Gold Digger: Overvalued or racing towards US$2500/oz? Will the real gold price please stand up?

Pic: Via Getty

KEY POINTS:

- ANZ, Victor Smorgon Group expect gold to trade near US$2500/oz by the end of 2024; Goldman Sachs has a US$2700/oz price target

- Naysayers like RBC Capital Markets commodity strategist Christopher Louney warn gold looks ‘overvalued’

- ASX Large Cap Standouts This Week: Westgold, Regis, Silver Lake

- ASX Small Cap Standouts This Week: Felix Gold, Matador Mining

“A noble spirit embiggens the smallest man,” a wise man, who may have actually been an evil pirate, once said.

Jebediah Springfield was, in actuality, the murderous Hans Sprungfeld and much like the herd mentality that led the town of Springfield to whack snakes in his honour, a rising gold price has embiggened analysts to pump up their forecasts.

It used to be a hearty joke told by aristocrats around the fireplace to disinterested servants that gold could bound beyond US$3000 an ounce.

Now, as the world collapses under geopolitical strife, central banks stock up for the apocalypse and eager beavers bay for rate cuts from the US Fed even conservative assessors are touting a move beyond US$2500/oz.

ANZ this week said it expects gold to trade near US$2500/oz by the end of 2024 (and silver to a decade long high of US$31/oz). Goldman Sachs has a US$2700/oz price target by year end, up from US$2300/oz previously.

All of a sudden those dreamers (and maybe even the #silversqueeze bros) don’t seem so crazy.

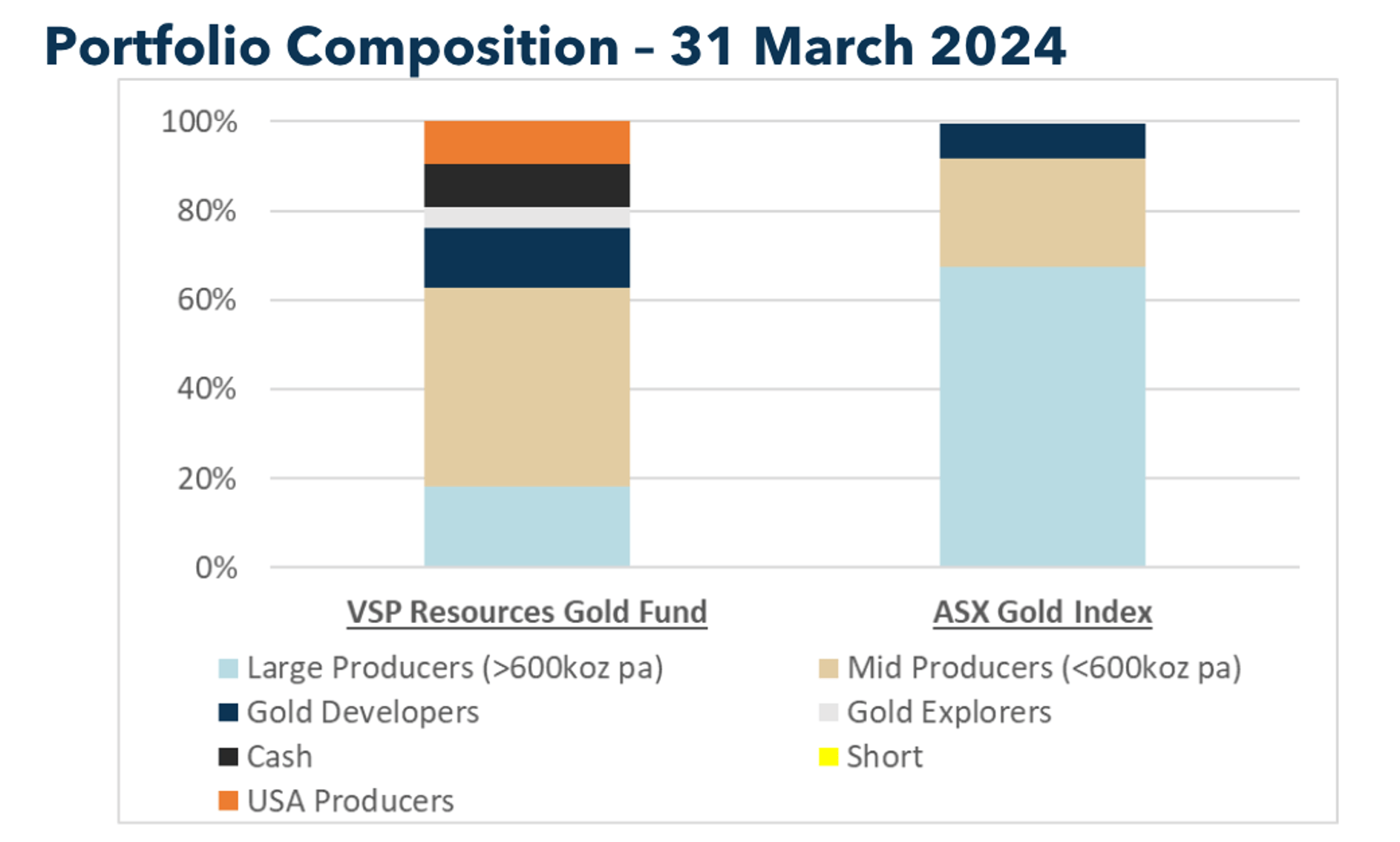

The Victor Smorgon Group has seen its gold fund return 13.9% in March and 38.2% since its May 2020 inception, outperforming the ASX Gold Equities Index by 43.0%. Here’s the composition difference between the two:

