Hi ho silver: Sun Silver’s looking to carve out its place on the ASX with a 292Moz silver equivalent resource

Mining

Mining

Special Report: Pure play silver companies are a rarity on the ASX, but with interest in the lesser known precious metal starting to pick up, newcomers such as Sun Silver are hoping to pick up a nice slice of the investment pie.

Silver has long been seen as poor man’s gold, often forgotten when its more glamourous counterpart lives in the limelight.

Those days might be coming to an end – at least to some degree.

The metal is seeing increasing use in photovoltaic solar panels, with the sector’s consumption rising 330% from 2014 to 2023 as solar power continues to grow towards becoming the world’s dominant form of renewable energy by 2027 according to the International Energy Agency.

Silver prices have gained strength this year, rising from US$24/oz at the beginning of this year to the current price of about US$28.27, a 17.8% gain that actually outpaced gold’s 16.8% increase to US$2,376/oz.

This is still a far cry from the all-time high of US$50/oz (US$180/oz inflation adjusted) it hit back in 1980 when the Hunt brothers from Texas tried to corner the market, but still a respectable showing nonetheless.

And as Barry Fitzgerald quoted Morgan Stanley as saying here, there’s still upside ahead.

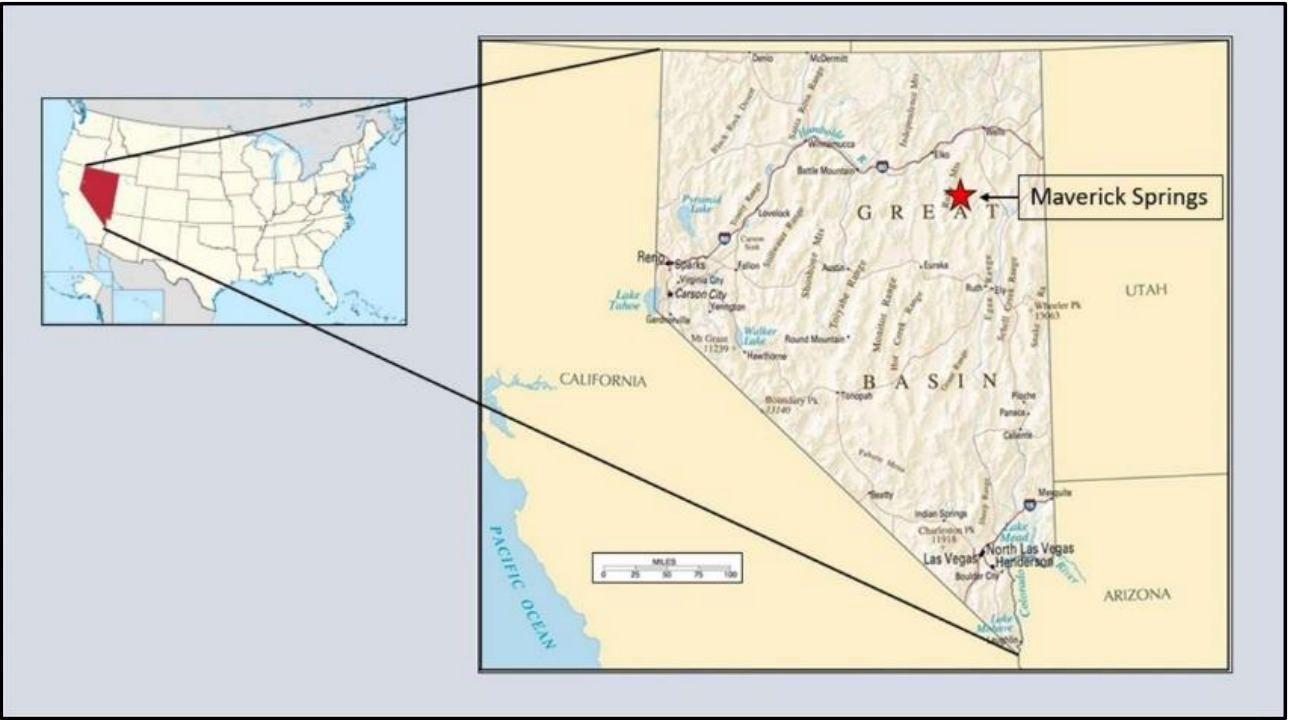

Maverick Springs project located in Nevada, USA. Pic: Sun Silver

This is good news for Sun Silver as it looks to raise between $10m and $13m from its initial public offering of 50 million to 65 million shares priced at 20c each.

Central to the company’s offering is its advanced 19.4km2 Maverick Springs project in Elko County, Nevada, which already boasts a JORC compliant inferred resource of 125.4Mt grading 72.4g/t silver equivalent for a contained 292Moz silver equivalent.

