You might be interested in

Mining

Resources Top 4: Strike busts up bourse on LEL lithium investment; WAK whacks home $7m raise

Mining

52pc premium: Lithium Energy scores top marks on value creation with sale of Solaroz for $97m

Mining

Mining

• Goldman Sachs bearish on lithium… again

• But the experts (that’s Benchmark Mineral Intelligence) show reason for optimism for high-quality lithium producers

• And the best performing battery metals ASX stocks over the past week were?…

At the risk of focusing too heavily on lithium yet again, let’s… focus on lithium yet again, for a few minutes at least…

Depending on who you believe, the lithium supply and demand outlook is either still overcooked on the supply side for the foreseeable, or it’s actually far more palatable than many might think.

Included among the ‘many’ there, are notable lithium bears Goldman Sachs, who as recently as a few days ago shared another damning take, including these words:

“The recent rally in lithium prices should not be interpreted as the end of the bear market, where further supply rationing is needed to reduce both the 2024E surplus and now larger surplus in 2025E.”

And these:

“While lithium chemicals forward curves remain in contango, we note that lithium chemicals futures have largely been in contango for most of the price decline from early 2023, so far making them a poor predictor of spot pricing.”

That contango, as a reminder of a reminder Stockhead’s Reuben gave the other day, is something we’ve been following a bit here in High Voltage.

‘Contango’ occurs when futures contract (buy later) prices rise above spot (buy now) prices.

We can think of at least one notable lithium analyst who’s been keeping tabs on the lithium futures contango, and continues to do so. Here he is…

Except for seaborne Li2CO3 CIF, all #lithium chemical & ore prices rose today in the Chinese spot market. At midday, average LC futures prices increased by 1.89% surpassing the average LC spot prices by CNY 9,076, resulting in a growing contango for the 6th consecutive day. pic.twitter.com/7PoQNTOjiC

— Juan Carlos Zuleta (@jczuleta) April 10, 2024

It’s not just the likes of Goldman Sachs (and Morgan Stanley, too of late) highlighting the supply glut. Lithium supply glut bears are everywhere.

Here’s Supply Chain Insights forecasting that “the battery market will remain in oversupply until 2030 unless more projects are scaled back or cancelled”:

Based on announced investment decisions and forecast demand growth, battery production capacity will grow by over 350% by 2030.

SC Insights forecast that the battery market will remain in oversupply until 2030 unless more projects are scaled back or cancelled. This leaves China… pic.twitter.com/cASeCYqQ29

— Derrick Allott (@DerrickSCI) April 9, 2024

But as one commenter on the post, er, commented:

“Even if there is all that battery capacity, will there be enough battery grade lithium?”

Which leads us to this:

With information that goes some way to contradicting the bearish bankers’ ongoing lithium supply glut vision, Benchmark Mineral Intelligence attempts to come to lithium hopefuls’ rescue this week.

And that’s probably as you might expect, given the price-reporting agency’s interest in and ties to the global lithium industry.

Nevertheless, here’s some of the crucial gist of one of its latest reports – Benchmark’s Solid-State and Lithium Metal Forecast.

It cites challenges and yet at the same time opportunities for the global lithium industry.

