‘The Never Never discovery is unique’: Spartan’s high-grade gold resources to deliver BIG share price upside, brokers say

Brokers have flagged that attractive gold production is well within Spartan’s reach. Pic: We Are via Getty Images.

- Euroz Hartleys and Canaccord Genuity rate Spartan as a Speculative Buy with 50c and 60c price targets respectively

- Combination of high-grade resources and a nearby processing plant is unique, according to Euroz

- Canaccord has an eye on Spartan’s drill program currently testing Never Never “look-alike” prospects

Spartan has been rated a ‘Speculative Buy’ by two leading brokers on the back of its +720,000oz high-grade Never Never gold resource and potential for “exponential high-grade resource growth”.

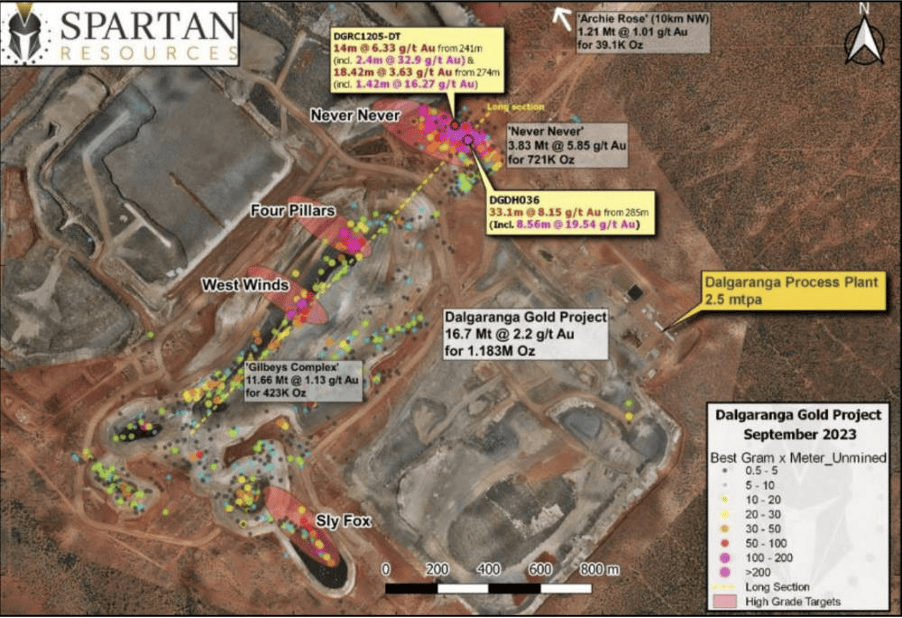

Spartan Resources (ASX:SPR), the former Gascoyne Resources, is up 250% year-to-date after mothballing the low grade ~1g/t Dalgaranga Gold Project to focus on exploring for high grade ounces at the exciting Never Never discovery.

Never Never, located on a granted Mining Lease in the shadow of a well-maintained 2.5Mtpa processing plant, has been a game-changer for the company.

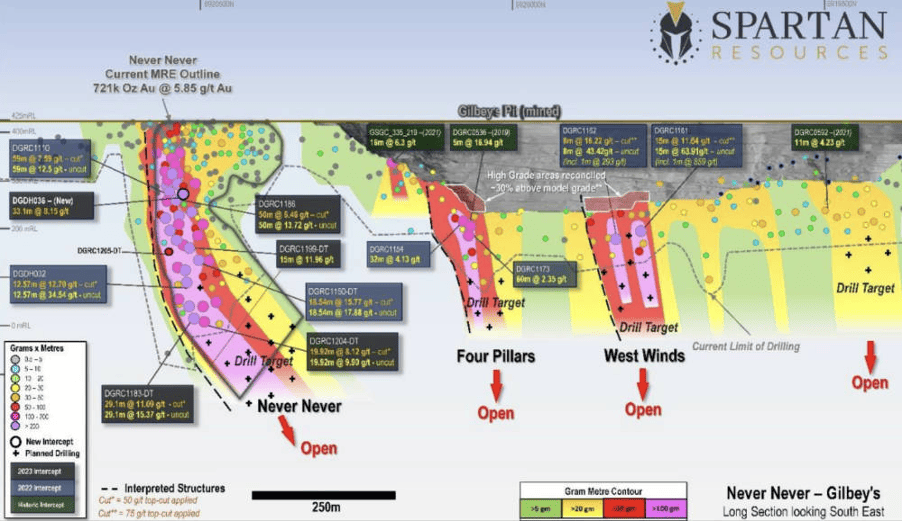

Outstanding drill hits — including an eyewatering 59m @ 12.50g/t from 138m — have culminated in a resource of 721,200oz at 5.85g/t gold at a low discovery cost of $13/oz (compared to the global discovery cost of US$62/oz).