Its executive chair Peter Edwards and co-CIO Joseph Sitch reckons gold could move to US$2500/oz with hints of recessionary scents wafting through the air.

“Heightened geopolitical tensions in a key election year for global economies, combined with strong central bank buying, should provide further support for the gold price,” they said.

“A recession has historically rewarded gold, averaging a price gain of around 13% in the past seven recessions, which implies a price of around US$2,500/oz.

“Together with the fact that gold ETF demand has not matched the rise in the gold price suggests that there is still significant potential upside for gold.”

Gold closed Thursday at US$US2383.70/oz on the LBMA, but caught new wind in futures markets on Friday after a reported missile strike by Israel on Iran.

Tailwinds for gold

ANZ’s Daniel Hynes and Soni Kumari had previously seen gold going to US$2300/oz by the end of the year. They now think it could go even higher to US$2500/oz by December, US$2550/oz by next March and US$2600/oz by next June.

For reference gold averaged just US$1926/oz in 2023 — at that point an all time year high.

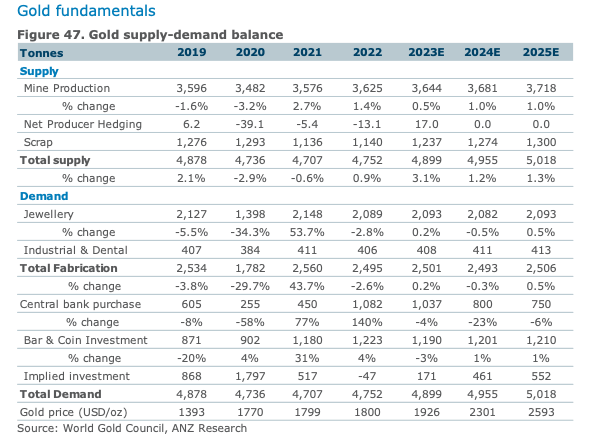

Between ANZ and World Gold Council data, they see gold demand and supply eclipsing 5000t for the first time in 2025.

But are there naysayers? You betcha

Of course not everyone can be convinced as the gold trade flips from contrarian bet to conventional wisdom.

RBC Capital Markets commodity strategist Christopher Louney warned gold looks ‘overvalued’ by more traditional macro drivers while bulls focused on safe haven demand, central bank demand and physical premia.

“Gold prices have rallied to record highs with market participants, ourselves included, attributing much of the driving force to be strong central bank demand, strong Chinese consumer demand, physical demand generally (take the Costco gold bar sales stories as an example), and geopolitical risks given ongoing conflicts in both Europe and the Middle East, never mind other potential flashpoints,” Louney said.

“All this time, however, we have cited gold as still holding inherent vulnerabilities. This is for a few reasons.”

He argued the current drivers for higher gold prices were not usually those most predictive of movements historically.

“It is important to stress here that these are relevant factors for gold, but rarely in recent times are they the overriding drivers of price or the most predictive parts of models on a sustained basis” Louney said.

“Gold models often rely much more on macro drivers like rates (which remain high), the dollar (which remains strong) and other items.

“By most of those measures, gold is actually quite overvalued, especially when looking at single factors. But even when using a blended model like ours for example, gold still looks overvalued versus our high scenario (never mind our middle scenario). Perhaps this is a signal to readjust our expectations? Or perhaps the gravity indicated by macro drivers is just not important right now?”

Louney cautioned that RBC “certainly may be wrong”, but noted poor investor interest in ETFs outside of Asia showed there could still be a reckoning for the bull run.

RBC’s high scenario has prices averaging US$2248/oz in 2024 and not lifting to current levels sustainably until 2025, when it sees high scenario averages of US$2394/oz.

