Resources Top 5: Quarterly reporting gains a-gogo, while Oceana takes the yellowcake

The Quarterly Reporters Big Sack Race was off and hopping. (Pic via Getty Images)

- Oceana Lithium goes off piste a tad with a sweet uranium anomaly find

- Argent surges (ed’s update, both these have now pulled back just a tad) on silver-tinged news

- Quarterly reporting double-didge heroes include: PVW, MGA, RNX, among several others

Here are some of the biggest resources winners in early trade, Tuesday April 30.

Argent Minerals (ASX:ARD)

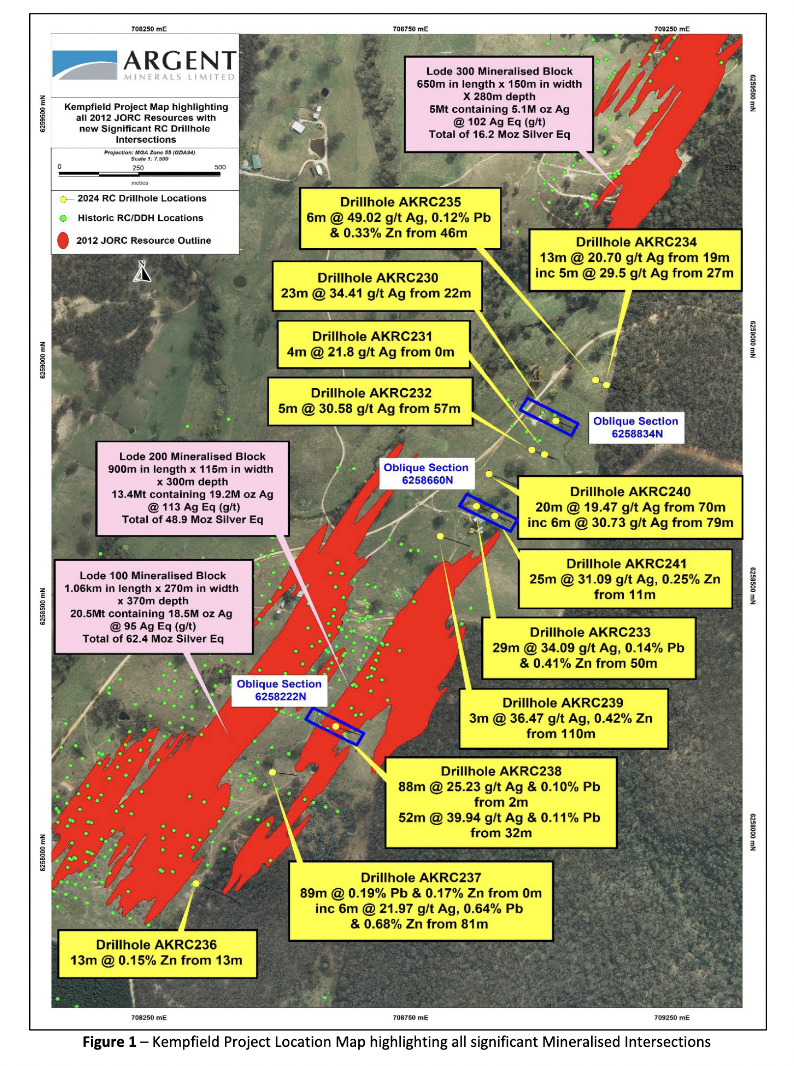

It’s been a beaut year thus far for silver, and Argent has tapped into that nicely, too, with very good timing regarding its efforts at its 100%-owned Kempfield polymetallic (gold-silver-base) project in NSW.

ARD is now up more than 122% for the year, boosted by a +20% intraday gain at the time of writing.

With a 127.5Moz equivalent silver bounty, Kempfield is one of NSW’s largest silver deposits. Its latest drilling and rock-chip sampling is an effort to bolster that further. And it appears to be doing exactly that.

The company has revealed today that all 12 Reverse Circulation (RC) drill holes completed across the Kempfield deposit have intersected shallow, broad thick high-grade zones of silver-lead-zinc mineralisation up to 88m thick from surface from the Western Lode area, and 29m thick high-grade silver-base metal mineralisation located northeast of the Lode 200 Resource Area.

