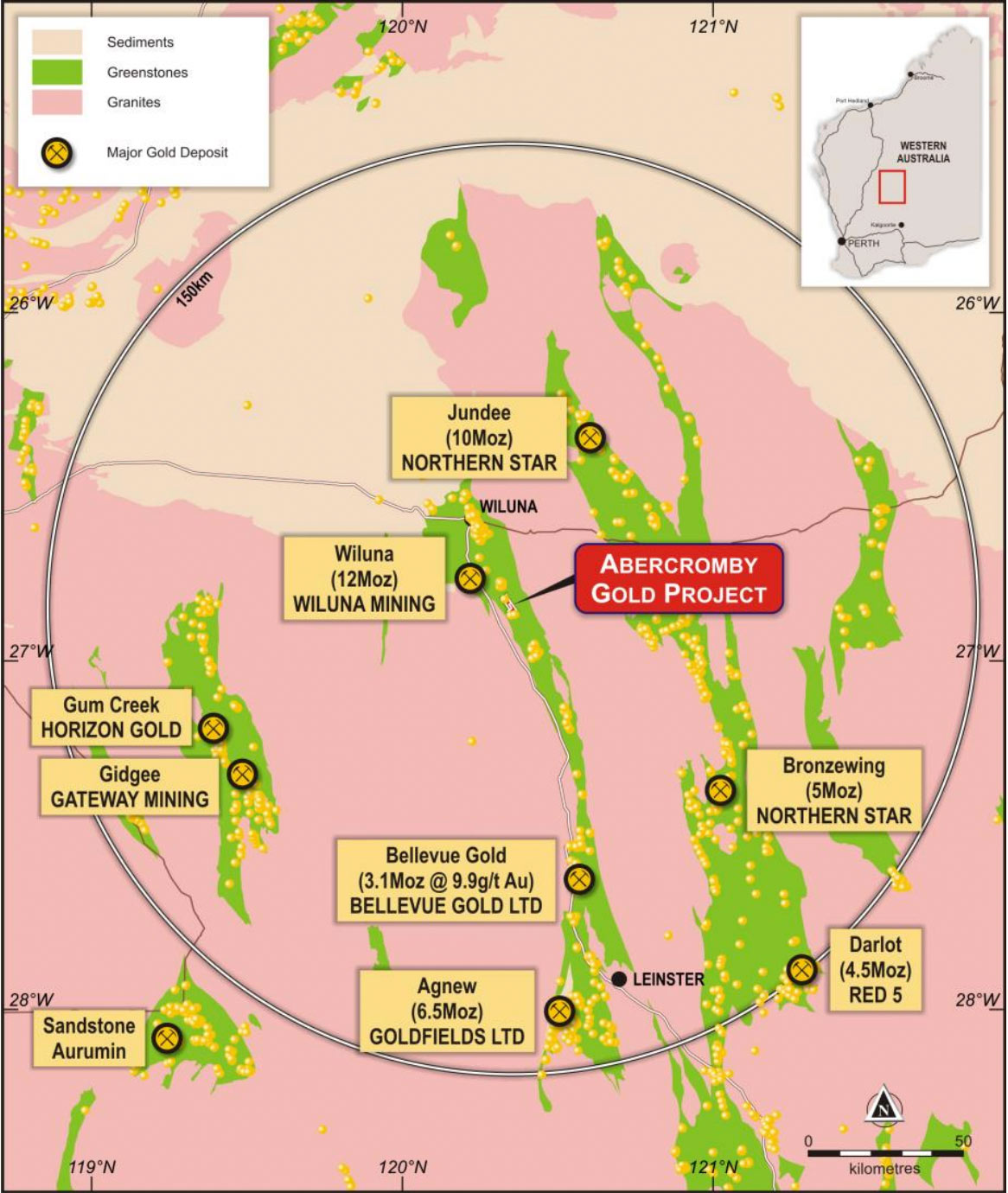

The project – a stone’s throw from the Wiluna (10Moz) and Jundee (10Moz) operations — is already on a mining lease.

BMG plans to get started on mining studies, alongside more drilling at Capital and other nearby targets.

We sat down for a chat with long time BMG MD Bruce McCracken.

“In the time I’ve been at BMG, this is really the most exciting point because there’s a pathway to development,” McCracken says.

“We’ve gone from explorer to explorer/potential developer now that we have a resource which gives us a quantifiable metric to value this project.

