Monsters of Rock: Iron ore and gold roll higher, but Goldman Sachs still says don’t get too excited about lithium

Pic: Via Getty

- Materials was a big winner today, up ~1.7%

- S&P/ASX 300 Metals and Mining index continues to rebound strongly from mid-March lows

- Iron ore, gold make gains; lithium miners also got a nudge, despite a dour research note from Goldman Sachs

Big miners have lifted the bourse today.

Materials was a big winner, up ~1.7% near close thanks to some strong gains from iron ore behemoths Rio Tinto (ASX:RIO), BHP (ASX:BHP) and Fortescue (ASX:FMG).

The S&P/ASX 300 Metals and Mining index, up ~1.8% for the day, continues to rebound strongly from mid-March lows.

Mining stocks were up as much as 2.3% to hit their highest level since Feb 5, backing on rising iron ore and copper prices. Shares of Rio Tinto $RIO, Fortescue $FMG and BHP Group $BHP advanced between 2.6% and 3.5%.

— CommSec (@CommSec) April 9, 2024

Iron ore futures climbed $US2.71 or 2.7% to $US102.68 a tonne on Monday, “buoyed by hopes of potential measures to bolster the steel industry in China and expectations of a wave of post-holiday restocking from the country’s steelmakers”, according to CommSec.

Copper looks strong, while gold and silver prices continue to push into record territory.

Lithium miners also got a nudge, despite a dour research note from Goldman Sachs.

“… the recent rally in lithium prices should not be interpreted as the end of the bear market, where further supply rationing is needed to reduce both the 2024E surplus and now larger surplus in 2025E,” it says.

“While lithium chemicals forward curves remain in contango, we note that lithium chemicals futures have largely been in contango for most of the price decline from early 2023, so far making them a poor predictor of spot pricing,” it says.

‘Contango’ occurs when futures contract (buy later) prices rise above spot (buy now) prices.

“Similarly, while recent lithium auctions have also brought improving near-term sector sentiment (with some market volume additions 2H weighted), we note announced cargo sales through March make up less than 1% of out CY24E global spodumene volumes and less than 0.5% of total lithium supply.”

In March, Pilbara Minerals (ASX:PLS) injected some sentiment into the market after accepting a pre-auction offer for 5000t of 5.5% Li2O con at US$1106/t, equivalent to US$1200/t for the benchmark 6% stuff (SC6).

That was well above SC6 spot prices of ~US$950/t. Fellow major Albemarle also sold its own spodumene via auction at a substantial premium.

Regardless, GS has a big ‘For Sale’ sign on PLS, mothballed miner Core Lithium (ASX:CXO) and Mineral Resources (ASX:MIN).

It continues to see IGO (ASX:IGO) as a buy “on valuation/FCF, with increasing corporate positioning for lower lithium prices for longer (reaffirmed by our recent Perth trip)”.

Today’s Best Miners

Liontown (ASX:LTR) (lithium) +8%

Red 5 (ASX:RED) (gold) +6.4%

Lynas (ASX:LYC) (rare earths) +4.6%

Whitehaven Coal (ASX:WHC) (coal) +4%

Rio Tinto (ASX:RIO) (iron ore, diversified) +3.4%

IGO (ASX:IGO) (nickel, lithium) +3.35%

Today’s Worst Miners

Newmont (ASX:NEM) (gold) -1.2%

Westgold Resources (ASX:WGX) (gold) -3.3%

Monstar Share Prices Today:

