Here are Sprott’s 2024 predictions for uranium, copper, gold and silver

Mining

Mining

Worried about your resources portfolio in 2024?

Here’s the good news from Sprott’s market strategist Paul Wong and ETF product manager Jacob White, who are predicting a better year for copper and exceptional times for uranium, gold and silver.

In a mid-January note Wong and White said the new renewable energy/EV-led commodity supercycle would continue to boost metal consumption again in 2024.

Like 2023, increased supply could lead to modest surpluses but geopolitical factors – like mining disruptions and resource nationalism — could undermine these surpluses quickly.

Political tensions in general will play a huge role in metals markets this year, according to Wong and White.

“Geopolitical tensions appear set to rise, especially with a slew of critical elections in 2024 (over 60 countries and more than half of the world’s population will be going to the polls),” they say.

“…with well-known and large-scale risks like escalating Middle East tensions, the Russia-Ukraine war, China’s property market crisis and tensions with Taiwan, and the U.S. national election, the safe haven attributes of precious metals may become more attractive.”

The copper market fluctuated throughout 2023 but ultimately maintained its value and closed the year up 1.19% at $3.84/lb, say Wong and White.

“Despite economic challenges, copper demonstrated remarkable resilience compared to other commodities like lithium and nickel,” they say.

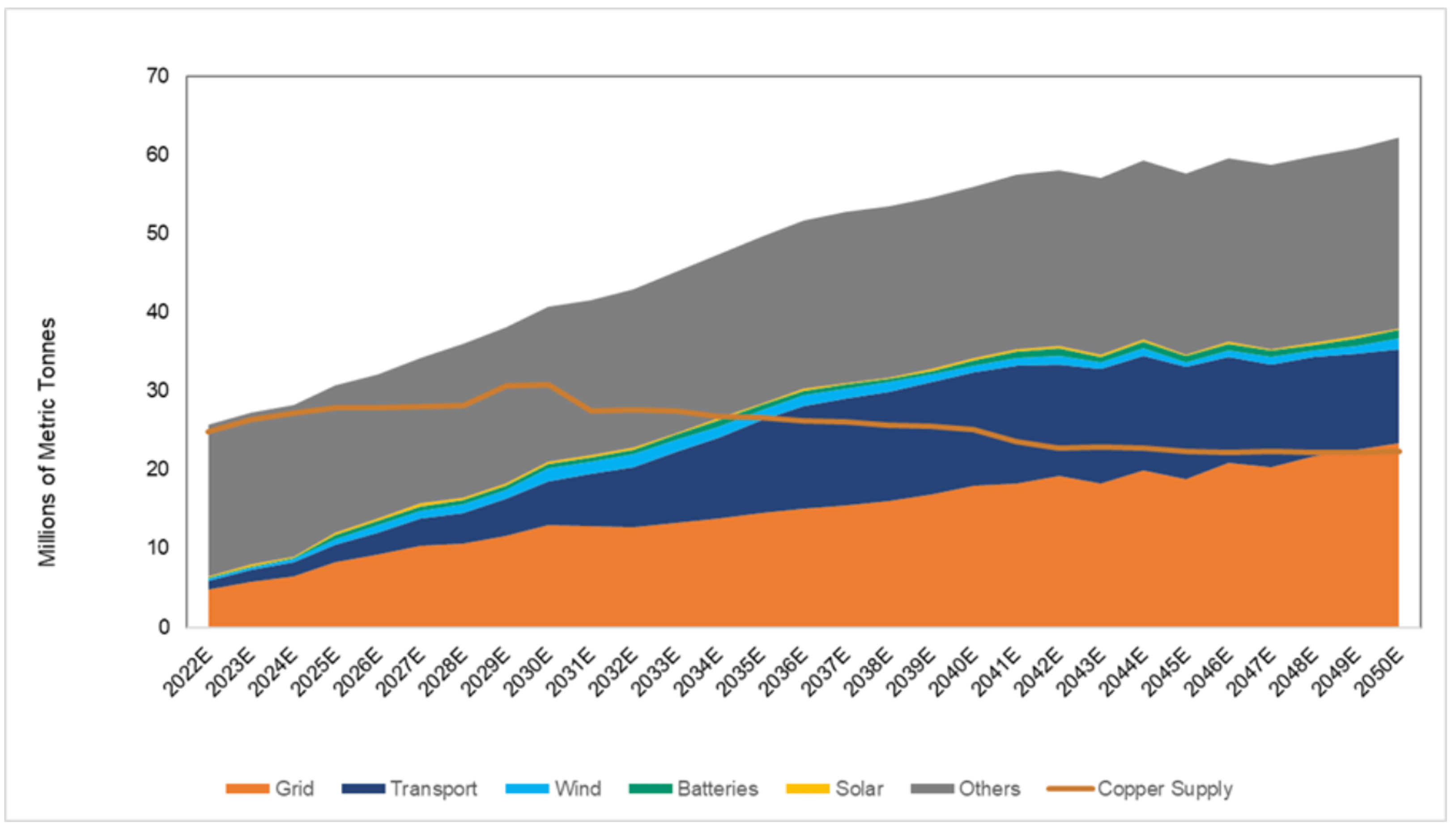

In 2024, the robust outlook for growth in copper demand contrasts starkly with the supply side.