“Wiluna is a very ounce-heavy province with a lot of production, a lot of major players. So how do we extract this value at the end of the day?

“We want Abercromby to be mined, whether it’s us or whether it’s someone else.”

“And we’ve done a lot of met work now, because Wiluna down the road has some refractory issues,” McCracken says.

“The good news is that [Abercromby] is free milling, not refractory, and the recovery is good – ~95% with low reagent use.

“That lends itself to conventional processing, which means it opens itself up to all the production availability in the region.

“That’s a real positive.”

“The gold discovery was made back in the late ’90s by CRA [Rio Tinto],” McCracken says.

“The ground has been held by a lot of major mining houses over the years, who were exploring for large base metal opportunities.

“When Rio were drilling it back in the late ’90s they were doing traverses looking primarily for nickel, and they hit this gold.

“But they weren’t interested in gold at all.

“And it pretty much sat with major mining houses until Norilsk divested their Australian interests back in 2020 and the opportunity was secured by Oracle Mining Proprietary Limited, which is the private company BMG acquired late 2020.

“There really hadn’t been any drilling done [at Abercromby] since the early 2000s until we drilled it late 2020.

“We knew there was gold mineralisation from the historic drilling and we knew there were high grade zones, but we didn’t know is it was just in a little confined zone, or not,” McCracken says.

“Now, we’ve done a chunk of work, and we’ve got a much better sense of that. Now, I don’t think we’ve got all the answers.

“But we’ve we’re starting to get a pretty good read on where the mineralisation is, and how it presents itself.

“And, you know, what it has delivered is a lot more ounces than I think people imagined.

“After we’d done our first drilling [campaign] we’d talk to different technical folks at the brokers and they all had in their head that maybe there was a couple of 100,000oz there, certainly with good grade.

“I don’t think people expected us to come in with a maiden resource in excess of 500,000oz.”

“It is, $8.35/oz for 519,000oz. That refers to the exploration since 2020,” McCracken says.