Significant results from the RC drilling include: 23m at 34.41g/t silver from 22m; and 88m at 25.23g/t silver from 2m depth.

High-grade assay results up to 76.47% g/t Ag from a 12-hole RC drilling program have expanded the mineralised footprint over our Kempfield Project in NSW.

Read the full ASX announcement: https://t.co/HgOZrtVUiP$ARD pic.twitter.com/KrDENr12i4

— @Argent_Minerals_Limited (@ArgentLimited) April 29, 2024

Argent MD Pedro Kastellorizos gave some further context:

“The newly defined high-grade silver-base metal zones demonstrate a strong continuation of mineralised extensions along strike and at depth within the Lode 200 Mineralised Block. These zones of mineralisation have identified that the lateral and vertical depth of the overall mineralised lode system is trending in a north-east direction towards the 16.2 Moz Silver Equivalent Lode 300 Mineralised Block.”

ARD share price

Oceana Lithium (ASX:OCN)

Lithium junior explorer Oceana is best known for its peggie hunt in both Australia and Brazil, but it’s uranium that takes the yellowcake for OCN today.

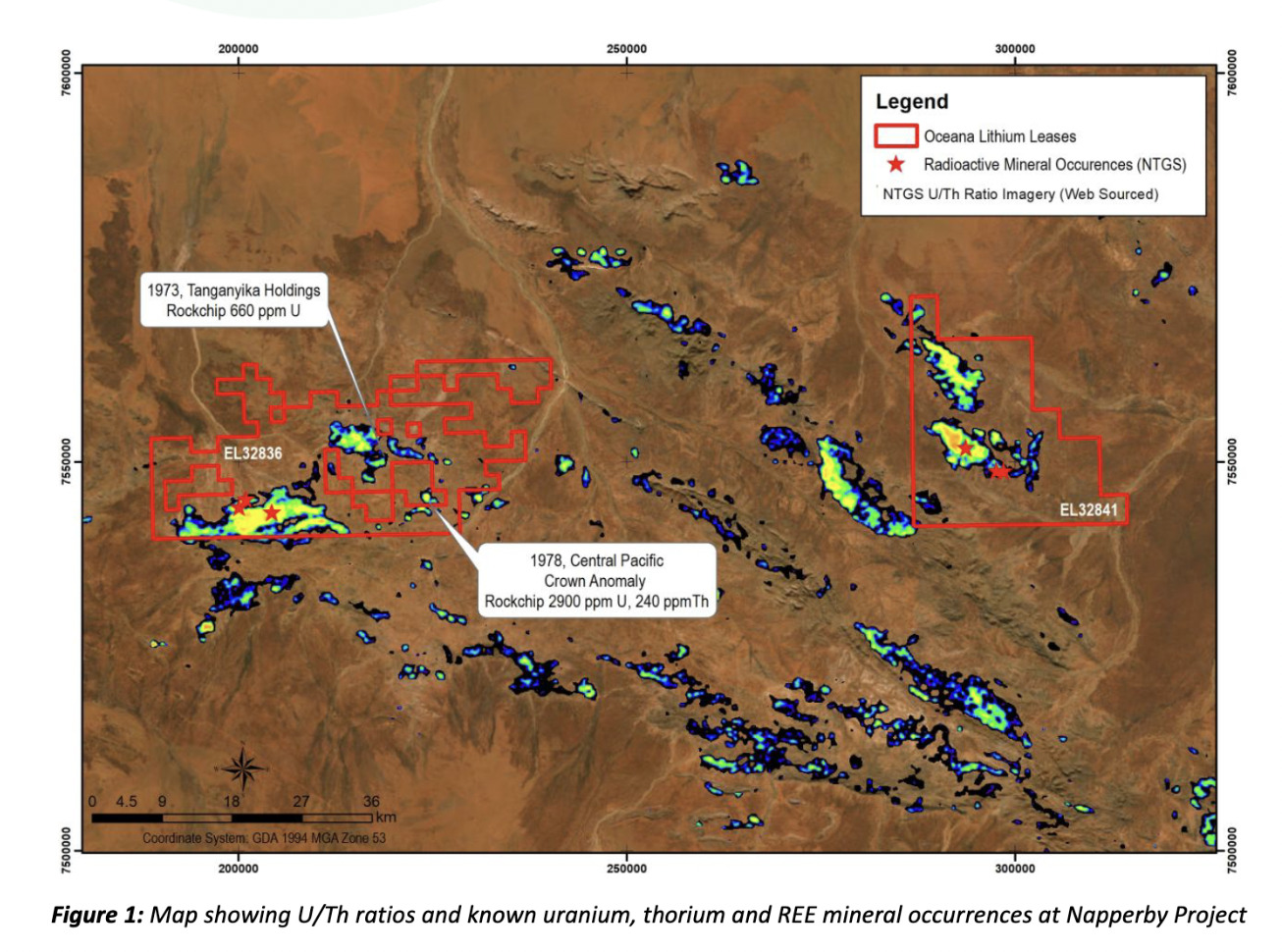

The company has defined, from soil sampling, a large uranium anomaly, +4.5km long and 700m wide, at its 100%-owned Napperby project in the Northern Territory.

That’s a project situated within the Arunta Province, which is known for its highly prospective lithium rocks, Rare Earth Elements (REEs) and uranium mineralisation. The Paleoproterozoic Wangala and Ennugan mountains in the region are renowned as “hot granites”, notes the company, hosting uranium and REEs in particular.

What next? Follow-up mapping of the identified uranium and sulphide targets will get underway, with a view to nailing some drill targets.

Field exploration activities will also assess lithium-caesium-tantalum (LCT) pegmatite potential along with uranium and REEs.

Read more > here.

OCN share price

PVW Resources (ASX:PVW)

It’s quarterly cashflow and activities reporting time again, and here’s one that’s burst to the top of that lane at the time of punching keys for a living. (Someone’s got to do it. R… right, AI-plotting dark lords?)

PVW is up more than 30% today (Ed: at time of writing – now pulled back to about 10%), and here are some of its latest reported highlights.