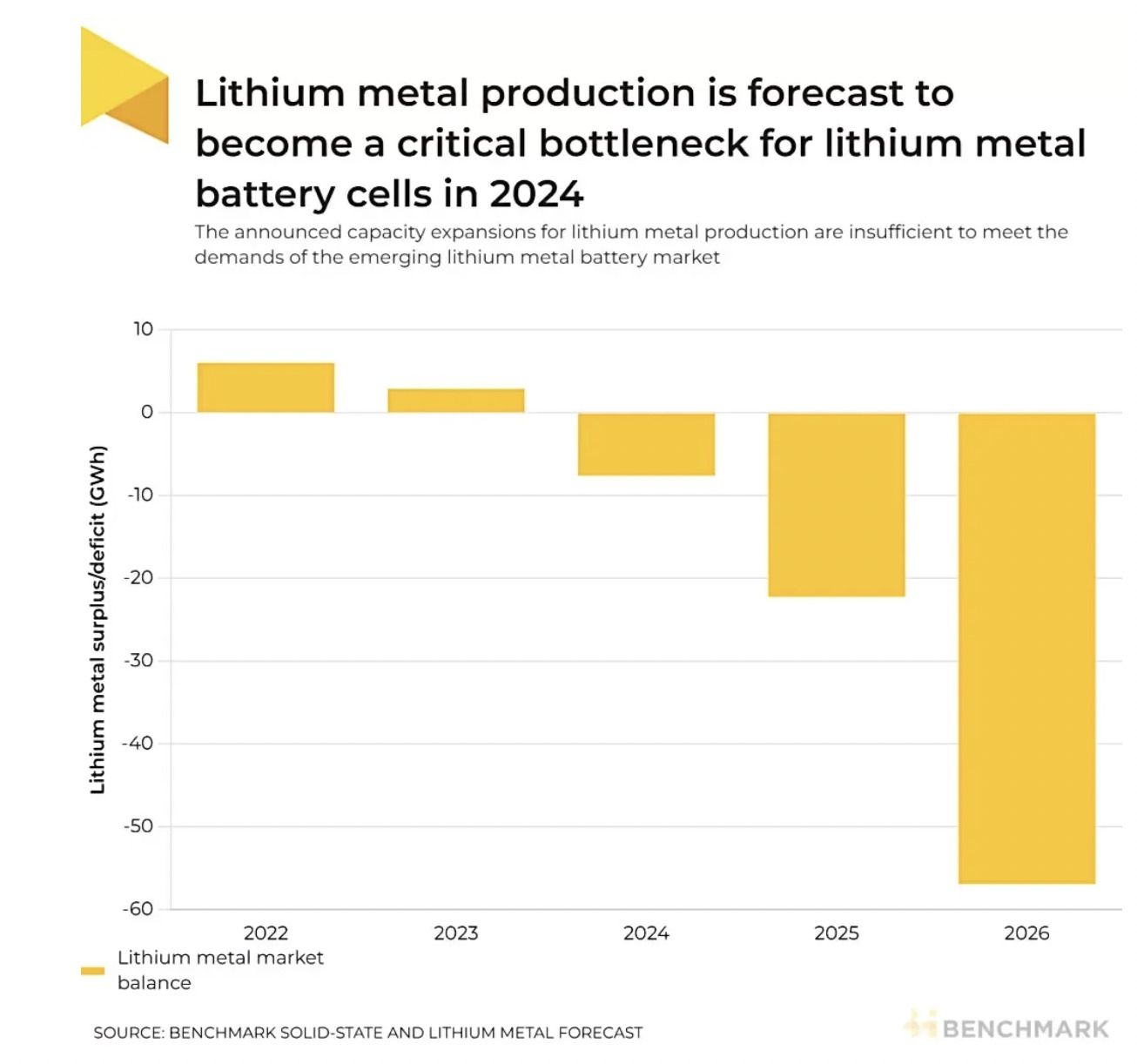

Essentially, Benchmark is seeing a surging global demand for lithium metal batteries, but forecasts that production is on target to fall short of meeting that demand.

Here’s a chart from the Benchmark report that pretty much sums up what they’re seeing.

“The announced capacity expansion for lithium metal production are insufficient to meet the demands of the emerging lithium metal battery market,” writes Benchmark.

If it’s correct, then that’s very much the opposite of bearish factors required to see global lithium pricings remain suppressed.

Putting its thesis into further context, Benchmark analyst Rory McNulty said this:

“To date, battery grade lithium metal demand has been largely driven by the primary battery and aerospace alloy markets.

“The demand growth that we are seeing today is driven by next-generation, rechargeable lithium metal batteries, and the requirements for these applications are much more strict.”

In its report, Benchmark further notes that global lithium metal production capacity was more than 7,500 tonnes per year in 2023, but less than half of it was battery grade.

With that in mind, remember that China utterly dominates the lithium supply chain and there are big question marks over that when it comes to the quality of lithium needed in bulk for next-gen lithium batteries, such as solid-state models.

McNulty added:

“The question that hangs over that Chinese capacity is whether it can deliver for the requirements of next generation battery technologies.”

Meeting the requirements for evolving lithium battery tech will be no easy feat, suggests Benchmark.

If solid-state batteries are indeed the way forward for EVs, then this will place further demand on high-grade lithium. And who are go-to countries for the high-grade, hard rock stuff? Canada and very much Australia.

#Chinese solid-state #battery producers rally after IM Motors launched "first mass-produced car with ultra-fast-charging solid-state battery"https://t.co/haGgRmRhhd pic.twitter.com/21vyr2J6Yf

— YUAN TALKS (@YuanTalks) April 9, 2024

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop. (Note: figures accurate per ASX at 5pm April 10.)

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| PVW | PVW Res Ltd | 0.025 | -7% | -7% | -67% | $2,535,119 |