This week’s large cap winners

WESTGOLD RESOURCES (ASX:WGX) +12%

REGIS RESOURCES (ASX:RRL) +10%

SILVER LAKE RESOURCES (ASX:SLR) +9%

This week’s large cap losers ❌

GOLD ROAD RESOURCES (ASX:GOR) -10%

WEST AFRICAN RESOURCES (ASX:WAF) -4%

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| CODE | COMPANY | %Wk | %Mth | %Yr | SHARE PRICE | MARKET CAP |

|---|---|---|---|---|---|---|

| LYN | Lycaonresources | 67% | 71% | 67% | 0.3 | $12,556,031.54 |

| FXG | Felix Gold Limited | 64% | 173% | -16% | 0.082 | $17,613,284.61 |

| TAR | Taruga Minerals | 50% | 50% | -51% | 0.009 | $6,354,241.07 |

| NPM | Newpeak Metals | 36% | 50% | -85% | 0.015 | $1,699,179.44 |

| ENR | Encounter Resources | 31% | 39% | 145% | 0.355 | $155,242,428.63 |

| MZZ | Matador Mining Ltd | 29% | 73% | 7% | 0.076 | $38,824,919.99 |

| GBZ | GBM Rsources Ltd | 27% | 56% | -53% | 0.014 | $15,036,955.56 |

| IPT | Impact Minerals | 25% | 54% | 67% | 0.02 | $57,294,077.78 |

| CTO | Citigold Corp Ltd | 25% | 0% | -17% | 0.005 | $16,500,000.00 |

| MCT | Metalicity Limited | 25% | 25% | 0% | 0.0025 | $8,970,107.59 |

| ARD | Argent Minerals | 24% | 110% | 50% | 0.021 | $20,668,144.03 |

| MXR | Maximus Resources | 24% | 31% | 5% | 0.042 | $12,516,884.95 |

| AS1 | Asara Resources Ltd | 22% | 22% | -67% | 0.011 | $8,821,753.50 |

| MBK | Metal Bank Ltd | 21% | 5% | -25% | 0.023 | $8,980,563.69 |

| AUN | Aurumin | 20% | 47% | 77% | 0.053 | $22,733,780.21 |

| LRL | Labyrinth Resources | 20% | 20% | -57% | 0.006 | $7,125,262.21 |

| POL | Polymetals Resources | 19% | 13% | 17% | 0.31 | $47,285,342.40 |

| BCM | Brazilian Critical | 19% | 9% | -70% | 0.025 | $18,498,920.38 |

| NVA | Nova Minerals Ltd | 19% | 17% | -14% | 0.315 | $66,021,753.69 |

| LM8 | Lunnon Metals | 18% | 11% | -74% | 0.295 | $63,172,508.73 |

| DTR | Dateline Resources | 17% | 0% | -18% | 0.014 | $20,338,990.66 |

| CDT | Castle Minerals | 17% | 0% | -53% | 0.007 | $8,571,450.89 |

| CYL | Catalyst Metals | 16% | 38% | -15% | 0.875 | $176,138,247.48 |

| CY5 | Cygnus Metals Ltd | 16% | 61% | -72% | 0.074 | $21,866,935.43 |

| PNT | Panther Metalsltd | 15% | 0% | -64% | 0.038 | $2,963,649.51 |

| RXL | Rox Resources | 15% | 44% | -40% | 0.23 | $79,411,165.90 |

| LCY | Legacy Iron Ore | 14% | 14% | 7% | 0.016 | $123,416,772.19 |

| KNB | Koonenberrygold | 13% | 33% | -38% | 0.026 | $4,406,766.40 |

| STN | Saturn Metals | 13% | 22% | 22% | 0.22 | $49,280,544.94 |

| CST | Castile Resources | 13% | 24% | -2% | 0.098 | $23,222,632.99 |

| KCN | Kingsgate Consolidated | 13% | 31% | 5% | 1.62 | $403,381,397.98 |

| STK | Strickland Metals | 13% | 53% | 207% | 0.135 | $200,469,547.44 |

| ARV | Artemis Resources | 13% | 6% | 13% | 0.018 | $28,750,334.53 |

| KAL | Kalgoorlie Gold Mining | 13% | 44% | -16% | 0.036 | $5,864,526.57 |

| RDS | Redstone Resources | 13% | 13% | -55% | 0.0045 | $4,164,203.07 |

| SVG | Savannah Goldfields | 12% | -3% | -82% | 0.028 | $7,870,377.65 |

| WGX | Westgold Resources. | 12% | 0% | 60% | 2.35 | $1,094,068,506.30 |

| GAL | Galileo Mining Ltd | 12% | 19% | -59% | 0.285 | $51,382,481.02 |

| CBY | Canterbury Resources | 12% | -3% | -22% | 0.029 | $4,980,485.98 |

| FML | Focus Minerals Ltd | 11% | 18% | 8% | 0.2 | $55,878,935.78 |