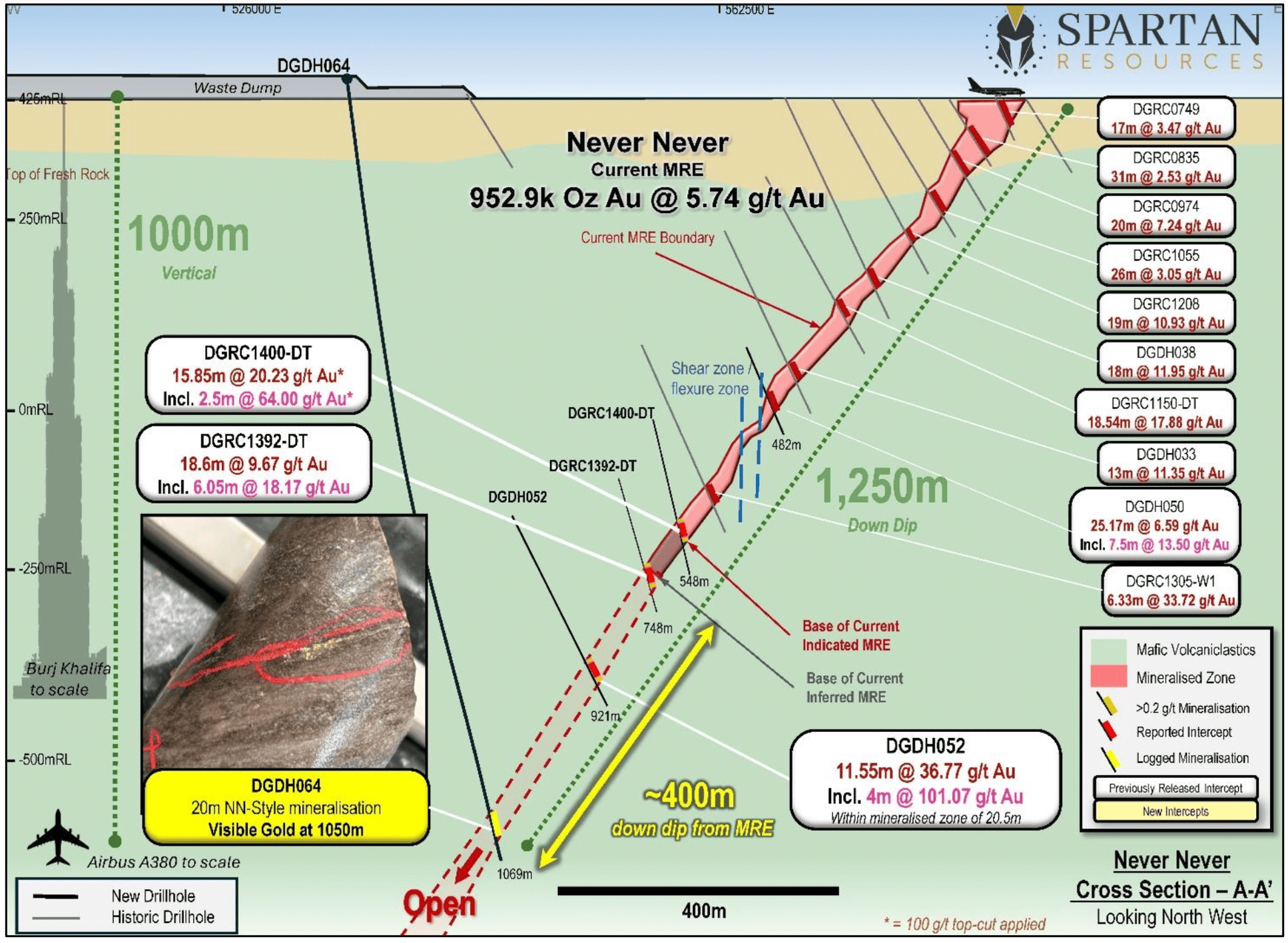

1.5Moz at Spartans ‘Never Never’ could be conservative

The turnaround story of 2023, Spartan Resources (ASX:SPR), continues to surpass expectations in 2024.

Shallow, high grade gold at its game changing +950koz Never Never discovery at Dalgaranga, all within 2km of the processing plant, has propelled the former failed miner ~500% over the past 12 months.

Canaccord Genuity recently estimated Never Never could host +1.5Moz of gold, “assuming mineralisation extends ~200m below the current resource”.

That could be conservative. The deepest ever hole has now hit +20m of mineralisation – including visible gold – from 1034m downhole, or ~400m below the resource.

“The Spartan investment proposition continues to strengthen with each drill-hole,” SPR boss Simon Lawson says.

“DGDH064 was drilled into an area that we expect to be mining many years in the future and provides further clear evidence of the sheer scale and endowment of the deposit.

“While it’s safe to say this is the deepest drill-hole we will be drilling from surface for the time being, we’re absolutely delighted to see a plus-20-metre down-hole intercept of typical Never Never-style mineralisation with visible gold logged in two areas.”

Is there light at the end of the tunnel for Strandline?

Sand miner Strandline Resources (ASX:STA) was worth ~$600m in late 2022 before a bumpy ramp up at the flagship Coburn operation and the resignation of long-time managing director Luke Graham sparked a precipitous fall in the share price.

The stock, worth ~$140m when it was suspended September last year, has yet to return to trading on the ASX due to an ongoing review of the business and its finances.

In better news, STA says Coburn pencilled in record monthly Heavy Mineral Concentrate (HMC) production of 15,510 dry tonnes in March 2024, up 37% on February (11,308 dry tonnes).

Another 14,503 dry tonnes of HMC had been shipped in early April, STA said today, as the operation edges towards name plate production levels.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.