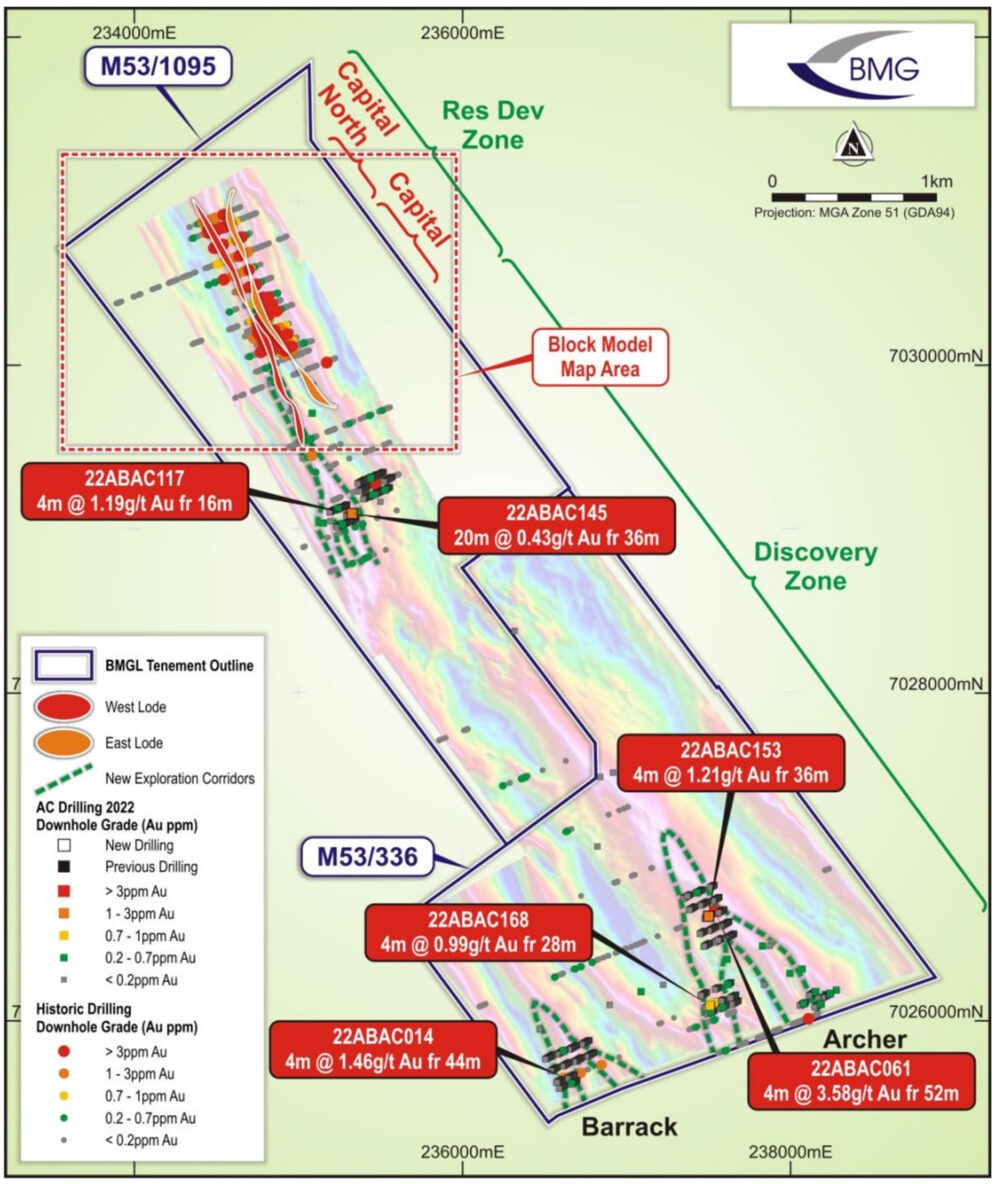

“We’ve done three drilling programs [and] that includes a couple of big air core programs to the south looking at targets beyond the area we’re in.

“It’s shaping up well. We’re pretty encouraged by what we’re seeing and the scope to add more to it, as well.

“Directly to the north?”

“I’m not sure who owns it now. I think the [Salt Lake Potash] administrators have now divested the assets, but they were doing a lot of potash mining out in Lake Way, which is to the northwest of where we are,” McCracken says.

“It does shallow out to the north. I guess it depends on availability and access to those tenements,” McCracken says.

“When we do the work further north, and we look at that extension, if we’re seeing that the mineralisation continues over the tenement boundary then we would look to either acquire or look to do a deal with the holder of that tenement in terms of the gold.

“But we think we have good opportunity, even outside of that, because it’s still open at depth and open to the south.

“There’s good capacity to extend that mineralised corridor to the south; in fact, we’ve got that anomaly directly south, and then there’s a couple of other areas right at the bottom of the tenement.

“Straight off the bottom of that [block model] there’s an area which we loosely refer to as Capital South.

“That contacts about one and a half kilometres.

“Then Barrack and Archer [targets] are much further to the south. The Archer contact is bigger in terms of the anomalous zone but Barrack’s got some interesting hits. That’s a more confined area.”

“We want to add more ounces,” McCracken says.

“At this point, we’re sitting back and looking at what we have and [figuring out] where the next holes will be.

“There’s really resource definition drilling to go into the main Capital zone to upgrade from inferred to indicated and above indicated.

“There are also still some gaps within that sort of primary zone that need further holes, so there is ounce potential there.

“And then there’s the regional stuff, like capital South, Archer and Barrack. There’re holes to go in there.

“Meanwhile we have the drill bit spinning at our under-option Bullabulling project, which is a lithium-gold opportunity around Coolgardie.

“Currently there is an RC program testing priority lithium targets.

“There’s also exploration work happening on the ground up at our Invincible project as well.

“So, there’s activity across our other projects while we take a breath on Abercrombie and work out exactly where we’re going to put the next lot of drill holes.”

“I think that the key reason why you invest in BMG is because the fundamental value proposition of our key asset is real, and significantly greater than the current market value of the company,” McCracken says.

“I would say to investors — we’ve got this asset that has real potential, it has scope to deliver good value well beyond where we currently sit in the market.

“It doesn’t take a rocket scientist to do some basic calculations and comparisons.

“You must do the work consistently, keep chipping away and remain disciplined because when you actually [create] something of value the market turns and catches up with you. And suddenly people realise, ‘Hang on, look at these guys!’

“Beyond that, we’ve got some other interesting projects that we’re continuing to chip away at.

“This pipeline [of projects] provide good opportunity from an exploration perspective, to deliver more value going forward.

“And that’s in a combination of gold, as well as lithium.”

“Strangely, gold [explorers] haven’t sparkled. Record prices in Australian dollar, but it’s not trickling down to the explorers yet,” McCracken says.

“You have to maintain the optimism though.”