You might be interested in

Uncategorized

Monsters of Rock: Chinese Government support and 'price war' sends EV sales racing back in April

Mining

Monsters of Rock: Gold bears pick forecasts above US$2000 for the 'first time ever'

Mining

Mining

The Treasury’s pencil pushers have a habit of issuing extremely cautious forecasts for commodity prices.

Sure, unless they are some sort of casino Rain Man type, they probably aren’t the kind to go flinging their weekly pay packet on Sportsbet Multis flogged on Kayo by washed up AFL footballers.

They serve an equally important purpose for the government of the day, who love to be the beneficiaries of low expectations.

“Hey, look at that shocking, shocking surplus, how great are we?!” The calling cry by many a Canberra shinybum.

And so this year’s $4.2 billion surplus, announced yesterday by Treasurer Jim Chalmers and a $41.1b turnaround on the previous forecast, was the first in 15 years but also strongly dependent on an overshoot in commodity prices, particularly iron ore, LNG and coal.

NO REALLY, READ: Budget Smuggling 2023: The bottom line is it’s awfully tight in there, Dr Chalmers

To be fair, it’s better to be under than over.

Over-optimistic expectations on iron ore earnings proved the undoing of the previous WA Liberal-National administration, which pissed away a once in a lifetime windfall on a stadium, a shopping mall no-one visits and a jetty named after the Queen, but was thankfully halted in its unrealised ambition to erect a cable car over the Swan River.

Treasury’s sensitivity analysis shows a US$10/t fall or lift in iron ore prices has an impact on nominal GDP for around $5.1b in 2023/2024 and $2.5b the year after. On tax receipts the difference is around $500 million either way.

A simple explanation from the budget papers themselves: “An increase in iron ore prices increases mining company profits and therefore company tax receipts. Lower domestic prices result in lower individuals and other withholding taxes and indirect tax receipts, partially offsetting the increase in company tax.”

The cash balance is expected to revert to a $13.9b deficit in the coming year, hitting $35.1b in 2024-25 and $36.6b in 2025-26 before falling to $28.5b in 2026-27.

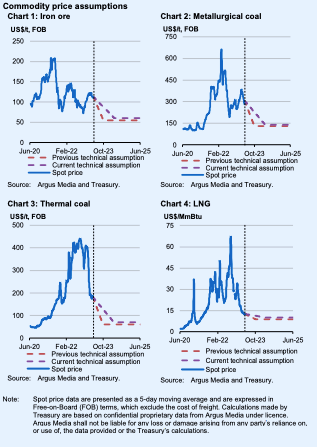

In the October budget iron had been forecast to fall to a long run price of US$55/t within six months, a level no serious commercial analyst would have considered.

Treasury now sees it dropping to US$60/t over a more temperate four quarter spell and a long run range of US$60-92/t. For reference Singapore futures were up 2.44% today to US$104.50/t.

Met coal is projected to drop to US$140/t in four quarters, up from the forecast of US$130/t in two quarters in October. It is currently paying over US$240/t. Long run range of US$140-200/t.

Thermal coal is expected to hit US$70/t in four quarters, up from US$60/t in two quarters. At that price most producers will be near breakeven or losing money, so it feels unlikely especially with prices still around US$170/t. The range is broad though at US$70-175/t.

LNG is expected to hit US$10 per British thermal unit in four quarters, up from US$9/mbtu in two, with a range of US$10-16/mbtu.

These are a damn sight more conservative than even the traditionally conservative big banks.

“Despite these changes, the Budget’s commodity price outlook is still broadly conservative relative to our forecast in 2023/24 and 2024/25. Broadly speaking, the 4‑quarter decline to long run prices is more rapid than our outlook,” Commbank’s Vivek Dhar said in a note.

“We see thermal coal, coking coal and LNG prices holding up at materially higher levels than the Budget’s outlook in 2023/24 and 2024/25. However, we note downside risks to our thermal coal and LNG prices given the rapid fall in both commodities in recent months.

“Thermal coal futures have plummeted 58% since the beginning of the year and 63% from peaks in early September 2022.”

In the long term, Dhar says CBA’s outlook converges with Canberra’s. But it is far more bullish on coking coal, which it expects to remain tight as India doubles steelmaking capacity to 300Mt by 2030.

CBA has a long-term target of US$200/t for coking coal.

“India’s rising demand for coking coal stems from plans to expand steel production capacity from ~155Mt to 300Mt by 2030/31,” he said.

“India will need to source its coking coal needs for steel production from mostly imports given the absence of high‑quality local coking coal resources.

“We believe cleaner alternatives to coking coal in the steel making process, like green hydrogen, will likely only become commercial after 2030.”

There were no major commodity moves overnight, with the materials sector hovering around a spare 0.02% drop as of 12.45pm AEST.

That meant it was very much a sentiment market today, with performance among the large mining stocks mixed.

Uranium developer Paladin Energy (ASX:PDN) rose more than 8%, with Monadelphous (ASX:MND), Stanmore Coal (ASX:SMR), Core Lithium (ASX:CXO) and Lynas Rare Earths (ASX:LYC) all capturing the attention of the market.

Meanwhile we’ll remain on ATH watch for Liontown Resources (ASX:LTR), which hit $2.92, up 1.74% this morning. It continues to trade well above the prices of Albemarle’s failed $2.50 per share bid from March.