You might be interested in

Mining

Want a chart that shows good things could be on the cards for copper? OFC you do

Mining

Hillgrove Resources is rattling the tin to carry out mine expansion drilling at Kanmantoo

Mining

Mining

Copper has been on the upswing with rising prices and strong forward demand but companies with the potential to bring on new production in the near-term are few and far between.

One of these rare gems is Hillgrove Resources (ASX:HGO), which is raring to get its previously-producing Kanmantoo mine back into the production game; not a surprising stance to take given that copper came out of the gates swinging at the beginning of 2023 and is now trading about US$9,145.25 per tonne, up some 9% from the end of last year.

The acceleration of the energy transition and China’s reopening – both of which are expected to drive demand for the metal – have also combined to drive copper’s outlook while major miner Rio Tinto (ASX:RIO) said its acquisition of Turquoise Hill Resources demonstrated its discipline to grow in materials the world needs. Coupled with this is the potential consolidation in the industry limiting copper exposure for investors, with Oz Minerals (ASX: OZL) looking likely to be acquired by BHP (ASX:BHP). There simply isn’t many near-term producers out there.

So just what makes Kanmantoo tick and why is Hillgrove one of most affordable options to secure exposure to the red metal?

Speaking to Stockhead, managing director Lachlan Wallace noted that a feasibility study released in December 2021 demonstrated that the Kanmantoo underground operations could be brought into production within seven months for a capital investment of just $26m.

This would deliver cashflow of about $200m over the first three years, which neatly reflects the advantages of having existing infrastructure including a processing plant and fully permitted tailings storage dating back to its time as an open pit producer.

“Following the feasibility study, we went to a number of different parties to finance the project. There was a lot of interest and we got pretty close to concluding the definitive financing documents, but the fall in copper price in the middle of the year caused delays.”

“Now with the return of strong copper prices over the last couple of months, the funding process to restart is back on track.”

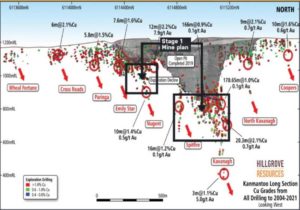

He noted that during this period, the company has not been sitting idle, with drilling delineating another 1.2Mt of resources since the feasibility study which is expected to grow the mine plan. But he highlights that is only the beginning.

“Since 2019 we’ve drilled 122 holes and of that, we’ve actually returned 143 intersections of economic grade and width. This is an extraordinary strike rate which highlights the down dip continuity of the mineral system. It gives us a very high degree of confidence that as we continue to drill, we will see more positive results which will continue to increase the resource base.”

And he has justification to be bullish given every drill program has resulted in a material increase in resources which have grown from about 1 million tonnes in 2019 to the current 6.9Mt.

The updated resource is over 20% greater than that used for the original mine plan, meaning that there’s already room to grow though this has yet to be factored in yet.

Wallace also pointed out that the current resource is centred on just two – Kavanagh and Nugent – of the nine mineralised lodes that were mined or drilled as part of the historical Kanmantoo open pit operations.

“Over the last couple of months we have started drilling two areas that were also mined in the open pit phase, Emily Star and North Kavanagh ” Wallace added.

The program, which is currently underway and expected to conclude towards the end of January, is aimed at putting together an initial resource estimate for the two lodes and bringing them into the mine plan, which will further increase mine life.

But wait… there’s more.

The current mine plan envisions mine throughput of between 1.2Mt and 1.5Mt, well below the 3.6Mt capacity of the processing plant.

“Adding in more work areas means that we have the potential to increase the annual throughput,” Wallace said.

“Because the majority of our costs on site are fixed in nature, bringing in additional tonnes can be done at a very low incremental cost which will have a material impact on the value of the project because we’re bringing them in with a much higher margin.

“ Furthermore, the mineral lodes at Kanmantoo typically have a high grade core with a lower grade halo.”

“This gives us a lot of upside exposure as copper prices rise. The higher the price goes, the more of that halo that we can take out for relatively low incremental cost. With plenty of spare mill capacity, we can quickly adapt the mine plan to capture any opportunity afforded by rising prices. ,” he added.

“I think the underlying thematic is strong as the decarbonisation of economy through electrification drives copper demand, whilst on the other hand, declining global head grades and increasing opposition to large mining projects in Latin America impacts the supply side.”

All of these come together to form a picture of just what makes Kanmantoo tick: a low-cost, fully-permitted project with a fast track towards production, quick payback, handsome returns and potential for growth.

“Most companies have significant hurdles, be they permitting, and raising capital which can be in the order of hundreds of millions of dollars for greenfields operations,” Wallace highlighted.

“Assuming projects get greenlit, it then takes multiple years to construct, and all the while they are exposed to construction-related time and cost blowouts, which are all too common throughout the mining industry.

“I don’t see there being any other operations in Australia that could get into production as quickly as Kanmantoo can.

“And that is really because we have that existing infrastructure and also we’ve already commenced the underground. We have two portals already complete and that basically enables us to walk straight in with a jumbo and start cutting rounds on day one.”

This is coupled with the rising copper market which has resulted in companies with copper exposure seeing substantial gains in their stock.

Hillgrove is no stranger to this, with its shares more than doubling from 3.4c in the earlier part of November 2022 to the current 7c price.

Despite this, its market capitalisation of about $82.2 million is less than half that of AIC Mines (ASX:A1M) which is developing the Eloise mine in Queensland that is also a previous producer and of similar scale.

Wallace noted that Hillgrove near-term plan has two prongs.

“We want to continue drilling to bring the additional work areas into the mine plan, whilst concurrently trying to conclude the project finance. As soon as that project finance is secured, we’ll be ramping up production very quickly,” he added.

“We have the contracts lined up, so the equipment and people are available to be able to commence and we’d be looking to ramp up very quickly with the view that we would be able to commence operations this year and copper production towards the end of this year or early next year.”

Meanwhile, besides defining maiden resources at the Emily Star and North Kavanagh, drilling could also extend resources at Kavanagh and Nugent given that are both open at depth and along strike.

Exploration will also be carried out to unlock the potential of the other as yet untested lodes at Kanmantoo.

“We also have some targets off-lease that we will continue to explore, including the potential for a “Winu” style sediment hosted Cu-Au mineral system in the South East of SA, however the first priority is known lodes within the permitted lease that have potential to be converted to copper tonnes for low cost through the existing infrastructure,” he concluded.

This article was developed in collaboration with Hillgrove Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.