| PUR | Pursuit Minerals | 11% | 0% | -74% | 0.005 | $14,719,857.08 |

| GSR | Greenstone Resources | 11% | 25% | -50% | 0.01 | $13,732,572.74 |

| VKA | Viking Mines Ltd | 11% | 0% | -17% | 0.01 | $9,227,325.88 |

| TBR | Tribune Res Ltd | 11% | 32% | 12% | 4.54 | $238,205,069.58 |

| RRL | Regis Resources | 10% | 23% | 6% | 2.285 | $1,714,619,094.16 |

| MI6 | Minerals260Limited | 10% | -3% | -64% | 0.16 | $33,930,000.00 |

| MAU | Magnetic Resources | 10% | 5% | 85% | 1.08 | $277,350,637.48 |

| TTM | Titan Minerals | 10% | 18% | -45% | 0.033 | $57,899,104.06 |

| SRN | Surefire Rescs NL | 10% | 10% | -52% | 0.011 | $21,849,385.94 |

| BNZ | Benzmining | 10% | 18% | -59% | 0.165 | $20,030,035.32 |

| GSN | Great Southern | 10% | 15% | 5% | 0.023 | $17,356,609.35 |

| TSO | Tesoro Gold Ltd | 9% | 13% | 25% | 0.035 | $35,657,840.53 |

| SPR | Spartan Resources | 9% | 13% | 435% | 0.655 | $632,842,041.68 |

| SLZ | Sultan Resources Ltd | 9% | -8% | -70% | 0.012 | $2,371,037.87 |

| SLR | Silver Lake Resource | 9% | 25% | 17% | 1.445 | $1,350,705,561.19 |

| G50 | Gold50Limited | 9% | 90% | -5% | 0.19 | $20,765,100.00 |

| ICL | Iceni Gold | 8% | 13% | -59% | 0.026 | $7,150,270.51 |

| SBM | St Barbara Limited | 8% | 81% | 30% | 0.3075 | $241,301,262.10 |

| AAR | Astral Resources NL | 8% | 23% | -17% | 0.07 | $66,249,925.06 |

| RED | Red 5 Limited | 7% | 24% | 142% | 0.435 | $1,489,434,236.07 |

| PNR | Pantoro Limited | 7% | 55% | 24% | 0.087 | $452,750,654.72 |

| AVM | Advance Metals Ltd | 7% | -19% | -84% | 0.029 | $1,322,333.21 |

| TMB | Tambourahmetals | 7% | -11% | -40% | 0.075 | $6,552,287.89 |

| RMS | Ramelius Resources | 7% | 29% | 46% | 2.07 | $2,342,257,960.95 |

| FG1 | Flynngold | 7% | 12% | -39% | 0.048 | $7,386,340.95 |

| SNG | Siren Gold | 7% | 14% | -43% | 0.065 | $12,066,385.26 |

| ADV | Ardiden Ltd | 6% | 3% | -45% | 0.165 | $9,690,213.43 |

| OBM | Ora Banda Mining Ltd | 6% | 36% | 143% | 0.34 | $630,532,227.68 |

| GRL | Godolphin Resources | 6% | 9% | -59% | 0.035 | $5,415,744.54 |

| BC8 | Black Cat Syndicate | 6% | 32% | -41% | 0.27 | $84,852,197.38 |

| ARL | Ardea Resources Ltd | 6% | 1% | 74% | 0.74 | $145,792,517.10 |

| KRM | Kingsrose Mining Ltd | 6% | 19% | -41% | 0.037 | $28,596,007.72 |

| ZAG | Zuleika Gold Ltd | 5% | 18% | 25% | 0.02 | $13,985,624.88 |

| MM8 | Medallion Metals. | 5% | 20% | -45% | 0.067 | $20,612,660.68 |

| PGD | Peregrine Gold | 5% | 2% | -38% | 0.23 | $14,593,860.52 |

| ADT | Adriatic Metals | 4% | 14% | 17% | 4.285 | $1,097,355,364.56 |

| GWR | GWR Group Ltd | 4% | -1% | 30% | 0.099 | $32,121,665.50 |

| TRE | Toubani Res Ltd | 4% | 0% | -39% | 0.125 | $16,733,208.25 |

| NXM | Nexus Minerals Ltd | 4% | 52% | -56% | 0.076 | $29,568,569.80 |

| AGC | AGC Ltd | 4% | 13% | 58% | 0.079 | $16,666,666.65 |

| FAL | Falconmetalsltd | 4% | 8% | -65% | 0.135 | $24,780,000.00 |

| ALK | Alkane Resources Ltd | 3% | 14% | -22% | 0.67 | $410,337,375.56 |

| EVN | Evolution Mining Ltd | 3% | 21% | 15% | 4.07 | $7,943,511,032.00 |

| AWJ | Auric Mining | 3% | 32% | 310% | 0.205 | $30,453,441.06 |

| TRM | Truscott Mining Corp | 3% | 31% | 31% | 0.0615 | $10,662,074.19 |

| AME | Alto Metals Limited | 2% | 54% | -34% | 0.043 | $31,025,496.40 |

| EMR | Emerald Res NL | 2% | 31% | 115% | 3.68 | $2,354,255,891.36 |

