GTI bulks up US uranium portfolio with significant Wyoming acquisition

Mining

Mining

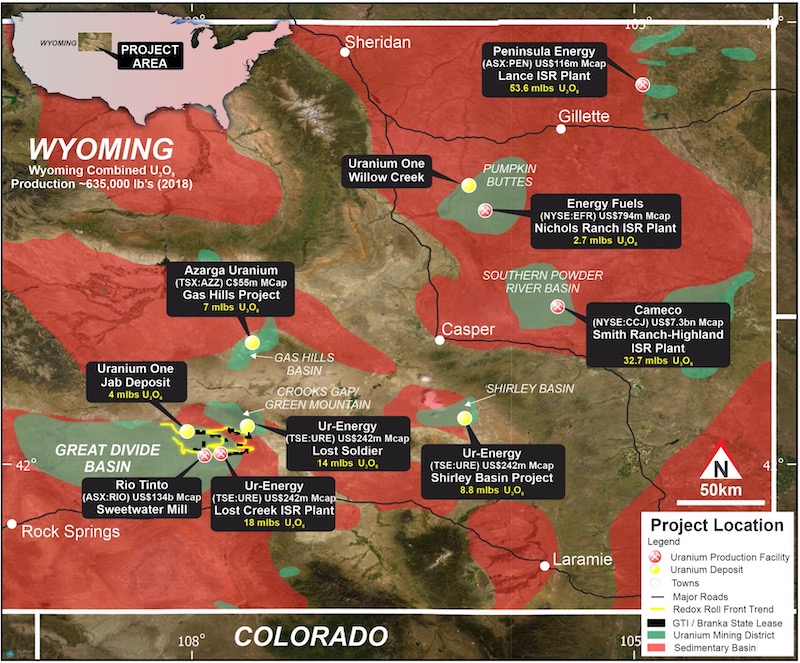

GTI Resources will significantly expand its US uranium portfolio after agreeing to acquire 85 km2 of carefully selected underexplored properties in Wyoming’s famed Great Divide Basin.

The acquisition will give GTI (ASX:GTR) control of the largest non-US, Russian or Canadian-owned uranium exploration landholding in the region, and the company’s first foray into low-cost in-situ recovery (ISR).

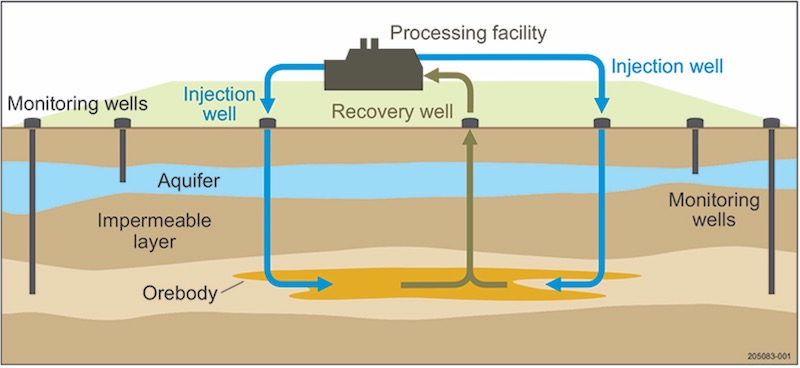

ISR accounts for around 90% of US uranium production and has been used in Wyoming since the 1960s, accounting for 100% of the state’s production since 1993.

It’s the lowest cost uranium mining method in the world, with less environmental impact than hard rock mining.

The land GTI has picked up is highly prospective for front roll uranium amenable to ISR, and sits in fine company adjacent TSX-listed UR Energy’s Lost Creek ISR production plant and Rio Tinto’s (ASX:RIO) Kennecott Sweetwater Mill.

UR Energy states that Lost Creek, which has an indicated and measured resource of around 12 million pounds at up to 440 parts per million uranium, is the lowest-cost uranium producer outsize of Kazakhstan. Nice company to hold.

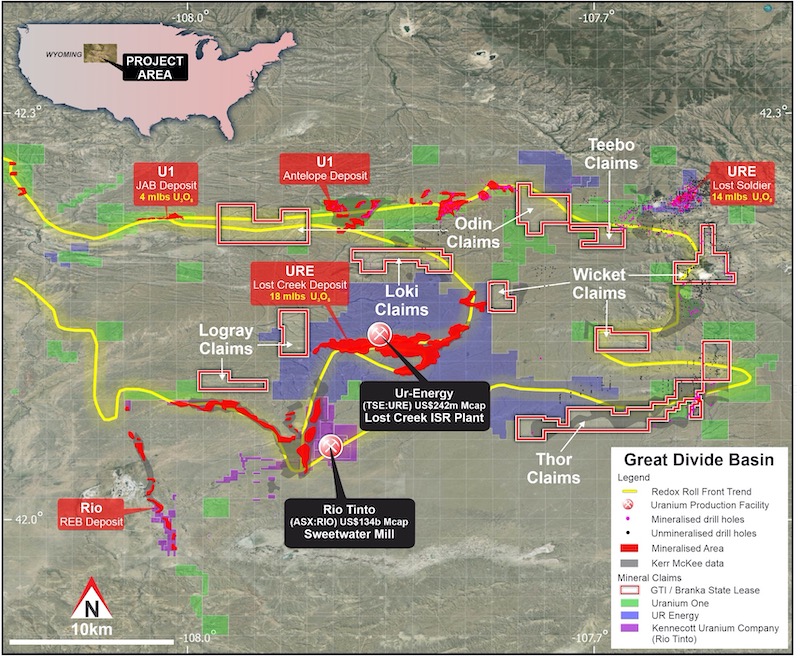

It terms of its own landholding, GTI will acquire around 22,000 acres across several groups of strategically located and underexplored mineral lode claims and two state leases.