There is potential for further growth, as its full extent has yet to be defined.

A new 25,000m drilling blitz is already underway to “rapidly” add high grade ounces. It will focus on going deeper at Never Never, as well as testing potential for Never Never “look-alikes” at the Four Pillars and West Winds prospects, underneath the Gilbey’s open pit 500m to the south.

The next resource update is due this quarter.

What do the brokers say?

Euroz Hartleys says discoveries like Never Never “are few and far between”.

“The Never Never discovery is unique,” it writes.

“It is a high-grade (5.8g/t with grade increasing with depth), thick (avg.30m), large (720koz) deposit with no significant metallurgical issues located just 600m from a new (5 yrs old), large amenable (2.5Mtpa) CIL (conventional) processing facility.”

The added potential for the discovery of multiple high-grade ‘repeats’ at the project makes Spartan a ‘speculative buy’, says Euroz, which slaps the stock with a target price of 50c a share, almost 22% higher than its current share price of 41c.

“The company has identified 3 compelling targets within 2km of the Never Never deposit which are showing early signs that there could be numerous Never Nevers in the area,” it says.

“We back an experienced management team that is well known across the industry for taking a different view on unloved (and complex) gold projects, extending life, and taking them back into production.”

Euroz adds that with $34.6m in funds, Spartan is well funded to explore and conduct feasibility studies on a potential restart.

“We believe that the milled grade will be much higher than the grade mined previously,” the broker said.

“We postulate at peak production an asset which produces 130- 150kozpa at 1.7-2.2g/t over (at minimum) a 7-year period at EH predicted AISC of A$1200- $1400/oz, putting it in the lowest quartile for Australian gold producers.”

‘One of the highest-grade Australian gold finds in recent years’

Spartan’s qualities have also earned it a Speculative Buy with a higher price target of 60c from Canaccord Genuity, which said that the discovery and subsequent growth of the Never Never deposit had markedly changed it into a company aiming to produce from one of the highest-grade Australian gold finds in recent years.

Canaccord drew attention to the company’s 25,000m drill program, saying that, besides growing the scale and confidence of Never Never, it will also test Four Pillars and West Winds, which are lookalike targets.

“Interestingly, SPR’s new interpretation of the Four Pillars (historical hits include 15m at 12g/t and 8m at 16g/t) and West Winds (historical hits 60m at 2.4g/t and 32m at 4.1g/t) targets, are cross-cut structures similar to Never-Never, where previously they were incorporated in the lower grade Gilbey’s pit resource model,” it said.

“Areas in the Gilbey’s pit, previously mined directly above both Four Pillars and West Winds, were coincident with +30% positive grade reconciliation and are supportive of the company’s interpretation in our view.

“With drilling underway, positive results from these targets could be a meaningful catalyst in the short term and support exponential high-grade resource growth if analogous to Never-Never.”

It also noted that Spartan has several work streams underway to investigate throughput, mining rate and blending strategies as part of its optimisation studies on the processing flowsheet targeting further improvements in overall metallurgical recoveries.

“Ultimately, this work will evolve in line with the current exploration program, and if the company can define additional underground opportunities, these will be incorporated ahead of the targeted decision to restart in mid-2024,” Canaccord added.

The broker said its valuation is built around a base case production scenario whereby the Never-Never open pit and underground deposit as well as the Gilbey’s open pit will support a 1.7Mtpa processing rate to produce about 136,000oz of gold at an AISC of $1616/oz.

“We assume first production in the 2H FY25, with the Never-Never underground accounting for 75% of the ounces produced over a 7-year mine life,” Canaccord said.

“We assume total capital to restart the project of A$120m, which incorporates a mill upgrade (addition of secondary crusher), pre-production underground development, paste plant and cutback on the Gilbey’s pit.”

Both Euroz and Canaccord flagged successful results from the drilling, the expected Dalgaranga Resource update in the current quarter and the restart decision in mid-2024 as key upcoming catalysts for the Spartan.

This article was developed in collaboration with Spartan Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.