| SFR | Sandfire Resources | 2% | 6% | 29% | 9.075 | $4,140,351,180.24 |

| DEG | De Grey Mining | 2% | 12% | -14% | 1.3575 | $2,471,439,475.88 |

| A8G | Australasian Metals | 2% | -10% | -60% | 0.064 | $3,335,711.62 |

| PRU | Perseus Mining Ltd | 1% | 14% | -2% | 2.31 | $3,118,506,058.05 |

| IDA | Indiana Resources | 1% | 3% | 55% | 0.082 | $50,621,639.00 |

| NST | Northern Star | 1% | 14% | 11% | 15.525 | $17,587,154,817.90 |

| RND | Rand Mining Ltd | 1% | 15% | 18% | 1.57 | $88,726,499.16 |

| SMI | Santana Minerals Ltd | 1% | 8% | 67% | 1.31 | $237,194,761.58 |

| TIE | Tietto Minerals | 0% | 5% | -9% | 0.6425 | $723,129,888.64 |

| SSR | SSR Mining Inc. | 0% | 35% | -66% | 8.02 | $36,993,146.08 |

| PDI | Predictive Disc Ltd | 0% | 7% | 31% | 0.235 | $456,773,699.36 |

| FFX | Firefinch Ltd | 0% | 0% | 0% | 0.2 | $236,569,315.40 |

| X64 | Ten Sixty Four Ltd | 0% | 0% | 0% | 0.57 | $130,184,181.57 |

| BCN | Beacon Minerals | 0% | 21% | -17% | 0.029 | $112,703,045.13 |

| RDN | Raiden Resources Ltd | 0% | 24% | 675% | 0.031 | $87,667,308.53 |

| WMC | Wiluna Mining Corp | 0% | 0% | 0% | 0.205 | $74,238,030.68 |

| BGD | Bartongoldholdings | 0% | -2% | 22% | 0.275 | $56,452,133.52 |

| BTR | Brightstar Resources | 0% | 12% | 36% | 0.019 | $53,762,723.03 |

| AZY | Antipa Minerals Ltd | 0% | 0% | -40% | 0.012 | $53,752,502.86 |

| MEU | Marmota Limited | 0% | -6% | 16% | 0.044 | $46,587,225.30 |

| YRL | Yandal Resources | 0% | 58% | 61% | 0.15 | $41,510,180.17 |

| GBR | Greatbould Resources | 0% | 3% | -35% | 0.064 | $39,035,219.86 |

| TBA | Tombola Gold Ltd | 0% | 0% | 0% | 0.026 | $33,129,242.98 |

| WA8 | Warriedarresourltd | 0% | -8% | -65% | 0.046 | $30,644,957.44 |

| NML | Navarre Minerals Ltd | 0% | 0% | -37% | 0.019 | $28,555,653.83 |

| PNX | PNX Metals Limited | 0% | 0% | 67% | 0.005 | $27,478,123.60 |

| ANL | Amani Gold Ltd | 0% | 0% | 0% | 0.001 | $25,143,441.13 |

| KAU | Kaiser Reef | 0% | 30% | -19% | 0.15 | $23,946,145.16 |

| HAW | Hawthorn Resources | 0% | 1% | -1% | 0.071 | $23,786,108.52 |

| KZR | Kalamazoo Resources | 0% | 5% | -42% | 0.098 | $17,130,746.72 |

| ASO | Aston Minerals Ltd | 0% | -20% | -89% | 0.012 | $16,835,835.50 |

| BNR | Bulletin Res Ltd | 0% | -29% | -46% | 0.049 | $14,680,666.15 |

| MRR | Minrex Resources Ltd | 0% | 0% | -24% | 0.013 | $14,103,277.54 |

| GMN | Gold Mountain Ltd | 0% | 0% | 33% | 0.004 | $11,902,022.75 |

| ASR | Asra Minerals Ltd | 0% | 40% | -33% | 0.007 | $11,647,970.18 |

| GUL | Gullewa Limited | 0% | 2% | 0% | 0.056 | $11,467,293.60 |

| LCL | LCL Resources Ltd | 0% | -15% | -63% | 0.011 | $10,507,480.69 |

| NAG | Nagambie Resources | 0% | -8% | -75% | 0.012 | $9,559,628.12 |

| MVL | Marvel Gold Limited | 0% | 0% | -47% | 0.009 | $8,637,907.03 |

| SI6 | SI6 Metals Limited | 0% | 0% | -30% | 0.0035 | $8,291,007.99 |

| ALY | Alchemy Resource Ltd | 0% | 0% | -50% | 0.007 | $8,246,533.79 |

| CPM | Coopermetalslimited | 0% | -19% | -72% | 0.105 | $8,227,343.25 |

| NAE | New Age Exploration | 0% | 0% | -20% | 0.004 | $7,175,595.64 |

| RGL | Riversgold | 0% | -13% | -53% | 0.007 | $6,773,630.20 |

| MTH | Mithril Resources | 0% | 0% | 0% | 0.002 | $6,737,608.94 |

| AL8 | Alderan Resource Ltd | 0% | 25% | -29% | 0.005 | $6,641,167.84 |