| A8G | Australasian Metals | 0.063 | -2% | -11% | -63% | $3,335,712 |

| INF | Infinity Lithium | 0.066 | 2% | -13% | -51% | $30,531,078 |

| LPI | Lithium Pwr Int Ltd | 0 | -100% | -100% | -100% | $361,898,974 |

| PSC | Prospect Res Ltd | 0.13 | 63% | 78% | -13% | $40,309,881 |

| PAM | Pan Asia Metals | 0.16 | 0% | 0% | -50% | $26,850,684 |

| CXO | Core Lithium | 0.155 | 0% | -26% | -82% | $331,225,009 |

| LOT | Lotus Resources Ltd | 0.42 | 1% | 6% | 110% | $769,110,765 |

| AGY | Argosy Minerals Ltd | 0.14 | 8% | -10% | -65% | $196,617,050 |

| AZS | Azure Minerals | 3.46 | -4% | -4% | 714% | $1,582,444,534 |

| NWC | New World Resources | 0.045 | 5% | 22% | -6% | $104,350,634 |

| QXR | Qx Resources Limited | 0.016 | -6% | -16% | -56% | $17,761,246 |

| GSR | Greenstone Resources | 0.009 | 13% | 29% | -59% | $12,313,021 |

| CAE | Cannindah Resources | 0.055 | -8% | -19% | -69% | $30,060,158 |

| AZL | Arizona Lithium Ltd | 0.027 | 13% | 13% | -45% | $96,043,638 |

| RIL | Redivium Limited | 0.003 | 0% | 0% | -75% | $10,923,419 |

| COB | Cobalt Blue Ltd | 0.15 | -6% | -3% | -59% | $56,739,503 |

| ESS | Essential Metals Ltd | 0 | -100% | -100% | -100% | $135,278,382 |

| LPD | Lepidico Ltd | 0.004 | 5% | -30% | -65% | $30,553,232 |

| MRD | Mount Ridley Mines | 0.002 | 0% | 33% | -43% | $11,677,324 |

| CZN | Corazon Ltd | 0.01 | 0% | 0% | -33% | $6,463,778 |

| LKE | Lake Resources | 0.063 | -5% | -45% | -86% | $103,176,271 |

| DEV | Devex Resources Ltd | 0.305 | 3% | -5% | 11% | $127,945,295 |

| INR | Ioneer Ltd | 0.2 | 25% | 33% | -31% | $432,962,490 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0.034 | -3% | -8% | -21% | $21,551,597 |

| RLC | Reedy Lagoon Corp. | 0.004 | 0% | 0% | -48% | $2,478,163 |

| GBR | Greatbould Resources | 0.062 | 5% | -3% | -31% | $37,233,594 |

| FRS | Forrestaniaresources | 0.029 | 107% | 45% | -67% | $2,265,000 |

| STK | Strickland Metals | 0.12 | 9% | 40% | 233% | $199,534,010 |

| MLX | Metals X Limited | 0.45 | 22% | 23% | 67% | $408,269,730 |

| CLA | Celsius Resource Ltd | 0.014 | 0% | 8% | -13% | $31,444,723 |

| FGR | First Graphene Ltd | 0.06 | 7% | 3% | -25% | $40,873,607 |

| HXG | Hexagon Energy | 0.021 | -13% | 24% | 75% | $11,284,150 |

| TLG | Talga Group Ltd | 0.74 | 5% | -15% | -57% | $277,220,546 |

| MNS | Magnis Energy Tech | 0.042 | 0% | 0% | -82% | $50,378,922 |

| OZL | OZ Minerals | 0 | -100% | -100% | -100% | $8,918,404,433 |

| PLL | Piedmont Lithium Inc | 0.21 | 11% | 0% | -73% | $76,766,500 |

| EUR | European Lithium Ltd | 0.063 | -3% | -9% | -11% | $90,827,410 |

| BKT | Black Rock Mining | 0.066 | 2% | 2% | -56% | $81,335,706 |

| QEM | QEM Limited | 0.16 | 3% | 0% | -16% | $24,979,632 |

| LYC | Lynas Rare Earths | 5.96 | 5% | -1% | -2% | $5,570,920,383 |

| ESR | Estrella Res Ltd | 0.005 | -17% | 43% | -58% | $8,796,859 |

| ARL | Ardea Resources Ltd | 0.71 | 6% | 30% | 61% | $139,882,010 |

| GLN | Galan Lithium Ltd | 0.39 | -7% | -5% | -62% | $151,256,718 |

| JLL | Jindalee Lithium Ltd | 0.65 | -4% | -16% | -72% | $42,343,082 |

| VUL | Vulcan Energy | 2.86 | 4% | 7% | -50% | $433,623,980 |

| SBR | Sabre Resources | 0.019 | 6% | 6% | -22% | $7,485,239 |

| CHN | Chalice Mining Ltd | 1.42 | 31% | 10% | -81% | $486,204,130 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 20% | -45% | $20,650,533 |

