Ground Breakers: New Hope the latest coal miner to rake in the dough as record prices continue

Mining

Mining

We don’t think coal miners were the heroes on the minds of Star Wars fans when they watched Luke Skywalker and the Rebel Alliance blow up the first Death Star.

But investors who have eschewed ESG convention and weathered years of volatile prices are certainly seeing the good side in their investments in coal right now, with New Hope Corp (ASX:NHC) the latest to post remarkable earnings figures as coal prices remain near all time highs.

NHC delivered underlying EBITDA of $645 million for the quarter to July 31, with final unaudited financial year EBITDA of $1.56 billion, stuffing its bank account with closing cash and equivalents of $815m against receivables of $504m.

That came after the $94.4m investment in Malabar Resources announced earlier this month, which handed New Hope a 15% interest in the private coal miner and its under construction Maxwell underground met coal mine in the Hunter Valley.

New Hope saw ROM coal production life 29.1% to 2.484Mt in the July quarter, with saleable production of 1.907Mt, with full year production down 27.8% to 10.112Mt and saleable coal production for the full year down 17.7% to 7.889Mt.

It sold a total of 8.839Mt, down 12.4%, after the wind down of the New Acland mine in Queensland, where a protracted approvals process hotly contested by environmental groups has delayed an expansion.

Queensland authorities issued the environmental authority for the Stage 3 extension on June 28, with the company working to secure its mining leases and water licence.

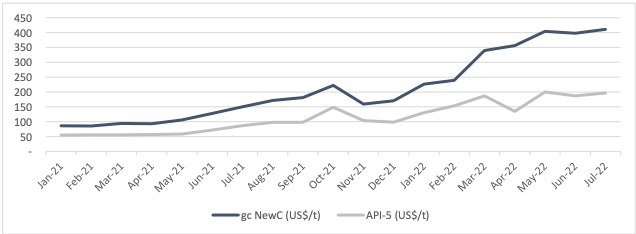

The GlobalCoal Newcastle Index price for the quarter was a record US$404.99/t, supported by the introduction of a ban on Russian coal in Europe, well above the current met coal price, something NHC says supports its strategy of maximising its washed high energy thermal coal.

Get ready for some hefty dividends, with major coal stocks Yancoal (ASX:YAL) and Coronado (ASX:CRN) already dipping into their suddenly deep pockets to provide significant returns to shareholders.

Whitehaven Coal (ASX:WHC) reports its full year results on August 25, with NHC to follow on September 20.

Ramelius Resources’ (ASX:RMS) shares took a big dive this morning, shedding more than 5% after the gold miner announced a $90-95 million non-cash impairment on the value of its Edna May gold operations in WA.

Along with a non-cash write-off for exploration and other minor assets of $18-20, offset by the $30.3m in cash received from the sale of its royalty over the Kathleen Valley lithium mine to Liontown Resources (ASX:LTR), RMS will log a pre-tax expense of $77.7-84.7m.

That should see its anticipated underlying NPAT of $105-110m cut to a statutory NPAT of $20-25m on he release of its full year results next Monday.

It all follows a string of tough updates around Ramelius’ Edna May mine, where it plans to deliver a decision on an as yet unapproved cutback of the Edna May pit later this year.

“While today’s downgrade may just be making a lower valuation official in an accounting sense, this Edna May hub impairment ($90-95m) would still represent a material ~59% of our A$156m site valuation,” RBC’s Alex Barkley said.

“At the Q4 result RMS guided to higher than expected FY23 AISC at A$1750-1950/oz (RBCe A$1747/oz). This was 25% above our pre-result expectations and 32% above prior FY23 guidance.

“We find the economics of the Edna May Stage 3 cutback may also be in doubt. Today’s impairment, plus surprisingly higher FY23 AISC guidance and risks to Edna May pit expansion, all suggest potential margin difficulties at Edna May. RMS is likely to trade lower on this announcement.”