Resources Top 4: Mothballed mines, high grade lithium hits, and a maiden 500,000oz gold resource

Picture: Getty Images

- Polymetals Resources hits thick high grades at the newly acquired Endeavour polymetallic mine in NSW

- BMG Resources unveils maiden 518,000oz resource for Abercromby project, delivered at discovery cost of just $8.35/oz

- Newly listed Leeuwin Metals says sampling of old holes has returned thick, high grade lithium at Kenpeg project in Canada

Here are the biggest small cap winners in early trade Monday April 17.

POLYMETALS RESOURCES (ASX:POL)

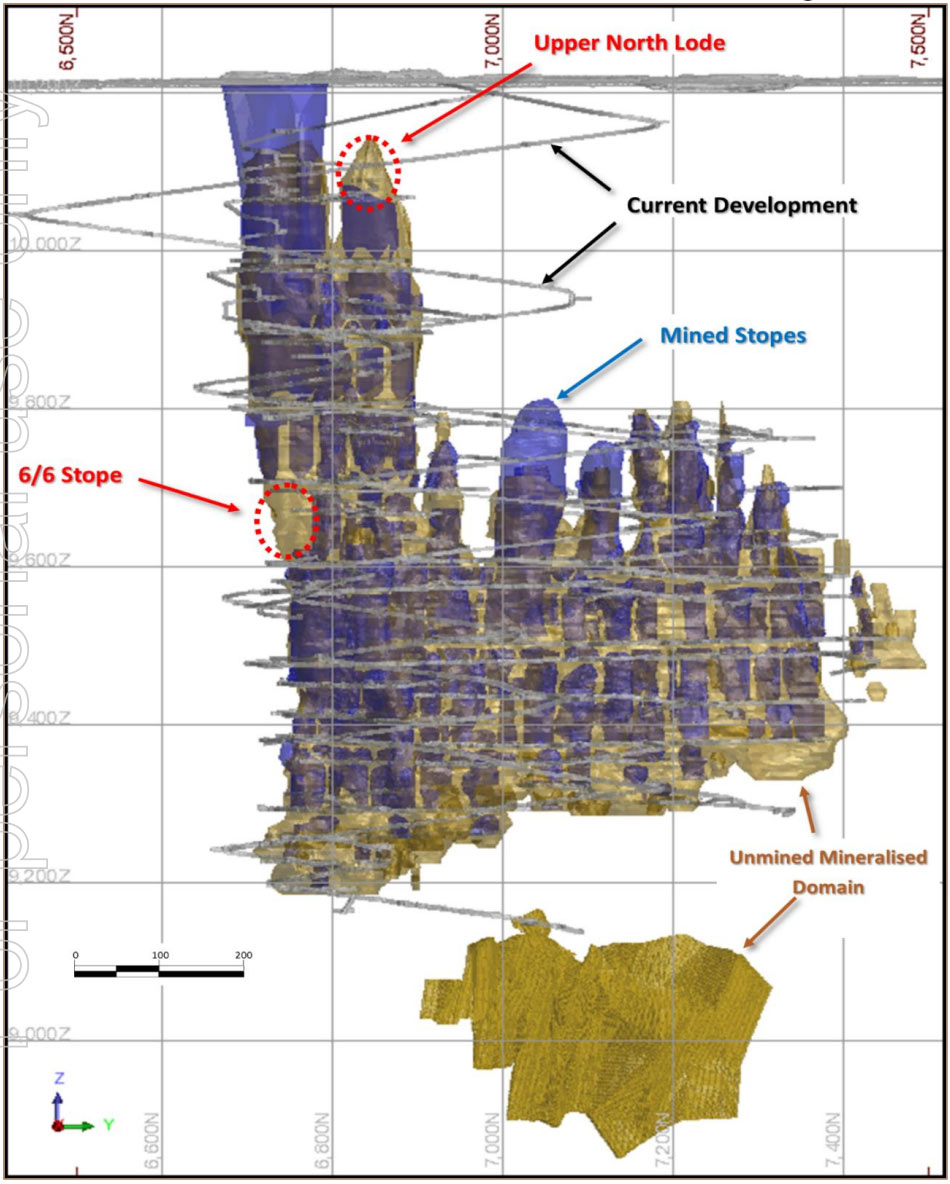

POL exploded out of the gate after announcing a bunch of thick high grade drill hits at the newly acquired Endeavour polymetallic mine in NSW.

Highlights from the first six holes of a 21-hole program include 81m @ 19.5% ZnEq from 77m to end of hole.

POL says all six holes hit the good stuff, with near surface mineralisation grading up to 13.9g/t gold, 2,020g/t silver, 12% zinc and 17% lead.

Results are still to come for the remaining 15 holes of the program, designed to test the unmined, near surface Level 1–2 Sulphide (North Lode) zone:

North Lode will underpin a restart strategy for the iconic mine, POL says, which was mothballed by previous owner Toho Zinc in 2019 due to depleting reserves after ~37 years of operation.