“Notably, despite plans for increased production, Codelco, the largest copper miner in the world, is experiencing its lowest production levels in 25 years,” the say.

“This predicament is exacerbated by the simultaneous global decline in ore grades, intensifying the supply challenges.”

Increasing production disruptions also exacerbate the gap between supply-demand.

“These disruptions historically hovered around 5% of supply, but the ratio has risen with recent events,” say Wong and White.

“Most notable was the shutdown of a significant mine in Panama which alone accounted for 1.5% of the global copper mine supply.

“Elsewhere, operational issues have led Anglo American to curtail its copper production.”

Collectively, these disruptions have tilted the copper market from a projected slight surplus to an impending deficit for the year 2024, they say.

“There is a minimal buffer in inventories that heightens the risk of a sudden price surge should buyers make large drawdowns to secure supplies,” say Wong and White.

“The possibility of more accommodative macroeconomic policy in 2024 further fuels the outlook for copper and creates price opportunities for copper miners.

“There is also the potential for mergers and acquisitions in the industry as many large miners prioritize copper as a strategic metal, adding an additional layer of optimism for existing copper miners.”

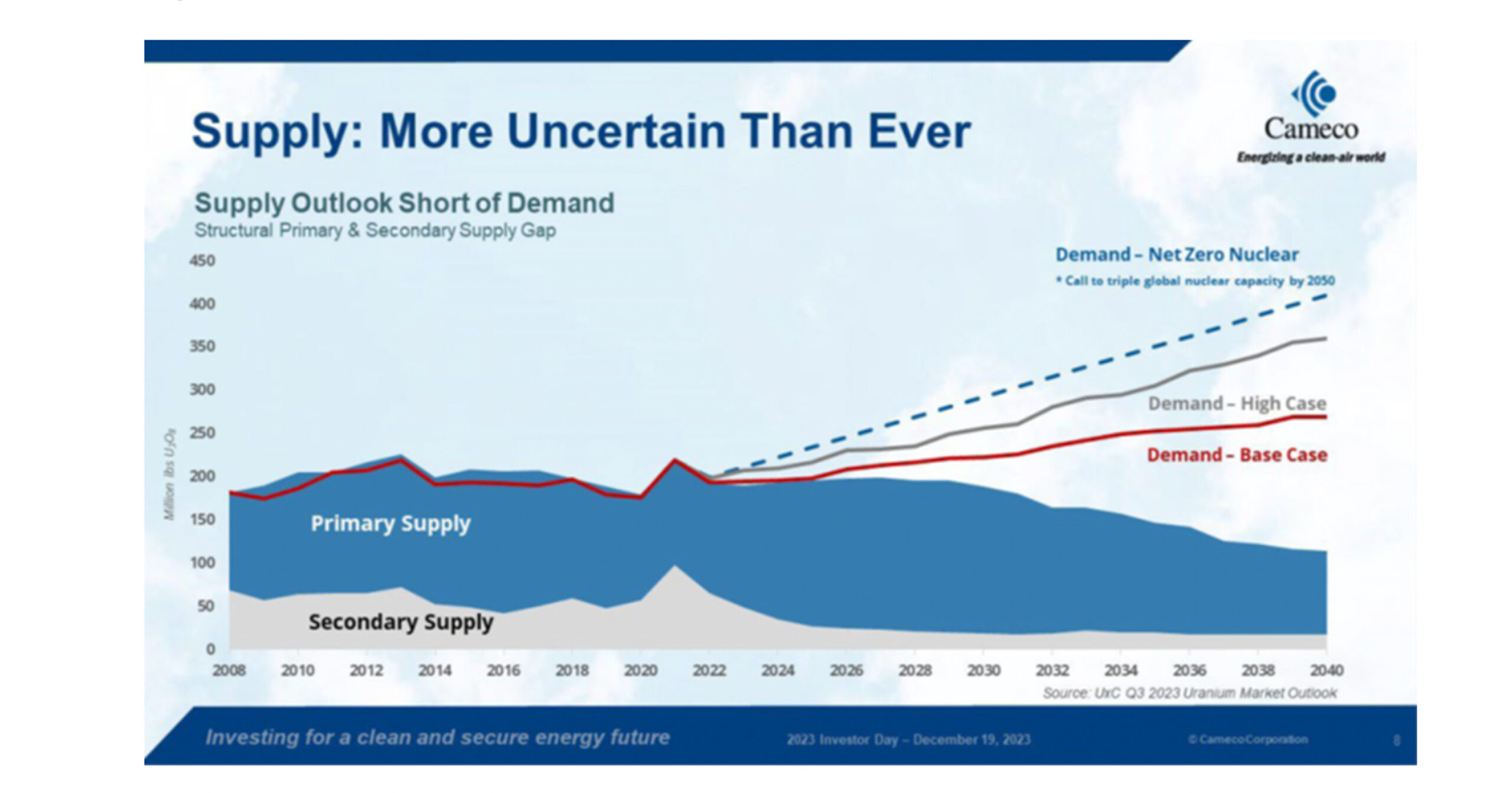

2023 was a blockbuster year for uranium and uranium miners as the spot price gained 88.54% to end the year at $91.09/lb.

The long-term fundamentals are bullish, and price momentum is likely to continue into 2024, say Wong and White.

Sentiment around nuclear energy — reliable baseload power to offset the intermittent nature of renewables – is bullish, with 22 countries pledging to triple nuclear capacity by 2050.

Add to this increasing geopolitical instability, and Western uranium miners may be the ultimate beneficiaries.

“In 2024 we expect utilities to continue to self-sanction and refrain from signing new contracts with Russian entities, perhaps accompanied by government legislation,” say Wong and White.

“The 2023 coup in Niger and Kazakhstan’s chronic inability to meet production guidance add to the uncertainty and underscore the importance of supply security.”

With uranium mine supply persistently below the needs of the world’s uranium reactors, the market has relied on secondary supplies.

“However, we believe that the era of inventory destocking, the primary source of secondary supplies, is over,” say Wong and White.

“We expect an industry shift from underfeeding to overfeeding will move enrichment processes from creating additional supplies of uranium to instead creating additional demand.