| NMT | Neometals Ltd | 0.135 | 0% | -16% | -78% | $80,965,341 |

| AXN | Alliance Nickel Ltd | 0.034 | 0% | -8% | -66% | $27,581,905 |

| PNN | Power Minerals Ltd | 0.155 | 7% | -26% | -64% | $13,543,296 |

| IGO | IGO Limited | 7.5 | 5% | -4% | -39% | $5,770,380,735 |

| GED | Golden Deeps | 0.045 | -8% | 7% | -44% | $5,198,506 |

| ADV | Ardiden Ltd | 0.165 | 3% | 14% | -52% | $9,690,213 |

| SRI | Sipa Resources Ltd | 0.019 | 12% | 12% | -27% | $4,335,005 |

| NTU | Northern Min Ltd | 0.032 | 3% | 10% | -18% | $189,151,336 |

| AXE | Archer Materials | 0.53 | 2% | 36% | 33% | $128,697,742 |

| PGM | Platina Resources | 0.025 | 25% | 4% | 14% | $13,086,787 |

| AAJ | Aruma Resources Ltd | 0.02 | 11% | 11% | -72% | $3,937,830 |

| IXR | Ionic Rare Earths | 0.017 | -6% | -11% | -26% | $75,593,657 |

| NIC | Nickel Industries | 0.875 | 5% | 6% | 4% | $3,771,512,694 |

| EVG | Evion Group NL | 0.027 | 23% | 23% | -56% | $8,303,020 |

| CWX | Carawine Resources | 0.11 | 2% | -12% | 20% | $25,973,799 |

| PLS | Pilbara Min Ltd | 3.92 | 4% | -2% | 9% | $11,646,640,947 |

| HAS | Hastings Tech Met | 0.37 | -5% | -33% | -83% | $48,934,961 |

| BUX | Buxton Resources Ltd | 0.11 | 5% | -12% | -45% | $19,923,393 |

| ARR | American Rare Earths | 0.285 | 27% | 0% | 33% | $133,224,291 |

| SGQ | St George Min Ltd | 0.018 | 0% | -14% | -66% | $18,287,998 |

| TKL | Traka Resources | 0.0015 | -25% | 0% | -68% | $3,501,317 |

| PAN | Panoramic Resources | 0.035 | 0% | 0% | -75% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | 0% | $48,441,219 |

| IPT | Impact Minerals | 0.014 | -7% | 0% | 40% | $40,105,854 |

| LIT | Lithium Australia | 0.03 | 3% | 11% | -9% | $36,668,750 |

| AKE | Allkem Limited | 0 | -100% | -100% | -100% | $6,304,350,967 |

| ARN | Aldoro Resources | 0.075 | 4% | -9% | -58% | $10,096,781 |

| JRV | Jervois Global Ltd | 0.023 | -8% | -4% | -66% | $62,157,976 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | $751,215,521 |

| SYR | Syrah Resources | 0.545 | 4% | -19% | -64% | $434,339,082 |

| FBM | Future Battery | 0.053 | -7% | -21% | -29% | $34,486,932 |

| ADD | Adavale Resource Ltd | 0.005 | -17% | 0% | -73% | $5,079,898 |

| LTR | Liontown Resources | 1.35 | 17% | 4% | -48% | $3,139,725,587 |

| CTM | Centaurus Metals Ltd | 0.33 | 6% | 22% | -63% | $168,299,095 |

| VML | Vital Metals Limited | 0.005 | 25% | 0% | -69% | $35,370,402 |

| BSX | Blackstone Ltd | 0.064 | 5% | -3% | -62% | $31,450,267 |

| POS | Poseidon Nick Ltd | 0.0065 | 8% | -7% | -82% | $25,994,743 |

| CHR | Charger Metals | 0.105 | 5% | -5% | -66% | $7,742,025 |

| AVL | Aust Vanadium Ltd | 0.015 | -6% | 0% | -62% | $146,378,554 |

| AUZ | Australian Mines Ltd | 0.012 | 20% | -25% | -57% | $14,393,631 |

| TMT | Technology Metals | 0 | -100% | -100% | -100% | $67,134,856 |

| RXL | Rox Resources | 0.22 | 19% | 38% | -41% | $83,104,709 |

| RNU | Renascor Res Ltd | 0.088 | 10% | 2% | -63% | $203,152,600 |

| GL1 | Globallith | 0.505 | 2% | -19% | -64% | $127,529,997 |

| BRB | Breaker Res NL | 0 | -100% | -100% | -100% | $158,126,031 |

| ASN | Anson Resources Ltd | 0.105 | -5% | -5% | -36% | $135,106,462 |

| SYA | Sayona Mining Ltd | 0.04 | 5% | -2% | -79% | $401,438,545 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.18 | 9% | -3% | 3% | $81,725,727 |