Proceeds from the IPO will be used to complete infill and resource expansion drilling as well as expand on previously completed metallurgical test work and carry out new test work.

Sun Silver will also commence mine and processing studies for Maverick Springs along with early-stage studies to assess the potential feasibility of silver paste and solar energy opportunities.

Along the way, the company will progress US Department of Energy, Department of Defence and Inflation Reduction Act grant applications.

Sun Silver also expects the growth potential at Maverick Springs to draw attention.

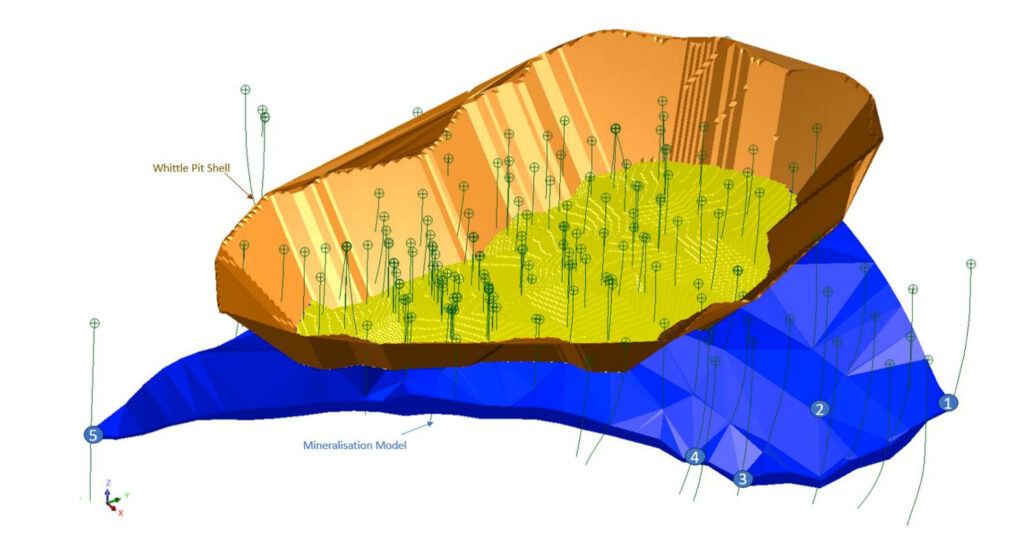

While the existing resource is certainly sizeable enough, the current mineralisation model covers less than a quarter of the project’s area.

The company notes that there is potential to expand the current mineralisation and upgrade resources to the higher confidence indicated level through additional fieldwork.

Notably, additional mineralisation depicted in the image below by the blue polygon currently sit outside the whittle pit shell and have not been included in the resource estimate but may be included in the future with higher commodity prices.

Mineralisation model for Maverick Springs with current resource 292Moz AgEq depicted in yellow. Pic: Sun Silver

The Sun Silver IPO opens on 18 April and will close on 17 May 2024.

Should the offering reach its minimum subscription level, shares in the company will be issued on 27 May and make its entry onto the ASX on 5 June.

This article was developed in collaboration with Sun Silver, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.