Has the moment finally arrived for the #silversqueeze bros?

Those very online guys may have been right about silver all along? Pic: Getty

Long known as gold’s poor cousin, silver has responded to a run in precious metals inspired by geopolitical uncertainty, inflation and hopes of interest rate cuts.

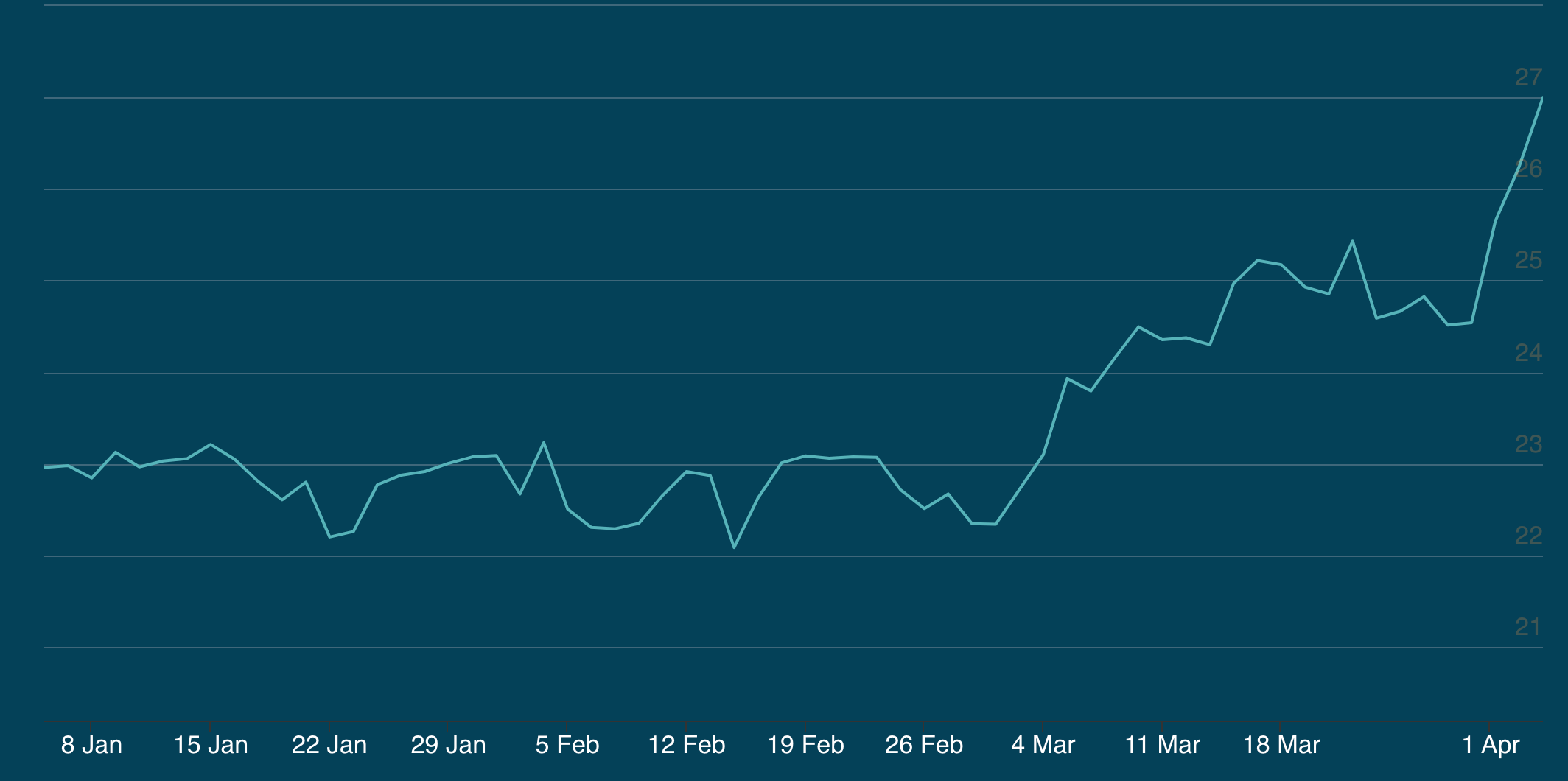

It’s up 10% in just a week, rising from US$24.54/oz to US$27/oz as gold hit all time highs.

Silver has, for years, been the province of internet weirdos. The silversqueeze sub-reddit has over 12,000 members and there’s no shortage of Twitter experts with ambitious claims on how high the commodity can rise.

#Silver will go to $50 this year to finish the handle and then breakout towards $100+. https://t.co/tsMcds7HBV pic.twitter.com/Z1UuRHllDJ

— Tim Hack (@realTimHack) April 4, 2024

Many silver optimists are even wilder. The metal hit records of US$48.70/oz over a decade ago, but has been increasingly disconnected from its hombre the gold bar in recent years.