| DCX | Discovex Res Ltd | 0% | 0% | -33% | 0.002 | $6,605,136.20 |

| OZM | Ozaurum Resources | 0% | -24% | -32% | 0.041 | $6,508,750.00 |

| REZ | Resourc & En Grp Ltd | 0% | 30% | -7% | 0.013 | $6,497,475.26 |

| PRX | Prodigy Gold NL | 0% | -25% | -73% | 0.003 | $6,041,321.97 |

| NMR | Native Mineral Res | 0% | 27% | -30% | 0.028 | $5,875,814.39 |

| TMX | Terrain Minerals | 0% | 0% | -33% | 0.004 | $5,726,682.69 |

| NSM | Northstaw | 0% | 3% | -67% | 0.04 | $5,595,031.36 |

| AYM | Australia United Min | 0% | 0% | 0% | 0.003 | $5,527,732.46 |

| TMZ | Thomson Res Ltd | 0% | 0% | 0% | 0.005 | $4,881,018.47 |

| BYH | Bryah Resources Ltd | 0% | 25% | -58% | 0.01 | $4,354,535.23 |

| AQX | Alice Queen Ltd | 0% | 20% | -77% | 0.006 | $4,145,940.41 |

| RML | Resolution Minerals | 0% | 0% | -40% | 0.003 | $4,024,992.02 |

| ICG | Inca Minerals Ltd | 0% | -23% | -71% | 0.005 | $4,023,694.09 |

| MDI | Middle Island Res | 0% | 20% | -44% | 0.018 | $3,703,518.34 |

| SFM | Santa Fe Minerals | 0% | 4% | -22% | 0.047 | $3,422,483.08 |

| GSM | Golden State Mining | 0% | 10% | -68% | 0.011 | $3,352,447.56 |

| FAU | First Au Ltd | 0% | 0% | -71% | 0.002 | $3,323,986.55 |

| PUA | Peak Minerals Ltd | 0% | 0% | -40% | 0.003 | $3,124,129.85 |

| SMS | Starmineralslimited | 0% | 14% | -45% | 0.04 | $3,036,911.96 |

| MEG | Megado Minerals Ltd | 0% | -8% | -78% | 0.011 | $2,799,011.14 |

| RMX | Red Mount Min Ltd | 0% | -43% | -62% | 0.001 | $2,673,576.04 |

| AVW | Avira Resources Ltd | 0% | -33% | -67% | 0.001 | $2,133,790.00 |

| EMU | EMU NL | 0% | 0% | -50% | 0.001 | $2,024,771.29 |

| CMM | Capricorn Metals | 0% | 6% | 11% | 5.25 | $1,981,497,162.75 |

| AZS | Azure Minerals | -1% | -6% | 712% | 3.41 | $1,573,270,942.25 |

| BGL | Bellevue Gold Ltd | -1% | 14% | 41% | 1.9575 | $2,313,476,737.22 |

| ZNC | Zenith Minerals Ltd | -1% | -3% | -35% | 0.097 | $35,238,088.30 |

| HCH | Hot Chili Ltd | -1% | 11% | 10% | 1.205 | $145,723,151.32 |

| KSN | Kingston Resources | -1% | -8% | -37% | 0.07 | $44,992,292.96 |

| IVR | Investigator Res Ltd | -2% | 33% | -18% | 0.056 | $87,113,376.57 |

| GMD | Genesis Minerals | -2% | 1% | 49% | 1.8775 | $2,047,528,338.20 |

| VMC | Venus Metals Cor Ltd | -2% | 11% | -14% | 0.098 | $18,593,410.93 |

| PRS | Prospech Limited | -3% | 8% | 5% | 0.039 | $11,616,395.05 |

| MTC | Metalstech Ltd | -3% | 3% | -36% | 0.18 | $33,067,053.25 |

| PNM | Pacific Nickel Mines | -3% | -10% | -62% | 0.036 | $14,220,605.57 |

| TG1 | Techgen Metals Ltd | -3% | 6% | -49% | 0.036 | $4,576,772.45 |

| DRE | Dreadnought Resources Ltd | -3% | 3% | -76% | 0.0175 | $63,235,313.28 |

| ILT | Iltani Resources Lim | -3% | 6% | 0% | 0.165 | $5,101,575.75 |

| GPR | Geopacific Resources | -3% | 65% | 17% | 0.028 | $23,008,086.44 |

| WAF | West African Res Ltd | -4% | 31% | 31% | 1.3125 | $1,360,925,631.30 |

| CAI | Calidus Resources | -4% | -24% | -53% | 0.125 | $95,119,279.75 |

| AQI | Alicanto Min Ltd | -4% | -17% | -40% | 0.025 | $15,383,420.15 |

| ANX | Anax Metals Ltd | -4% | 9% | -64% | 0.025 | $14,191,610.35 |

| ERM | Emmerson Resources | -4% | -10% | -41% | 0.047 | $25,601,360.04 |

| HMX | Hammer Metals Ltd | -4% | 15% | -51% | 0.046 | $39,001,923.36 |