| ATM | Aneka Tambang | 1.1 | 0% | 0% | 0% | $1,434,014 |

| TVN | Tivan Limited | 0.052 | 2% | -13% | -38% | $91,926,087 |

| ALY | Alchemy Resource Ltd | 0.007 | -13% | -13% | -56% | $8,246,534 |

| GAL | Galileo Mining Ltd | 0.245 | -11% | -4% | -67% | $49,406,232 |

| BHP | BHP Group Limited | 45.46 | 1% | 3% | 1% | $228,878,185,771 |

| LEL | Lithenergy | 0.54 | 13% | -8% | -12% | $58,320,847 |

| MMC | Mitremining | 0.52 | 8% | 70% | 79% | $48,149,054 |

| RMX | Red Mount Min Ltd | 0.0015 | -14% | -14% | -57% | $5,347,152 |

| GW1 | Greenwing Resources | 0.067 | 0% | -3% | -65% | $11,962,598 |

| AQD | Ausquest Limited | 0.011 | 0% | 0% | -35% | $9,076,641 |

| LML | Lincoln Minerals | 0.007 | 17% | 8% | -56% | $11,928,317 |

| 1MC | Morella Corporation | 0.003 | -25% | -14% | -67% | $24,715,198 |

| REE | Rarex Limited | 0.016 | 0% | -16% | -71% | $11,617,572 |

| MRC | Mineral Commodities | 0.023 | 0% | -4% | -57% | $22,642,870 |

| PUR | Pursuit Minerals | 0.005 | 0% | 0% | -69% | $14,719,857 |

| QPM | Queensland Pacific | 0.038 | -3% | -10% | -72% | $76,476,532 |

| EMH | European Metals Hldg | 0.3 | 11% | 3% | -48% | $32,753,496 |

| BMM | Balkanminingandmin | 0.056 | -10% | -19% | -76% | $4,404,512 |

| PEK | Peak Rare Earths Ltd | 0.19 | -3% | -12% | -60% | $53,188,352 |

| LEG | Legend Mining | 0.013 | 0% | -13% | -75% | $43,567,158 |

| MOH | Moho Resources | 0.006 | 0% | 0% | -63% | $3,235,069 |

| AML | Aeon Metals Ltd. | 0.005 | -17% | -17% | -78% | $6,030,203 |

| G88 | Golden Mile Res Ltd | 0.013 | 8% | 8% | -35% | $5,757,120 |

| WKT | Walkabout Resources | 0.13 | 8% | 18% | 24% | $77,195,067 |

| TON | Triton Min Ltd | 0.013 | -7% | -13% | -65% | $20,298,105 |

| AR3 | Austrare | 0.125 | 4% | 14% | -50% | $17,931,017 |

| ARU | Arafura Rare Earths | 0.195 | -3% | 26% | -59% | $450,508,927 |

| MIN | Mineral Resources. | 71.61 | 2% | 7% | -6% | $13,916,765,425 |

| VMC | Venus Metals Cor Ltd | 0.1 | 8% | 10% | -9% | $18,972,868 |

| S2R | S2 Resources | 0.13 | -7% | -16% | -4% | $63,400,119 |

| CNJ | Conico Ltd | 0.0015 | 0% | -50% | -83% | $1,805,095 |

| VR8 | Vanadium Resources | 0.046 | 5% | 18% | -46% | $25,213,509 |

| PVT | Pivotal Metals Ltd | 0.022 | 0% | 57% | -37% | $15,490,602 |

| BOA | Boadicea Resources | 0.03 | 30% | 15% | -64% | $4,193,997 |

| IPX | Iperionx Limited | 2.29 | 1% | 1% | 186% | $519,130,189 |

| SLZ | Sultan Resources Ltd | 0.011 | 0% | -58% | -71% | $2,371,038 |

| NKL | Nickelxltd | 0.026 | -4% | -30% | -61% | $2,283,194 |

| NVA | Nova Minerals Ltd | 0.255 | 2% | -9% | -45% | $55,885,866 |

| MLS | Metals Australia | 0.022 | -8% | -12% | -45% | $15,562,130 |

| MQR | Marquee Resource Ltd | 0.015 | -12% | -25% | -21% | $6,614,150 |

| MRR | Minrex Resources Ltd | 0.013 | -7% | 0% | -28% | $13,560,844 |

| EVR | Ev Resources Ltd | 0.01 | 11% | -9% | -38% | $11,891,443 |

| EFE | Eastern Resources | 0.009 | 29% | 29% | -22% | $9,935,572 |

| CNB | Carnaby Resource Ltd | 0.635 | 7% | 43% | -51% | $105,035,887 |

| BNR | Bulletin Res Ltd | 0.048 | -31% | -31% | -45% | $14,387,053 |