“The uranium market is forecast to face a growing supply-demand deficit that could ultimately benefit uranium and uranium miners.”

The Federal Reserve’s aggressive tightening in 2023 and subsequent high real interest rates/strong U.S. dollar was supposed to have a negative impact in the gold price.

And yet it made an all-time high, driven by aggressive buying from central banks and sovereigns.

In 2024, a less hawkish Fed stance could bolster gold prices and — in anticipation of this shift — prompt further short covering and new long CFTC and ETF positions in gold, say Wong and White.

“The official sector’s gold buying trends since Q2 2022 underscore the strength of demand,” they say.

“Central bank quarterly purchases have averaged 328 tonnes over the past five quarters, a 2.6-times increase from the prior decade’s quarterly average of 127 tonnes per quarter.

“Efforts by many countries (for example, China) to move away from U.S. dollar-based reserve assets will only strengthen as deglobalization and geopolitical stresses increase.”

Wong and White expect the confluence of central bank policies, Treasury liquidity impairment, inflationary pressures, and geopolitical factors to have positive effects on gold prices in 2024.

“Central bank buying and investor hedging against potential policy shifts and economic uncertainties are likely to drive robust demand, highlighting gold’s enduring appeal and strategic importance in a turbulent economic landscape.”

Could this be silver’s breakout year?

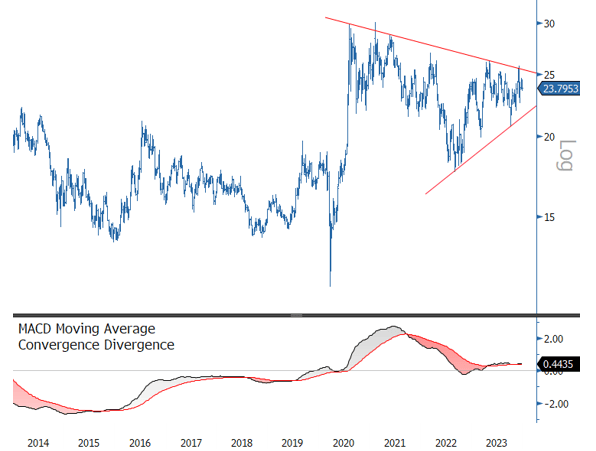

Silver, which plays a dual role as investment vehicle and industrial metal, was held range bound by several significant factors in 2023, say Wong and White.

“Investment demand slowed in anticipation of rising interest rates and slower economic growth, notably in the U.S. and China,” they say.

“High carry costs and elevated lease rates prompted the release of silver into the physical market, further loosening conditions.”

The outlook for silver is more promising. A Fed pivot in monetary policy is expected around mid-2024 and could lead to more supportive market flows for silver. Silver may also likely benefit as the economy — and particularly the industrial sector — recovers.

“We expect silver prices to improve, driven by lower interest rates, more robust physical investment, ETF purchases and increased industrial demand,” say Wong and White.

“With higher volatility than gold, silver has the potential to outperform during the rally phase as it plays catch-up to gold’s price moves.

“Technical patterns in the silver market also suggest the potential for an explosive move higher.”