| MLS | Metals Australia | -4% | -4% | -41% | 0.022 | $15,562,129.53 |

| SPD | Southernpalladium | -4% | 28% | -13% | 0.435 | $18,739,072.25 |

| CWX | Carawine Resources | -5% | 0% | 12% | 0.105 | $25,973,799.39 |

| WTM | Waratah Minerals Ltd | -5% | 69% | -13% | 0.105 | $16,430,094.78 |

| GED | Golden Deeps | -5% | -11% | -48% | 0.042 | $4,620,893.96 |

| MKR | Manuka Resources. | -5% | 2% | 2% | 0.083 | $57,119,960.73 |

| SVL | Silver Mines Limited | -5% | 27% | -22% | 0.19 | $278,986,707.55 |

| HXG | Hexagon Energy | -5% | -14% | 58% | 0.019 | $10,771,233.92 |

| TAM | Tanami Gold NL | -5% | 12% | 3% | 0.037 | $47,003,881.84 |

| A1G | African Gold Ltd. | -5% | -3% | -53% | 0.036 | $6,095,203.60 |

| WCN | White Cliff Min Ltd | -6% | 31% | 113% | 0.017 | $29,238,973.45 |

| BMR | Ballymore Resources | -6% | 4% | -22% | 0.125 | $22,091,323.13 |

| TCG | Turaco Gold Limited | -6% | 0% | 143% | 0.165 | $104,872,167.02 |

| IGO | IGO Limited | -6% | -7% | -49% | 7.09 | $5,512,909,678.64 |

| ARN | Aldoro Resources | -6% | -9% | -59% | 0.074 | $9,962,156.98 |

| EM2 | Eagle Mountain | -6% | -19% | -62% | 0.059 | $22,478,106.30 |

| SVY | Stavely Minerals Ltd | -6% | 0% | -81% | 0.029 | $11,840,142.88 |

| AMI | Aurelia Metals Ltd | -7% | 22% | 38% | 0.1775 | $304,158,132.72 |

| HRN | Horizon Gold Ltd | -7% | -3% | -24% | 0.28 | $40,555,178.44 |

| MKG | Mako Gold | -7% | 17% | -65% | 0.014 | $13,664,114.52 |

| CHN | Chalice Mining Ltd | -7% | 14% | -84% | 1.295 | $511,486,744.76 |

| RSG | Resolute Mining | -7% | 20% | -6% | 0.4425 | $936,782,005.72 |

| ORN | Orion Minerals Ltd | -7% | 0% | -19% | 0.013 | $76,001,700.84 |

| PXX | Polarx Limited | -7% | 0% | -16% | 0.013 | $28,693,289.32 |

| LEX | Lefroy Exploration | -7% | 13% | -55% | 0.13 | $28,064,187.48 |

| HMG | Hamelingoldlimited | -8% | 0% | -26% | 0.074 | $11,655,000.00 |

| SXG | Southern Cross Gold | -8% | 7% | 178% | 2.07 | $186,773,470.92 |

| KAI | Kairos Minerals Ltd | -8% | -11% | -34% | 0.012 | $31,450,946.27 |

| KCC | Kincora Copper | -8% | 16% | -44% | 0.036 | $7,173,931.73 |

| G88 | Golden Mile Res Ltd | -8% | 9% | -45% | 0.012 | $4,934,674.26 |

| GNM | Great Northern | -8% | -20% | -73% | 0.012 | $1,855,548.92 |

| TLM | Talisman Mining | -8% | 21% | 64% | 0.23 | $43,313,680.27 |

| FFM | Firefly Metals Ltd | -8% | 24% | 6% | 0.745 | $358,118,002.33 |

| MEK | Meeka Metals Limited | -8% | -3% | -33% | 0.034 | $41,980,103.69 |

| HRZ | Horizon | -8% | 3% | -45% | 0.034 | $24,534,428.66 |

| AUC | Ausgold Limited | -8% | 6% | -38% | 0.033 | $73,476,518.66 |

| SPQ | Superior Resources | -8% | 10% | -77% | 0.011 | $22,013,424.60 |

| MOH | Moho Resources | -8% | -8% | -73% | 0.0055 | $2,695,890.99 |

| M2R | Miramar | -8% | -39% | -74% | 0.011 | $2,046,956.23 |

| EMC | Everest Metals Corp | -9% | 33% | 54% | 0.105 | $18,071,141.99 |

| THR | Thor Energy PLC | -9% | -13% | -53% | 0.021 | $3,854,631.46 |

| CEL | Challenger Gold Ltd | -9% | 2% | -48% | 0.083 | $113,155,061.96 |

| MEI | Meteoric Resources | -9% | -5% | 90% | 0.2275 | $487,579,362.03 |

| MRZ | Mont Royal Resources | -9% | 0% | -30% | 0.07 | $5,101,787.58 |

| NWM | Norwest Minerals | -9% | 71% | 30% | 0.048 | $19,794,095.01 |

| CDR | Codrus Minerals Ltd | -10% | -14% | -67% | 0.038 | $4,386,890.78 |