| AX8 | Accelerate Resources | 0.039 | 0% | 34% | 50% | $24,398,853 |

| AM7 | Arcadia Minerals | 0.095 | 12% | 36% | -49% | $10,250,709 |

| AS2 | Askarimetalslimited | 0.05 | -4% | -42% | -88% | $5,079,926 |

| BYH | Bryah Resources Ltd | 0.009 | -10% | 13% | -64% | $4,354,535 |

| DTM | Dart Mining NL | 0.04 | 3% | 186% | -40% | $8,648,026 |

| EMS | Eastern Metals | 0.034 | 17% | 26% | -44% | $2,802,492 |

| FG1 | Flynngold | 0.051 | 19% | 39% | -39% | $7,550,482 |

| GSM | Golden State Mining | 0.012 | 0% | 9% | -65% | $3,352,448 |

| IMI | Infinitymining | 0.06 | -12% | -15% | -65% | $7,125,203 |

| LRV | Larvottoresources | 0.091 | 5% | 40% | -33% | $20,348,660 |

| LSR | Lodestar Minerals | 0.002 | 33% | 0% | -60% | $4,046,795 |

| RAG | Ragnar Metals Ltd | 0.019 | -5% | -5% | 17% | $8,531,657 |

| CTN | Catalina Resources | 0.003 | -25% | -40% | -40% | $3,715,461 |

| TMB | Tambourahmetals | 0.072 | -4% | -14% | -15% | $6,054,646 |

| TEM | Tempest Minerals | 0.01 | 11% | 25% | -47% | $4,672,120 |

| EMC | Everest Metals Corp | 0.11 | 33% | 41% | 53% | $16,428,311 |

| WML | Woomera Mining Ltd | 0.005 | 0% | 25% | -50% | $5,481,625 |

| KZR | Kalamazoo Resources | 0.1 | 4% | 4% | -38% | $17,130,747 |

| LMG | Latrobe Magnesium | 0.051 | 2% | 2% | -28% | $102,622,171 |

| KOR | Korab Resources | 0.008 | -20% | 33% | -56% | $2,936,400 |

| CMX | Chemxmaterials | 0.044 | -12% | -27% | -60% | $5,187,631 |

| NC1 | Nicoresourceslimited | 0.145 | 4% | -17% | -71% | $15,323,081 |

| GRE | Greentechmetals | 0.25 | 6% | -4% | 187% | $21,600,794 |

| CMO | Cosmometalslimited | 0.042 | 11% | 5% | -66% | $5,308,567 |

| FRB | Firebird Metals | 0.12 | -4% | 4% | -20% | $17,083,368 |

| S32 | South32 Limited | 3.33 | 10% | 11% | -21% | $14,720,090,346 |

| OMH | OM Holdings Limited | 0.455 | 6% | 11% | -40% | $337,152,992 |

| JMS | Jupiter Mines. | 0.255 | 19% | 50% | 13% | $460,483,750 |

| E25 | Element 25 Ltd | 0.235 | 18% | 24% | -66% | $56,557,887 |

| EMN | Euromanganese | 0.092 | 6% | 8% | -59% | $18,773,391 |

| KGD | Kula Gold Limited | 0.009 | 29% | 13% | -44% | $4,378,157 |

| LRS | Latin Resources Ltd | 0.2 | 14% | -5% | 90% | $489,898,406 |

| CRR | Critical Resources | 0.014 | 0% | -15% | -65% | $24,889,904 |

| ENT | Enterprise Metals | 0.002 | -33% | -33% | -78% | $1,603,942 |

| SCN | Scorpion Minerals | 0.025 | -4% | -22% | -60% | $10,645,861 |

| GCM | Green Critical Min | 0.004 | 0% | -20% | -73% | $4,546,340 |

| ENV | Enova Mining Limited | 0.018 | -18% | -56% | 64% | $11,638,132 |

| RBX | Resource B | 0.039 | -9% | -5% | -71% | $3,224,695 |

| AKN | Auking Mining Ltd | 0.02 | -9% | -9% | -68% | $4,707,074 |

| RR1 | Reach Resources Ltd | 0.003 | 0% | 31% | -18% | $9,836,169 |

| EMT | Emetals Limited | 0.005 | -17% | 0% | -38% | $4,250,000 |

| PNT | Panthermetalsltd | 0.033 | 10% | -13% | -69% | $2,876,483 |

| WIN | Widgienickellimited | 0.052 | 0% | 2% | -83% | $14,301,363 |

| WMG | Western Mines | 0.15 | -3% | -9% | -63% | $11,637,893 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | -50% | $2,133,790 |