32.2Mt of ore grading 8.01% zinc, 5.04% lead and 89.2g/t silver had been mined and processed to that point, with a 16.3Mt resource remaining when POL bought the project for ~$10.4m in shares (52m shares priced at 20c).

Those shares are now worth ~$18.2m.

“Mine development to access the North Lode had been established prior to the Endeavor Mine being placed on care and maintenance in December 2019,” POL says.

“The North Lode was identified by Polymetals as a high priority target early in its due diligence of the project and is recognised as having potential to generate near term and significant cash flow, particularly from the precious metal (gold and silver) component.”

Once the rest of the drilling results come through POL will work to establish sufficient ore reserves “to support recommencement of operations and long-term economic production at Endeavor”.

$15m capped POL – which listed on the ASX mid 2021 to hunt gold deposits in the West African nation of Guinea — is now up 32% year-to-date.

It had $1.9m in the bank at the end of December.

BMG RESOURCES (ASX:BMG)

How many sub $10m capped explorers have a +0.5Moz gold resource, surrounded by mining majors, in an established WA goldfield? Not many, we reckon.

BMG today unveiled a maiden 518,000oz resource for the Abercromby project, delivered at a discovery cost of just $8.35 per ounce.

The resource comprises 354koz @ 1.17g/t Au (open pittable) and 164koz @ 3.09g/t Au (underground) at the Capital deposit, with 68% in the higher confidence indicated category.

70% of ounces are within 200m of surface, with mineralisation ‘open’ at depth and along strike.

Abercromby was acquired by BMG in 2020 after sitting idle in the portfolio of a mining major for much of the last 20 years, despite historic hits at Capital like 57.5m @ 5.73g/t Au from 80m.

The project – a stone’s throw from the Wiluna (10Moz) and Jundee (10Moz) operations — is already on a mining lease.

BMG plans to get started on mining studies, alongside more drilling at Capital and other nearby targets.

“Through efficient use of exploration spend across three major drilling campaigns, BMG has shifted from pure explorer to potential developer with a large resource base and huge potential for further growth,” BMG MD Brue McCracken says.

“Abercromby now has a metric for valuation that BMG can use to quantitatively demonstrate to the market its success in leveraging value from the drill bit.

“Abercromby is well located for development. The potential to monetise the project in a rapidly appreciating gold price environment, underpinned by this maiden resource for the Capital Deposit, places BMG in an enviable position as we continue to pursue sustained, long-term shareholder value.”

The $8m capped minnow is flat year-to-date. It had $700,000 in the bank at the end of December.

TAMBOURAH METALS (ASX:TMB)

(Up on no news)

TMB has a handful of early-stage WA exploration projects prospective for lithium, gold, rare earths, and copper.

Its lithium projects Tambourah, Nullagine and Russian Jack are surrounded Pilbara Minerals’ (ASX:PLS) Pilgangoora mine, MinRes (ASX:MIN) and Albemarle’s Wodgina, and Global Lithium’s (ASX:GL1) Marble Bar deposit in the Pilbara.

This month, veteran geologist and lithium expert Ralf Kriege will begin his role as company CEO.

Notably, Kriege was the exploration manager at Liatam Mining, where he tackled greenfields and brownfields exploration at the Bald Hill lithium mine and Cowan lithium exploration project in the WA Goldfields.

Bald Hill was among the wave of WA lithium mines to start producing in the last lithium boom.

It opened March 2018 with a capacity of 155,000tpa but was mothballed the following year when owner Alita went bankrupt due to plummeting lithium prices.

That mine is currently the subject of an ownership battle which could value it at up to $1.5 billion.

TMB also inked a deal with Australia’s national science agency, CSIRO, to apply machine learning to define first pass exploration targets across Russian Jack.

The $5m capped stock is up 20% year-to-date. It had $3.8m in the bank at the end of December.

READ: Late on lithium? Here are some explorers with big battery dreams

LEEUWIN METALS (ASX:LM1)

LM1 says sampling of two old holes has returned thick, high grade lithium at the Kenpeg project in Canada.

Never before assayed for lithium, these holes returned a highlight 20.59m @ 1.23% Li2O from 29.87m (XL-10) and 15.12m @ 1.40% Li2O from 73.6m (XL-22).

XL-22 also included a shallower intersection, 8.29m @ 1.13% Li2O from 31.69m.

That’s thick and high grade, with most hard rock lithium orebodies grading between 0.8%-1.5%.

LM1 now plans to complete additional sampling of historical holes drilled by TANCO in the 1980s.

On-the-ground exploration will ramp up in the summer season, focussing on over 6km of mapped pegmatite swarms.

“These results represent the potential for a significant discovery of a large scale lithium rich pegmatite swarm with additional regional upside,” the company says.

“This confirms the company’s belief that the region has the potential to be a significant lithium district within Manitoba, Canada.”

Backed by mining major Glencore, LM1 listed on the ASX late March after raising $8m in an IPO.

It is currently up 56% on a listing price of 25c/sh.

At Stockhead, we tell it like it is. While Leeuwin Metals is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.