| AAJ | Aruma Resources Ltd | -10% | 12% | -78% | 0.019 | $3,740,938.61 |

| GOR | Gold Road Res Ltd | -10% | 5% | -10% | 1.61 | $1,755,018,192.06 |

| AAU | Antilles Gold Ltd | -10% | -5% | -51% | 0.018 | $18,290,699.86 |

| ION | Iondrive Limited | -10% | 0% | -57% | 0.009 | $4,376,567.51 |

| GUE | Global Uranium | -10% | -18% | -25% | 0.094 | $25,297,278.82 |

| ADN | Andromeda Metals Ltd | -11% | -26% | -60% | 0.017 | $49,764,334.91 |

| WWI | West Wits Mining Ltd | -11% | 21% | -6% | 0.017 | $41,316,658.02 |

| SBR | Sabre Resources | -11% | -11% | -23% | 0.017 | $6,362,452.86 |

| MAT | Matsa Resources | -11% | 18% | -23% | 0.033 | $16,280,017.26 |

| PGO | Pacgold | -11% | 10% | -63% | 0.165 | $13,883,997.60 |

| AM7 | Arcadia Minerals | -11% | 31% | -50% | 0.085 | $10,905,010.00 |

| DLI | Delta Lithium | -12% | -17% | -35% | 0.265 | $185,485,856.92 |

| USL | Unico Silver Limited | -12% | 30% | -12% | 0.15 | $42,927,480.70 |

| S2R | S2 Resources | -12% | -2% | -9% | 0.1275 | $56,607,249.13 |

| FEG | Far East Gold | -13% | 12% | -56% | 0.14 | $37,350,091.08 |

| QML | Qmines Limited | -13% | 3% | -56% | 0.07 | $16,255,726.35 |

| GIB | Gibb River Diamonds | -13% | 4% | -39% | 0.028 | $5,922,264.46 |

| BMO | Bastion Minerals | -13% | -30% | -70% | 0.007 | $3,444,670.76 |

| ADG | Adelong Gold Limited | -13% | -13% | -77% | 0.0035 | $3,081,711.35 |

| NES | Nelson Resources. | -13% | 17% | -30% | 0.0035 | $2,147,580.15 |

| XAM | Xanadu Mines Ltd | -13% | 20% | 40% | 0.067 | $116,688,408.61 |

| BEZ | Besragoldinc | -13% | -26% | -55% | 0.1 | $43,900,595.13 |

| GML | Gateway Mining | -14% | -30% | -63% | 0.019 | $6,218,269.65 |

| TGM | Theta Gold Mines Ltd | -14% | -3% | 76% | 0.155 | $110,288,674.89 |

| KIN | KIN Min NL | -14% | 11% | 78% | 0.073 | $84,826,839.46 |

| GTR | Gti Energy Ltd | -14% | -25% | -29% | 0.006 | $12,299,682.55 |

| BM8 | Battery Age Minerals | -15% | -30% | -73% | 0.094 | $8,992,511.16 |

| TMS | Tennant Minerals Ltd | -15% | -15% | -32% | 0.023 | $21,980,789.02 |

| M24 | Mamba Exploration | -15% | -8% | -81% | 0.023 | $4,602,056.90 |

| TNC | True North Copper | -15% | 15% | 60% | 0.085 | $43,859,502.65 |

| SKY | SKY Metals Ltd | -15% | 3% | -43% | 0.034 | $19,308,631.18 |

| CLA | Celsius Resource Ltd | -15% | -27% | -31% | 0.011 | $24,706,568.28 |

| OAU | Ora Gold Limited | -17% | -17% | 100% | 0.005 | $34,836,005.35 |

| VRC | Volt Resources Ltd | -17% | 0% | -50% | 0.005 | $20,793,390.64 |

| MOM | Moab Minerals Ltd | -17% | -17% | -29% | 0.005 | $3,559,815.30 |

| CAZ | Cazaly Resources | -18% | -5% | -36% | 0.018 | $8,183,453.83 |

| HAV | Havilah Resources | -19% | 15% | -39% | 0.19 | $64,911,038.05 |

| CLZ | Classic Min Ltd | -20% | -84% | -84% | 0.008 | $2,790,310.37 |

| PKO | Peako Limited | -20% | -20% | -50% | 0.004 | $2,108,338.88 |

| DTM | Dart Mining NL | -25% | 114% | -58% | 0.03 | $7,737,707.49 |

| CXU | Cauldron Energy Ltd | -26% | -8% | 526% | 0.037 | $48,599,360.76 |

| SIH | Sihayo Gold Limited | -33% | -33% | -50% | 0.001 | $12,204,256.18 |

| MHC | Manhattan Corp Ltd | -33% | -33% | -60% | 0.002 | $5,873,959.55 |

| KTA | Krakatoa Resources | -33% | 33% | -64% | 0.012 | $5,665,286.64 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.