| CAI | Calidus Resources | 0.135 | 13% | -7% | -41% | $98,924,051 |

| GT1 | Greentechnology | 0.13 | 0% | -30% | -80% | $41,827,773 |

| KAI | Kairos Minerals Ltd | 0.013 | 0% | 0% | -29% | $32,761,402 |

| MTM | MTM Critical Metals | 0.055 | -11% | -31% | -48% | $14,898,663 |

| NWM | Norwest Minerals | 0.044 | 47% | 38% | 2% | $12,419,824 |

| PGD | Peregrine Gold | 0.225 | 2% | 2% | -42% | $16,290,821 |

| RAS | Ragusa Minerals Ltd | 0.023 | -12% | -26% | -77% | $3,422,371 |

| RGL | Riversgold | 0.007 | 0% | -13% | -53% | $7,741,292 |

| SRZ | Stellar Resources | 0.016 | 23% | 23% | 60% | $20,107,963 |

| STM | Sunstone Metals Ltd | 0.016 | 7% | 45% | -50% | $56,010,425 |

| ZNC | Zenith Minerals Ltd | 0.098 | 7% | 9% | -35% | $34,885,707 |

| WC8 | Wildcat Resources | 0.635 | -2% | -12% | 2017% | $778,233,972 |

| ASO | Aston Minerals Ltd | 0.012 | -14% | -25% | -89% | $15,540,771 |

| THR | Thor Energy PLC | 0.022 | 0% | -12% | -45% | $4,038,185 |

| YAR | Yari Minerals Ltd | 0.005 | -17% | -17% | -72% | $2,894,147 |

| IG6 | Internationalgraphit | 0.16 | -6% | 52% | -27% | $13,793,157 |

| LPM | Lithium Plus | 0.14 | -7% | -22% | -46% | $11,178,466 |

| ODE | Odessa Minerals Ltd | 0.005 | 0% | -17% | -38% | $5,216,413 |

| KOB | Kobaresourceslimited | 0.099 | -10% | -10% | -27% | $12,780,833 |

| AZI | Altamin Limited | 0.05 | 0% | -9% | -31% | $21,503,603 |

| FTL | Firetail Resources | 0.04 | 0% | -31% | -60% | $5,956,222 |

| LNR | Lanthanein Resources | 0.003 | 0% | 0% | -83% | $5,864,727 |

| CLZ | Classic Min Ltd | 0.01 | -20% | -80% | -80% | $2,835,935 |

| NVX | Novonix Limited | 1.1 | 22% | 18% | -1% | $491,313,980 |

| OCN | Oceanalithiumlimited | 0.052 | -9% | -16% | -85% | $2,811,978 |

| SUM | Summitminerals | 0.068 | 8% | 1% | -48% | $3,193,028 |

| DVP | Develop Global Ltd | 2.27 | -4% | -9% | -29% | $528,984,807 |

| OD6 | Od6Metalsltd | 0.07 | -3% | -25% | -77% | $5,710,669 |

| HRE | Heavy Rare Earths | 0.035 | -5% | -19% | -65% | $2,117,078 |

| LIN | Lindian Resources | 0.145 | 21% | 7% | -45% | $143,990,280 |

| PEK | Peak Rare Earths Ltd | 0.19 | -3% | -12% | -60% | $53,188,352 |

| ILU | Iluka Resources | 7.25 | 0% | 4% | -35% | $3,085,404,356 |

| ASM | Ausstratmaterials | 1.45 | 6% | 53% | 19% | $232,674,815 |

| ETM | Energy Transition | 0.037 | -5% | 9% | -16% | $51,802,213 |

| VMS | Venture Minerals | 0.023 | 5% | 0% | 35% | $47,600,274 |

| IDA | Indiana Resources | 0.078 | 1% | 0% | 63% | $47,534,954 |

| VTM | Victory Metals Ltd | 0.27 | 8% | -2% | 20% | $21,977,907 |

| M2R | Miramar | 0.013 | -28% | -13% | -69% | $1,935,304 |

| WCN | White Cliff Min Ltd | 0.017 | 21% | 6% | 143% | $24,365,811 |

| TAR | Taruga Minerals | 0.006 | -14% | -14% | -63% | $4,236,161 |

| ABX | ABX Group Limited | 0.0665 | 19% | 2% | -37% | $15,002,419 |

| MEK | Meeka Metals Limited | 0.035 | -5% | -3% | -27% | $45,684,230 |

| RR1 | Reach Resources Ltd | 0.003 | 0% | 31% | -18% | $9,836,169 |

| DRE | Dreadnought Resources Ltd | 0.019 | 6% | -10% | -72% | $59,722,240 |

| KFM | Kingfisher Mining | 0.078 | -7% | -5% | -65% | $4,189,770 |

| AOA | Ausmon Resorces | 0.0025 | 25% | -17% | -38% | $2,647,498 |

| WC1 | Westcobarmetals | 0.047 | -8% | 7% | -53% | $5,748,116 |

| GRL | Godolphin Resources | 0.033 | -8% | 3% | -49% | $5,584,987 |

| DM1 | Desert Metals | 0.023 | -26% | -18% | -79% | $6,370,217 |

| PTR | Petratherm Ltd | 0.024 | 0% | 26% | -64% | $4,944,525 |

| ITM | Itech Minerals Ltd | 0.075 | -3% | -10% | -69% | $9,048,984 |