With prices in the doldrums there has been sparingly little silver exposure on the ASX outside of market giant South32 (ASX:S32) and its high grade Cannington mine in north Queensland.

According to Adriatic Metals (ASX:ADT) CEO Paul Cronin, whose dual ASX and London listed miner just opened the silver dominant Vares mine in Bosnia and Herzegovina, silver has typically traded at a ratio of 30 times lower than the gold price.

In the first half of 2023 it hit a historically high level of 83:1.

The US$189m development, which will ramp up to full-scale production in 2025, had a revenue mix consisting of roughly 50% base metals like copper and zinc and 50% silver and gold when it was in studies a couple years back — when Adriatic used spot silver prices of US$24/oz as its benchmark.

Silver and gold now make up over 60% of its potential revenue mix, and Cronin says conditions are brewing for the metal to breakout even further.

Silver in high demand, short supply

Historically a precious metal used as a more affordable alternative to gold as a store of wealth, silver is increasingly becoming an industrial metal.

According to the Silver Institute, industrial demand accounted for 45% of silver demand by 2022, with a massive rise in use in photovoltaic solar cells and fast chargers for electric vehicles offsetting a collapse in silver use in photographic film.

Now major weaknesses in silver supply are emerging, Cronin said, with big deficits growing since 2020.

“If you look at the physical inventories being held in the LBMA vaults that’s been shrinking, it’s now at its lowest level in history,” he said.

“And then coupled with that, if you think back to February on the COMEX futures contract for March, you’d normally see 99% of contracts get closed out before the end of the contract term.

“But we saw about 3% of contracts ask for physical delivery and for the first time ever COMEX had to send out a notice saying well, we can’t do that sorry.

“They have delivered but now if you look at the May contract which is the next big contract month there’s something like already three and a half per cent that have asked for physical, so there’s a shortage basically.

“I think silver miners know it and I think that fundamental shift in the supply-demand balance is really been driven by industrial rather than the precious metal value for silver.”

Cronin thinks the need to increase EV charging times will be a big driver of silver demand.

“In 2022 for the first time we saw industrial demand for silver outplay the precious metal demand. We saw that again in 2023 (and) I reckon we’ll see it in 2024 as well,” he said.

“And that is fundamentally being driven by two things, photovoltaic cells and high velocity electric vehicle charging.

“At each high EV charging point now you’ve got about three ounces of silver in there, but on the ultra fast chargers, you’ve got about six and that’s driving it in my view.

“I don’t think these things ever go up in a straight line, we’ll see a little bit of toing and froing as we always do in the precious metals markets, but it’ll perform well.”

Where could prices go?

There are a number of analysts, especially in North America where silver deposits and pure play miners are more prominent, who are extremely bullish on the commodity.

“Silver markets may be set up as the most exciting trade in the energy transition theme across the entire commodities complex today,” TD Securities’ Daniel Ghali said in a recent note.

“The energy transition is this decade’s investment zeitgeist, and implications for silver are often overlooked.”

That could see available stockpiles depleted far quicker than anticipated, especially if rate cuts from the Fed bring financial investors deeper into the market.

Adriatic’s Cronin believes silver will rise at a quicker pace than gold, the latter also a bonus for the miner with its spot price currently up around US$500/t on study numbers.

Supply challenges are increasingly being felt not through primary silver producers but at base metals mines where silver is produced as a by-product of zinc and lead.

Those commodities have struggled due to high interest rates, inflationary pressure and challenges in the Chinese economy, underlined by WA lead miner Galena Mining’s (ASX:G1A) decision to go into voluntary administration on Friday.

“Where we’re going to continue to see a reduction in silver output is actually from those companies that have VMS deposits and those various deposits, in reality, are driven by zinc and lead,” Cronin noted.

“And while zinc and lead prices remain relatively low, particularly zinc, I don’t see a huge amount of increase in silver production.

“As a result of that, I think you’re going to continue to see silver prices march up.”

As for those internet silver superfans, they may be looking a little more sensible in the years to come if those predictions hold.

“On silver, I think you’ve now got a lot of buyside analysts scrambling to understand what just happened and why. You’ve seen a few colourful characters out there for a while talking about the silver squeeze and what’s going to happen in silver,” Cronin said.

“You become kind of numb to that after a while because you just see the same stuff repeated over and over. But if you actually look at some of those guys that we probably dismissed a couple years ago as being a little bit up curve themselves, they’re probably right.

“So, it’ll be interesting to see how this plays out and interesting to see how sentiment responds to it. I think we’ve seen a bit of that in the last couple of days.

“I’ve been surprised by the rate at which silver has increased, but I do expect it to continue to increase although on a far less aggressive basis.”

Adriatic Metals (ASX:ADT) share price today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.