The company, despite admitting some challenges in the quarter due to its Tanami REE projects and NT projects being hard to reach due to late wet season rains, has kept shareholders’ interest going with strong gold focus and targets in Kalgoorlie and Leonora.

In particular, says the company… “The focus for the coming quarter is on planning gold exploration activities at the Kalgoorlie Project and finalising new project assessments.”

Re the Kalgoorlie Project, its gold targets are a priority for 2024. An aircore program of 4,500m has been budgeted and proposed with program of works approvals pending.

Per the company report:

“The lack of exploration in the south of E27/614, the existence of multiple gold anomalies in auger drilling and multiple anomalous gold results in previous Aircore drilling are all important factors that together warrant a significant drilling programme.”

PVW share price

Sihayo Gold (ASX:SIH)

Here’s an under-the-radar goldie junior that tends to only very occasionally get a mention on these pages in passing – often on, perhaps less-than-reassuring, thin trading action. To be 100% real about it.

But look, it’s up an unnervingly clean 100% so far today. On some news, though, so let’s have at it for a few pars and see what’s doing.

Briefest of backgrounding first. The explorer’s main game has been the development of the Sihayo Gold Project (75% interest) in Indonesia, along with the Shihayo Pungkut gold-copper project (generation contract of work) and the gold and silver resource at the Sihorbo South prospect, which is part of the greater Hutabargot Julu project.

The news then, is an off-market takeover offer from a cashed-up group called Provident Aurum, owned by Indonesian firm Provident Minerals, which happens to be Sihayo’s largest shareholder since 2013.

Provident provided a recent unsecured working capital loan of US$3.9 million to Sihayo, and assistance in connection with Indonesian regulatory approvals.

The proposed offer is at a price of 0.225 cents cash per Sihayo share, and is subject to a number of conditions, naturally.

Watch Sihayo’s space. Or not. Suppose it’s your call, really.

SIH share price

5 for 1 deal – five other stocks rising on quarterly gains

Renegade Exploration (ASX:RNX)

Rimfire Pacific Mining (ASX:RIM)

At Stockhead we tell it like it is. While Argent Minerals and Oceana Lithium are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.