| KTA | Krakatoa Resources | 0.008 | 0% | -27% | -71% | $3,776,858 |

| M24 | Mamba Exploration | 0.027 | 8% | -4% | -75% | $4,970,221 |

| LNR | Lanthanein Resources | 0.003 | 0% | 0% | -83% | $5,864,727 |

| TKM | Trek Metals Ltd | 0.049 | 40% | 26% | -29% | $22,592,806 |

| BCA | Black Canyon Limited | 0.099 | -10% | -6% | -59% | $7,715,561 |

| CDT | Castle Minerals | 0.006 | 0% | 0% | -68% | $7,346,958 |

| DLI | Delta Lithium | 0.3 | 7% | -6% | -13% | $199,754,000 |

| A11 | Atlantic Lithium | 0.375 | 3% | -1% | -28% | $243,625,895 |

| KNI | Kunikolimited | 0.29 | 18% | 29% | -39% | $23,393,952 |

| CY5 | Cygnus Metals Ltd | 0.063 | 29% | 11% | -75% | $16,618,871 |

| WR1 | Winsome Resources | 1.26 | 43% | 40% | -10% | $234,665,613 |

| LLI | Loyal Lithium Ltd | 0.3 | -2% | 15% | -6% | $25,850,069 |

| BC8 | Black Cat Syndicate | 0.25 | 6% | 0% | -45% | $79,982,093 |

| BUR | Burleyminerals | 0.051 | -27% | -9% | -78% | $6,153,509 |

| PBL | Parabellumresources | 0.056 | -7% | -10% | -84% | $3,488,800 |

| L1M | Lightning Minerals | 0.07 | -3% | -3% | -55% | $3,378,005 |

| WA1 | Wa1Resourcesltd | 14.99 | 19% | 16% | 886% | $901,644,551 |

| EV1 | Evolutionenergy | 0.0865 | -10% | -8% | -64% | $22,725,891 |

| 1AE | Auroraenergymetals | 0.098 | -7% | -22% | -11% | $17,114,745 |

| RVT | Richmond Vanadium | 0.315 | -3% | 3% | -21% | $29,310,654 |

| PMT | Patriotbatterymetals | 0.85 | -2% | -7% | -38% | $507,022,829 |

| PAT | Patriot Lithium | 0.099 | 15% | 36% | -63% | $6,404,776 |

| BM8 | Battery Age Minerals | 0.097 | -3% | -31% | -74% | $8,258,429 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | -66% | $4,408,998 |

| VHM | Vhmlimited | 0.52 | 4% | -3% | -35% | $80,036,385 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | 7% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.01 | 11% | -23% | -55% | $19,863,078 |

| SRL | Sunrise | 0.9 | 50% | 131% | -47% | $66,768,349 |

| SYR | Syrah Resources | 0.545 | 4% | -19% | -64% | $434,339,082 |

| EG1 | Evergreenlithium | 0.091 | -13% | -21% | -64% | $5,341,850 |

| WSR | Westar Resources | 0.014 | 27% | 8% | -52% | $2,595,005 |

| LU7 | Lithium Universe Ltd | 0.02 | 11% | -9% | -33% | $7,381,916 |

| MEI | Meteoric Resources | 0.24 | 9% | 12% | 109% | $477,628,763 |

| REC | Rechargemetals | 0.045 | -10% | -29% | -67% | $6,286,049 |

| SLM | Solismineralsltd | 0.115 | 10% | -4% | 10% | $8,533,057 |

| DYM | Dynamicmetalslimited | 0.18 | -5% | -10% | -5% | $6,480,000 |

| TOR | Torque Met | 0.145 | 21% | -6% | 26% | $26,375,453 |

| ICL | Iceni Gold | 0.026 | 18% | 4% | -61% | $6,410,587 |

| TMX | Terrain Minerals | 0.004 | 0% | 0% | -27% | $5,726,683 |

| MHC | Manhattan Corp Ltd | 0.003 | 20% | 20% | -40% | $8,810,939 |

| MHK | Metalhawk. | 0.062 | -11% | -6% | -38% | $6,342,210 |

| ANX | Anax Metals Ltd | 0.029 | 7% | 45% | -59% | $13,289,975 |

| FIN | FIN Resources Ltd | 0.017 | 6% | -11% | 0% | $9,739,031 |

| LM1 | Leeuwin Metals Ltd | 0.07 | 1% | -13% | -72% | $3,279,617 |

| HAW | Hawthorn Resources | 0.071 | 1% | -8% | 1% | $25,126,171 |

| LCY | Legacy Iron Ore | 0.015 | 0% | -6% | -12% | $107,989,676 |

| RON | Roninresourcesltd | 0.11 | -12% | 5% | -15% | $4,050,751 |

| ASR | Asra Minerals Ltd | 0.008 | 14% | 60% | -20% | $11,647,970 |

| PFE | Panteraminerals | 0.04 | 5% | -22% | -56% | $10,419,283 |

| KM1 | Kalimetalslimited | 0.42 | -1% | -8% | 0% | $32,063,680 |

| LTM | Arcadium Lithium PLC | 6.62 | 4% | -13% | 0% | $2,587,248,820 |