GTI will also have at its disposal a highly experienced local execution team, with Great Divide Basin uranium deposit discovery success and proven development and exploration expertise.

According to the company, several of the Wyoming properties were part of extensive regional reconnaissance drill programs conducted in the 1970s and 80s by major US companies including Kerr McGee Uranium, Conoco Minerals, Phillips, Wold Nuclear, Union Carbide, Occidental Petroleum, Western Nuclear and Pathfinder Mines.

It’s an exhaustive list, but at the time ISR was not as common a mining practice for the recovery of uranium, meaning the historical explorers tended to focus on shallower mineralisation.

That’s since flipped, with ISR now the only means of uranium production in the state – it currently homes seven operable ISR facilities, with two more licensed for construction.

The Wyoming properties to be acquired were carefully selected to include areas proximate to known mineralisation, and to fill gaps between UR Energy and Uranium One’s mineral holdings.

Wyoming ranked second overall of 78 mining jurisdictions measured in the 2020 Fraser Institute Survey of Mining Companies – making it a great place to do business and to explore for uranium.

In support of its Wyoming acquisition, GTI has secured the services of Doug Beahm to guide the exploration and development of its projects with permitting already underway for a 50,000-foot drill program at the Thor project area.

Principal engineer with BRS Engineering, Beahm is a engineer and geologist with more than 45 years of experience in mineral exploration, mine development and project evaluation.

His experience spans time working in uranium exploration, mining and mine land reclamation in the western part of the US since 1975.

As a firm, BRS specialises in uranium exploration, mineral resource evaluation, mine design, feasibility, mine operations and reclamation, and has completed a number of projects and reports across the development spectrum over the years.

Wyoming geologist James Baughman will also join, helping to guide the company’s uranium activities.

Baughman is a former president and CEO at High Plains Uranium – a company sold for US$55 million to Uranium One in 2006 – as well as Cyclone Uranium.

He brings more than 30 years’ experience advancing minerals projects from grassroots to the advanced stage.

ISR refers to the process in which an acid or alkaline solution is injected and extracted into an area using a series of wells drilled from surface to leach target ores.

Like so:

In 2019, 57% of the world’s uranium was mined by ISR, with most of the mining in major production areas the US, Uzbekistan and Kazakhstan now carried out this way.

South Australia is home to two ISR uranium mines, as well as a satellite ISR operation.

The property holdings are split into two stages. Under the agreed binding deal, GTR will issue the owners of Branka 135 million fully paid ordinary shares at a deemed value of 2c each and pay $600,000 reimbursement for establishment and landholding costs of the first stage of properties.

The vendors will receive further conditional consideration of 22.5 million shares at the same value, and a further $450,000 reimbursement, subject to the properties covered by stage two of the deal being registered with the US Federal Bureau of Land Management.

The vendors will also be entitled to a deferred consideration of an added 37.5 million GTI shares subject to the achievement of certain project milestones.

The deal is subject to a series of conditions to be satisfied within 90 days.

GTI will also undergo a capital raise to fund the acquisition, project exploration, payment of costs and working capital.

The company will raise $2.025 million through the placement of 135 million shares at 1.5c each, with one free attaching option for every four shares subscribed.

A second placement of 40 million shares at the same issue price will be undertaken to add a further $600,000 to the kitty, with the same attaching options in place.

GTI shareholders will also be given the chance to participate in a fully underwritten, non-renouncable entitlement offer of 97,439,750 shares on a one-for-eight basis at an issue price of 1.5c, to raise $1,461,596.

A free attaching option will be included for every four shares subscribed.

All options will be exercisable at 3c, expiring three years from issue and to be listed on ASX.

GTI is concurrently exploring for uranium at the hard rock Henry Mountains project in Utah, where exploration drilling was recently completed at the Section 36 project area.

The company said it believed further drilling was warranted at the project, and that the shallow nature of mineralisation could support low-cost, rapid exploration advancement.

It intends to finalise planning of further fieldwork pending assays to come, and said the intention was to continue to progress its regional projects in anticipation of uranium and vanadium price improvements to the point where the nearby White Mesa Mill recommences processing of ores mined in the region.

GTI also highlighted a recent move by TSX-listed International Consolidated Uranium (CUR) to acquire a portfolio of conventional uranium projects in Utah and Colorado from US-listed Energy Fuels Inc (EFR) – the owner of White Mesa.

That deal included toll milling and operating agreements, positioning International Consolidated as a potential near-term US producer.

“GTI sees this move by EFR and CUR as encouraging, particularly because it appears to affirm EFR’s intention to toll treat ore,” the company said.

“GTI is positioning its Utah projects for, when uranium market conditions improve, a potential return of the White Mesa Mill to purchasing ore.”

Meanwhile the company is reviewing its options to advance its exploration efforts at the Niagara gold project in Western Australia.

GTI said it expected to advise of next steps at Niagara over the coming months while prioritising uranium exploration at its current projects and the too-be-acquired Wyoming properties.

This article was developed in collaboration with GTI Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.